Bitcoin Bulls Push BTC Back Up To $28K Level Amid Surging Address Activity

29 May 2023 - 5:45PM

NEWSBTC

Bitcoin (BTC), the pioneer of cryptocurrencies, continues to

captivate the financial world with its ever-evolving landscape. In

recent developments, Bitcoin’s active addresses have witnessed a

significant surge, soaring to a three-week high. This surge

in activity has not only breathed new life into the Bitcoin network

but has also reverberated in the form of a substantial increase in

the crypto’s price. The increased demand resulting from heightened

network activity has propelled the alpha coin’s price to new

heights, igniting a sense of excitement and potential within the

cryptocurrency market. Related Reading: Bitcoin Core 25.0

Hits The Market: A Sneak Peek Into The Future Surge in Bitcoin’s

Active Addresses Signals Growing Utility Bitcoin’s utility is on

the rise as the number of active addresses for the cryptocurrency

has surged to a remarkable three-week high, according to crypto

intelligence portal Santiment in a Twitter update. 📈 May’s

concerningly low #Bitcoin address activity is finally starting to

rebound again. Increasing utility is necessary for #crypto assets

to enjoy sustained rallies. Keep an eye on whether $BTC can head

into June with 1M or more daily active addresses.

https://t.co/LSa2slHWgt pic.twitter.com/zqTH9KGIqc — Santiment

(@santimentfeed) May 27, 2023 After a lull in activity, the latest

data reveals that the number of active addresses for BTC has

reached an impressive 960,000, marking the first time since May 3

that such levels have been attained. Source: Santiment In sync with

the surge in active addresses, Bitcoin’s price on CoinGecko has

climbed $28,032, giving it a 3.0% increase within the last 24

hours. This surge in price also translated to an increase of 4.7%

over the course of seven days. Source: Coingecko The surge in

active addresses showcases the growing utility and adoption of

Bitcoin, which is vital for its sustained growth in the

cryptocurrency ecosystem. As we approach the month of June, all

eyes are on Bitcoin to see if it can surpass the significant

milestone of 1 million daily active addresses. Bitcoin Whales

Resume Aggressive Accumulation Despite a temporary slowdown

in accumulation, Bitcoin whales – those holding 10,000 or more BTC

– have once again intensified their acquisition of the leading

cryptocurrency, with a particular surge observed over the weekend.

This aggressive accumulation by whales suggests a renewed

confidence in Bitcoin’s long-term potential and may serve as an

indicator for future market trends. BTCUSD reclaims the key $28K

territory today. Chart: TradingView.com Related Reading: Shiba Inu

All Green Today – What’s The Energy Behind The Glow? In the wake of

these developments, the crypto market has witnessed a significant

increase in liquidations, surpassing a staggering $118 million

within the past 24 hours alone. According to The Kobeissi Letter,

an authoritative source on market insights, the recent breakthrough

of Bitcoin above the $28,000 mark coincided with the news of a debt

ceiling deal “reached in principle” on the previous night. In

the debt ceiling deal, the debt ceiling is rumored to not be raised

by a specific amount. Instead, the debt ceiling will run uncapped

until January 1st, 2025. Many are underestimating how significant

this is. This means that the debt ceiling is basically unlimited

for the… — The Kobeissi Letter (@KobeissiLetter) May 28, 2023

Elaborating further, The Kobeissi Letter reveals that the debt

ceiling is rumored to remain uncapped until January 1, 2025,

without a specific raise in the limit. This development introduces

a level of uncertainty and potential implications for the financial

landscape, driving market participants to seek alternative

investments such as Bitcoin. -Featured image from VectorStock

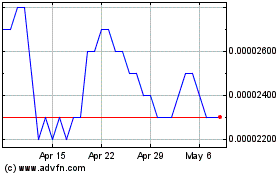

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024