Tenaris S.A. (NYSE and Mexico: TS and EXM Italy: TEN) (“Tenaris”)

today announced its results for the quarter ended March 31, 2022 in

comparison with its results for the quarter ended March 31, 2021.

Summary of 2022 First Quarter Results

(Comparison with fourth and first quarter of 2021)

|

|

1Q 2022 |

4Q 2021 |

1Q 2021 |

|

Net sales ($ million) |

2,367 |

2,057 |

15% |

1,182 |

100% |

|

Operating income ($ million) |

484 |

273 |

77% |

52 |

839% |

|

Net income ($ million) |

503 |

336 |

50% |

101 |

400% |

|

Shareholders’ net income ($ million) |

503 |

370 |

36% |

106 |

373% |

|

Earnings per ADS ($) |

0.85 |

0.63 |

36% |

0.18 |

373% |

|

Earnings per share ($) |

0.43 |

0.31 |

36% |

0.09 |

373% |

|

EBITDA* ($ million) |

627 |

483 |

30% |

196 |

220% |

|

EBITDA margin (% of net sales) |

26.5% |

23.5% |

|

16.6% |

|

*EBITDA is defined as operating income (loss)

plus depreciation, amortization and impairment charges /

(reversals). EBITDA includes severance charges of $12 million in 1Q

2022 (related to the discontinuation of our industrial equipment

business in Brazil and the closure of NKKTubes), $8 million in 4Q

2021 and $5 million in 1Q 2021. If these charges were not included

EBITDA would have been $639 million (27.0%) in 1Q 2022, $491

million (23.9%) in 4Q 2021 and $201 million (17.0%) in 1Q 2021.

Our sales in the first quarter increased a

further 15% sequentially, driven by higher prices for OCTG in the

Americas and higher shipments of line pipe in Europe and South

America. Our EBITDA rose 30% sequentially with the margin exceeding

26%, as higher prices more than compensated increases in energy and

raw material costs. We decided to discontinue our industrial

equipments business in Brazil which recorded an EBITDA loss of $14

million, including severance provisions, during the quarter, and we

fully impaired the value of our 49% share in the joint venture with

Severstal in Russia, recording a charge of $15 million.

Working capital increased by $609 million in the

quarter, with higher receivables, reflecting an increase in sales,

and higher inventories which were affected by higher costs for raw

material and energy. Operating working capital days amounted to

141, which compares with 165 in the first quarter of 2021 and 135

in the fourth quarter of 2021. Free cash flow was negative at $94

million and we ended the quarter with a net cash position of $562

million.

Market Background and Outlook

The Russian invasion of Ukraine and the

sanctions that have been imposed on Russian individuals, companies

and institutions has changed the outlook for energy worldwide. Oil

and gas prices are higher than they were before the invasion as

alternative sources to Russian exports of oil and gas are sought in

Europe and other markets. In addition, current oil and gas

production levels are not keeping pace with global demand and

inventories are at low levels.

Inflationary pressures and high commodity prices

intensified by the Russian invasion are inducing a monetary

response by central banks and a slow down in global growth as well

as increased uncertainty, which is further heightened by the

ongoing COVID outbreak and governmental response in China.

Drilling activity is increasing around the world

led by North America and the Middle East. Offshore drilling

activity is also increasing, led by Latin America. Pipeline project

activity is also increasing in the Middle East, South America and

the Mediterranean and Black Seas.

The outlook for steelmaking raw materials has

also changed. Russia and Ukraine have both been major suppliers of

pig iron, ferroalloys and semi-finished steel to European and

American markets and the costs of these materials have risen

sharply since the invasion.

OCTG prices are also increasing on higher

consumption while inventories have declined to low levels in key

regions such as North America and the Middle East.

In the second quarter, we anticipate further

growth in sales, with higher volumes in the Middle East and South

America, and stable margins with higher prices compensating the

increase in costs. We also anticipate that free cash flow will be

positive. In the second half, we anticipate further growth in

sales, and margins should remain around the same level as the first

half.

Analysis of 2022 First Quarter Results

|

Tubes Sales volume (thousand metric tons) |

1Q 2022 |

4Q 2021 |

1Q 2021 |

|

Seamless |

772 |

731 |

6% |

496 |

56% |

|

Welded |

50 |

68 |

(26%) |

71 |

(29%) |

|

Total |

822 |

799 |

3% |

568 |

45% |

|

Tubes |

1Q 2022 |

4Q 2021 |

1Q 2021 |

|

(Net sales - $ million) |

|

|

|

|

|

|

North America |

1,347 |

1,118 |

20% |

514 |

162% |

|

South America |

348 |

341 |

2% |

166 |

109% |

|

Europe |

232 |

167 |

39% |

143 |

62% |

|

Middle East & Africa |

182 |

209 |

(13%) |

196 |

(7%) |

|

Asia Pacific |

94 |

75 |

26% |

60 |

57% |

|

Total net sales ($ million) |

2,203 |

1,910 |

15% |

1,080 |

104% |

|

Operating income ($ million) |

471 |

245 |

92% |

38 |

1,140% |

|

Operating margin (% of sales) |

21.4% |

12.8% |

|

3.5% |

|

Net sales of tubular products and services

increased 15% sequentially and 104% year on year. Volumes increased

3% sequentially and 45% year on year while average selling prices

increased 12% sequentially and 41% year on year. In North America

sales increased 20% sequentially, thanks to higher prices

throughout the region reflecting higher drilling activity and

declining market inventory levels with seasonally higher volumes of

OCTG in Canada. In South America sales increased 2% sequentially,

due to higher OCTG prices across the region but lower volumes of

line pipe and industrial products in Brazil and Argentina. In

Europe sales increased 39% due to sales of offshore line pipe to

Sakarya project in Turkey and higher prices on mechanical pipe

sales to distributors. In the Middle East and Africa sales

decreased 13% and remain at low levels, particularly in Kuwait,

where the transition to a new contract is still pending, and with

minimal sales of offshore line pipe in Africa and OCTG to Qatar. In

Asia Pacific sales increased 26% mainly due to higher sales in

Oceania.

Operating result from tubular products and

services amounted to a gain of $471 million in the first quarter of

2022, compared to a gain of $245 million in the previous quarter

and $38 million in the first quarter of 2021. In the previous

quarter, Tubes operating income included a $57 million impairment

charge on NKKTubes fixed assets. During the quarter Tubes operating

margin increased to 21.4%, following a 12% increase in average

selling prices which more than offset the increase in energy and

raw material costs.

|

Others |

1Q 2022 |

4Q 2021 |

1Q 2021 |

|

Net sales ($ million) |

164 |

147 |

11% |

102 |

60% |

|

Operating income ($ million) |

13 |

29 |

(54%) |

13 |

(1%) |

|

Operating margin (% of sales) |

8.0% |

19.4% |

|

13.0% |

|

Net sales of other products and services

increased 11% sequentially and 60% year on year. The sequential

increase in sales is mainly related to higher sales of excess raw

materials and sucker rods, partially offset by lower sales of

energy, industrial equipment in Brazil, which is being

discontinued, and no sales from the Geneva structural pipe business

in the United States, which was sold in the previous quarter.

Operating income of the Others segment, in the quarter, includes a

$5 million severance charge related to the discontinuation of the

industrial equipment business in Brazil.

Selling, general and administrative

expenses, or SG&A, amounted to $365 million, or 15.4%

of net sales, in the first quarter of 2022, compared to $338

million, 16.4% in the previous quarter and $255 million, 21.6% in

the first quarter of 2021. SG&A expenses during the quarter

included $5 million of leaving indemnities, mainly related to the

discontinuation of our industrial equipment business in Brazil and

the closure of NKKTubes (an additional $7 million charge for the

same concepts is included in the cost of sales). Sequentially, our

SG&A expenses increased mainly due to higher selling expenses

associated with higher sales and higher labor costs, however, they

decreased as a percentage of sales due to the better absorption of

the fixed and semi-fixed components of SG&A expenses on higher

sales.

Other operating results

amounted to a gain of $4 million in the first quarter of 2022,

compared to $12 million in the previous quarter and $8 million in

the first quarter of 2021. The result of the quarter is mainly

related to land sales in the United States.

Financial results amounted to a

loss of $1 million in the first quarter of 2022, compared to a gain

of $2 million in the previous quarter and a gain of $12 million in

the first quarter of 2021. During the quarter, a net interest gain

of $7 million was offset by a net $8 million foreign exchange loss,

mainly related to the appreciation of the Brazilian Real against

the U.S. dollar.

Equity in earnings of non-consolidated

companies generated a gain of $88 million in the first

quarter of 2022, compared to a gain of $133 million in the previous

quarter and a gain of $79 million in the first quarter of 2021. The

result of the quarter is net of an impairment charge on the value

of our joint venture in Russia, amounting to $15 million. Results

from non-consolidated companies are mainly derived from our

participation in Ternium (NYSE:TX) and reflect the good dynamics at

the flat steel sector derived from high steel prices.

Income tax charge amounted to

$67 million in the first quarter of 2022, compared to $72 million

in the previous quarter and $42 million in the first quarter of

2021. Despite the sequential increase in income before income tax,

the tax charge of the quarter is lower as it includes a $44 million

positive adjustment from inflation adjustments net of foreign

exchange, mainly in Argentina.

Cash Flow and Liquidity

Net cash used in operations during the first

quarter of 2022 was $27 million, compared with net cash provided by

operations of $46 million in the previous quarter and $70 million

in the first quarter of 2021. Working capital increased by $609

million during the quarter, mainly reflecting higher trade

receivables, following the increase in sales, and higher

inventories partially offset by an increase in trade payables.

Capital expenditures amounted to $67 million for

the first quarter of 2022, compared to $69 million in the previous

quarter and $45 million in the first quarter of 2021.

During the quarter we had negative free cash

flow of $94 million, compared to negative $23 million in the

previous quarter and positive $25 million in the first quarter of

2021.

At March 31, 2022 we maintained a positive net

cash position of $562 million, compared to $700 million at December

31, 2021.

Conference call

Tenaris will hold a conference call to discuss

the above reported results, on April 28, 2022, at 09:00 a.m.

(Eastern Time). Following a brief summary, the conference call will

be opened to questions. To access the conference call dial in +1

866 789 1656 within North America or +1 630 489 1502

Internationally. The access number is “ 5464727”. Please dial in 10

minutes before the scheduled start time. The conference call will

be also available by webcast at

http://ir.tenaris.com/events-and-presentations.

A replay of the conference call will be

available on our webpage

http://ir.tenaris.com/events-and-presentations or by phone from

12:00 pm ET on April 28, through 12:00 pm on May 6, 2022. To access

the replay by phone, please dial +1 855 859 2056 or +1 404 537 3406

and enter passcode “5464727” when prompted.

Some of the statements contained in this press

release are “forward-looking statements”. Forward-looking

statements are based on management’s current views and assumptions

and involve known and unknown risks that could cause actual

results, performance or events to differ materially from those

expressed or implied by those statements. These risks include but

are not limited to risks arising from uncertainties as to future

oil and gas prices and their impact on investment programs by oil

and gas companies.Consolidated Condensed Interim Income

Statement

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended March 31, |

|

|

2022 |

2021 |

|

|

Unaudited |

|

Net sales |

2,367,041 |

1,181,789 |

|

Cost of sales |

(1,521,942) |

(882,999) |

|

Gross profit |

845,099 |

298,790 |

|

Selling, general and administrative expenses |

(364,922) |

(255,026) |

|

Other operating income (expense), net |

4,077 |

7,827 |

|

Operating income |

484,254 |

51,591 |

|

Finance Income |

8,825 |

5,698 |

|

Finance Cost |

(1,835) |

(4,675) |

|

Other financial results |

(8,108) |

10,754 |

|

Income before equity in earnings of non-consolidated

companies and income tax |

483,136 |

63,368 |

|

Equity in earnings of non-consolidated companies |

87,604 |

79,141 |

|

Income before income tax |

570,740 |

142,509 |

|

Income tax |

(67,307) |

(41,744) |

|

Income for the period |

503,433 |

100,765 |

|

|

|

|

|

Attributable to: |

|

|

|

Shareholders' equity |

502,774 |

106,346 |

|

Non-controlling interests |

659 |

(5,581) |

|

|

503,433 |

100,765 |

Consolidated Condensed Interim Statement of Financial

Position

| (all amounts in thousands of

U.S. dollars) |

At March 31, 2022 |

|

At December 31, 2021 |

|

|

Unaudited |

|

|

|

ASSETS |

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

Property, plant and equipment, net |

5,771,759 |

|

|

5,824,801 |

|

|

Intangible assets, net |

1,365,335 |

|

|

1,372,176 |

|

|

Right-of-use assets, net |

119,655 |

|

|

108,738 |

|

|

Investments in non-consolidated companies |

1,500,637 |

|

|

1,383,774 |

|

|

Other investments |

241,294 |

|

|

320,254 |

|

|

Derivative financial instruments |

5,755 |

|

|

7,080 |

|

|

Deferred tax assets |

259,709 |

|

|

245,547 |

|

|

Receivables, net |

232,833 |

9,496,977 |

|

205,888 |

9,468,258 |

|

Current assets |

|

|

|

|

|

|

Inventories, net |

3,032,127 |

|

|

2,672,593 |

|

|

Receivables and prepayments, net |

125,643 |

|

|

96,276 |

|

|

Current tax assets |

219,702 |

|

|

193,021 |

|

|

Trade receivables, net |

1,718,058 |

|

|

1,299,072 |

|

|

Derivative financial instruments |

12,088 |

|

|

4,235 |

|

|

Other investments |

354,104 |

|

|

397,849 |

|

|

Cash and cash equivalents |

315,399 |

5,777,121 |

|

318,127 |

4,981,173 |

|

Total assets |

|

15,274,098 |

|

|

14,449,431 |

|

EQUITY |

|

|

|

|

|

|

Shareholders' equity |

|

12,508,121 |

|

|

11,960,578 |

|

Non-controlling interests |

|

145,795 |

|

|

145,124 |

|

Total equity |

|

12,653,916 |

|

|

12,105,702 |

|

LIABILITIES |

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

Borrowings |

7,905 |

|

|

111,432 |

|

|

Lease liabilities |

88,991 |

|

|

82,694 |

|

|

Deferred tax liabilities |

261,310 |

|

|

274,721 |

|

|

Other liabilities |

227,806 |

|

|

231,681 |

|

|

Provisions |

91,254 |

677,266 |

|

83,556 |

784,084 |

|

Current liabilities |

|

|

|

|

|

|

Borrowings |

340,121 |

|

|

219,501 |

|

|

Lease liabilities |

34,885 |

|

|

34,591 |

|

|

Derivative financial instruments |

18,520 |

|

|

11,328 |

|

|

Current tax liabilities |

171,425 |

|

|

143,486 |

|

|

Other liabilities |

266,416 |

|

|

203,725 |

|

|

Provisions |

8,512 |

|

|

9,322 |

|

|

Customer advances |

96,905 |

|

|

92,436 |

|

|

Trade payables |

1,006,132 |

1,942,916 |

|

845,256 |

1,559,645 |

|

Total liabilities |

|

2,620,182 |

|

|

2,343,729 |

|

Total equity and liabilities |

|

15,274,098 |

|

|

14,449,431 |

Consolidated Condensed Interim Statement of Cash

Flows

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended March 31, |

|

|

2022 |

2021 |

|

|

Unaudited |

|

Cash flows from operating activities |

|

|

|

Income for the period |

503,433 |

100,765 |

|

Adjustments for: |

|

|

|

Depreciation and amortization |

143,076 |

144,469 |

|

Income tax accruals less payments |

6,915 |

12,091 |

|

Equity in earnings of non-consolidated companies |

(87,604) |

(79,141) |

|

Interest accruals less payments, net |

(1,300) |

(46) |

|

Changes in provisions |

6,888 |

4,036 |

|

Changes in working capital |

(608,628) |

(83,326) |

|

Currency translation adjustment and others |

10,616 |

(28,354) |

|

Net cash (used in) provided by operating

activities |

(26,604) |

70,494 |

|

|

|

|

|

Cash flows from investing activities |

|

|

|

Capital expenditures |

(66,934) |

(45,291) |

|

Changes in advance to suppliers of property, plant and

equipment |

(18,565) |

(3,104) |

|

Proceeds from disposal of property, plant and equipment and

intangible assets |

4,819 |

4,923 |

|

Changes in investments in securities |

109,236 |

176,932 |

|

Net cash provided by investing activities |

28,556 |

133,460 |

|

|

|

|

|

Cash flows from financing activities |

|

|

|

Payments of lease liabilities |

(15,678) |

(15,900) |

|

Proceeds from borrowings |

268,143 |

94,605 |

|

Repayments of borrowings |

(256,144) |

(168,271) |

|

Net cash (used in) financing activities |

(3,679) |

(89,566) |

|

|

|

|

|

(Decrease) Increase in cash and cash

equivalents |

(1,727) |

114,388 |

|

Movement in cash and cash equivalents |

|

|

|

At the beginning of the period |

318,067 |

584,583 |

|

Effect of exchange rate changes |

(2,021) |

(3,844) |

|

(Decrease) Increase in cash and cash equivalents |

(1,727) |

114,388 |

|

|

314,319 |

695,127 |

Exhibit I – Alternative performance

measures

EBITDA, Earnings before interest, tax, depreciation and

amortization.

EBITDA provides an analysis of the operating

results excluding depreciation and amortization and impairments, as

they are non-cash variables which can vary substantially from

company to company depending on accounting policies and the

accounting value of the assets. EBITDA is an approximation to

pre-tax operating cash flow and reflects cash generation before

working capital variation. EBITDA is widely used by investors when

evaluating businesses (multiples valuation), as well as by rating

agencies and creditors to evaluate the level of debt, comparing

EBITDA with net debt.

EBITDA is calculated in the following manner:

EBITDA= Operating results + Depreciation and amortization +

Impairment charges/(reversals).

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended March 31, |

|

|

2022 |

2021 |

|

Operating income |

484,254 |

51,591 |

|

Depreciation and amortization |

143,076 |

144,469 |

|

EBITDA |

627,330 |

196,060 |

Net Cash / (Debt)

This is the net balance of cash and cash

equivalents, other current investments and non-current investments

less total borrowings. It provides a summary of the financial

solvency and liquidity of the company. Net cash / (debt) is widely

used by investors and rating agencies and creditors to assess the

company’s leverage, financial strength, flexibility and risks.

Net cash/ debt is calculated in the following manner:

Net cash= Cash and cash equivalents + Other investments (Current

and Non-Current) +/- Derivatives hedging borrowings and investments

– Borrowings (Current and Non-Current)

|

(all amounts in thousands of U.S. dollars) |

At March 31, |

|

|

2022 |

2021 |

|

Cash and cash equivalents |

315,399 |

695,245 |

|

Other current investments |

354,104 |

649,878 |

|

Non-current investments |

233,988 |

274,542 |

|

Derivatives hedging borrowings and investments |

6,662 |

5,281 |

|

Current borrowings |

(340,121) |

(246,440) |

|

Non-current borrowings |

(7,905) |

(294,649) |

|

Net cash / (debt) |

562,127 |

1,083,857 |

Free Cash Flow

Free cash flow is a measure of financial performance, calculated

as operating cash flow less capital expenditures. FCF represents

the cash that a company is able to generate after spending the

money required to maintain or expand its asset base.

Free cash flow is calculated in the following manner:

Free cash flow= Net cash (used in) provided by operating

activities – Capital expenditures.

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended March 31, |

|

|

2022 |

2021 |

|

Net cash (used in) provided by operating activities |

(26,604) |

70,494 |

|

Capital expenditures |

(66,934) |

(45,291) |

|

Free cash flow |

(93,538) |

25,203 |

Operating working capital days

Operating working capital is the difference between the main

operating components of current assets and current liabilities.

Operating working capital is a measure of a company’s operational

efficiency, and short-term financial health.

Operating working capital days is calculated in the following

manner:

Operating working capital days= [(Inventories + Trade

receivables – Trade payables – Customer advances) / Annualized

quarterly sales ]x 365

|

(all amounts in thousands of U.S. dollars) |

At March 31, |

|

|

2022 |

2021 |

|

Inventories |

3,032,127 |

1,910,293 |

|

Trade receivables |

1,718,058 |

907,738 |

|

Customer advances |

(96,905) |

(52,569) |

|

Trade payables |

(1,006,132) |

(634,648) |

|

Operating working capital |

3,647,148 |

2,130,814 |

|

Annualized quarterly sales |

9,468,164 |

4,727,156 |

|

Operating working capital days |

141 |

165 |

Giovanni

Sardagna Tenaris

1-888-300-5432www.tenaris.com

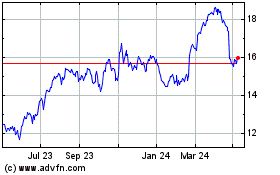

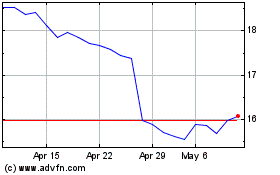

Tenaris (BIT:TEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tenaris (BIT:TEN)

Historical Stock Chart

From Apr 2023 to Apr 2024