Reports: FTX Targeting BlockFi Purchase At $25M

01 July 2022 - 6:27AM

NEWSBTC

BlockFi, Celsius, Nexo, and more: tough times can lead to difficult

measures, and this year’s bear market is showing no exception to

some of these players. Look no further than the current state of

affairs for centralized finance (CeFi) platforms, who have been

facing substantial headwinds with no end in sight. Now, after days

of rumors and reported exploratory deals, reports have emerged that

powerhouse crypto exchange FTX is putting together the final ties

around an acquisition deal of BlockFi at just a $25M valuation. The

news comes after reports emerged that FTX passed on an acquisition

deal for Celsius after seeing the CeFi firm’s balance sheet.

BlockFi On The Block Should the purchase come to fruition at the

reported valuation, it’ll be a major hit for BlockFi equity

holders, following a nearly $5B valuation last year in the midst of

bull market movement. However, that $25M number could move

drastically between today’s reports and closing time – and a

successful acquisition will of course take months to close. BlockFi

CEO Zac Prince described the number as “market rumors” and outright

denied the number, stating in a tweet that “we aren’t being sold

for $25M.” FTX is on the shortlist of exchanges that have sought

out opportunity in the midst of crypto market downturn, exploring

buyouts or equity share purchases for both Celsius and BlockFi in

recent weeks, according to a variety of reports. However, based on

the hard facts available to the public, the viability and

likelihood of a buyout for BlockFi is still difficult to measure.

Celsius (CEL) has faced an uphill battle as the platform has still

paused withdrawals for customers. | Source: CEL-USD on

TradingView.com Related Reading | Ethereum Loses Steam As Exchange

Supply Spikes State Of CeFi: Pulse Check How did we get here? Bear

market downturn over the past month or two has caused major pain

for CeFi platforms, in a flurry of madness that started with

Celsius freezing withdrawals earlier this month amid worries of a

bank run and lack of immediate liquidity within the platform’s

holdings. BlockFi has undoubtedly faced the heat, too, as FTX

provided the firm with a $250M emergency line of credit just last

week. While reports across the market suggest that BlockFi has

several options on the table, it seems that few will lead down a

path that spares equity shareholders of value at present time. Nexo

has largely stayed quiet during the chaos, but there’s various

internet sleuths who have targeted Nexo with content campaigns

around the company’s practices as well. Regardless of how you feel

about CeFi, the decline of infrastructure in this bear market

shouldn’t be celebrated – we’ll see how it all shakes out when the

tides recover. Related Reading | USDC Exchange Reserves Rise As

Investors Escape From Bitcoin Featured image from Pixabay, Charts

from TradingView.com The writer of this content is not associated

or affiliated with any of the parties mentioned in this article.

This is not financial advice.

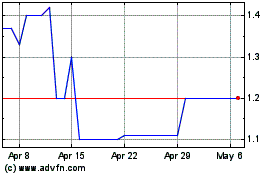

Nexo (COIN:NEXOUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nexo (COIN:NEXOUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024