Polkadot Holds Key Demand Level – DOT Could Hit $11 In Coming Weeks

22 November 2024 - 3:30PM

NEWSBTC

Polkadot (DOT) has entered a consolidation phase, trading below the

$6 mark after a strong 30% rally since last Friday. This period of

sideways movement has brought some volatility, but market

conditions suggest DOT might be gearing up for its next major move.

Investors watch the asset closely as it maintains a bullish

structure despite temporary resistance near the $6 level. Related

Reading: Last Chance To Buy Ethereum? Analyst Expects $6,000 Once

It Breaks 8-Month Accumulation Top crypto analyst Ali Martinez has

shared a technical analysis highlighting Polkadot’s resilience.

According to Martinez, DOT is holding the firm above a critical

demand zone, a sign that the asset could prepare for a significant

breakout. His insights point to growing interest and optimism

around Polkadot, fueled by its potential for another bullish leg.

As one of the leading blockchain ecosystems with robust

interoperability solutions, Polkadot continues to capture attention

in a market increasingly favoring quality projects. The next few

days will determine whether DOT can capitalize on its recent

momentum to push past key resistance levels. All eyes remain on

Polkadot’s price action as it tests investor confidence and market

strength. If the anticipated surge materializes, DOT could soon

reclaim higher ground, further solidifying its position in the

crypto space. Polkadot Preparing For A Breakout

Polkadot appears to be on the verge of a breakout as it maintains

bullish momentum despite a recent pullback from the $6 resistance

level. After a nearly 10% retrace, DOT has found stability above

the critical $5.7 demand zone, signaling buyers are still firmly in

control. This resilience has sparked optimism among investors and

analysts, who view the current price action as a setup for a

significant rally. Top crypto analyst Ali Martinez recently shared

his insights on X, pointing to Polkadot’s weekly price chart as

evidence of its potential. According to Martinez, DOT has shown

remarkable strength by holding above the $3.6 support level, which

has served as a foundation for its recent recovery. He suggests

that if the current momentum continues, DOT could climb to $11 in

the coming weeks, representing a substantial gain from current

levels. Martinez also emphasized that reaching and consolidating

above the $11 mark could set the stage for an even bigger rally. He

predicts that such a move would open the door for a surge to $22,

aligning with broader bullish expectations for the altcoin market.

Related Reading: Bitcoin Demand Outweighs Supply As LTH Enter

Active Distribution Phase With Polkadot’s fundamentals and

technical setup aligning, all eyes are on its ability to overcome

key resistance levels. If these predictions materialize, DOT could

reestablish itself as a leading player in the crypto market. DOT

Price Action: Technical Details Polkadot is trading at $5.6,

maintaining its position above the critical 200-day Moving Average

(MA) at $5.3. Breaking above this key indicator is a strong bullish

signal, suggesting that DOT shows long-term strength as buyers gain

control. The price is also holding firmly above the $5.6 demand

level, which served as crucial support during June and July but was

lost until its recent recovery. This regained demand level at $5.6

has reignited optimism among investors, as sustaining this zone

could provide the foundation for further bullish momentum. If DOT

manages to hold steady above this level in the coming days, a move

toward new supply zones is likely, with the next target at

approximately $6.5. Related Reading: Ethereum Consolidation

Continues – Charts Signal Potential Breakout The combination of

breaking the 200-day MA and reclaiming a significant demand level

demonstrates that DOT has the potential to maintain its current

upward trajectory. However, sustained buying pressure will be

necessary to overcome resistance and push toward higher targets.

For now, all eyes remain on DOT’s ability to consolidate above

$5.6, which will be a key indicator of whether it can continue

climbing in the coming weeks. Featured image from Dall-E, chart

from TradingView

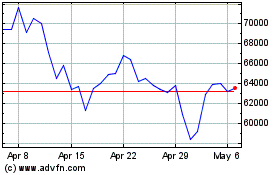

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

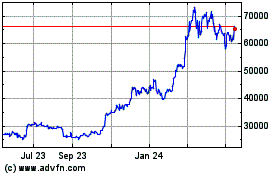

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024