Air France-KLM Shares Slide Amid Bond-Issuance Plans

16 November 2022 - 8:23PM

Dow Jones News

By Joshua Kirby

Shares in Air France-KLM lost ground Wednesday after the

Franco-Dutch airline group said it was stepping up repayment of

pandemic-era state aid via an issuance of bonds convertible into

shares worth around 300 million euros ($310.5 million).

At 843GMT, shares traded 9.6% lower at EUR1.27.

The deeply subordinated undated bonds can be converted into new

shares or exchanged for existing ones, equivalent to a maximum 200

million underlying shares and a nominal maximum amount of around

EUR300 million, via a placement to qualified investors only, AF-KLM

said Wednesday.

The net proceeds will be used to accelerate repayment of EUR4

billion in French state aid, granted in April 2021 to relieve the

financial squeeze of the pandemic.

The convertible bonds will have a nominal value of EUR100,000

and a settlement date of Wednesday next week, AF-KLM said. The

reference share price will meanwhile be based on the average price

of the group's Paris-listed shares Wednesday, while the bonds'

conversion or exchange value will be set at a premium of 20%-25%

over this price, the company said.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

November 16, 2022 04:08 ET (09:08 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

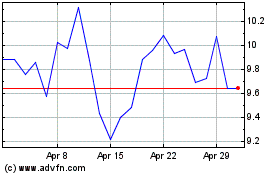

Air FranceKLM (EU:AF)

Historical Stock Chart

From Mar 2024 to Apr 2024

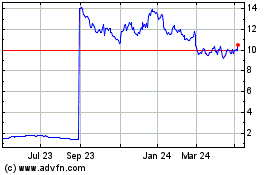

Air FranceKLM (EU:AF)

Historical Stock Chart

From Apr 2023 to Apr 2024