Bitcoin Price Trades A Little Over $24,000, Can It Target $27,000?

16 August 2022 - 2:00PM

NEWSBTC

Bitcoin price peeped above the $24,000 price level after falling

from the $25,000 mark few trading sessions ago. Over the past week

Bitcoin secured a 6% gain and on the daily chart the coin fell by

1%. This had pointed towards a sign of consolidation. Bitcoin price

had formed higher highs and high lows which are an indication of

bullishness on the chart. Incase the king coin manages to remain

above the $24,000 mark for a substantial period of time, it can aim

at $27,000 over the upcoming trading sessions. In case the coin

loses momentum, it can fall to $23,000 level. Technical outlook for

the king coin pointed towards the continued bullishness which meant

that buying strength hadn’t faded away from the market. For Bitcoin

price to hold onto present price momentum, a continued buying

strength will prove necessary. The global cryptocurrency market cap

today was at $1.2 Trillion, with a 1.6% fall in last 24 hours. With

consistent buying strength, Bitcoin will experience a tough

resistance at the $27,000 level. Bitcoin Price Analysis: One Day

Chart BTC was trading at $24,100 at the time of writing. Over the

past week, the coin had witnessed price appreciation. In the past

24 hours, Bitcoin price moved laterally. According to the Fibonacci

levels, if the coin manages to trade above the 23.6% level, a move

to 38.2% could be possible. This meant that overhead resistance

level stood at $27,000. A retracement could cause Bitcoin to fall

to $23,000 and then to $20,000 respectively. Over the last trading

session, the amount of BTC traded was in red which meant that

buying strength noted a downtick. Technical Analysis The lateral

movement in Bitcoin’s chart had indicated fall in buying strength

on the king coin’s chart. The consolidation did not have

significant effect on the technical outlook. The Relative Strength

Index captured a small depreciation in buying strength, despite

this, RSI was well above the half-line. A reading above the

half-line is an indication of more buyers compared to the sellers

of the coin. Bitcoin price was trading above the 20-SMA line.

Trading above that was an indication that BTC’s buyers were driving

the price momentum in the market. This also meant that at lower

levels too, BTC had demand on its chart. Related Reading: Why

Solana Could Poised For A 40% Price Move To The Upside The rise in

price was depicted on other technical indicator. The Moving Average

Convergence Divergence points towards the current price momentum

and reversals in the same. MACD after a bullish crossover gave rise

to green histograms above the half-line which were buy signal for

the coin. Chaikin Money Flow reads the capital inflows and outflows

on the chart. Even with other bullish indicators, CMF was below the

half-line indicating that capital inflows were lesser than outflows

at press time. Related Reading: Litecoin Breezes Past $64 Level As

LTC Picks Up Speed Featured image from UnSplash, Chart from

TradingView.com

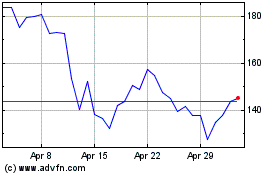

Solana (COIN:SOLUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Solana (COIN:SOLUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024