Bitcoin Decline Ahead? Bearish Crossover Forms In This Metric

25 February 2023 - 3:30AM

NEWSBTC

The Bitcoin taker buy/sell ratio is currently forming a crossover

that has led to the price of the asset observing a decline in the

past. Bitcoin Taker Buy Sell Ratio Moving Averages Are Crossing

Over As pointed out by an analyst in a CryptoQuant post, the

350-day moving average (MA) of the metric is crossing with the

100-day exponential moving average (EMA) right now. The “taker

buy/sell ratio” is an indicator that measures the ratio between the

taker buy and taker sell volumes in the Bitcoin futures market.

When the value of this metric is greater than 1, it means the long

or the taker buy volume is higher than the short or the taker sell

volume currently. Such a trend suggests that more users are willing

to pay a higher price for BTC right now. On the other hand, values

below the threshold imply the taker sell volumes are more dominant

in the futures market at the moment, and thus, a bearish sentiment

is shared by the majority. Related Reading: Bitcoin Bearish Signal:

Exchange Whale Ratio Surges Now, here is a chart that shows the

trend in the 350-day MA and 100-day EMA versions of the Bitcoin

taker buy/sell ratio over the last few years: Looks like the two

metrics have come together in recent days | Source: CryptoQuant As

you can see in the above graph, the quant has highlighted how the

behavior of these two moving averages of the taker buy/sell ratio

seems to have affected the price of the cryptocurrency. It looks

like whenever the two metrics have made a cross, the BTC price has

observed a buy or sell signal. More specifically, whenever the

100-day EMA has crossed below the 350-day MA, the price has felt a

bearish effect, while the reverse type of crossover has generally

been bullish for the coin. Related Reading: Bitcoin On-Chain Data

Shows Why $24,700 Is A Major Resistance For BTC Also, a peculiar

trend that has historically been seen with the 100-day EMA is that

whenever this indicator breaks the 1 line, the BTC price forms a

bottom (when the break is above) or top (when it’s below).

Recently, these Bitcoin taker buy/sell ratio lines have touched

each other again. The bearish type of crossover seems to be forming

here, as the 100-day EMA has dipped below the 350-day MA. If the

past instances of this crossover are anything to go by, BTC may

soon see some downward push. The price has actually already slid

down a bit in the last few days, but currently, it’s unclear if the

crossover is already in effect or if the real decline is yet to

come. The 100-day EMA taker buy/sell ratio also looks to be

plunging recently and the metric is now fast approaching the 1

level. If a break below takes place, then a local top may be

confirmed for the price, if, again, the past pattern holds any

relevance. BTC Price At the time of writing, Bitcoin is trading

around $23,900, up 1% in the last week. BTC seems to have declined

in the last few days | Source: BTCUSD on TradingView Featured image

from Mark Basarab on Unsplash.com, charts from TradingView.com,

CryptoQuant.com

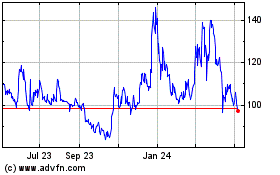

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

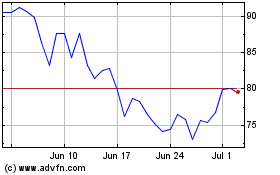

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024