What’s Next As Uniswap Price Moves Closer To Key Support Line?

25 February 2023 - 6:00AM

NEWSBTC

The Uniswap price has noted significant appreciation since the

beginning of this year. Over the past week, UNI managed to move up

by 6%. In the last 24 hours, however, the altcoin registered a 2.2%

fall. At the moment, the altcoin was trading very close to its

crucial support level. The technical outlook of the altcoin had a

bearish structure as demand and accumulation noted a decline on the

daily chart. A slight fall in demand again will cause the bears to

take over in the next trading session. Related Reading: Bitcoin

Decline Ahead? Bearish Crossover Forms In This Metric As Bitcoin

fell below the $25,000 price level, the other altcoins fell with it

and are now stuck beneath their immediate resistance levels.

Uniswap must move above the $7 price mark for the bulls to take

over the price momentum. Uniswap is trading 86% below its all-time

high secured in 2021. Uniswap Price Analysis: One-Day Chart UNI was

trading at $6.78 at the time of writing. The altcoin price was

close to its crucial support line of $6.60. A further fall in

buying strength will drag the altcoin price to $6.30. Traders can,

however, find shorting opportunities at $6.60 and then at $6.40,

respectively. The amount of Uniswap traded in the last session was

red, signifying a demanding fall. In the event of an increase in

demand in the market, the coin could attempt to trade at $6.90 and

then at $7. The bulls can return to the market if UNI trades above

the $7.60 level. Technical Analysis Uniswap had formed a bearish

divergence on the daily chart. The Relative Strength Index stood at

the 50-mark after noting a downtick. The fall in the indicator

reflects a depreciation in buying strength. The indicator had noted

a bearish divergence, so the coin reflected a bearish price

movement. Uniswap price stood above the 20-Simple Moving Average

line (SMA), which meant that the altcoin was driving its price

momentum in the market. The price of UNI at press time was moving

south, and it could move below the 20-SMA line, giving the sellers

an upper hand. The altcoin will continue to depreciate on its chart

unless it claims the 50% Fibonacci level. The 50% Fibonacci level

will act as a price pivot point for the altcoin. The other

technical indicators have also shown that the market has started to

side with the bears. The Moving Average Convergence Divergence,

which indicates price momentum and trend reversal, displayed a fall

in green histograms tied to buy signals. Related Reading: Bitcoin

Price Tries To Reclaim $24,000 As Crypto Market Trades Sideways The

Bollinger Bands are responsible for detecting price volatility.

These bands remained wide and parallel, suggesting that the price

would move between those two bands, with the upper band acting as a

line of resistance. This can often mean that the altcoin could see

a further price decline. Featured Image From UnSplash, Charts From

TradingView.com.

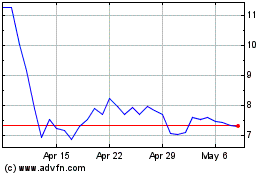

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024