Long-Term Dogecoin Holders Are In “Denial” – On-Chain Metrics Expose Weakness

27 February 2025 - 8:30AM

NEWSBTC

Dogecoin (DOGE) is trading at key demand levels after two weeks of

intense selling pressure, with bears driving DOGE down over 30%.

The broader crypto market has faced a prolonged correction that

started in mid-January, but meme coins have been the most impacted.

As the market leader in the meme coin sector, Dogecoin has suffered

extreme volatility, testing lower support levels as investor

sentiment remains bearish. Related Reading: XRP Breaks Down Below

Key Demand – Analyst Expects A Drop To $1.65 Glassnode’s on-chain

metrics reveal that long-term Dogecoin holders are in “denial”,

signaling growing uncertainty among those who have held DOGE for

extended periods. The DOGE Long-Term Holder Net Unrealized

Profit/Loss (NUPL) indicator has been in a declining trend, meaning

that many long-term holders are seeing diminishing unrealized

profits or even slipping into losses. This trend suggests that

holders who once remained confident in Dogecoin’s long-term

potential are now facing market doubt and may consider selling if

conditions don’t improve. As DOGE trades near crucial support, the

next few days will be critical for determining whether bulls can

reclaim control and push for recovery or if selling pressure will

continue, forcing DOGE into deeper correction territory. Bitcoin

and the whole market are setting fresh lows, and this week will be

crucial for bulls to defend key demand at these levels. Dogecoin

Crashes: Can Bulls Regain Control? Dogecoin has experienced a

massive sell-off, plunging more than 59% from its December high of

around $0.48 to a recent low of $0.19. This dramatic decline has

fueled panic across the market, with sentiment deteriorating

further as many analysts begin calling for the start of a bear

market. The downturn has weakened investors’ confidence, and meme

coins—once the hottest sector in the market—are now facing the

harshest corrections. Despite the ongoing decline, on-chain data

suggests not all hope is lost for DOGE. Crypto analyst Ali Martinez

shared Glassnode metrics indicating that long-term Dogecoin holders

are in “denial”, according to the DOGE Long-Term Holder Net

Unrealized Profit/Loss (NUPL) indicator. This data suggests that

many long-term investors are still holding onto their DOGE despite

the downturn but are starting to grow tired of the prolonged

downtrend. Historically, such “denial phases” can precede either a

final capitulation or a strong rebound if bulls reclaim control.

Related Reading: Solana Loses Long-Term Support Level – Analyst

Shares Insights The upcoming week will be crucial in determining

whether Dogecoin can bounce back from current levels or if sellers

will continue to dominate. If DOGE manages to hold key support

levels and reclaim momentum, a relief rally could be in sight.

However, if selling pressure persists, the price may continue

trending downward, extending the correction further. Dogecoin Price

Struggles After 19% Drop Dogecoin is trading at $0.21 after a sharp

19% drop since Monday, continuing its downward trajectory amid

broader market weakness. The meme coin sector has been one of the

hardest hit in recent weeks, with DOGE struggling to find strong

support as selling pressure remains dominant. Bulls now face a

critical test as holding above current levels is essential to avoid

further downside. To initiate a recovery rally, DOGE needs to

reclaim the $0.24 mark, a key resistance level that could signal

the start of an uptrend. However, market sentiment remains

cautious, and price action suggests that DOGE could enter a

consolidation phase below this level before any meaningful recovery

begins. Related Reading: Litecoin Trading Activity Increases Over

The Past Month – Potential LTC ETF Draws Speculation If Dogecoin

fails to hold above $0.21, bears may continue pushing the price

lower, potentially revisiting previous support levels. However, if

buyers step in and DOGE stabilizes, it could build momentum for a

future push toward higher prices. In the short term, traders should

closely watch whether bulls can defend current demand levels and

reclaim key resistance levels to confirm a potential reversal in

price action. Featured image from Dall-E, chart from TradingView

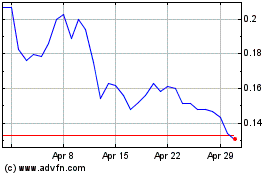

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025