The Agfa-Gevaert Group in full year 2022 - regulated information

08 March 2023 - 5:45PM

The Agfa-Gevaert Group in full year 2022 - regulated information

Regulated information – March

8,

2023 -

7:45 a.m.

CET The

Agfa-Gevaert Group in full year

2022:

- Adjusted EBITDA decrease of

9% versus 2021 due to continuing cost

inflation, lockdowns in China and softer demand in

non-healthcare markets

- HealthCare IT: momentum

created

- Significant improvement in order intake, both in terms of

volume and in terms of quality, resulting in top line growth and

stabilization of recurring revenue

- Conversion of sales growth in EBITDA delayed by post-COVID

reinvestments in R&D and commercial efforts

- Digital Print & Chemicals:

overall revenue growth

- profitability strongly impacted by cost

inflation and one-offs

- Profitability impacted by lagging price increase impact,

industrial inefficiencies, cost inflation and investments in the

future

- Inca acquisition creates new growth opportunities

- Zirfon membranes for green hydrogen production take off

- Radiology Solutions:

profitability suffered from margin and volume pressure in

China

- Medical film impacted by lockdowns in China and geopolitical

situation

- Direct Radiography: growth and streamlining of operations

- Offset Solutions: turnaround

established and sale to Aurelius Group on

track

- Successful pricing and restructuring actions, but demand

weakness in H2

- Sale to Aurelius Group on track – targeted closing in first

week of April 2023

- Net loss of 223 million Euro

mainly impacted by

non-cash impairment

charges

- Significant impairments in Radiology Solutions and Offset

Solutions impacted restructuring/non-recurring items

- Additional tax expenses related to the Offset Solutions

carve-out and the above-mentioned impairments

- Strong decrease in net pension liability (material

countries): positive impact of 177 million Euro

versus end of 2021

Mortsel (Belgium), March

8,

2023

– Agfa-Gevaert today

commented on its results in

2022.

|

in million Euro |

FY 2022 |

FY 2021 |

% change(excl. FX effects) |

Q4 2022 |

Q4 2021 |

% change(excl. FX

effects) |

|

|

REVENUE |

|

|

|

|

|

|

|

HealthCare IT |

244 |

219 |

11.5% (4.0%) |

70 |

59 |

19.1% (12.1%) |

|

Radiology Solutions |

462 |

464 |

-0.4% (-5.4%) |

129 |

128 |

0.6% (-2.9%) |

|

Digital Print & Chemicals |

372 |

330 |

12.9% (10.4%) |

99 |

93 |

5.9% (4.2%) |

|

Offset Solutions |

779 |

748 |

4.2% (-0.1%) |

192 |

204 |

-5.7% (-8.0%) |

|

GROUP |

1,857 |

1,760 |

5.5% (1.0%) |

490 |

484 |

1.3% (-2.8%) |

|

ADJUSTED EBITDA (*) |

|

|

|

|

|

|

|

HealthCare IT |

26.9 |

30.2 |

-10.8% |

11.1 |

11.2 |

-0.9% |

|

Radiology Solutions |

46.9 |

60.7 |

-22.9% |

18.6 |

17.6 |

5.7% |

|

Digital Print & Chemicals |

3.2 |

19.2 |

-83.1% |

(5.1) |

3.3 |

|

|

Offset Solutions |

35.7 |

12.4 |

188.7% |

0.9 |

0.2 |

334.9% |

|

Unallocated |

(18.6) |

(18.7) |

|

(4.9) |

(5.4) |

|

|

GROUP |

94 |

104 |

-9.2% |

21 |

27 |

-23.2% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

(*) before restructuring and non-recurring

items

“2022 has been a year of unprecedented economic and geopolitical

instability. Cost inflation, supply chain disruptions and COVID

lockdowns in China impacted our activities.Especially in these

turbulent times, we continued to execute our strategic agenda.

Given the expected strong increase in demand, the Board of

Directors yesterday validated an investment in a new production

facility for our Zirfon green hydrogen membranes in our Belgian

site in Mortsel. We finalized the acquisition of Inca Digital

Printers, which strengthens our position in high-speed digital

printing and speeds up our entry in digital packaging printing. In

HealthCare IT, we stepped up investments in R&D and commercial

resources and we established a new management team, focusing on the

core North American markets. The sale of our Offset Solutions

division to Aurelius Group, which is expected to close early April,

should enable us to increase the focus on our growth businesses. In

our efforts to build a simple, agile and future-oriented

organizational model, we re-organized our internal financial

services and partnered with Atos for our internal IT operations.

Our 2023 priorities are the implementation of further price

increases across our businesses, the reduction of costs related to

our operating model initiatives, and to deliver growth in

HealthCare IT, Zirfon and digital printing,” said Pascal Juéry,

President and CEO of the Agfa-Gevaert Group.

Agfa-Gevaert Group

|

in million Euro |

FY 2022 |

FY 2021 |

% change(excl. FX

effects) |

Q4 2022 |

Q4 2021 |

% change(excl. FX

effects) |

|

Revenue |

1,857 |

1,760 |

5.5% (1.0%) |

490 |

484 |

1.3% (-2.8%) |

|

Gross profit (*) |

529 |

498 |

6.3% |

135 |

128 |

5.1% |

|

% of revenue |

28.5% |

28.3% |

|

27.5% |

26.5% |

|

|

Adjusted EBITDA (*) |

94 |

104 |

-9.2% |

21 |

27 |

-23.2% |

|

% of revenue |

5.1% |

5.9% |

|

4.2% |

5.5% |

|

|

Adjusted EBIT (*) |

31 |

42 |

-24.5% |

5 |

11 |

-57.4% |

|

% of revenue |

1.7% |

2.4% |

|

1.0% |

2.3% |

|

|

Net result |

(223) |

(14) |

|

(186) |

(18) |

|

(*) before

restructuring and non-recurring items

Full year

- The HealthCare IT and Digital Print & Chemicals divisions

posted sales growth excluding currency impact. Mainly due to price

increases, Offset Solutions’ top line remained stable and Radiology

Solutions’ medical film business was heavily impacted by the COVID

lockdowns in China.

- The Group’s gross profit margin remained stable at 28.5% of

revenue, mainly due to price increase actions to tackle the strong

impact of cost inflation and supply chain issues.

- Adjusted EBITDA was influenced by inflationary pressure,

disrupted supply chains and industrial inefficiencies in Q4.

- On top of heavy transformation efforts, impairments in

Radiology Solutions (73 million Euro) and Offset Solutions (41

million Euro) had a strong impact on restructuring and

non-recurring items, resulting in a charge of 192 million Euro,

versus 33 million Euro in 2021.

- The net finance costs amounted to 19 million Euro.

- Income tax expenses increased to 42 million Euro versus 15

million Euro in 2021, primarily driven by additional tax expenses

related to the Offset Solutions carve-out and the impairment of

deferred tax assets related to the performance of Radiology

Solutions and the Offset Solutions transaction.

- The Agfa-Gevaert Group posted a net loss of 223 million

Euro.

Fourth quarter

- The HealthCare IT division continued to post strong sales

figures, whereas the Offset Solutions division and several

activities of the Digital Print & Chemicals division continued

to feel the impact of the weaker economic conditions. In the

Radiology Solutions division, the medical film business started to

recover from the impact of the COVID lockdowns in China.

- Although impacted by manufacturing inefficiencies and cost

inflation, the Group’s gross profit margin improved to 27.5% of

revenue thanks to all pricing actions.

Financial position and cash

flow

- Net financial debt (including IFRS 16) evolved from a net cash

position of 325 million Euro at the end of 2021 to a net cash

position of 72 million Euro, as it was partially impacted by the

Inca acquisition and the share buy-back program.

- Although the Group was able to reduce trade working capital

from 31% of turnover in Q3 2022 to 28% in Q4, this is still an

increase versus the end of 2021 (26%). In absolute numbers, trade

working capital evolved from 449 million Euro at the end of 2021 to

523 million Euro, including an effect of Inca at year-end (19

million Euro).

- In the full year 2022, the Group used a free cash flow of 127

million Euro. In the fourth quarter, the free cash flow amounted to

minus 2 million Euro.

- After a first pension buy-in transaction for the UK pension

plan in 2021, an additional buy-in transaction has taken place

which leads to a full de-risking of the UK pension plan, without

additional cash contributions.

- A strong decrease in net pension liability (material countries)

was recorded: positive impact of 177 million Euro versus the end of

2021.

OutlookOverall, the

Agfa-Gevaert Group expects a recovery in profitability in the full

year 2023 versus 2022.

2023 outlook per division:

- HealthCare IT: The division’s growth strategy is expected to

deliver top line growth, as well as double-digit adjusted EBITDA

growth in 2023.

- Radiology Solutions: Stability is expected, with continuous

margin pressure for medical film. The progress in Direct

Radiography that was recorded in the second half of 2022 is

expected to continue.

- Digital Print & Chemicals: The division expects to restore

profitability, based on pricing, cost improvement actions and

positive contributions from the Inca acquisition and the Zirfon

membranes. The revenue generated by Zirfon will continue to grow

very strongly.

HealthCare IT

|

in million Euro |

FY 2022 |

FY 2021 |

% change(excl. FX

effects) |

Q4 2022 |

Q4 2021 |

% change(excl. FX

effects) |

|

Revenue |

244 |

219 |

11.5% (4.0%) |

70 |

59 |

19.1% (12.1%) |

|

Adjusted EBITDA (*) |

26.9 |

30.2 |

-10.8% |

11.1 |

11.2 |

-0.9% |

|

% of revenue |

11.0% |

13.8% |

|

15.8% |

19.0% |

|

|

Adjusted EBIT (*) |

19.6 |

21.6 |

-9.3% |

9.3 |

9.2 |

1.3% |

|

% of revenue |

8.0% |

9.9% |

|

13.3% |

15.6% |

|

(*) before restructuring and non-recurring items

Full year

- HealthCare IT’s order book remains at a very healthy level. The

division recorded a 18% growth in the 12 months rolling order

intake versus the year before, with high value business (own

software) increasing with 23%.

- Due to increased momentum in the second half of the year, the

HealthCare IT division’s top line increased in North America and

Europe versus the previous year. The growth was driven by the

revenue recognition from a number of important contracts, as well

as a stabilization of recurring revenue.

- Impacted by the strong post-COVID cost inflation, the

division’s gross profit margin decreased from 46.5% of revenue in

2021 to 45.2%. The adjusted EBITDA margin decreased from 13.8% to

11.0%. In 2022 the division also stepped up its investments in

R&D and commercial resources to grow the business.

- The KLAS Research 2022 Europe PACS report named Agfa HealthCare

among top performers in terms of customer satisfaction. In the

report, Agfa HealthCare is confirmed to have one of the most

expansive footprints, with strong customer bases.

- Recently, Agfa HealthCare has been recognized as Best in KLAS

for its Enterprise Imaging for Radiology solution in the PACS

Middle East/Africa category. This achievement is a sign of Agfa

HealthCare’s focus on delivering high value and support to its

customers in the region.

- 2022 was a year of consolidation, as the focus turned towards

profitable growth. As shown by the positive development of the

order intake, the division’s strategy to target customer segments

and geographies for which its Enterprise Imaging solution is best

fit and to prioritize higher value revenue streams is working and

delivering. This strategy will ultimately allow the division to

reach the targeted growth of EBITDA: starting from a

mid-single-digit percentage in 2019 to percentages in the

high-teens over the next years.

Fourth quarter

- North America continued to perform well in the fourth quarter

and Europe, LATAM and ASPAC posted significant sales growth.

- Impacted by cost inflation, the gross profit margin evolved

from 50.3% in the very strong fourth quarter of 2021 to 45.1%.

- Adjusted EBITDA improved quarter-over-quarter, reaching 15.8%

of revenue in the fourth quarter.

- Introducing its new ‘That’s life in flow’ tagline, Agfa

HealthCare showcased how its Enterprise Imaging solution creates an

optimal work experience for radiologists at the RSNA 2022 event in

Chicago. Visitors were able to experience how the Enterprise

Imaging platform delivers ‘Life in flow’ to meet radiologists’

daily challenges through a highly focused, efficient, and

customizable experience.

- As result of the strong momentum built up at the RSNA event,

the North America team was able to generate additional business in

December.

Radiology Solutions

|

in million Euro |

FY 2022 |

FY 2021 |

% change(excl. FX

effects) |

Q4 2022 |

Q4 2021 |

% change(excl. FX

effects) |

|

Revenue |

462 |

464 |

-0.4% (-5.4%) |

129 |

128 |

0.6% (-2.9%) |

|

Adjusted EBITDA (*) |

46.9 |

60.7 |

-22.9% |

18.6 |

17.6 |

5.7% |

|

% of revenue |

10.1% |

13.1% |

|

14.4% |

13.7% |

|

|

Adjusted EBIT (*) |

22.3 |

37.7 |

-40.9% |

12.5 |

11.6 |

7.5% |

|

% of revenue |

4.8% |

8.1% |

|

9.7% |

9.1% |

|

(*) before

restructuring and non-recurring items

Full year

- Mainly in China, the medical film business was impacted by the

COVID lockdowns. The current geopolitical situation and slower than

normal volumes in some export markets also had an impact.

- The market driven top line decline for the Computed Radiography

business was further amplified by the current geopolitical

situation and component shortages. Agfa continues to manage the CR

business to maintain healthy profit margins.

- Following a number of slower quarters, the Direct Radiography

business’ revenue started to pick up in the second half of the

year. Strong sales growth was recorded in ASPAC and LATAM. In a

number of countries in those regions, first-of-a-kind installations

were realized with several systems, including high-end modalities

and the recently introduced VALORY X-ray room. Recently, the DR

market saw the entry of several new competitors with low-cost

solutions. The order book for DR remains strong, with continuously

longer conversion lead times affected by the supply chain

environments.

- Agfa is taking actions (right-sizing of the organization,

relocations, costs control actions, price increases, net working

capital actions) to increase the business’ agility and to better

adapt it to the current market conditions.

- The division’s full year profitability was affected by volume

decreases, mix effects and cost inflation.

Fourth quarter

- While China continued to be impacted by issues related to

COVID-19, the medical film business performed well in most other

regions. The Direct Radiography range continued the top line growth

that was initiated in the third quarter.

- Based on pricing and cost control actions in all business

lines, the division’s profitability improved significantly versus

the previous quarters of 2022.

Digital Print & Chemicals

|

in million Euro |

FY 2022 |

FY 2021 |

% change(excl. FX

effects) |

Q4 2022 |

Q4 2021 |

% change(excl. FX

effects) |

|

Revenue |

372 |

330 |

12.9% (10.4%) |

99 |

93 |

5.9% (4.2%) |

|

Adjusted EBITDA (*) |

3.2 |

19.2 |

-83.1% |

(5.1) |

3.3 |

|

|

% of revenue |

0.9% |

5.8% |

|

-5.1% |

3.5% |

|

|

Adjusted EBIT (*) |

(9.5) |

7.4 |

|

(8.7) |

0.3 |

|

|

% of revenue |

-2.6% |

2.3% |

|

-8.8% |

0.4% |

|

(*) before

restructuring and non-recurring items

Full year

- In the field of digital print, the top line of the sign &

display business grew strongly. The ink product ranges for sign

& display applications performed well throughout the year. In

spite of industry-wide logistic challenges for the high-end

equipment, the wide-format printing equipment business posted solid

revenue growth. In the field of industrial inkjet, the décor

printing business was impacted by the weakening economic

environment, as customers are postponing investments in their

digitization process. Volumes for OEM inks decreased due to the

lockdowns in China, the unstable geopolitical situation and the

weak economic environment.

- At the Fespa trade show on June 1, 2022 Agfa announced the

closing of the acquisition of Inca Digital Printers, a UK based

leading developer and manufacturer of advanced high speed printing

and production technologies for sign and display applications as

well as for the rapidly growing digital printing market for

packaging. Integration has been completed and the first contracts

have been signed for the first Agfa ink-powered and Agfa-branded

Onset wide-format machines. The development of Inca’s Speedset

single-pass packaging printer is proceeding as planned. The machine

is generating strong interest among potential customers.

- In 2022, no less than five of Agfa’s inkjet printing solutions

have been honored with a Pinnacle Product Award from PRINTING

United Alliance. The Pinnacle Product Awards recognize products

that improve or advance the printing industry with exceptional

contributions in quality, capability, and productivity. PRINTING

United Alliance is the most comprehensive member-based printing and

graphic arts association in the United States.

- Sales figures for the Zirfon membranes for advanced alkaline

electrolysis are growing according to plan and production was

ramped up to a steady regime. In 2022, the number of active

customers for Zirfon has increased to over 100. March 7, 2023, the

Board of Directors validated an investment for a new industrial

unit for the Zirfon membranes at Agfa’s Mortsel site in Belgium.

This will allow the Group to be ready for the expected further

increase in customer demand. In October, Agfa received the

prestigious essenscia Innovation Award 2022 for its Zirfon UTP 220

membrane technology. Essenscia is the Belgian sector federation of

the chemical industry and life sciences.

- The weakness in the electronics industry and lockdowns in China

impacted volumes of the Orgacon conductive materials and the

products for the production of printed circuit boards.

- Agfa’s specialty film and foil products business remained

stable versus 2021.

- Mainly due to strong cost inflation, lower volumes for certain

businesses (including industrial inkjet and products for the

electronics industry) caused by COVID lockdowns in China and

logistic challenges, the division’s gross profit margin decreased

from 26.3% of revenue in 2021 to 24.9%. In the fourth quarter,

additional cost reduction measures have been taken to adjust to the

economic reality.

- As price actions did not yet suffice to tackle cost inflation

in 2022, Agfa implements double-digit price increases across its

Digital Print & Chemicals portfolio worldwide, effective

January 1st, 2023.

Fourth quarter

- The fourth quarter was marked by a contrasted top line

performance between the various activities. The division’s revenue

increase was driven by the strong sales figures of the sign &

display business.

- Mainly impacted by manufacturing inefficiencies and one-off

effects, mix effects and cost inflation (including additional wage

indexation in Belgium), the division’s gross profit margin

decreased from 22.2% of revenue in the fourth quarter of 2021 to

18.7%.

Offset Solutions

|

in million Euro |

FY 2022 |

FY 2021 |

% change(excl. FX

effects) |

Q4 2022 |

Q4 2021 |

% change(excl. FX

effects) |

|

Revenue |

779 |

748 |

4.2% (-0.1%) |

192 |

204 |

-5.7% (-8.0%) |

|

Adjusted EBITDA (*) |

35.7 |

12.4 |

188.7% |

0.9 |

0.2 |

334.9% |

|

% of revenue |

4.6% |

1.7% |

|

0.5% |

0.1% |

|

|

Adjusted EBIT (*) |

17.9 |

(6.0) |

|

(3.5) |

(4.5) |

|

|

% of revenue |

2.3% |

-0.8% |

|

-1.8% |

-2.2% |

|

(*) before

restructuring and non-recurring items

Full year

- The division continued to focus on high-value regions,

concentrating on margins rather than volumes. In spite of the lower

volumes, the successful implementation of price increases to tackle

the overall cost inflation, among others for raw materials,

packaging and freight led to top line growth.

- Although affected by cost inflation, the gross profit margin

improved from 20.4% of revenue in 2021 to 22.7% due to the

implemented price adjustments and the focus on high-value

regions.

- Adjusted EBITDA improved strongly to 35.7 million Euro.

- In August 2022, the Agfa-Gevaert Group has signed a share

purchase agreement with Aurelius Group for the sale of its Offset

Solutions division. Both parties aim to complete the transaction in

the first week of April 2023. Aside from the charges taken in 2022

(mainly the impairment loss of 41 million Euro), an additional

P&L impact is to be expected in H1 2023 of about 45-60 million

Euro, mainly depending on the levels of working capital at

closing.

Fourth quarter

- Reflecting the weaker economic environment and the resulting

strong volume decrease in Europe, the division booked a moderate

revenue decrease versus the fourth quarter of 2021, which benefited

strongly from price increase actions.

End of messageManagement Certification of Financial

Statements and Quarterly ReportThis statement is made in

order to comply with new European transparency regulation enforced

by the Belgian Royal Decree of November 14, 2007 and in effect as

of 2008."The Board of Directors and the Executive Committee of

Agfa-Gevaert NV, represented by Mr. Frank Aranzana, Chairman of the

Board of Directors, Mr. Pascal Juéry, President and CEO, and Mr.

Dirk De Man, CFO, jointly certify that, to the best of their

knowledge, the consolidated financial statements included in the

report and based on the relevant accounting standards, fairly

present in all material respects the financial condition and

results of Agfa-Gevaert NV, including its consolidated

subsidiaries. Based on our knowledge, the report includes all

information that is required to be included in such document and

does not omit to state all necessary material

facts.”Statement of riskThis statement is made in

order to comply with new European transparency regulation enforced

by the Belgian Royal Decree of November 14, 2007 and in effect as

of 2008."As with any company, Agfa is continually confronted with –

but not exclusively – a number of market and competition risks or

more specific risks related to the cost of raw materials, product

liability, environmental matters, proprietary technology or

litigation." Key risk management data is provided in the annual

report available on www.agfa.com.

Confirmation Information – press release Agfa-Gevaert

NVThe statutory auditor, KPMG Bedrijfsrevisoren –

Réviseurs d’Entreprises, represented by F. Poesen, has confirmed

that the audit procedures, which have been substantially completed,

have not revealed any material misstatement in the accounting

information included in the Company’s annual announcement.

Berchem, March 8, 2023

KPMG Bedrijfsrevisoren / Réviseurs d’EntreprisesRepresented byF.

Poesen, Partner

Contact:Viviane DictusDirector

Corporate CommunicationSeptestraat 272640 Mortsel - BelgiumT +32

(0) 3 444 71 24E viviane.dictus@agfa.com

The full press release and financial information is also

available on the company's website: www.agfa.com.

Consolidated Statement

of Profit or Loss (in million

Euro)

Consolidated figures following IFRS accounting

policies.

|

|

2022 |

2021 |

Q4 2022unaudited |

Q4 2021 |

|

Revenue |

1,857 |

1,760 |

490 |

484 |

|

Cost of sales |

(1,329) |

(1,263) |

(357) |

(357) |

|

Gross profit |

528 |

497 |

133 |

127 |

|

Selling expenses |

(249) |

(231) |

(65) |

(62) |

|

Administrative expenses |

(182) |

(155) |

(50) |

(39) |

|

R&D expenses |

(101) |

(95) |

(28) |

(24) |

|

Net impairment loss on trade and other receivables, including

contract assets |

(1) |

(2) |

- |

(1) |

|

Other operating income |

27 |

41 |

6 |

10 |

|

Other operating expenses |

(182) |

(47) |

(147) |

(29) |

|

Results from operating activities |

(160) |

9 |

(150) |

(17) |

|

Interest income (expense) - net |

- |

(1) |

1 |

- |

|

Interest income |

4 |

2 |

2 |

1 |

|

Interest expense |

(4) |

(3) |

(2) |

(1) |

|

Other finance income (expense) - net |

(20) |

(6) |

(5) |

- |

|

Other finance income |

6 |

10 |

1 |

4 |

|

Other finance expense |

(26) |

(16) |

(6) |

(4) |

|

Net finance costs |

(19) |

(8) |

(5) |

- |

|

Share of profit of associates, net of tax |

(1) |

- |

(1) |

- |

|

Profit (loss) before income taxes |

(181) |

1 |

(156) |

(18) |

|

Income tax expenses |

(42) |

(15) |

(30) |

- |

|

Profit (loss) for the period |

(223) |

(14) |

(186) |

(18) |

|

Profit (loss) attributable to: |

|

|

|

|

|

Owners of the Company |

(221) |

(17) |

(182) |

(22) |

|

Non-controlling interests |

(2) |

4 |

(4) |

5 |

|

|

|

|

|

|

|

Results from operating activities |

(160) |

9 |

(150) |

(17) |

|

Restructuring and non-recurring items |

(192) |

(33) |

(155) |

28 |

|

Adjusted EBIT |

31 |

42 |

5 |

11 |

|

|

|

|

|

|

|

Earnings per Share Group (Euro) |

(1.41) |

(0.11) |

(1.18) |

(0.14) |

Consolidated Statements of Comprehensive Income for

the year ending

December 2021

/ December

2022 (in million

Euro) Consolidated figures following IFRS

accounting policies.

|

|

2022 |

2021 |

|

Profit / (loss) for the period |

(223) |

(14) |

|

Other Comprehensive Income, net of tax |

|

|

|

Items that are or may be reclassified subsequently to

profit or loss: |

|

|

|

Exchange differences: |

7 |

30 |

|

Exchange differences on translation of foreign operations |

7 |

30 |

|

Cash flow hedges: |

- |

(9) |

|

Effective portion of changes in fair value of cash flow hedges |

(5) |

4 |

|

Changes in the fair value of cash flow hedges reclassified to

profit or loss |

5 |

(1) |

|

Adjustments for amounts transferred to initial carrying amount of

hedged items |

- |

(13) |

|

Income taxes |

- |

2 |

|

Items that will not be reclassified subsequently to profit

or loss: |

123 |

91 |

|

Equity investments at fair value through OCI – change in fair

value |

(2) |

2 |

|

Remeasurements of the net defined benefit liability |

148 |

96 |

|

Income tax on remeasurements of the net defined benefit

liability |

(23) |

(7) |

|

Total Other Comprehensive

Income for the period, net of tax |

130 |

112 |

|

|

|

|

|

Total Comprehensive

Income for the period,

net of tax |

(93) |

99 |

|

Attributable to |

|

|

|

Owners of the Company |

(91) |

91 |

|

Non-controlling interests |

(2) |

8 |

Consolidated Statements of Comprehensive Income for

the quarter ending

December

2021

/ December

2022 (in million

Euro) Consolidated figures following IFRS

accounting policies.

|

|

Q4

2022unaudited |

Q4

2021 |

|

Profit / (loss) for the period |

(186) |

(17) |

|

Other Comprehensive Income, net of tax |

|

|

|

Items that are or may be reclassified subsequently to

profit or loss: |

|

|

|

Exchange differences: |

(42) |

10 |

|

Exchange differences on translation of foreign operations |

(42) |

10 |

|

Cash flow hedges: |

4 |

(3) |

|

Effective portion of changes in fair value of cash flow hedges |

2 |

- |

|

Changes in the fair value of cash flow hedges reclassified to

profit or loss |

2 |

1 |

|

Adjustments for amounts transferred to initial carrying amount of

hedged items |

- |

(5) |

|

Income taxes |

- |

1 |

|

Items that will not be reclassified subsequently to profit

or loss: |

9 |

14 |

|

Equity investments at fair value through OCI – change in fair

value |

- |

- |

|

Remeasurements of the net defined benefit liability |

19 |

14 |

|

Income tax on remeasurements of the net defined benefit

liability |

(10) |

- |

|

Total Other Comprehensive

Income for the period, net of tax |

(30) |

21 |

|

|

|

|

|

Total Comprehensive

Income for the period,

net of tax |

(216) |

3 |

|

Attributable to |

|

|

|

Owners of the Company |

(209) |

(3) |

|

Non-controlling interests |

(7) |

6 |

Consolidated Statement of Financial

Position (in million Euro)

Consolidated figures following IFRS accounting

policies.

| |

31/12/2022 |

31/12/2021 |

|

Non-current assets |

602 |

756 |

| Goodwill |

218 |

280 |

| Intangible

assets |

29 |

13 |

| Property, plant

and equipment |

107 |

129 |

| Right-of-use

assets |

45 |

68 |

| Investments in

associates |

1 |

1 |

| Other financial

assets |

5 |

8 |

| Assets related to

post-employment benefits |

18 |

40 |

| Trade

receivables |

9 |

12 |

| Receivables under

finance leases |

72 |

70 |

| Other assets |

8 |

11 |

| Deferred tax

assets |

91 |

124 |

| Current

assets |

1,153 |

1,339 |

| Inventories |

487 |

418 |

| Trade

receivables |

291 |

307 |

| Contract

assets |

94 |

76 |

| Current income

tax assets |

56 |

63 |

| Other tax

receivables |

28 |

19 |

| Other financial

assets |

1 |

2 |

| Receivables under

finance lease |

31 |

30 |

| Other

receivables |

6 |

4 |

| Other current

assets |

17 |

18 |

| Derivative

financial instruments |

3 |

1 |

| Cash and cash

equivalents |

138 |

398 |

| Non-current

assets held for sale |

2 |

3 |

|

TOTAL ASSETS |

1,756 |

2,095 |

|

|

31/12/2022 |

31/12/2021 |

| Total

equity |

561 |

685 |

| Equity

attributable to owners of the company |

520 |

632 |

| Share

capital |

187 |

187 |

| Share

premium |

210 |

210 |

| Retained

earnings |

1,042 |

1,284 |

| Other

reserves |

(3) |

(1) |

| Translation

reserve |

(9) |

(15) |

| Post-employment

benefits: remeasurements of the net defined benefit liability |

(908) |

(1,033) |

|

Non-controlling interests |

41 |

54 |

|

Non-current liabilities |

610 |

812 |

| Liabilities for

post-employment and long-term termination benefit plans |

536 |

735 |

| Other employee

benefits |

9 |

11 |

| Loans and

borrowings |

41 |

46 |

| Provisions |

14 |

12 |

| Deferred tax

liabilities |

9 |

6 |

| Contract

liabilities |

- |

1 |

| Current

liabilities |

585 |

597 |

| Loans and

borrowings |

25 |

27 |

| Provisions |

36 |

42 |

| Trade

payables |

249 |

252 |

| Contract

liabilities |

109 |

111 |

| Current income

tax liabilities |

29 |

28 |

| Other tax

liabilities |

32 |

28 |

| Other

payables |

6 |

9 |

| Employee

benefits |

95 |

99 |

| Derivative

financial instruments |

2 |

2 |

| TOTAL

EQUITY AND LIABILITIES |

1,756 |

2,095 |

Consolidated Statement of Cash Flows (in million

Euro) Consolidated figures following IFRS accounting

policies.

|

|

2022 |

2021 |

Q4

2022unaudited |

Q4 2021 |

|

Profit (loss) for the period |

(223) |

(14) |

(186) |

(18) |

|

Income taxes |

42 |

15 |

30 |

- |

|

Share of (profit)/loss of associates, net of tax |

1 |

- |

1 |

- |

|

Net finance costs |

19 |

8 |

5 |

- |

|

Operating result |

(160) |

9 |

(150) |

(17) |

|

|

|

|

|

|

|

Depreciation & amortization (excluding D&A on right-of-use

assets) |

35 |

34 |

9 |

8 |

|

Depreciation & amortization on right-of-use assets |

28 |

28 |

7 |

7 |

|

Impairment losses on goodwill |

70 |

- |

70 |

- |

|

Impairment losses on intangibles and PP&E |

29 |

- |

29 |

- |

|

Impairment losses on right-of-use assets |

15 |

1 |

15 |

1 |

|

|

|

|

|

|

|

Exchange results and changes in fair value of derivates |

10 |

5 |

(3) |

2 |

|

Recycling of hedge reserve |

5 |

(1) |

2 |

1 |

|

Government grants and subsidies |

(5) |

(13) |

(2) |

(5) |

|

(Gains)/losses on the sale of intangible assets and PP&E |

(1) |

(8) |

- |

- |

|

Result on the disposal of discontinued operations |

- |

- |

- |

- |

|

Expenses for defined benefit plans & long-term termination

benefits |

35 |

30 |

7 |

10 |

|

Accrued expenses for personnel commitments |

70 |

75 |

19 |

20 |

|

Write-downs/reversal of write-downs on inventories |

12 |

11 |

4 |

4 |

|

Impairments/reversal of impairments on receivables |

1 |

2 |

- |

1 |

|

Additions/reversals of provisions |

23 |

13 |

17 |

17 |

|

|

|

|

|

|

|

Operating cash flow before changes in working

capital |

166 |

186 |

24 |

48 |

|

|

|

|

|

|

|

Change in inventories |

(65) |

(48) |

57 |

40 |

|

Change in trade receivables |

25 |

6 |

(4) |

(4) |

|

Change in contract assets |

(14) |

(8) |

(6) |

(2) |

|

Change in trade working capital assets |

(55) |

(50) |

47 |

35 |

|

Change in trade payables |

(7) |

38 |

2 |

(7) |

|

Change in contract liabilities |

(8) |

3 |

(16) |

(9) |

|

Changes in trade working capital liabilities |

(15) |

41 |

(13) |

(16) |

|

Changes in trade working capital |

(69) |

(10) |

33 |

19 |

|

|

2022 |

2021 |

Q4

2022unaudited |

Q4 2021 |

|

Cash out for employee benefits |

(149) |

(273) |

(37) |

(38) |

|

Cash out for provisions |

(27) |

(39) |

(10) |

(8) |

|

Changes in lease portfolio |

(2) |

(1) |

(12) |

(9) |

|

Changes in other working capital |

4 |

17 |

19 |

15 |

|

Cash settled operating derivatives |

(9) |

12 |

(3) |

4 |

|

|

|

|

|

|

|

Cash used in operating

activities |

(86) |

(108) |

15 |

29 |

|

|

|

|

|

|

|

Income taxes paid |

(15) |

(8) |

(11) |

(3) |

|

Net cash from / (used in) operating

activities |

(100) |

(116) |

4 |

26 |

|

|

|

|

|

|

|

Capital expenditure |

(33) |

(26) |

(9) |

(7) |

|

Proceeds from sale of intangible assets and PP&E |

2 |

12 |

- |

1 |

|

Acquisition of subsidiaries, net of cash acquired |

(48) |

- |

- |

- |

|

Disposal of discontinued operations, net of cash disposed of |

(5) |

- |

- |

- |

|

Acquisition of associates |

(1) |

(1) |

(1) |

(1) |

|

Repayment of loans granted to 3rd parties |

- |

9 |

- |

- |

|

Interests received |

7 |

4 |

3 |

1 |

|

Dividends received |

- |

- |

- |

- |

|

|

|

|

|

|

|

Net cash from / (used in) investing

activities |

(76) |

(2) |

(8) |

(5) |

|

|

|

|

|

|

|

Interests paid |

(5) |

(4) |

(2) |

(1) |

|

Dividends paid to non-controlling interests |

(11) |

(5) |

(5) |

(5) |

|

Purchase of treasury shares |

(21) |

(29) |

- |

(8) |

|

Proceeds from borrowings |

3 |

2 |

- |

- |

|

Repayment of borrowings |

(4) |

(3) |

(2) |

(1) |

|

Payment of finance leases |

(30) |

(29) |

(7) |

(7) |

|

Proceeds / (payment) of derivatives |

(9) |

(2) |

(4) |

(4) |

|

Other financing income / (costs) received/paid |

1 |

4 |

(1) |

3 |

|

|

|

|

|

|

|

Net cash from / (used

in) financing

activities |

(77) |

(67) |

(21) |

(24) |

|

|

|

|

|

|

|

Net increase / (decrease) in cash & cash

equivalents |

(253) |

(185) |

(26) |

(3) |

|

|

|

|

|

|

|

Cash & cash equivalents at the start of the

period |

398 |

585 |

178 |

400 |

|

Net increase / (decrease) in cash & cash equivalents |

(253) |

(185) |

(26) |

(3) |

|

Effect of exchange rate fluctuations on cash held |

(7) |

(1) |

(14) |

1 |

|

Gains/(losses) on marketable securities |

- |

(1) |

- |

- |

|

Cash & cash equivalents at the end of the

period |

138 |

398 |

138 |

398 |

Consolidated Statement of changes in Equity (in million

Euro) Consolidated figures following IFRS accounting

policies.

|

in million Euro |

Share capital |

Share premium |

Retained earnings |

Reserve for own shares |

Revaluation reserve |

Hedging reserve |

Remeasurement of the net defined benefit

liability |

Translation reserve |

Total |

NON-CONTROLLING INTERESTS |

TOTAL EQUITY |

|

Balance at January 1,

2021 |

187 |

210 |

1,412 |

(82) |

- |

7 |

(1,122) |

(42) |

570 |

51 |

620 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period |

- |

- |

(17) |

- |

- |

- |

- |

- |

(17) |

4 |

(14) |

|

Other comprehensive income, net of tax |

- |

- |

- |

- |

2 |

(9) |

89 |

26 |

109 |

4 |

112 |

|

Total comprehensive income for the period |

- |

- |

(17) |

- |

2 |

(9) |

89 |

26 |

91 |

8 |

99 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners, recorded directly in

equity |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(5) |

(5) |

|

Purchase of own shares |

- |

- |

- |

(29) |

- |

- |

- |

- |

(29) |

- |

(29) |

|

Cancellation of own shares |

- |

- |

(111) |

111 |

- |

- |

- |

- |

- |

- |

- |

|

Total transactions with owners, recorded directly in

equity |

- |

- |

(111) |

82 |

- |

- |

- |

- |

(29) |

(5) |

(34) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December

31,

2021 |

187 |

210 |

1,284 |

- |

2 |

(2) |

(1,033) |

(15) |

632 |

54 |

685 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2022 |

187 |

210 |

1,284 |

- |

2 |

(2) |

(1,033) |

(15) |

632 |

54 |

685 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period |

- |

- |

(221) |

- |

- |

- |

- |

- |

(221) |

(2) |

(223) |

|

Other comprehensive income, net of tax |

- |

- |

- |

- |

(2) |

- |

125 |

7 |

130 |

- |

130 |

|

Total comprehensive income for the period |

- |

- |

(221) |

- |

(2) |

- |

125 |

7 |

(91) |

(2) |

(93) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners, recorded directly in

equity |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(10) |

(10) |

|

Purchase of own shares |

- |

- |

- |

(21) |

- |

- |

- |

- |

(21) |

- |

(21) |

|

Cancellation of own shares |

- |

- |

(21) |

21 |

- |

- |

- |

- |

- |

- |

- |

|

Total transactions with owners, recorded directly in

equity |

- |

- |

(21) |

- |

- |

- |

- |

- |

(21) |

(10) |

(31) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December

31, 2022 |

187 |

210 |

1,042 |

- |

(1) |

(2) |

(908) |

(9) |

520 |

41 |

561 |

- Statements EN

- Press release EN

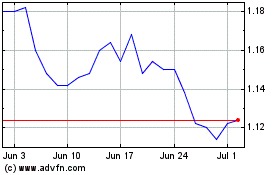

AGFA Gevaert NV (EU:AGFB)

Historical Stock Chart

From Mar 2024 to Apr 2024

AGFA Gevaert NV (EU:AGFB)

Historical Stock Chart

From Apr 2023 to Apr 2024