Rio Tinto Says 2Q Iron-Ore Exports Up, But Cautions on Economic Outlook -- Update

15 July 2022 - 10:14AM

Dow Jones News

By Rhiannon Hoyle

Rio Tinto PLC on Friday sounded a cautious note on the global

economic outlook, even as it reported a lift in shipments of its

flagship product iron ore, the main ingredient in steel.

The Anglo-Australian mining company highlighted concerns about a

growing risk of a recession, and said the trade disruptions, food

protectionism and energy crisis squeezing supply chains will need

to ease significantly before inflation pressures subside.

"The economic outlook is weakening due to the Russia-Ukraine

war, tighter monetary policy to curb rising inflation, and targeted

Covid-19 restrictions in China," said Rio Tinto, the world's second

largest mining company.

Higher rates of inflation have increased the miner's closure

liabilities, it said. Rio Tinto estimated a roughly US$400 million

pretax hit to underlying earnings in its first fiscal half.

Faced with falling commodity prices, Chief Executive Jakob

Stausholm sought to reassure investors on the miner's strategy.

"We are determined to further strengthen Rio Tinto while

investing to grow in the commodities needed for the energy

transition, decarbonize our portfolio, be a partner and employer of

choice, maintain our tight capital allocation and continue to pay

attractive dividends," he said.

The company on Friday said it produced more iron ore and copper

in its fiscal second quarter versus a year earlier, but downgraded

full-year goals for aluminum and diamond output.

It reported shipments of 79.9 million metric tons from its

mammoth iron-ore operations in Australia's Pilbara during the three

months through June, up 5% on a year ago. Alongside Brazil's Vale

SA, Rio Tinto is the world's top producer of the steel

ingredient.

Its full-year estimate for Australian iron-ore shipments is

unchanged, at 320 million-335 million tons, although Rio Tinto

cautioned on potential impacts from the Covid-19 pandemic. It also

said guidance is dependent on a smooth ramp-up of its new

Gudai-Darri operation and the availability of skilled labor, as

worker shortages challenge the industry.

The miner also recorded a 9% year-on-year rise in second-quarter

mined copper output, to 126,000 tons, and a 3% increase in bauxite

production, to 14.1 million tons.

However, second-quarter aluminum output tumbled by 10%, to

731,000 tons, after a labor strike reduced capacity at its Kitimat

smelter in British Columbia. "A controlled restart began at the end

of the second quarter of 2022, with ramp-up progressing subject to

plant stability," the miner said.

Production at the Boyne smelter in Australia's Queensland state

was impacted by Covid-19-related absenteeism.

Rio Tinto cut its fiscal-year aluminum production goal to 3.0

million-3.1 million tons, from 3.1 million-3.2 million previously.

It pared its alumina guidance to 7.6 million-7.8 million tons, from

8.0 million-8.4 million.

The miner also reduced its full-year diamonds production

estimate to 4.5 million-5.0 million carats, from 5.0 million-6.0

million. A build up of maintenance and impacts from the Covid-19

pandemic impacted performance during the half, it said.

Rio Tinto said it continues to negotiate the restart of work at

the Simandou iron ore project in Guinea. The military junta in

Guinea Conakry has suspended Rio Tinto and the Winning Consortium

Simandou from mining activities on the iron-ore deposit after a

deadline to create a joint venture was missed.

Rio Tinto is also "continuing to explore all options" for its

Jadar lithium project in Serbia. Officials in January revoked Rio

Tinto's licenses for the project following community protests over

environmental concerns.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

July 14, 2022 19:59 ET (23:59 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

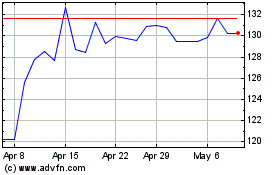

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

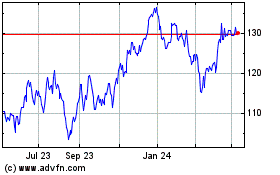

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024