Air France-KLM announces the closing of bookbuilding on its

offering of undated deeply subordinated bonds convertible into new

shares and/or exchangeable for existing shares for a nominal amount

of approximately EUR300m

Paris, 16 November 2022

Air France-KLM announces the closing

of bookbuilding on its offering

of undated deeply subordinated bonds convertible into new shares

and/or exchangeable for existing shares for a nominal amount of

approximately EUR300m.

Air France-KLM (the

“Company”) has closed the books on the offering of undated deeply

subordinated bonds convertible into new shares and/or exchangeable

for existing shares (the “Bonds”), for a nominal amount of

approximately EUR 300 million within the limits of a maximum number

of 200 million underlying shares by way of a placement to qualified

investors only (the “Offering”).

The Bonds are expected

to price within the marketing range both in terms of coupon and

conversion/exchange premium as per the press release on the launch

of the offering published today. The books for the offering have

been closed and the Joint Bookrunners have received demands

indications well above EUR 300 million. The Offering is expected to

have a nominal amount of approximately EUR 300 million. The

reference share price will be equal to the volume-weighted average

trading price (VWAP) of Air France-KLM’s shares on the regulated

market of Euronext in Paris (“Euronext Paris”) as from the opening

of trading today until the close of trading today. The final terms

of the Offering including the reference share price and

conversion/exchange price will be communicated post market

close.

CMA CGM who holds 9.0%

of Air France-KLM has placed an order pro-rata to its current

shareholding.

The settlement and

delivery of the Bonds is expected to take place on 23 November 2022

(the “Issue Date”).

Deutsche Bank

Aktiengesellschaft, HSBC Continental Europe and Natixis are acting

as structuring banks and as joint global coordinators of the

Offering (the “Structuring Banks” and the “Joint Global

Coordinators”). Crédit Agricole Corporate and Investment Bank is

acting as co-global coordinator (the “Co-Global Coordinator”), and

together with the Joint Global Coordinators and with Société

Générale as joint bookrunners (the “Joint Bookrunners”).

Public

information

The Offering of the

Bonds is not subject to a prospectus approved by the French

Financial Markets Authority (Autorité des marchés financiers) (the

“AMF”). This press release does not constitute or form part of any

offer or solicitation to purchase or subscribe for or to sell

securities.

Detailed information

on Air France-KLM, including its business, results, prospects and

related risk factors are described in the Company’s universal

registration document filed with the AMF on April 4th, 2022under

number D.22-0236 (the “URD”) as supplemented by an amendment to the

URD filed with the AMF on May 24th, 2022, which are available

together with all the press releases of the Company, the half-year

financial report of the Company for the six-month period ended 30

June 2022, and the press release for the three-month period ended

30 September 2022 on the Company’s website

(www.airfranceklm.com).

|

Investor Relations |

|

Press |

|

Frederic Kahane |

Michiel Klinkers |

|

| |

|

+33 1 41 56 56

00 |

|

frkahane@airfranceklm.com |

Michiel.klinkers@airfranceklm.com |

Mail.mediarelations@airfranceklm.com |

Website: www.airfranceklm.com

IMPORTANT

NOTICE

This press release may

not be released, published or distributed, directly or indirectly,

to U.S. Persons or in or into the United States of America,

Australia, Canada or Japan. The distribution of this press release

may be restricted by law in certain jurisdictions and persons into

whose possession any document or other information referred to

herein comes, should inform themselves about and observe any such

restriction. Any failure to comply with these restrictions may

constitute a violation of the securities laws of any such

jurisdiction.

No communication or

information relating to the offering of the Bonds or the Repurchase

may be transmitted to the public in a country where there is a

registration obligation or where an approval is required. No action

has been or will be taken in any country in which such registration

or approval would be required. The issuance by the Company or the

subscription of the Bonds may be subject to legal and regulatory

restrictions in certain jurisdictions; none of Air France-KLM and

the Joint Global Coordinators and Joint Bookrunners do not assume

any liability in connection with the breach by any person of such

restrictions.

This press release is

an advertisement and not a prospectus within the meaning of

Regulation (EU) 2017/1129 (the “Prospectus

Regulation”) and of Regulation (EU) 2017/1129 as it forms

part of the United Kingdom domestic law by virtue of the European

Union (Withdrawal) Act 2018 (the “UK Prospectus

Regulation”). This press release is not an offer to the

public other than to qualified investors, or an offer to subscribe

or designed to solicit interest for purposes of an offer to the

public other than to qualified investors in any jurisdiction,

including France.

The Bonds have been

and will be offered only by way of an offering in France and

outside France (excluding the United States of America, Australia,

Canada, Japan and any other jurisdiction where a registration

process or an approval would be required by applicable laws and

regulations), solely to qualified investors as defined in article 2

point (e) of the Prospectus Regulation and in accordance with

Article L. 411-2, 1° of the French Monetary and Financial Code

(Code monétaire et financier) and article 2 of the UK Prospectus

Regulation. There will be no public offering in any country

(including France) in connection with the Bonds, other than to

qualified investors. This press release does not constitute a

recommendation concerning the issue of the Bonds. The value of the

Bonds and the shares of Air France-KLM can decrease as well as

increase. Potential investors should consult a professional adviser

as to the suitability of the Bonds for the person concerned.

Prohibition of sales to

European Economic Area retail investors

No action has been

undertaken or will be undertaken to make available any Bonds to any

retail investor in the European Economic Area. For the purposes of

this provision:

a. the expression

"retail investor" means a person who is one (or

more) of the following:

i. a retail client

as defined in point (11) of Article 4(1) of Directive 2014/65/EU

(as amended, "MiFID II"); or

ii. a customer

within the meaning of Directive (EU) 2016/97, as amended, where

that customer would not qualify as a professional client as defined

in point (10) of Article 4(1) of MiFID II; or

iii. not a

“qualified investor” as defined in the Prospectus

Regulation; and

b. the expression

“offer" includes the communication in any form and

by any means of sufficient information on the terms of the offer

and the Bonds to be offered so as to enable an investor to decide

to purchase or subscribe the Bonds.

Consequently, no key

information document required by Regulation (EU) No 1286/2014 (as

amended, the "PRIIPs Regulation") for offering or

selling the Bonds or otherwise making them available to retail

investors in the European Economic Area has been prepared and

therefore offering or selling the Bonds or otherwise making them

available to any retail investor in the European Economic Area may

be unlawful under the PRIIPs Regulation.

Prohibition of sales to UK

retail Investors

No action has been

undertaken or will be undertaken to make available any Bonds to any

retail investor in the United Kingdom (“UK”). For

the purposes of this press release:

a. the expression

“retail investor” means a person who is one (or

more) of the following:

i. a retail client,

as defined in point (8) of Article 2 of Regulation (EU) No 2017/565

as it forms part of domestic law by virtue of the European Union

(Withdrawal) Act 2018 (“EUWA”); or

ii. a customer

within the meaning of the provisions of the FSMA and any rules or

regulations made under the FSMA to implement Directive (EU)

2016/97, where that customer would not qualify as a professional

client, as defined in point (8) of Article 2(1) of Regulation (EU)

No 600/2014 as it forms part of domestic law by virtue of the EUWA;

or

iii. not a qualified

investor as defined in Article 2 of the UK Prospectus Regulation;

and

b. the expression an

“offer” includes the communication in any form and

by any means of sufficient information on the terms of the offer

and the Bonds to be offered so as to enable an investor to decide

to purchase or subscribe for the Bonds.

Consequently no key

information document required by Regulation (EU) No 1286/2014 as it

forms part of domestic law by virtue of the EUWA (the “UK

PRIIPs Regulation”) for offering or selling the Bonds or

otherwise making them available to retail investors in the United

Kingdom has been prepared and therefore offering or selling the

Bonds or otherwise making them available to any retail investor in

the United Kingdom may be unlawful under the UK PRIIPs

Regulation.

MIFID II

product governance / Professional investors and ECPs only target

market – Solely for the purposes of each manufacturer’s

product approval process, the target market assessment in respect

of the Bonds has led to the conclusion that: (i) the target market

for the Bonds is eligible counterparties and professional clients,

each as defined in MiFID II; and (ii) all channels for distribution

of the Bonds to eligible counterparties and professional clients

are appropriate. Any person subsequently offering, selling or

recommending the Bonds (a “distributor”) should

take into consideration the manufacturers’ target market

assessment; however, a distributor subject to MiFID II is

responsible for undertaking its own target market assessment in

respect of the Bonds (by either adopting or refining the

manufacturers’ target market assessment) and determining

appropriate distribution channels.

France

The Bonds have not

been and will not be offered or sold or cause to be offered or

sold, directly or indirectly, to the public in France other than to

qualified investors. Any offer or sale of the Bonds and

distribution of any offering material relating to the Bonds have

been and will be made in France only to qualified investors

(investisseurs qualifiés), as defined in article 2 point (e) of the

Prospectus Regulation, and in accordance with Article L.411-2 1° of

the French Monetary and Financial Code (Code monétaire et

financier).

United Kingdom

This press release is

addressed and directed only (i) to persons located outside the

United Kingdom, (ii) to investment professionals as defined in

Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended (the

“Order”), (iii) to high net worth companies, and

other persons to whom it may lawfully be communicated, falling

within by Article 49(2) (a) to (d) of the Order (the persons

mentioned in paragraphs (i), (ii) and (iii) all deemed relevant

persons (the “Relevant Persons”)). The Bonds and,

as the case may be, the shares to be delivered upon exercise of the

conversion rights (the “Financial Instruments”),

are intended only for Relevant Persons and any invitation, offer or

agreement related to the subscription, tender, or acquisition of

the Financial Instruments may be addressed and/or concluded only

with Relevant Persons. All persons other than Relevant Persons must

abstain from using or relying on this document and all information

contained therein.

This press release is

not a prospectus which has been approved by the Financial Conduct

Authority or any other United Kingdom regulatory authority for the

purposes of Section 85 of the Financial Services and Markets Act

2000.

United States of

America

This press release may

not be released, published or distributed to U.S. Persons or in or

into the United States (including its territories sand possessions,

any state of the United States and the District of Columbia). This

press release does not constitute an offer or a solicitation of an

offer of securities in the United States or to, or for the account

or benefit of, U.S. Persons. The Bonds and the shares deliverable

upon conversion or exchange of the Bonds described in this press

release have not been, and will not be, registered under the U.S.

Securities Act of 1933, as amended (the “Securities

Act”), or the securities laws of any state of the United

States, and such securities may not be offered, sold or otherwise

transferred in the United States or to, or for the account or

benefit of, U.S. persons absent registration under the Securities

Act or pursuant to an available exemption from, or in a transaction

not subject to, the registration requirements thereof and

applicable state or local securities laws.

The securities of Air

France-KLM have not been and will not be registered under the

Securities Act and Air France-KLM does not intend to make a public

offer of its securities in the United States or to U.S. Persons.

Terms used in this paragraph have the meanings given to them by

Regulation S under the Securities Act.

Australia, Canada and

Japan

The Bonds may not and

will not be offered, sold or purchased in Australia, Canada or

Japan. The information contained in this press release does not

constitute an offer of securities for sale in Australia, Canada or

Japan.

The distribution of

this press release in certain countries may constitute a breach of

applicable law.

- 20221116 Air France-KLM announces the closing of bookbuilding

on its offering of undated deeply subordinated bonds EN

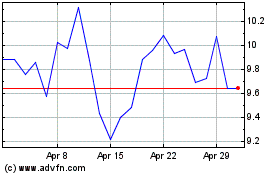

Air FranceKLM (EU:AF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air FranceKLM (EU:AF)

Historical Stock Chart

From Apr 2023 to Apr 2024