Rio Tinto: China Covid Curbs Weighed More on Steel Demand Than Output -- Commodity Comment

15 July 2022 - 10:26AM

Dow Jones News

Rio Tinto PLC on Friday reported a lift in second-quarter

production of iron ore, copper and bauxite, but downgraded

full-year guidance for aluminum, alumina and diamonds. Here are

some remarks from its quarterly operations report.

On iron-ore production:

"Gudai-Darri delivered first ore from the main plant in June. As

it ramps up, we expect increased production volumes and improved

product mix in the second half, with Gudai-Darri capacity to be

reached in 2023. Pilbara operations produced 78.6 million [metric]

tons (100% basis) in the second quarter, 4% higher than the second

quarter of 2021. While significantly higher than average rainfall

in May impacted mine production, continued focus on mine pit health

and commissioning of Gudai-Darri supported a stronger second

quarter."

On iron-ore markets:

"Iron ore Platts CFR prices trended downwards to $120/ton at the

end of the second quarter, even though the average prices were just

below $140/ton year to date. The downward pressure was driven by

extended Covid-19 restrictions that impacted China's downstream

steel demand to a greater extent than steel production and iron ore

consumption."

On aluminum output:

"Aluminum production [of 731,000 tons] was 10% lower than the

second quarter of 2021 due to reduced capacity at our Kitimat

smelter in British Columbia following the strike which commenced in

July 2021. A controlled restart began at the end of the second

quarter of 2022, with ramp-up progressing subject to plant

stability. Production at Boyne smelter in Queensland was impacted

due to process instability following COVID-19 related unplanned

absences. Production has been stabilized and the cells that have

been taken offline are being ramped up over the next 12 months. All

of our other smelters continued to have stable performance."

On aluminum markets:

"Following record high prices in the first quarter, the expected

disruption to Russian aluminum production did not materialize.

Strong aluminum supply and weaker domestic demand in China shifted

it to a net export position for aluminum in the first half of 2022.

Alumina shifted to a net export position over the same period due

to strong growth in domestic refining. The outlook for demand

growth has also been dampened by Covid-19 restrictions in China and

the reduced consumer sentiment in developed markets. Nevertheless,

reported inventories continue to decline and high power prices are

limiting production growth outside China."

On copper output:

"Mined copper production of 126,000 tons was 9% higher than the

second quarter of 2021 due to higher material movement and higher

grades and recoveries at Kennecott and Escondida, partly offset by

lower grades and recoveries at Oyu Tolgoi as a result of planned

mine sequencing."

On copper markets:

"After reaching a record quarterly average price in the first

quarter, prices started trending down in late April, as a wave of

uncertainty surrounding the global economy and China's Covid-zero

policy weighed on the prospects for copper demand. Exchange

inventories remain at multi-year lows, and mine supply continues to

face disruptions, although mine project start-ups in the second

half should help alleviate market tightness."

On lithium markets:

"The electric-vehicle market continues to enjoy firm growth,

despite rising raw material costs and general supply chain issues

in the automotive market. After sharp price increases in the

previous quarters, lithium carbonate prices stabilized in the

second quarter, as supply starts to keep pace with demand. Mine

supply growth is expected to pick up further in the second half as

idled mine capacity and new projects come online."

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

July 14, 2022 20:11 ET (00:11 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

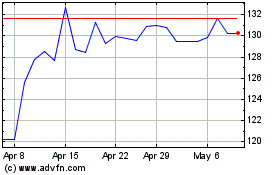

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

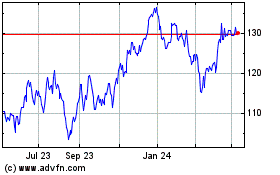

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024