Generali 1st Half Beat Expectations Despite Profit Fall as Russia Impairments Weighed -- Update

02 August 2022 - 5:33PM

Dow Jones News

By Ed Frankl

Assicurazioni Generali SpA said it beat expectations for the

first half despite a decline in profit as impairments from its

Russian business took their toll.

Italy's largest insurer said its impairment from Russian

investments totaled EUR138 million in the first six months of the

year, leading it to a decline in net profit to 1.40 billion euros

($1.44 billion) compared with EUR1.54 billion for the same period

of the previous year.

However, without the impairment, net result would have ticked up

above last year's, Generali said.

The Trieste-based company said in March that it would pull out

of Russia after the country's invasion of Ukraine.

Gross written premiums grew 2.4% to EUR41.88 billion in the year

to June 30, driven by a strong rise in property & casualty

premiums, led by its non-motor line, Generali said.

Premiums at its life segment dropped slightly by 0.5%.

The results beat expectations of net profit at EUR1.33 billion

and gross written premiums of EUR41.12 billion.

Generali added that it would launch a EUR500 million share

buyback, worth around 3% of its share capital, on Aug. 3, to last

until Oct. 29, 2023.

But the company's combined ratio--in which the lower the

percentage, the higher the profitability margin--increased by 2.8

percentage points to 92.5%, reflecting a higher loss ratio and the

impact of hyperinflation in Argentina, it said.

The company flagged that the global insurance sector may be

affected by uncertainty due to an economic slowdown, which may

become recession, and an escalating increase in inflation.

It added that new variants of Covid-19 continued to be a

concern.

In a call with the media, Chief Executive Philippe Donnet said

there would be price rises to counter inflation.

Speaking on the 1H results, Mr. Donnet said: "We have been able

to achieve these results in an increasingly uncertain geopolitical

and macroeconomic context."

Generali added that its solvency ratio, a measure of capital

strength, was 233% after accounting for the buyback, up from 227%

at the end of 2021.

Generali's operating result rose 4.8% to EUR3.14 billion,

benefiting from its life segment, which grew 17% on what it called

a more profitable business mix.

The operating result at its wealth-management business dipped,

however, by 3.3%.

The company confirmed its midterm targets "despite an evolving

macroeconomic scenario".

Write to Ed Frankl at edward.frankl@dowjones.com

(END) Dow Jones Newswires

August 02, 2022 03:18 ET (07:18 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

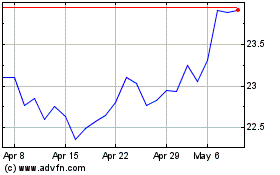

Generali (BIT:G)

Historical Stock Chart

From Mar 2024 to Apr 2024

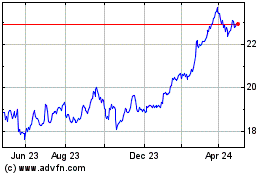

Generali (BIT:G)

Historical Stock Chart

From Apr 2023 to Apr 2024