Generali Leadership Drama Nears AGM Finale

29 April 2022 - 2:38AM

Dow Jones News

By Ed Frankl

Shareholders of Assicurazioni Generali SpA will on Friday decide

the future management of the company, as a leadership battle at the

top of Italy's largest insurer comes to a head.

Chief Executive Philippe Donnet, who has led the Trieste-based

company since 2016, is seeking re-election but is being challenged

by some leading shareholders, who have drawn up their own slate for

the management board.

Investors will vote on the new board at the company's annual

general meeting on Friday.

The rival slate, put together by Generali's second-largest

shareholder Francesco Gaetano Caltagirone, includes former Goldman

Sachs banker Claudio Costamagna as chairman and Luciano Cirina as

its CEO candidate.

Cirina, who was Generali's former regional head of Austria &

Central Eastern Europe, was fired by Generali after he put his name

in line to replace his boss.

Mr. Caltagirone controls 9.5% of Generali and is joined in

challenging the current leadership by Leonardo del Vecchio, the

chairman of eyewear heavyweight EssilorLuxottica SpA, who owns

6.6%. According a report by Reuters, the rival board is also being

backed by the holding company of the Benetton family, Edizione SpA,

which owns 4.0% of shares.

Together, the challengers claim that Generali has gradually lost

ground to peers such as Allianz SE, AXA SA and Zurich Insurance

Group AG. They want to deliver faster earnings growth of 14% by

2024, sharper cost-cutting and to spend as much as EUR7 billion on

acquisitions.

Generali says that since Mr. Donnet's first investor day in 2016

its performance compared with peers' has beaten rivals in terms of

shareholder return and share price.

At a strategy day in December, Mr. Donnet proposed plans for EPS

growth of 6%-8% and up to EUR3 billion in M&A.

The current CEO has the backing of the insurer's largest

shareholder, Mediobanca SpA, which has 17.2% in voting rights, and

likely a number of institutional investors.

Some analysts expressed skepticism over the rival board

proposals at the time of their announcement in late March.

The plans were more aggressive but "poorly supported," also with

a tight delivery schedule, Citi analysts said in a research

note.

The rivals' 14% EPS growth wouldn't just beat the existing

Generali plan, but the entire sector, BNP Paribas Exane analysts

said. "If you offer this to investors, you need to be prepared to

back it up. We don't feel we got that," they said at the time.

A higher-than-average turnout is expected at the AGM as the

company soaks in increased investor focus, with 71% worth of

Generali's capital voting, according to Italian daily La

Repubblica.

Write to Ed Frankl at edward.frankl@dowjones.com

(END) Dow Jones Newswires

April 28, 2022 12:23 ET (16:23 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

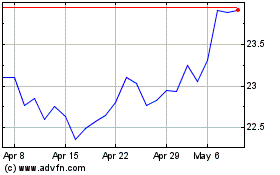

Generali (BIT:G)

Historical Stock Chart

From Mar 2024 to Apr 2024

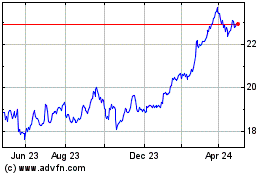

Generali (BIT:G)

Historical Stock Chart

From Apr 2023 to Apr 2024