The US Fed adds $297 Billion In A Week, Fanning Bitcoin Rally

17 March 2023 - 8:35PM

NEWSBTC

The total amount of assets held by United States Federal Reserve

(Fed) banks is up 3.56% in the past week, rising to $8.639 trillion

from $8.342 trillion, trackers on March 17 show. Fed Injected

$297 Billion Into The Market Last Week With the Fed holding assets

and injecting $297 billion in the last week alone to avert a

contagion following the collapse of three banks last week, the

central bank has reverted to quantitative easing. The result

is what observers say is a “Fed Put,” a phenomenon where the

central bank intervenes and rolls out an accommodative policy

whenever there are sharp price falls in the equity markets. Early

this week, bank stocks crashed with widespread fears of bank runs

should the Fed fail to intervene. Related Reading: Bitcoin

Price Restarts Rally As The Bulls Target New Monthly High Observers

note that the $297 billion increment over the last week was not due

to asset purchases since last week, Treasuries and mortgage-backed

securities declined. Instead, this expansion was due to the $12

billion Bank Term Funding Program and a series of loans extended to

shore up major banks. For this action, the Fed unwound what they

have been trying to achieve over the last year. The “Fed Put”

is back with assets on their balance sheet increasing $297 billion

over the last week, the largest spike higher since March 2020. Thus

nearly half of the Quantitative Tightening since last April was

undone in a week. Bitcoin And Crypto Prices Rally Following the

collapse of Silvergate Bank, Silicon Valley Bank (SVB), and

Signature Bank, all of which were considered crypto-friendly and

aided blockchain projects in a way to process funds, bank stocks

across the board collapsed. Meanwhile, the USDC, a stablecoin

pegged to the US dollar, briefly de-pegged following news that it

had $3.3 billion locked up in SVB. Moreover, there was

turbulence in DAI, an algorithmic stablecoin managed by MakerDAO,

one of the largest DeFi protocols. MakerDAO initiated steps to

ensure DAI remains at parity with the USD, boosting MKR, the

platform’s governance token. While normalcy has returned and

Bitcoin is back trading above $26,000, a nine-month high, the

intervention by the US government and Fed seemed to have unwound

most of their tightening efforts over the last few months.

Related Reading: Bitcoin Priced In Bank Shares Is The Crypto Chart

You Can’t Miss As trackers show, the Fed has been gradually

unloading assets from its portfolio over the past months. This was

as they tightened around the economy, intervening to curb runaway

inflation. This tightening looks to have worked though, as

recent economic data revealed that inflation fell in February to

6%, the lowest in over 15 months. This contraction in consumer

prices was in line with market expectations. Feature Image From

Andrew Harnik/AP, Chart From TradingView

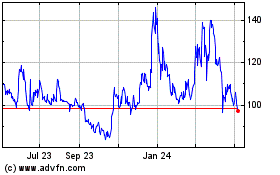

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

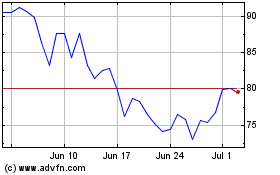

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024