Why Did Bitcoin Plunge? Here’s What On-Chain Data Says

11 March 2023 - 12:00AM

NEWSBTC

Bitcoin has slipped under the $20,000 level today for the first

time in two months. Here’s why this plunge may have taken place,

according to on-chain data. Bitcoin Price Dropped With Coinbase

Premium Turning Negative As pointed out by an analyst in a

CryptoQuant post, the U.S. government’s recent movement may have

played a role in the latest decline in BTC’s price. There are a

couple of relevant indicators here: the Coinbase Premium and the

Spent Output Age Bands (SOAB). The “Coinbase Premium” measures the

difference between the Bitcoin price listed on the cryptocurrency

exchange Coinbase and that listed on Binance. Coinbase is an

exchange that’s popularly used by U.S.-based investors (especially

large institutions), while Binance has a more global-oriented

audience. Due to this reason, the Coinbase Premium can provide

hints about whether American holders are buying (or selling) more

or less than global investors right now. When the value of the

metric is positive, it means the price listed on Coinbase is

greater than that on Binance currently, and hence the U.S.-based

users have been putting on higher buying pressure than the global

investors (or alternatively, they have just been selling less

heavily). On the other hand, negative values of the metric suggest

that U.S. participants might be engaging in a higher amount of

selling than the world user base at the moment. Related Reading:

Bitcoin Miner Reserve Plunges, Bearish Sign For Price? Now, here is

a chart that shows how the Bitcoin Coinbase Premium has changed

over the past week: Looks like the value of the metric has gone

down in recent days | Source: CryptoQuant As displayed in the above

graph, the Bitcoin Coinbase Premium has turned negative recently.

This means that U.S. investors may have been putting some

extraordinary selling pressure on the cryptocurrency during this

period. Interestingly, the price of the coin has declined while the

premium has become negative, which may suggest that U.S.

participants may have had more of a hand in this latest plunge. The

chart also contains data for the other indicator of interest here,

the “SOAB,” which tells us which age bands (or groups) in the

market have been moving their coins recently. Curiously, the 6m-12m

age band, which includes all Bitcoin investors that have been

holding onto their coins for at least 6 months and at most 12

months ago, has shown a large movement just a few days ago. Related

Reading: Bitcoin MVRV Approaches Crucial Retest, Here’s What Can

Happen Next As for the source of these aged coins, the quant

explains, “the transaction is linked to bitcoins seized by the U.S.

government because they are related to Silkroad.” The timing of

this large Bitcoin transaction and the selling pressure rising on

Coinbase is interesting and could suggest that there may be a link

between the two. “It’s difficult to say what impact this

transaction had on the price drop because we can’t see what’s

happening on the exchange,” notes the analyst. “But everything

suggests that it caused extra selling pressure.” BTC Price At the

time of writing, Bitcoin is trading around $19,800, down 11% in the

last week. BTC has plunged over the past day or so | Source: BTCUSD

on TradingView Featured image from Kanchanara on Unsplash.com,

charts from TradingView.com, CryptoQuant.com

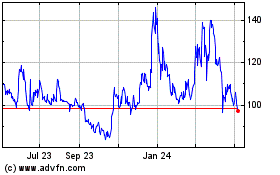

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

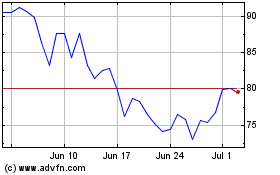

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024