Uniswap Rally Could Be In Jeopardy, Despite UNI’s Solid Social Engagement

05 October 2022 - 1:45AM

NEWSBTC

Uniswap (UNI) started with a bearish stride in 2022 along with

Ripple and most other cryptocurrencies but it has been gaining some

impressive price action as seen in the past few weeks. UNI’s social

engagement up by 53.62% Supply of unique wallet addresses surged

since September 12 UNI price looking bullish; up by 4.15% According

to CoinMarketCap, UNI’s price has been looking bullish and spiked

by 4.15% or trading at $6.77 as of this writing. Related Reading:

Tornado Cash Sees Drop In Activity After U.S. Treasury Sanctions –

What Now For TORN? UNI Shows Impressive Social Dominance More so,

UNI has been outperforming other cryptocurrencies when it comes to

its social metrics. UNI’s social engagements have spiked by 53.62%

while social mention has grown by 62.15%. In the past couple of

weeks, Uniswap is seen to gain social media dominance plus also

improved in terms of development activities. In addition, Uniswap’s

weighted sentiment is positive as shown from September 28 to

September 30. On the other hand, the weighted sentiment dropped

immensely as witnessed on October 1. As a consolation, the

development activity of UNI has grown rapidly since last week or

September 29 and has been fairly consistent ever since. The

impressive uptick in terms of development activity is said to be

triggered mainly by the network’s Swap widget update. Chart:

Santiment These continuous advancements and upgrades are said to be

hinting at a bull run and attract more investors. Related Reading:

Chainlink Crosses $6.18 Trillion In Transaction Value – Will This

Boost LINK Price? On the other hand, despite the recent UNI

updates, it has not helped its TVL as it has been stuck on the same

level since September. The thing is, even if the whales were

dubious of Uniswap’s DeFi protocols, users are gaining more

interest in UNI. Meanwhile, the top wallet addresses were also seen

to surge in terms of supply since September 12, especially since

whale interest is very important for the token’s progress. Uniswap

Velocity Down In Last 7 Days On the downside, UNI’s velocity is

seen to drop in the past couple of days implying a reduced number

of wallet addresses. UNI price has dipped in the past two weeks as

precipitated by the market turmoil triggered by the inflation

happening around the world but it is seen to currently recover a

bit. Meanwhile, it is said to get even worse as predicted by many

crypto analysts after the coin has dropped by as much as 72.56%

over the past year. UNI’s moving averages witnessed a bearish

movement specifically at its 100-day EMA and SMA saw at $5.62 and

$5.66; respectively. Its RSI is currently at 43.66 which signifies

a spike in sell action and shows that investors may potentially

lose more in the coming days. With that being said, the sentiment

of analysts on Uniswap is generally negative, especially with its

lack of significant utility value. UNI total market cap at $5.17

billion on the daily chart | Source: TradingView.com Featured image

from Cryptopolitan, Chart: TradingView.com

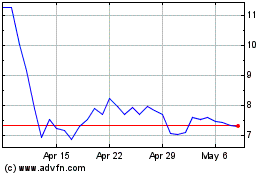

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024