Chainlink Crosses $6.18 Trillion In Transaction Value – Will This Boost LINK Price?

04 October 2022 - 3:40AM

NEWSBTC

The reception of Chainlink among crypto enthusiasts has been

positive. The ecosystem’s transaction volume has surpassed $6

trillion, according to the project’s official Twitter account.

Because of this rise, the number of native integrations in the

ecosystem rose from 12 to 15. At this point, it appears that

Chainlink may be en route to the proverbial moon. Shouldn’t a

price increase coincide with improved metrics? No, not quite. The

on-chain stats for LINK don’t look good, according to the

statistics provided by Santiment. Related Reading: Ethereum Sees

Surge In Number Of New Addresses – Will ETH Shine This October?

Chainlink Market Cap Down As of this writing, there has been

significantly less progress made on the LINK chain than in previous

months. The value of Chainlink’s stock on the market is likewise

much lower. The market cap for LINK on October 2 was $284,961,375,

a decline of 78.06% from its all-time high of

$1,299,905,978 on September 29, data from CoinGecko

show. A downward trend may be forming. However, at this time,

Chainlink’s price is quite volatile on the intraday and 4-hour

time frames. LINK’s historical volatility is rather high, ranging

between 64.75 and 50.27, indicating that its price frequently

fluctuates between ranges. The Stoch RSI figures are also falling,

although the relative strength index of the coin is quite constant.

Although the coin’s performance indicates a downward trend, LINK

HODLers may still have reason for optimism. Chart: TradingView.com

LINK Investor Confidence Up According to statistics from

CryptoQuant, LINK exchange reserves are currently below average.

This may suggest that the coin is not undergoing a significant

selling pressure. This is depicted on the graphs as a price

increase. As of the time of writing, LINK is up 2.26 percent on a

4-hour scale. The price of the coin fluctuates between $7,026 and

$6,574. These two support levels are significant, as any breach by

the bears might cause a sell-off that pushes the price below $6.

The chart also reveals a head-and-shoulders shape, which can act as

a development impediment. However, as of this writing, the token

has broken through and is on an intraday and 4-hour upswing.

Considering the current report for the third quarter of 2022, this

could indicate a rise in investor confidence. As the ecosystem

continues to flourish, LINK holders should anticipate more good

news in the coming days. Related Reading: Crypto Community Predicts

Polygon (MATIC) To Rise Nearly 20% By October 31 LINK total market

cap at $3.5 billion on the daily chart | Source: TradingView.com

Featured image from Pixabay, chart from TradingView.com

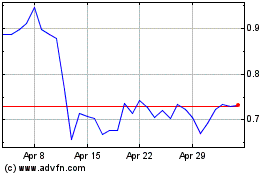

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024