Flow Monitoring: Why This Price FLOW May Not Attract Short-Term Traders

28 August 2022 - 6:35PM

NEWSBTC

FLOW, a blockchain-powered coin, is back in its element. FLOW price

plunged by 4.00% Network releases MetaplierFlow gave rise to

collaboration with CelerNetwork Coin performance may not attract

short-term traders Even though the network may not currently be

experiencing a strong bull run, it does appear to be focused on

giving consumers who access its decentralized architecture more

options. The native coin of the Flow ecosystem is called FLOW. It

is employed for all payments of protocol-level fees, rewards, and

staking of tokens. In order to attain its goal, the ecosystem

recently released MetaplierFlow, a Decentralized Exchange (DEX),

which now includes a few integrations. The said integration gave

rise to a relationship with the cross-chain platform

CelerNetwork. Related Reading: Cardano Price Trajectory

Signals Negative Bearing, Weekly Chart Mostly In Red Integrations

Didn’t Impact FLOW Price Another initiative aimed at improving the

decentralization of the ecosystem is the recent cooperation. Keep

in mind that developing such systems has been done before. In the

past, FLOW collaborated on a similar goal with a Decentralized

Autonomous Organization (DAO). While there are certain differences,

the most recent development will allow its users to quickly connect

to other cryptocurrencies. The specified assets are USDC, Wrapped

Ethereum [WETH], Wrapped Bitcoin [WBTC], and Wrapped Ethereum. The

additions didn’t appear to worry FLOW, though. According to

CoinMarketCap, FLOW price has nosedived by 4% or trading at $1.82

as of this writing. Related Reading: Shiba Inu Burn Events Spark A

Rally In Altcoin Over The Past Weeks The integrations didn’t cause

its price to rise or fall. The one-month green take, however, was

insufficient to generate enthusiasm for the coin. Investors in FLOW

could benefit from these improvements in certain ways. First,

compared to the period between August 18 and August 22, the

volatility on the four-hour chart against the USDT was remarkably

reduced. The Bollinger Bands revealed this feeling (BB). The

Relative Strength Index (RSI), which measures momentum, was neutral

but had ominous indications at 45.70. However, with the AO value at

-0.048, it was more of a negative sign. Stats Way Off Short-Term

Traders’ Estimates An in-depth analysis of the on-chain portion

reveals that the coin’s performance did not meet expectations,

particularly for short-term traders. The merger sparked a positive

trend in development activity. However, there was hardly any

difference in the whales’ overall supply, which was worth $5

million and more. Investors may wish to maintain their expectations

at a low level because FLOW is nearly 95% away from re-hitting it’s

All-Time High (ATH). Even while the cryptocurrency market has not

quite made a decisive move out of its bear state, all may not be

lost. The earned coin can be used to create, develop, and grow

Dapps as well as to stake, delegate, hold, and vote. For signing

into transactions, use the ecosystem’s client library as a tool.

For the purpose of using FLOW tokens, investors can log in using

their accounts. Holders of Flow have the ability to interact with

the coin’s crypto community, take part in conversations, and cast

votes for Flow governance. BTC total market cap at $384 billion on

the daily chart | Source: TradingView.com Featured image from The

Coin Republic, chart from TradingView.com

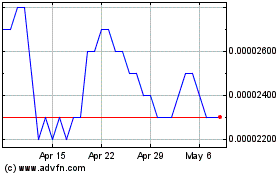

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024