Bitcoin MVRV Approaches Crucial Retest, Here’s What Can Happen Next

09 March 2023 - 2:00AM

NEWSBTC

On-chain data shows Bitcoin MVRV is approaching a crucial retest

currently. Here’s what a successful liftoff could mean for the

crypto’s price. Bitcoin MVRV Ratio Is Nearing Its 100-Day EMA Line

As pointed out by an analyst in a CryptoQuant post, BTC has gone on

to see long-term growth whenever the metric has responded to this

line before. The “MVRV ratio” is an indicator that measures the

ratio between the Bitcoin market cap and its realized cap. The

“realized cap” here refers to a capitalization model for BTC that

assumes that each coin in the circulating supply actually has its

real worth as equal to the price at which it was last moved (rather

than the current BTC price, as the normal market cap says). The

realized cap is often known as a fair-value model for the asset, so

the MVRV tells us whether the BTC price (the market cap) is

currently fair or not, by comparing the two caps of the coin. When

the ratio has a value greater than 1, it means the market cap is

greater than the realized cap, and hence the cryptocurrency may be

overvalued right now. On the other hand, values below this

threshold imply the coin may be undervalued currently. Related

Reading: Dogecoin Whale Withdraws $5 Million In DOGE From Binance,

Bullish Sign? Now, here is a chart that shows the trend in the

Bitcoin MVRV ratio, as well as its 100-day exponential moving

average (EMA), over the last few years: Looks like the value of the

metric has been declining in recent weeks | Source: CryptoQuant As

you can see in the above graph, the Bitcoin MVRV ratio was below 1

during the bear market lows of the past year, showing that the

cryptocurrency was underpriced. With the latest rally, however, the

metric has escaped from this zone and now has a value greater than

1. In the chart, the analyst has highlighted the historical

bottoming zone in green and the top zone in red. Currently, while

the MVRV may be showing slightly overvalued conditions, the price

is still not high enough yet to hit the zone where tops have formed

in the past. A curious pattern appears when looking at the

indicator’s interaction with its 100-day EMA curve. It looks like

whenever the ratio has retested this line from above and has

successfully rebounded off it, the price of Bitcoin has gone on to

enjoy some bullish trend in the long term. Related Reading: Bitcoin

“Social Dominance” Surges As Altcoins Struggle Currently, as the

rally has come to a stop and the price has been noticing some

decline, the MVRV ratio is also going down and is now nearing its

100-day EMA line. Right now, it’s unclear if the metric will

continue this trajectory and a retest will take place, but if one

does and it’s successful, then Bitcoin could feel a bullish push

from it if the past pattern is anything to go by. BTC Price At the

time of writing, Bitcoin is trading around $22,000, down 7% in the

last week. BTC continues to consolidate | Source: BTCUSD on

TradingView Featured image from Kanchanara on Unsplash.com, charts

from TradingView.com, CryptoQuant.com

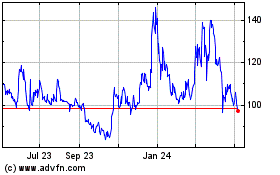

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

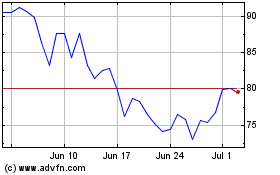

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024