Key Bitcoin Levels Under The Spotlight This Weekend: Insights From Glassnode

01 December 2024 - 8:00PM

NEWSBTC

Bitcoin (BTC), the largest cryptocurrency by market capitalization,

has experienced a remarkable uptrend over the past three weeks,

inching close to the elusive $100,000 mark. This follows

Donald Trump’s victory in the presidential election over Democratic

Party candidate Kamala Harris, which boosted investor confidence in

a new era for the broader industry. This has led to increased

adoption of the leading crypto, with major corporations worldwide

adopting it as a strategic reserve asset. In addition, inflows into

exchange-traded funds (ETFs) have increased, further contributing

to the bull run. However, after its recent 7% correction, the

Bitcoin price fell to around $91,000. Then it regained the $96,000

mark, raising questions about its ability to break through the

psychological $100,000 barrier before the end of the year. Critical

Support At $92,700 The peak price of $99,540 achieved last week has

left investors wondering whether Bitcoin can sustain its momentum

or if selling pressure will lead to further consolidation.

Despite the uncertainty, Glassnode founders Yann Allemann and Jan

Happel have provided insights into Bitcoin’s potential trajectory

as December approaches. They acknowledge the challenges ahead but

maintain that the $100,000 target remains feasible. Related

Reading: Ethereum Struggles Below $3,659 Resistance: Is Momentum

Fading? In a social media post on X (formerly Twitter), Allemann

and Happel outlined critical levels to watch in Bitcoin’s price

action. They noted that while Bitcoin is currently in a

bullish channel, resistance at $97,200 has yet to be overcome.

Should this resistance hold firm, a retest of the $92,700 support

level—aligned with the Daily 20 Simple Moving Average (SMA)—is

likely. This support zone is deemed crucial by the two

founders for maintaining the bullish channel and keeping the

$100,000 target within reach. Bitcoin Could Surge To

$125,000–$140,000 By Year-End Adding to the bullish sentiment,

crypto analyst Ali Martinez highlighted historical trends

indicating that Bitcoin has typically surged in December following

US presidential elections. In the last two cycles, Bitcoin

recorded gains of 30% and 46%, leading Martinez to speculate that

if history repeats itself, Bitcoin could close out the year in the

range of $125,000 to $140,000. Related Reading: Cardano Price

Breakout: Bull Flag Rally Points To Another 50% Surge Martinez

further pointed out that long-term Bitcoin holders have been taking

profits as the price climbed from $62,000 to $99,000. However, he

emphasized that this profit-taking behavior is typical during bull

markets and should not be interpreted as a signal to short the

asset. The analyst asserts that according to historical

patterns, long-term holders often realize gains as prices rise,

which can create short-term volatility but does not necessarily

indicate a shift in the overall market trend. At the time of

writing, BTC is trading at $96,500, down a slight 0.3% in the

24-hour time frame and down nearly 2% in the past week. Featured

image from DALL-E, chart from TradingView.com

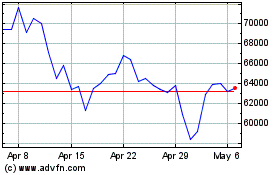

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

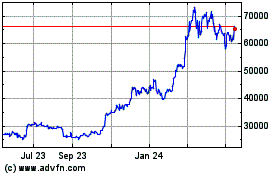

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024