Bitcoin Funding Rates Surge 20% On Major Exchanges — What’s Happening?

24 November 2024 - 6:00AM

NEWSBTC

The price of Bitcoin picked up this week from where it left off in

the previous week, forging successive all-time highs in the past

seven-day span. Over the last few days, the big question on

everyone’s mind has been — when will the premier cryptocurrency

surpass the $100,000 level? While most investors are worried about

a short-term target, some market participants are more concerned

about the long-term prospects of the world’s largest

cryptocurrency. According to the latest on-chain data, it appears

that the price of Bitcoin could see a shakeout sooner than

expected. Will The Rising Bullish Sentiment Sustain The

Rally? According to market intelligence platform

IntoTheBlock, the Bitcoin funding rates have witnessed a notable

upswing in recent days. The relevant indicator here is the “funding

rate” metric, which tracks the periodic fee exchanged between

traders in the derivatives (perpetual futures) market. Related

Reading: Cardano Gains Steam: ADA Sights More Growth After Breaking

$0.8119 When the funding rate is high or positive, it implies that

the long traders are paying traders with short positions.

Typically, this direction of the periodic payment suggests a strong

bullish sentiment in the market. On the other hand, a

negative value of the funding rate metric means that investors with

short positions are paying traders with buy positions in the

derivatives market. This trend suggests that the market is shrouded

by a bearish sentiment. Data from IntoTheBlock shows that the

Bitcoin funding fees for perpetual swaps have increased by more

than 10% — and up to 20% on major trading platforms. However, the

on-chain firm noted that this continuous funding rate growth could

hint at speculative overheating, potentially resulting in market

corrections. According to IntoTheBlock, one of the possible

catalysts of this bullish sentiment is the United States

government’s approach to crypto under Donald Trump. With the

“strategic Bitcoin reserves” more of a possibility under the

incoming US president, investors are banking on Bitcoin surpassing

a six-figure valuation. As of this writing, the flagship

cryptocurrency is valued at around $98,400, reflecting a 1%

increase in the past 24 hours. Bitcoin Perpetual Futures Market

Remains Restrained — What It Means In a recent post on the X

platform, Glassnode revealed that the Bitcoin perpetual futures

market “remains restrained.” This suggests that several traders are

still approaching the market with caution despite the steady price

climb of BTC in recent weeks. Related Reading: Dogecoin Price Set

To Skyrocket By Saturday, Warns Crypto Analyst Data from Glassnode

shows that the Bitcoin funding rates are just above 0.01%, which

falls short of the March 2024 level (~0.07%) when the BTC price

reached a local top. Ultimately, this suggests that there is still

room for growth in the value of the premier cryptocurrency.

Featured image from iStock, chart from TradingView

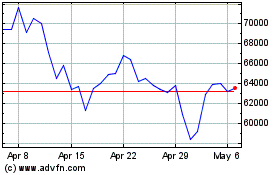

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

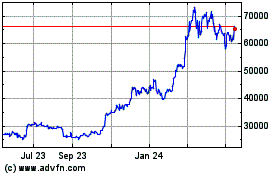

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024