Rate Hikes On The Horizon, Will It Doom Bitcoin Below $20,000?

08 March 2023 - 7:14AM

NEWSBTC

Bitcoin continues to trade sideways as volatility in the market’s

most prominent cryptocurrency diminishes. Bitcoin has successfully

held the $22,000 support level, although it did suffer a dip below

$22,000 that was quickly bought by the bulls. The volatility

of the cryptocurrency market has been poor in recent weeks. BTC’s

short-term implied volatility (IV) has recently fallen below 40%,

and its trading volume has hit new lows. This indicates that BTC

has entered an “extremely tight liquidity phase,” according to a

Twitter post by market researcher and data analyst WuBlockchain.

Additionally, Bitcoin liquidations in the last 24 hours topped $70

million as the flagship crypto asset fell below $20,000, wiping out

the liquidity of long positions on exchanges’ order books,

according to Glassnode data. Related Reading: Cardano, XRP

Sentiment Plummets, Time To Be Greedy While Others Are Fearful?

Further Hawkish Policies Will Delay BTC’s Bull Market? With the

recent statements made by the Federal Reserve (Fed) Chairman Jerome

Powell, the crypto market fears further increase as there is

potential for further interest rates to control inflation levels.

This spike in rates is likely to affect the price of the top

cryptocurrencies on the market and cause a further decline in the

total crypto market capitalization, which is currently below the

trillion-dollar level. Per the financial institution’s mandate,

Jerome Powell has stated that they will continue to “use tools to

reduce inflation over time” to decrease inflation numbers to

2%. Historically, when the Fed introduced restrictive

monetary policies that led to higher interest rates, stocks and

cryptocurrencies recorded losses; higher interest rates generally

affected investors’ appetite to dive into the cryptocurrency

market. Powell added: The latest economic data have come in

stronger than expected, which suggests that the ultimate level of

interest rates is likely to be higher than previously anticipated.

If the totality of the data were to indicate that faster tightening

is warranted, we would be prepared to increase the pace of rate

hikes Michael Van de Poppe, CEO and founder of trading platform

Eight Global, addressed the most recent statements by Fed Chairman

Jerome Powell, stating that selling has increased for risk-on

assets in anticipation of higher interest rates and a faster pace

to control inflation, based on the latest news and the “likelihood”

of a 50 basis point (bps) rate hike in the coming months. Critical

Area For Bitcoin As Bitcoin retests the $22,000 liquidity of

long positions, more than 5,000 BTC have left exchanges in the last

24 hours, according to the on-chain data analysis firm CryptoQuant,

which also stated that the crypto market is primarily

bearish. The spike in BTC outflows from exchanges could

support bullish investors. The less BTC is available on the market,

the more likely it is to hold above critical support. Bitcoin

is trading above its support line at $22,300, down -1.3% in the

past 24 hours. In the broader time frames, BTC has fallen

significantly in the seven and fourteen-day time frames, posting

retracements of -5.5% and 10%, respectively. If Bitcoin fails

to hold above its nearest support, it seems poised to visit the

lower levels of $21,000 and $20,000. Related Reading: Synthetix

(SNX) Holds Monthly Gains As Broader Market Plummets Featured image

from Unsplash, chart from TradingView.com

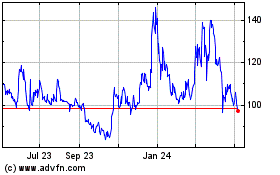

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

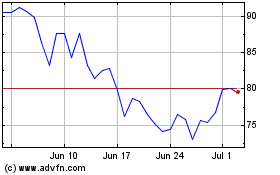

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024