China Is Fast Losing Money: Their Bitcoin Stash Just Fell By $388 Million

22 April 2023 - 8:00AM

NEWSBTC

When Bitcoin prices fell from $31,000 to below $29,000, the total

value of BTC held by China fell by over $388 million to around

$5,4 billion. China’s Bitcoin Stash Fell By $388 Million

Bitcoin is trading below $28,500 and looks likely to edge even

lower, considering the formation in the daily chart. With every

tick lower, China and other countries, including Ukraine and

Georgia, are losing money. The loss could even be bigger for the

Chinese considering their big stash of BTC, which translates to

around 0.924% of the total fixed supply of 21 million, according to

Bitcoin Treasuries data. Related Reading: Bitcoin In Danger Zone:

Bulls Must Hold $27,700 For Price Recovery, Expert Suggests Records

show that China holds 194,000 BTC, 833,000 ETH, and a variety of

other unnamed cryptocurrencies. These digital assets were

confiscated from the PlusToken scam in 2019 and were worth over $3

billion. FUN FACT: Government of China🇨🇳 is a crypto whale. Chinese

authorities seized 194k BTC, 833k ETH, and others from the

PlusToken scam in 2019. They forfeited these $6 billion-worth

assets to the national treasury. FWIW, MicroStrategy has 130k $BTC.

pic.twitter.com/Ilqp7EnenL — Ki Young Ju (@ki_young_ju) November 2,

2022 According to reports, these assets were tied to the country’s

national treasury. Still, some funds associated with the scam are

reportedly being regularly sent to mixers and liquidated at spot

rates, impacting prices. However, whether the Chinese government

still holds these assets remain unknown. There is no official

Bitcoin address to verify the status of these coins. PlusToken Scam

was a global Ponzi scheme targeting Chinese and South Korean

investors. It started in April 2018, taking advantage of

unsuspecting people who thought they could make quick money from an

investment opportunity. All users had to pay for registration using

cryptocurrencies, mainly BTC, before investing. Perpetrators said

they were developing cryptocurrency products. Six Chinese

nationals were arrested in Vanuatu and extradited to China to face

the law in June 2019. A year later, the Chinese Ministry of Public

Security said they arrested other suspects, recovering over $3

billion of crypto assets. United States Is A Crypto Leader

Cryptocurrency trading and related operations, including mining,

are banned in China. Therefore, whether Chinese authorities will

“trade” these cryptocurrencies for other assets is unclear for now.

Related Reading: Quant Explains Bitcoin Funding Rates Pattern That

Precedes Uptrends The country outlawed trading in 2017 and mining

in 2021, forcing crypto miners, mainly of Bitcoin, to other

jurisdictions. Since the ban, the United States has emerged as the

biggest host of crypto mining operations. China accounted for over

50% of all crypto mining operations at peak. According

to trackers, the largest public Bitcoin mining companies are

in the United States and Canada. Riot Blockchain is the largest

publicly listed Bitcoin mining company with a market cap of $1.82

billion. Feature Image From Canva, Chart From TradingView

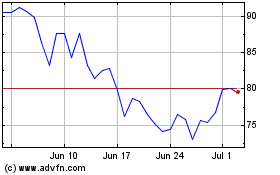

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

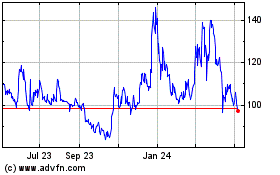

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024