Bitcoin Puell Multiple Hits 14-Month High, Here’s What It Means

20 February 2023 - 10:30PM

NEWSBTC

On-chain data shows the 7-day moving average (MA) Bitcoin Puell

Multiple has hit a 14-month high recently. Here’s what it may mean

for the market. Bitcoin 7-Day MA Puell Multiple Has Risen Above 1

Recently As pointed out by an analyst in a CryptoQuant post, the

BTC price was around $48,000 the last time the metric was at its

current level. The “Puell Multiple” is an indicator that measures

the ratio between the daily revenue of the Bitcoin miners and the

365-day MA of the same (both in USD). When the value of this metric

is greater than 1, it means the miners are making more right now

than the average for the past year. If the indicator hits very high

values above this mark, then miners become likely to sell as they

are likely raking in a significant amount of profits. On the other

hand, the multiple being below the threshold implies the mining

revenues are less than the norm at the moment. Low enough values

under this mark have historically been a sign that the

cryptocurrency is undervalued. Now, here is a chart that shows the

trend in the 7-day MA Bitcoin Puell Multiple over the last couple

of years: Looks like the 7-day MA value of the metric has shown

some rise in recent days | Source: CryptoQuant As displayed in the

above graph, the 7-day MA Bitcoin Puell Multiple had been below the

1 mark during the past year or so as the bear market had gripped

the asset. With the latest rally in the coin’s price, however, the

indicator seems to have seen some rapid rise, and it has now broken

out of the zone again. Related Reading: Brazilian Government To

Clarify Bitcoin Law With New Decree This is the first time in about

14 months that the metric has crossed above the 1 level. To see

what effect this might have on the current market, here is a chart

that highlights how the indicator behaved during the past cycles:

The trend in the indicator over the history of BTC | Source:

CryptoQuant In the graph, the quant has marked the different levels

that have been relevant for the 7-day MA Bitcoin Puell Multiple

during the previous cycles. It looks like sustainable rallies have

usually taken place whenever the metric has made a successful break

above the 1 mark. When the indicator is below 1, some miners may

have trouble running their operations as the lower revenues may not

pay costs like electricity bills. Thus, during times like this,

some miners may be forced to sell their reserves to keep their

facilities going. Related Reading: Bitcoin Price At Risk of

Downside Thrust Before A Fresh Increase However, the analyst

explains that when the indicator shows a rising trend breaking

through 1, miners start getting more comfortable with keeping their

bills paid and therefore, the selling pressure goes down from this

cohort. If the same pattern follows this time as well, then the

current break of the Bitcoin Puell Multiple in the region above

this level could be good news for the viability of the current

rally. BTC Price At the time of writing, Bitcoin is trading around

$24,500, up 13% in the last week. Looks like BTC has moved sideways

since the rise | Source: BTCUSD on TradingView Featured image from

Michael Förtsch on Unsplash.com, charts from TradingView.com,

CryptoQuant.com

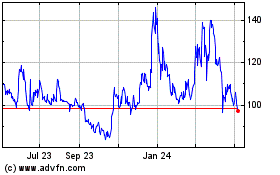

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

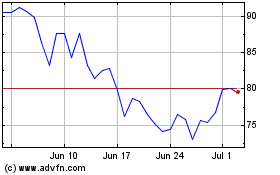

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024