Celsius Investors May Be Left Dismayed As CEL Drops 6.5% In Last 7 Days

05 October 2022 - 5:42PM

NEWSBTC

To everyone’s surprise, the Celsius Network is still

operating after the drama surrounding its bankruptcy in July.

Alex Mashinky, the company’s CEO, quit on September 27 despite the

announcement of a revival. The Securities and Exchange Commission

joined the chorus of agencies that came down hard on the company.

When the SEC ruled that interest-paying crypto investments must be

registered, Celsius found itself under a microscope. The native

token of Celsius, CEL, was impacted by these events, but what’s

more unexpected is that CEL is still being used. However, investors

of CEL tokens will be even more dissatisfied now that controversy

surrounds the token. As of this writing, CEL is trading at $1.37,

down 6.5 percent in the last seven days, data from Coingecko show.

A Chill In The Air At Celsius Unlike most widely traded currencies,

trading in CEL right now is extremely light, as evidenced by the

gaps in the candle chart. Recent data shows a decline in CEL token

trading volume from 19.8 million to 4.49 million. The percentage

reduction in business activity was staggering, at 77.3%. This is

hardly surprising given that other on-chain signals also do not

bode well for CEL. The market capitalization has decreased from a

weekly high of $655,331,055 to $582,698,525. The coin’s trading

activity is comparable to tokens with minimal activity. This is

simply CEL burning off over time. Recently, though, the graphs are

green. Is It Doable, Or Not? CEL is still a tradable asset on the

broader crypto market, making it open to speculation despite the

fact that it is barely alive. According to CoinGecko, CEL has

gained 2.6% in value over the previous 24 hours. Given that

there are gaps in the charts where little to no activity was

recorded, this is a major surprise. However, this may not be a true

recovery. Taking into account everything discussed previously, CEL

may be on its last legs. Recent reports indicate that CEL’s active

addresses have drastically decreased during the past month. This

decline in active CEL trading addresses is a pessimistic indication

to potential investors that could boost CEL’s price recovery.

Related Reading: Uniswap Rally Could Be In Jeopardy, Despite UNI’s

Solid Social Engagement CELUSD pair trying to keep its balance at

$1.36 on the daily chart | Source: TradingView.com Featured image

from Forkast, Chart: TradingView.com

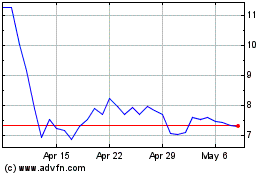

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024