Regulatory News:

Arkema (Paris:AKE):

Excellent financial performance in 2021, reflecting

accelerating demand for innovative and sustainable materials, as

well as the Group’s reactivity in a demanding and volatile

operating context

- Group sales of €9.5 billion, up by 25.9%

compared with 2020 at constant scope and currency:

- Growth in volumes of +7.3%, driven notably by robust demand for

sustainable solutions with high technological content, particularly

in batteries, 3D printing, consumer goods and more environmentally

friendly paints

- Increase in selling prices of 18.6% over the year, reflecting

the Group’s initiatives to offset strong raw materials and energy

inflation, an improved product mix, as well as the tightness of

upstream acrylics

- EBITDA at historic high of €1,727 million, up by

46.1% compared with 2020, and EBITDA margin at

18.1%, in an environment marked by operational disruptions

and high raw materials and energy costs:

- Excellent performance of Specialty Materials, up strongly in

each of the segments, with EBITDA of €1,503 million (€1,018 million

in 2020) and EBITDA margin of 18.5%

- Increase in EBITDA of Intermediates (€316 million vs. €231

million in 2020), driven by favorable market conditions in acrylics

in Asia and despite the negative scope effect related to the PMMA

and Functional Polyolefins divestments

- Adjusted net income multiplied by 2.3 to €896

million, representing €11.88 per share (€5.11 in 2020)

- Recurring cash flow stable at €756 million (€762

million in 2020) and net debt down sharply to €1,177

million, including €700 million in hybrid bonds (net debt of

€1,910 million at end-2020), representing 0.7x 2021 EBITDA

- Proposed dividend of €3.0 per share (€2.5 in

2020)

Strengthening of the Specialty Materials platform in line

with the 2024 ambition

- Major steps taken to refocus on Specialty Materials, which

represent close to 90% of 2021 pro forma sales (1), with the

finalization of the PMMA divestment and the proposed acquisition of

Ashland’s performance adhesives business

- Numerous customer partnerships and targeted capacity increase

projects to support the Group’s sustainable growth strategy,

particularly in bio-based products, materials lightweighting, clean

mobility, new energies, electronics and more environmentally

friendly coatings

Confidence of the Group in the outlook for 2022

- Continued implementation of the Group’s strategy, in particular

with the closing of the Ashland performance adhesives acquisition,

the start-up at mid-year of the PA11 plant in Singapore and the

hydrofluoric acid plant in the United States, as well as the

strengthening of innovation and targeted investments to support our

organic growth

- In 2022, in a global environment that should remain volatile,

the Group aims, at constant scope (2), to achieve a Specialty

Materials’ EBITDA comparable to the record high of 2021

- 2024 targets fully supported by the level of performance in

2021 and the significant progress made in the execution of the

strategic roadmap

Following Arkema’s Board of Directors’ meeting, held on 23

February 2022 to approve the Group’s consolidated financial

statements for 2021, Chairman and CEO Thierry Le Hénaff said:

“I would particularly like to thank Arkema’s employees, who

through their commitment and initiatives, enabled the Group to

reach an excellent financial performance in 2021 in a demanding

operating context, and to successfully complete a number of

important organic growth and portfolio management projects.

Arkema’s growth was driven by increasingly strong demand for high

performance solutions that address challenges linked to sustainable

megatrends.

Moreover, our strategy goes hand in hand with demanding CSR

commitments which are rooted in the company’s values. After a year

marked by Arkema’s inclusion in the CAC 40 ESG index and by the

third place achieved in the ‘Chemicals’ category of the DJSI World

index, we are happy to have been certified as a Top Employer 2022

in four countries, which account for two-thirds of our employees

and recruitments worldwide.

2022 will mark another important step forward in our ambition to

become a pure Specialty Materials player. The acquisition of

Ashland’s adhesives business is expected to close shortly, and will

be followed by the start-up of our two major projects, namely, the

bio-based polyamide 11 plant in Singapore and the production of

hydrofluoric acid in the United States. Moreover, we have never

identified so many innovation opportunities in areas with high

technological content. Thanks to our geographic positioning, the

intimacy developed with our customers and our unique expertise

centered around materials science, I believe Arkema is very well

positioned to seize these opportunities.”

KEY FIGURES FOR 2021

in millions of euros

2021

2020

Change

Sales

9,519

7,884

+20.7%

EBITDA

1,727

1,182

+46.1%

Specialty Materials

1,503

1,018

+47.6%

Intermediates

316

231

+36.8%

Corporate

-92

-67

EBITDA margin

18.1%

15.0%

Specialty Materials

18.5%

15.8%

Intermediates

22.9%

16.2%

Recurring operating income (REBIT)

1,184

619

+91.3%

REBIT margin

12.4%

7.9%

Adjusted net income

896

391

+129.2%

Adjusted net income per share (in €)

11.88

5.11

+132.5%

Recurring cash flow

756

762

-0.8%

Free cash flow

479

651

-26.4%

Net debt including hybrid bonds

1,177

1,910

2021 BUSINESS PERFORMANCE

At €9,519 million, sales were up 20.7% compared

with the prior year, and up 25.9% at constant scope and currency.

In a market environment that recovered significantly after 2020, a

year marked by a health and economic crisis, volumes rose by 7.3%,

with the Group leveraging the acceleration of demand for high

performance, sustainable materials. Thus, Arkema benefited from its

cutting-edge innovation and its positioning on solutions that have

a high technological content or that are more environmentally

friendly in the battery, consumer goods, decorative paints,

electronics and 3D printing markets. Certain markets which are more

minor for Arkema like oil & gas and paper were down

year-on-year, as was the automotive sector, impacted by chip

shortages. The price effect came in at +18.6%, reflecting both the

adaptation of selling prices throughout the year in the face of

high raw materials, energy and logistics cost inflation, and much

more favorable market conditions in upstream acrylics relative to

the low level of 2020. The 4.1% negative scope effect relates to

the divestments of PMMA, finalized on 3 May 2021, and Functional

Polyolefins, completed in June 2020, which were partly offset by

acquisitions in Specialty Materials. The currency effect was

limited over the year (-1.1%).

The share of Specialty Materials increased to 85.5% of total

Group sales in 2021 (82% in 2020). Lastly, the evolution in the

geographic breakdown of sales reflects the growing importance of

Asia, as well as the impact of logistics disruptions and the

divestment of PMMA in the United States. Accordingly, North America

accounted for 31% of Group sales in 2021 versus 33% in 2020, Asia

and the rest of the world represented 33% versus 31% in 2020, and

Europe remained stable at 36%.

The Group’s EBITDA rose by 46.1% year-on-year to

€1,727 million – a historic high – despite a negative scope

effect of around €75 million, mainly related to divestments in

Intermediates. All segments reported a significant improvement in

their results, reflecting higher volumes in attractive markets, the

Group’s capacity to pass on higher raw materials and energy costs,

the shift in the product mix toward higher value-added solutions

and favorable market conditions in upstream acrylics.

In this predominantly favorable environment, the EBITDA

margin improved by more than 300 bps compared with 2020 to

reach its historic high at 18.1%.

Recurring operating income (REBIT) was up by more than

90% to €1,184 million, and the REBIT margin improved

by 450 bps to 12.4%. Recurring depreciation and amortization

amounted to €543 million, down €20 million year-on-year,

essentially due to the divestment of PMMA.

The financial result represented a net expense of €56

million, down €29 million compared with 2020. This year-on-year

change is primarily due to a more favorable interest rate on the

portion of the Group’s debt swapped into US dollars and, to a

lesser extent, to the refinancing, at favorable market conditions,

of the €480 million senior bond that matured in April 2020.

Excluding exceptional items, the Group’s tax rate amounted to

20% of REBIT in 2021. In 2022, the tax rate excluding exceptional

items is expected to amount to around 21% of REBIT.

Adjusted net income, at €896 million (or

€11.88 per share), more than doubled versus 2020.

CASH FLOWS AND NET DEBT AT 31 DECEMBER 2021

Coming in at €756 million in 2021, recurring cash

flow was stable year-on-year (€762 million in 2020), with the

Group’s improved operating performance in 2021 offset by the change

in working capital (€319 million outflow in 2021 in the context of

a strong business recovery and significant inflation in raw

materials, after a decrease in working capital in 2020 following

the pandemic). However, working capital remained well controlled at

12.7% of annual sales excluding the PMMA business (11.8% at

end-December 2020 and 13.8% at end-December 2019), and below its

normative level of around 14%. Recurring cash flow also includes

recurring capital expenditure of €506 million, or 5.3% of Group

sales.

The EBITDA to cash conversion rate, now calculated based on

recurring cash flow, was 43.8%, in line with the Group’s long-term

objective of 40%.

Free cash flow came to €479 million for the year

(€651 million in 2020), and was mainly impacted by the ramp-up of

exceptional capital expenditure corresponding to the bio-based

polyamides project in Asia and the hydrofluoric acid supply project

with Nutrien in the United States (€252 million in 2021 compared

with €140 million in 2020). For the year as a whole, recurring and

exceptional capital expenditure amounted to €758 million, in line

with the Group’s guidance of €750 million. In 2022, Arkema

estimates that recurring capital expenditure should come to around

5.5% of Group sales and that the ongoing exceptional capital

expenditure should come to an end with an amount of around €130

million.

Free cash flow in 2021 also included a non-recurring cash

outflow of €25 million, mainly corresponding to restructuring costs

and the consequences of winter storm Uri in the United States.

Net cash flow from portfolio management operations

amounted to €909 million in 2021. It mainly included

proceeds from the divestments of PMMA and the epoxides businesses,

as well as the bolt-on acquisitions of Poliplas, Edge Adhesives

Texas and Agiplast. In 2020, this figure came to €6 million and

notably included the divestment of the Functional Polyolefins

business.

Lastly, cash flow from financing activities represented a

net outflow of €652 million for the year. In particular,

this figure includes an outflow of €329 million corresponding to

the cost of share buybacks, notably those carried out under the

€300 million buyback program announced in May 2021 and completed on

24 November, payment of the 2020 dividend of €2.5 per share for a

total amount of €191 million, and €15 million in interest paid on

hybrid bonds.

Net debt including hybrid bonds fell sharply to stand at

€1,177 million versus €1,910 million at end-2020, and the

net debt (including hybrid bonds) to last-twelve-months EBITDA

ratio stood at 0.7x. Including the finalization of the acquisition

of Ashland’s adhesives, this ratio should remain below 2x annual

EBITDA in 2022.

In line with the policy of gradually increasing the dividend,

the Board of Directors has decided that, at the annual general

meeting of 19 May 2022, it will recommend a dividend payment of

€3.0 per share in respect of 2021 (vs. €2.5 per share in respect of

2020), to be paid entirely in cash. Shares will be traded

ex-dividend on 23 May 2022 and the dividend will be paid as from 25

May 2022.

CONTINUED PROGRESS IN CSR

To reinforce its sustainable offering commitment, the Group

started some years ago to assess its portfolio in light of

sustainability criteria and, in 2020, set itself the objective of

increasing to 65% the share of its sales that significantly

contribute to the United Nations Sustainable Development Goals

(SDGs) by 2030 (ImpACT+ objective (3)). At end-2021, the Group

increased the share of sales assessed to 85%, compared with 72% at

end-2020, and based on this new scope, the share of sales that

significantly contribute to the SDGs reached 51% (vs. 50% at

end-2020).

Moreover, in order to accelerate its transition toward a

circular economy, the Group intends to significantly strengthen the

life-cycle analysis of its products, which enables to assess their

environmental impact. Thus, the Group aims to increase to 50% the

share of sales assessed by a life-cycle analysis by end-2024 vs.

27% at end-2021.

In terms of climate and the environment, the Group achieved

further progress in its key indicators in 2021. In particular, its

greenhouse gas emissions (4) were down significantly, falling by

14% compared with 2020 and by 34% compared with the baseline year

of 2015. In a context of strongly rising production volumes, this

significant reduction reflects the pro-active steps taken by the

Group as part of its climate plan roll-out.

Regarding safety, the Group confirmed the previous year’s very

solid level with a TRIR (5) of 1.0, and moreover substantially

improved its PSER (6) to 3.1 in 2021, compared with 4.0 in 2020.

Arkema aims to further improve these results and targets to achieve

in 2030 a TRIR of 0.8 and a PSER of 2.0.

Moreover, in line with its commitment to equal opportunity and

in recognition of the contribution of diversity to company

performance, the Group is continuing to increase the share of women

in senior management and executive positions, with this figure

reaching 24% in 2021 (vs. 23% in 2020), and targets 26% in

2024.

Lastly, Arkema improved its ranking in the DJSI World index,

rising to 3rd place in the “Chemicals” category in 2021 compared

with 6th place in 2020, and in 2021 joined the new CAC 40® ESG

index, which lists the 40 companies that have demonstrated

environmental, social and governance (ESG) best practices. The

Group has thus been rewarded for its sustainability performance and

for integrating its CSR commitment into its development strategy,

which will create long-term value.

2021 PERFORMANCE BY SEGMENT

ADHESIVE SOLUTIONS (24% OF TOTAL GROUP SALES)

in millions of euros

2021

2020

Change

Sales

2,278

1,996

+14.1%

EBITDA

316

261

+21.1%

EBITDA margin

13.9%

13.1%

Recurring operating income (REBIT)

250

198

+26.3%

REBIT margin

11.0%

9.9%

Sales in the Adhesive Solutions segment totaled €2,278

million, up 14.1% compared with 2020. Volumes grew by 5.4%,

benefiting from robust demand in the construction and DIY market,

as well as the post-Covid business recovery in high performance

industrial applications, but they were impacted in the second half

of the year by shortages of several important raw materials. The

price effect, which grew constantly throughout the year, was a

positive 5.4% and reflects the Group’s ongoing actions to pass on

high inflation in raw materials. The 4.1% positive scope effect

corresponds to the integration of Fixatti, Ideal Work, Poliplas and

Edge Adhesives Texas and the currency effect was a negative

0.8%.

EBITDA for the segment rose by 21.1% compared with 2020

to €316 million, driven by positive sales momentum, the

shift in the product mix toward higher value-added applications and

the contribution of acquisitions, with the impact of higher raw

materials costs progressively offset by price increase initiatives.

In this context, the EBITDA margin expanded by 80 bps

compared with 2020 to 13.9%, in line with the guidance of

14% announced in early 2021, which constitutes a good performance,

particularly given the mechanical dilutive impact of price

increases on this ratio of around 100 bps for the year.

ADVANCED MATERIALS (32.5% OF TOTAL GROUP SALES)

in millions of euros

2021

2020

Change

Sales

3,087

2,527

+22.2%

EBITDA

662

496

+33.5%

EBITDA margin

21.4%

19.6%

Recurring operating income (REBIT)

408

245

+66.5%

REBIT margin

13.2%

9.7%

Sales in the Advanced Materials segment rose by a strong

22.2% compared with 2020 to €3,087 million. Volumes were up

by a significant 10.3% compared with the prior year, driven by High

Performance Polymers, which benefited from a strong dynamic in most

end markets, despite a decline in the automotive sector, and from

the acceleration in demand for high performance, sustainable

solutions, particularly in batteries, bio-based consumer goods,

sports and water filtration. Volume growth was more moderate in

Performance Additives, where demand remained lower in the oil &

gas and paper markets. The 12.8% increase in prices reflects both

the actions taken to increase selling prices in the context of

marked raw materials, energy and logistics cost inflation, and

product mix improvement toward high performance, higher value-added

solutions. The scope effect was a positive 0.2%, corresponding to

the integration of Agiplast, finalized on 1 June 2021, and the

currency effect was a negative 1.1%.

In this context, the segment’s EBITDA amounted to €662

million, up by 33.5% year-on-year, supported notably by the

excellent year of High Performance Polymers. The EBITDA

margin increased to 21.4%, compared with 19.6% in

2020.

COATING SOLUTIONS (29% OF TOTAL GROUP SALES)

in millions of euros

2021

2020

Change

Sales

2,746

1,911

+43.7%

EBITDA

525

261

+101.1%

EBITDA margin

19.1%

13.7%

Recurring operating income (REBIT)

407

142

+186.6%

REBIT margin

14.8%

7.4%

Sales in the Coating Solutions segment were up sharply by

43.7% to €2,746 million. Volumes grew by 8.1%, driven by

robust demand across all of the segment’s key markets, namely

decorative paints, 3D printing, industrial coatings, graphic arts

and electronics. The positive 37.6% price effect reflects the

necessary price increases implemented for downstream products to

offset very high raw materials and energy inflation, and the

significant tightness of upstream acrylics. The currency effect

reduced segment sales by 2.0%.

At €525 million, EBITDA doubled and the EBITDA

margin reached the high level of 19.1% (13.7% in 2020),

benefiting from the growth and product mix improvement linked to

strong demand for more environmentally friendly solutions such as

water-based and bio-based paints, powder coatings and UV-curable

resins, as well as more favorable conditions in upstream

acrylics.

INTERMEDIATES (14.5% OF TOTAL GROUP SALES)

in millions of euros

2021

2020

Change

Sales

1,378

1,425

-3.3%

EBITDA

316

231

+36.8%

EBITDA margin

22.9%

16.2%

Recurring operating income (REBIT)

219

109

+100.9%

REBIT margin

15.9%

7.6%

At €1,378 million, sales in the Intermediates

segment were down 3.3% compared with the prior year, impacted by a

negative scope effect of 29.1% corresponding to the PMMA divestment

finalized in May 2021 and the Functional Polyolefins divestment on

1 June 2020. The positive 22.1% price effect was attributable to

much more favorable market conditions for acrylics in Asia compared

to the low level of the previous years, and to a solid performance

in Fluorogases. Volumes rose by 3.6% over the year, driven by

higher demand post-Covid, but held back in the second half for

acrylics in Asia following Chinese authorities’ measures aimed at

limiting energy consumption.

In this context of a buoyant market, and despite a negative

scope effect of around €90 million, segment EBITDA increased

by 36.8% to €316 million and the EBITDA margin

improved to 22.9% (16.2% in 2020).

KEY FIGURES FOR FOURTH-QUARTER 2021

in millions of euros

Q4'21

Q4'20

Change

Sales

2,500

1,985

+25.9%

EBITDA

417

289

+44.3%

Specialty Materials

359

261

+37.5%

Adhesive Solutions

69

69

+0.0%

Advanced Materials

168

123

+36.6%

Coating Solutions

122

69

+76.8%

Intermediates

80

42

+90.5%

Corporate

-22

-14

EBITDA margin

16.7%

14.6%

Specialty Materials

16.5%

15.9%

Adhesive Solutions

11.9%

13.5%

Advanced Materials

19.2%

19.1%

Coating Solutions

16.8%

14.1%

Intermediates

25.6%

12.6%

Recurring operating income (REBIT)

273

144

+89.6%

REBIT margin

10.9%

7.3%

Adjusted net income

212

92

+130.4% Adjusted net income per share (in €)

2.86

1.20

+138.3%

Recurring cash flow

222

180

+23.3% Free cash flow

108

116

-6.9%

Group sales totaled €2,500 million, up 28.4% on

Q4’20 at constant scope and currency. Volumes were down slightly

(-0.5%), penalized notably by the lack of availability of numerous

important raw materials in the Adhesive Solutions segment and

weaker demand in Coating Solutions compared with the high

prior-year comparison base. The solid growth in Advanced Materials

offset lower volumes in those two segments. The 28.9% positive

price effect was primarily attributable to the Group’s price

increase policy to offset very strong raw materials, energy and

logistics cost inflation, and to the tightness of upstream

acrylics. The 5.9% negative scope effect reflects the divestment of

PMMA, which was partly offset by the integration of acquisitions in

Specialty Materials. The 3.4% positive currency effect was mainly

linked to the appreciation of the US dollar against the euro.

Group EBITDA rose by 44.3% to €417 million despite

a negative scope effect of more than €30 million, resulting mainly

from the divestment of PMMA. This good performance was supported by

the product mix improvement in Specialty Materials linked to the

acceleration of demand for solutions that have a high technological

content and are more environmentally friendly, as well as by the

favorable market conditions in upstream acrylics. In this generally

favorable environment, albeit disrupted by raw materials inflation

and shortages, the EBITDA margin rose to a fourth-quarter

record level of 16.7% (14.6% in Q4’20).

Sales in the Adhesive Solutions segment totaled €580

million, up 13.3% relative to fourth-quarter 2020. In a context

of continuing good demand, volumes were impacted by key raw

materials shortages from our suppliers and fell by 3.3% compared

with the high comparison base of Q4’20. These pressures should fade

away at the end of first-quarter 2022. The positive 11.5% price

effect reflects the Group’s ongoing initiatives to pass on the very

high raw materials inflation. The 2.8% positive scope effect

corresponds to the integration of Poliplas and Edge Adhesives Texas

and the currency effect was a positive 2.3%.

At €69 million, EBITDA for the segment was stable

compared with the excellent performance of fourth-quarter 2020. The

EBITDA margin came to 11.9% (13.5% for Q4’20),

impacted in particular by the strong mechanical dilutive effect of

price increases on this ratio.

In the continuity of third-quarter trends, sales in the

Advanced Materials segment rose by a sharp 35.7% compared with

Q4’20, coming in at €874 million. Driven by a favorable

environment across most of the segment’s key markets – with the

exception of the automotive and oil & gas sectors, which

remained down – volumes grew by 4.2%, also supported by a continued

very positive dynamic in batteries, bio-based materials, sports and

water filtration. The 28.1% positive price effect reflects price

increase initiatives and the product mix improvement in

technological, high performance solutions with high added value.

The Agiplast acquisition resulted in a 0.1% positive scope effect

and the currency effect was a positive 3.3%.

With EBITDA of €168 million, up 36.6% compared

with Q4’20, and an EBITDA margin of 19.2%, the

segment once again delivered an excellent performance in the

quarter.

At €725 million, sales in the Coating Solutions

segment were up sharply by 48.3% relative to fourth-quarter 2020.

In the context of a high prior-year comparison base, volumes were

down by 2.9%. Underlying demand remains nevertheless well-oriented

in the segment’s key markets. The 47.7% positive price effect was

attributable to ongoing pricing actions in downstream activities to

offset high raw materials inflation, as well as to the significant

tightness of upstream acrylics. The currency effect in the fourth

quarter was a positive 3.5%.

Driven by a positive product mix and favorable market conditions

in upstream acrylics, EBITDA grew strongly by 76.8% to

€122 million, and the EBITDA margin increased by 270

bps to 16.8%.

At €312 million, sales in the Intermediates

segment were down 6.6% relative to fourth-quarter 2020, impacted by

a 39.5% negative scope effect linked to the divestment of PMMA.

Volumes decreased by 2.4%, weighed down at the start of the quarter

by restrictions imposed in China to limit energy consumption. The

positive price effect of 29.9% reflects much better conditions for

the acrylics market in Asia compared with the low level of the

prior year and an improvement in Fluorogases. The currency effect

for the quarter was a positive 5.4%.

In this context, and despite the impact of the divestment of

PMMA, EBITDA rose sharply to €80 million (€42 million

in Q4’20) and the EBITDA margin came in at 25.6%

(12.6% in Q4’20).

SUBSEQUENT EVENTS

Following the completion on 24 November 2021 of the €300 million

share buyback program announced in May 2021, the Board of Directors

decided on 24 January 2022 to reduce Arkema’s share capital by

3.19%, by canceling 2,450,435 treasury shares acquired at a total

cost of €270 million. Following this operation, Arkema’s share

capital amounted to €742,860,410, divided into 74,286,041 shares

with a par value of €10.

Moreover, on 17 January 2022, Arkema announced plans to increase

its global production capacity for Pebax® elastomers by 25% through

an investment at its Serquigny plant in France to support its

customers’ strong growth, in particular in the sports and consumer

goods markets.

Lastly, on 26 January 2022, the Group increased its previously

announced 35% fluoropolymer production capacity increase at its

Changshu site in China to support strong demand in lithium-ion

batteries and in other important markets. Arkema is now targeting a

capacity increase of 50%, with no change in the expected start-up

date (end-2022).

OUTLOOK FOR 2022

In 2022, Arkema should benefit from a positive level of global

demand, with nuances in different regions and markets, and from its

leading positioning on innovative, high performance Specialty

Materials. In particular, the Group will leverage its innovation

dynamic in fields such as clean mobility, materials lightweighting,

natural resources management and living comfort & home

efficiency, as well as the start-up of production units in

high-growth regions.

At the start of the year, the environment remains volatile,

marked by uncertainty related to the health crisis, growing

geopolitical tensions and continued strong constraints in raw

materials and energy in the continuity of second-half 2021. In this

demanding context, while remaining attentive to demand trends, the

Group will continue to pass on higher costs in its selling prices

and ensure that it optimizes supply chain management.

In first-quarter 2022, Group EBITDA is expected to increase

strongly, driven by the growth in Advanced Materials and Coating

Solutions. The Adhesive Solutions segment will still remain

temporarily impacted by raw materials shortages, and its EBITDA is

expected to come in, at constant scope, somewhere between the

first-quarter 2020 and the record first-quarter 2021 levels.

Intermediates should achieve a solid start to the year.

For full-year 2022, Arkema is aiming to achieve, at constant

scope, Specialty Materials EBITDA comparable to the record high of

2021. Moreover, the scope effect at Group level will include the

contribution of Ashland’s performance adhesives, expected to close

in the first quarter, and the residual effect of the divestment of

PMMA.

In line with its strategy to become a pure Specialty Materials

player by 2024, the Group will continue its bolt-on acquisition

policy in 2022, as well as its review of the Intermediates segment.

Lastly, beyond the start-up, expected in the middle of the year, of

the two major industrial projects, namely the bio-based polyamides

plant in Singapore and the hydrofluoric acid plant in the United

States, Arkema will continue to strengthen its innovation and

capacities to support, in a targeted manner, customer demand in

fast-growing markets.

On the strength of its 2021 performance and the significant

progress made in the execution of its strategic roadmap, the Group

is fully reaffirming its confidence in its ability to achieve its

ambitious 2024 targets.

Further details concerning the Group’s 2021 results are provided

in the “Full year 2021 results and outlook” presentation and the

Factsheet, both available on Arkema’s website at:

www.arkema.com/global/en/investor-relations/

The consolidated financial statements at 31 December 2021 have

been audited, and an unqualified certification report has been

issued by the Company’s statutory auditors. These financial

statements and the statutory auditors’ report will be available in

late March in the Company’s Universal Registration Document, which

will be posted on Arkema’s website at:

www.arkema.com/global/en/investor-relations/

FINANCIAL CALENDAR

5 May 2022: Publication of first-quarter 2022 results 19 May

2022: Annual general meeting 29 July 2022: Publication of

second-quarter 2022 results 10 November 2022: Publication of

third-quarter 2022 results

DISCLAIMER

The information disclosed in this press release may contain

forward-looking statements with respect to the financial position,

results of operations, business and strategy of Arkema.

In the current context, where the Covid-19 pandemic persists

across the world, and the evolution of the situation as well as the

magnitude of its impacts on the global economy are highly

uncertain, the retained assumptions and forward-looking statements

could ultimately prove inaccurate.

Such statements are based on management’s current views and

assumptions that could ultimately prove inaccurate and are subject

to risk factors such as (but not limited to) changes in raw

materials prices, currency fluctuations, the pace at which

cost-reduction projects are implemented, developments in the

Covid-19 situation, and changes in general economic and financial

conditions. Arkema does not assume any liability to update such

forward-looking statements whether as a result of any new

information or any unexpected event or otherwise. Further

information on factors which could affect Arkema’s financial

results is provided in the documents filed with the French Autorité

des marchés financiers.

Balance sheet, income statement and cash flow statement data, as

well as data relating to the statement of changes in shareholders’

equity and information by segment included in this press release

are extracted from the consolidated financial statements at 31

December 2021 as approved by Arkema’s Board of Directors on 23

February 2022. Quarterly financial information is not audited.

Information by segment is presented in accordance with Arkema’s

internal reporting system used by management.

Details of the main alternative performance indicators used by

the Group are provided in the tables appended to this press

release. For the purpose of analyzing its results and defining its

targets, the Group also uses EBITDA margin, which corresponds to

EBITDA expressed as a percentage of sales, EBITDA equaling

recurring operating income (REBIT) plus recurring depreciation and

amortization of tangible and intangible assets, as well as REBIT

margin, which corresponds to recurring operating income (REBIT)

expressed as a percentage of sales.

For the purpose of tracking changes in its results, and

particularly its sales figures, the Group analyzes the following

effects (unaudited analyses):

- scope effect: the impact of changes in the Group’s scope

of consolidation, which arise from acquisitions and divestments of

entire businesses or as a result of the first-time consolidation or

deconsolidation of entities. Increases or reductions in capacity

are not included in the scope effect;

- currency effect: the mechanical impact of consolidating

accounts denominated in currencies other than the euro at different

exchange rates from one period to another. The currency effect is

calculated by applying the foreign exchange rates of the prior

period to the figures for the period under review;

- price effect: the impact of changes in average selling

prices is estimated by comparing the weighted average net unit

selling price of a range of related products in the period under

review with their weighted average net unit selling price in the

prior period, multiplied, in both cases, by the volumes sold in the

period under review;

- volume effect: the impact of changes in volumes is

estimated by comparing the quantities delivered in the period under

review with the quantities delivered in the prior period,

multiplied, in both cases, by the weighted average net unit selling

price in the prior period.

Building on its unique set of expertise in materials science,

Arkema offers a portfolio of first-class technologies to

address ever-growing demand for new and sustainable materials. With

the ambition to become in 2024 a pure player in Specialty

Materials, the Group is structured into 3 complementary, resilient

and highly innovative segments dedicated to Specialty Materials

-Adhesive Solutions, Advanced Materials, and Coating Solutions-

accounting for some 85.5% of Group sales in 2021, and a

well-positioned and competitive Intermediates segment. Arkema

offers cutting-edge technological solutions to meet the challenges

of, among other things, new energies, access to water, recycling,

urbanization and mobility, and fosters a permanent dialogue with

all its stakeholders. The Group reported sales of around €9.5

billion in 2021, and operates in some 55 countries with 20,200

employees worldwide.

A French société anonyme (limited company) with share capital of

€742,860,410 – Registered in Nanterre: RCS 445 074 685 Nanterre

Follow us on: Twitter.com/Arkema_group

Linkedin.com/company/arkema

____________________________ (1) Including the full year

contribution of all M&A operations announced in 2021 (2)

Excluding the acquisition of Ashland’s adhesives expected to close

in first-quarter 2022 (3) Corresponds to the share of sales that

contribute significantly to SDGs, set according to an approach that

complies with the established guidelines in this area by the World

Business Council for Sustainable Development (WBCSD) (4) In

absolute value terms for greenhouse gases (5) Total recordable

injury rate per million hours worked (6) Process safety event rate

per million hours worked, established according to the criteria of

the ICCA/CEFIC (International Council of Chemical

Associations/European Chemical Industry Council).

ARKEMA financial

statements

Consolidated financial information - At the

end of December 2021

Consolidated financial statements as of December 2020 and 2021

have been audited.

CONSOLIDATED INCOME STATEMENT

4th quarter

2021

4th quarter

2020

(In millions of euros)

Sales

2,500

1,985

Operating expenses

(1,969)

(1,607)

Research and development expenses

(65)

(64)

Selling and administrative expenses

(210)

(184)

Other income and expenses

(92)

(46)

Operating income

164

84

Equity in income of affiliates

(1)

(1)

Financial result

(13)

(17)

Income taxes

(42)

(22)

Net income

108

44

Attributable to non-controlling interests

(4)

1

Net income - Group share

112

43

Earnings per share (amount in euros)

1.58

0.38

Diluted earnings per share (amount in euros)

1.57

0.37

End of

December 2021

End of

December 2020

(In millions of euros)

Sales

9,519

7,884

Operating expenses

(7,376)

(6,336)

Research and development expenses

(243)

(241)

Selling and administrative expenses

(784)

(745)

Other income and expenses

617

38

Operating income

1,733

600

Equity in income of affiliates

(1)

(2)

Financial result

(56)

(85)

Income taxes

(369)

(178)

Net income

1,307

335

Attributable to non-controlling interests

(2)

3

Net income - Group share

1,309

332

Earnings per share (amount in euros)

17.15

3.98

Diluted earnings per share (amount in euros)

17.04

3.96

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

4th quarter

2021

4th quarter

2020

(In millions of euros)

Net

income

108

44

Hedging adjustments

7

3

Other items

2

-

Deferred taxes on hedging adjustments and other items

0

(2)

Change in translation adjustments

104

(84)

Other recyclable comprehensive income

113

(83)

Impact of remeasuring unconsolidated investments

(3)

-

Actuarial gains and losses

14

3

Deferred taxes on actuarial gains and losses

(1)

(1)

Other non-recyclable comprehensive income

10

2

Total income and expenses recognized directly in equity

123

(81)

Total comprehensive income

231

(37)

Attributable to non-controlling interest

(3)

-

Total comprehensive income - Group share

234

(37)

(In

millions of euros)

End of

December 2021

End of

December 2020

Net income

1,307

335

Hedging adjustments

(12)

28

Other items

2

-

Deferred taxes on hedging adjustments and other items

(1)

(5)

Change in translation adjustments

278

(212)

Other recyclable comprehensive income

267

(189)

Impact of remeasuring unconsolidated investments

(6)

-

Actuarial gains and losses

76

(47)

Deferred taxes on actuarial gains and losses

(15)

11

Other non-recyclable comprehensive income

55

(36)

Total income and expenses recognized directly in equity

322

(225)

Total comprehensive income

1,629

110

Attributable to non-controlling interest

1

1

Total comprehensive income - Group share

1,628

109

INFORMATION BY SEGMENT 4th

quarter 2021 (In millions of euros)

AdhesiveSolutions AdvancedMaterials

CoatingSolutions Intermediates Corporate

Total Sales

580

874

725

312

9

2,500

EBITDA

69

168

122

80

(22)

417

Recurring depreciation and amortization of property, plant and

equipment and intangible assets

(18)

(68)

(30)

(25)

(3)

(144)

Recurring operating income (REBIT)

51

100

92

55

(25)

273

Depreciation and amortization related to the revaluation of

property, plant and equipment and intangible assets as part of the

allocation of the purchase price of businesses

(12)

(4)

(1)

-

-

(17)

Other income and expenses

(19)

(66)

-

(5)

(2)

(92)

Operating income

20

30

91

50

(27)

164

Equity in income of affiliates

-

(1)

-

-

-

(1)

Intangible assets and property, plant, and equipment

additions

34

174

55

29

10

302

Of which: recurring capital expenditure

34

108

54

24

10

230

4th quarter 2020

(In millions of euros)

AdhesiveSolutions

AdvancedMaterials CoatingSolutions

Intermediates Corporate Total

Sales

512

644

489

334

6

1,985

EBITDA

69

123

69

42

(14)

289

Recurring depreciation and amortization of property, plant and

equipment and intangible assets

(17)

(66)

(30)

(30)

(2)

(145)

Recurring operating income (REBIT)

52

57

39

12

(16)

144

Depreciation and amortization related to the revaluation of

property, plant and equipment and intangible assets as part of the

allocation of the purchase price of businesses

(9)

(4)

(1)

-

-

(14)

Other income and expenses

(6)

(11)

0

(26)

(3)

(46)

Operating income

37

42

38

(14)

(19)

84

Equity in income of affiliates

-

(1)

-

-

-

(1)

Intangible assets and property, plant, and equipment

additions

17

124

40

65

5

251

Of which: recurring capital expenditure

17

102

37

37

5

198

INFORMATION BY SEGMENT End

of December 2021 (In millions of euros)

AdhesiveSolutions AdvancedMaterials

CoatingSolutions Intermediates Corporate

Total Sales

2,278

3,087

2,746

1,378

30

9,519

EBITDA

316

662

525

316

(92)

1,727

Recurring depreciation and amortization of property, plant and

equipment and intangible assets

(66)

(254)

(118)

(97)

(8)

(543)

Recurring operating income (REBIT)

250

408

407

219

(100)

1,184

Depreciation and amortization related to the revaluation of

property, plant and equipment and intangible assets as part of the

allocation of the purchase price of businesses

(48)

(15)

(5)

-

-

(68)

Other income and expenses

(53)

(181)

(13)

875

(11)

617

Operating income

149

212

389

1,094

(111)

1,733

Equity in income of affiliates

-

0

-

(1)

-

(1)

Intangible assets and property, plant, and equipment

additions

77

441

102

121

22

763

Of which: recurring capital expenditure

77

249

97

61

22

506

End of December

2020 (In millions of euros)

AdhesiveSolutions

AdvancedMaterials CoatingSolutions

Intermediates Corporate Total

Sales

1,996

2,527

1,911

1,425

25

7,884

EBITDA

261

496

261

231

(67)

1,182

Recurring depreciation and amortization of property, plant and

equipment and intangible assets

(63)

(251)

(119)

(122)

(8)

(563)

Recurring operating income (REBIT)

198

245

142

109

(75)

619

Depreciation and amortization related to the revaluation of

property, plant and equipment and intangible assets as part of the

allocation of the purchase price of businesses

(35)

(16)

(6)

-

-

(57)

Other income and expenses

(42)

(31)

(3)

157

(43)

38

Operating income

121

198

133

266

(118)

600

Equity in income of affiliates

-

(2)

-

0

-

(2)

Intangible assets and property, plant, and equipment

additions

69

271

88

161

16

605

Of which: recurring capital expenditure

69

204

83

88

16

460

CONSOLIDATED CASH FLOW STATEMENT

End of

December 2021

End of

December 2020

(In millions of euros)

Operating cash flows

Net income

1,307

335

Depreciation, amortization and impairment of assets

817

748

Other provisions and deferred taxes

58

41

(Gains)/losses on sales of long-term assets

(991)

(240)

Undistributed affiliate equity earnings

1

2

Change in working capital

(290)

201

Other changes

13

28

Cash flow from operating activities

915

1,115

Investing cash flows

Intangible assets and property, plant, and

equipment additions

(763)

(605)

Change in fixed asset payables

78

13

Acquisitions of operations, net of cash acquired

(40)

(226)

Increase in long-term loans

(36)

(39)

Total expenditures

(761)

(857)

Proceeds from sale of intangible assets and

property, plant, and equipment

18

6

Proceeds from sale of operations, net of cash transferred

1,161

326

Proceeds from sale of unconsolidated investments

8

-

Repayment of long-term loans

47

67

Total divestitures

1,234

399

Cash flow from investing activities

473

(458)

Financing cash flows

Issuance (repayment) of shares and paid-in

surplus

-

7

Purchase of treasury shares

(329)

(25)

Issuance of hybrid bonds

-

299

Redemption of hybrid bonds

-

(300)

Dividends paid to parent company shareholders

(191)

(168)

Interest paid to bearers of subordinated perpetual notes

(15)

(28)

Dividends paid to non-controlling interests

(4)

(7)

Increase in long-term debt

11

302

Decrease in long-term debt

(68)

(87)

Increase / (Decrease) in short-term debt

(56)

(528)

Cash flow from financing activities

(652)

(535)

Net increase/(decrease) in cash and cash

equivalents

736

122

Effect of exchange rates and changes in scope

(38)

58

Cash and cash equivalents at beginning of period

1,587

1,407

Cash and cash equivalents at end or the

period

2,285

1,587

CONSOLIDATED BALANCE SHEET

31

December 2021

31

December 2020

(In millions of euros)

ASSETS

Goodwill

1,925

1,933

Intangible assets, net

1,517

1,433

Property, plant and equipment, net

3,031

2,828

Equity affiliates: investments and loans

29

29

Other investments

52

57

Deferred tax assets

144

159

Other non-current assets

218

209

TOTAL NON-CURRENT ASSETS

6,916

6,648

Inventories

1,283

881

Accounts receivable

1,432

1,131

Other receivables and prepaid expenses

181

163

Income tax receivables

91

70

Other current financial assets

109

40

Cash and cash equivalents

2,285

1,587

Assets held for sale

4

191

TOTAL CURRENT ASSETS

5,385

4,063

TOTAL ASSETS

12,301

10,711

LIABILITIES AND

SHAREHOLDERS' EQUITY Share

capital

767

767

Paid-in surplus and retained earnings

5,598

4,458

Treasury shares

(305)

(6)

Translation adjustments

243

(32)

SHAREHOLDERS' EQUITY - GROUP SHARE

6,303

5,187

Non-controlling interests

47

48

TOTAL SHAREHOLDERS' EQUITY

6,350

5,235

Deferred tax liabilities

342

320

Provisions for pensions and other employee benefits

493

530

Other provisions and non-current liabilities

443

383

Non-current debt

2,680

2,663

TOTAL NON-CURRENT LIABILITIES

3,958

3,896

Accounts payable

1,274

987

Other creditors and accrued liabilities

430

339

Income tax payables

155

69

Other current financial liabilities

52

15

Current debt

82

134

Liabilities related to assets held for sale

-

36

TOTAL CURRENT LIABILITIES

1,993

1,580

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

12,301

10,711

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY

Shares issued

Treasury shares

Shareholders' equity - Group

share

Non-controlling

interests

Shareholders' equity

(In millions of euros)

Number

Amount

Paid-in surplus

Hybrid bonds

Retained earnings

Translation

adjustments

Number

Amount

At 1 January 2021

76,736,476

767

1,272

700

2,486

(32)

(59,756)

(6)

5,187

48

5,235

Cash dividend

-

-

-

-

(206)

-

-

-

(206)

(4)

(210)

Issuance of share capital

-

-

-

-

-

-

-

-

-

-

-

Purchase of treasury shares

-

-

-

-

-

-

(3,033,726)

(329)

(329)

-

(329)

Cancellation of purchased treasury shares

Grants of treasury shares to employees

-

-

-

-

(30)

-

313,929

30

-

-

-

Sale of treasury shares

Share-based payments

-

-

-

-

17

-

-

-

17

-

17

Issuance of hybrid bonds

-

-

-

-

-

-

-

-

-

-

-

Redemption of hybrid bonds

-

-

-

-

-

-

-

-

-

-

-

Other

-

-

-

-

6

-

-

-

6

2

8

Transactions with shareholders

-

-

-

-

(213)

-

(2,719,797)

(299)

(512)

(2)

(514)

Net income

-

-

-

-

1,309

-

-

-

1,309

(2)

1,307

Total income and expense recognized directly through equity

-

-

-

-

44

275

-

-

319

3

322

Comprehensive income

-

-

-

-

1,353

275

-

-

1,628

1

1,629

At 31 December 2021

76,736,476

767

1,272

700

3,626

243

(2,779,553)

(305)

6,303

47

6,350

ALTERNATIVE PERFORMANCE INDICATORS

To monitor and analyse the financial performance of the Group

and its activities, the Group management uses alternative

performance indicators. These are financial indicators that are not

defined by the IFRS. This note presents a reconciliation of these

indicators and the aggregates from the consolidated financial

statements under IFRS.

RECURRING OPERATING INCOME (REBIT) AND EBITDA

(In millions of euros)

End of

December 2021

End of

December 2020

4th

quarter 2021

4th

quarter 2020

OPERATING INCOME

1,733

600

164

84

- Depreciation and amortization related to the revaluation of

tangible and intangible assets as part of the allocation of the

purchase price of businesses

(68)

(57)

(17)

(14)

- Other income and expenses

617

38

(92)

(46)

RECURRING OPERATING INCOME (REBIT)

1,184

619

273

144

- Recurring depreciation and amortization of tangible and

intangible assets

(543)

(563)

(144)

(145)

EBITDA

1,727

1,182

417

289

Details of depreciation and amortization

of tangible and intangible assets:

(In millions of euros)

End of

December 2021

End of

December 2020

4th

quarter 2021

4th

quarter 2020

Depreciation and amortization

of tangible and intangible assets

(817)

(748)

(246)

(172)

Of which: Recurring depreciation and amortization of tangible and

intangible assets

(543)

(563)

(144)

(145)

Of which: Depreciation and amortization related to the revaluation

of assets as part of the allocation of the purchase price of

businesses

(68)

(57)

(17)

(14)

Of which: Impairment included in other income and expenses

(206)

(128)

(85)

(13)

ADJUSTED NET INCOME AND ADJUSTED EARNINGS PER SHARE

(In millions of euros)

End of

December 2021

End of

December 2020

4th

quarter 2021

4th

quarter 2020

NET INCOME - GROUP SHARE

1,309

332

112

43

- Depreciation and amortization related to the revaluation of

tangible and intangible assets as part of the allocation of the

purchase price of businesses

(68)

(57)

(17)

(14)

- Other income and expenses

617

38

(92)

(46)

- Other income and expenses - Non-controlling interests

-

-

-

-

- Taxes on depreciation and amortization related to the revaluation

of assets as part of the allocation of the purchase price of

businesses

15

14

3

4

- Taxes on other income and expenses

(146)

(54)

16

7

- One-time tax effects

(5)

-

(10)

-

ADJUSTED NET INCOME

896

391

212

92

- Weighted average number of ordinary shares

76,409,368

76,457,875

- Weighted average number of potential ordinary

shares

75,859,550

76,702,124

ADJUSTED EARNINGS PER SHARE (in euros)

11.88

5.11

2.86

1.20

DILUTED ADJUSTED EARNINGS PER SHARE (in euros)

11.81

5.10

2.85

1.20

RECURRING CAPITAL EXPENDITURE

(In millions of euros)

End of

December 2021

End of

December 2020

4th

quarter 2021

4th

quarter 2020

INTANGIBLE ASSETS AND

PROPERTY, PLANT, AND EQUIPMENT ADDITIONS

763

605

302

251

- Exceptional capital expenditure

252

140

71

50

- Investments relating to portfolio management operations

-

-

-

-

- Capital expenditure with no impact on net debt

5

5

1

3

RECURRING CAPITAL EXPENDITURE

506

460

230

198

CASH FLOWS AND EBITDA TO CASH CONVERSION RATE

(In millions of euros)

End of

December 2021

End of

December 2020

4th

quarter 2021

4th

quarter 2020

Cash flow from operating

activities

915

1,115

308

298

+ Cash flow from investing activities

473

(458)

(177)

(318)

NET CASH FLOW

1,388

657

131

(20)

- Net cash flow from portfolio management operations

909

6

23

(136)

FREE CASH FLOW

479

651

108

116

Exceptional capital expenditure

(252)

(140)

(71)

(50)

- Non-recurring cash flow

(25)

29

(43)

(14)

RECURRING CASH FLOW

756

762

222

180

The net cash flow from portfolio management operations corresponds

to the impact of acquisition and divestment operations.

Non-recurring cash flow corresponds to cash flow from other income

and expenses. For the sake of comparability and to eliminate the

impact of non-recurring cash flow, a new metric – recurring cash

flow excluding exceptional items (exceptional capital expenditure

and non-recurring cash flow) – has been introduced and now serves

as the basis for calculating the EBITDA to cash conversion rate.

The EBITDA to cash conversion rate for 2020 has thus been adjusted

to reflect this new definition. (In millions of euros)

End of

December 2021

End of

December 2020

RECURRING CASH FLOW

756

762

EBITDA

1,727

1,182

EBITDA TO CASH CONVERSION RATE

43.8%

64.5%

NET DEBT (In millions of euros)

End of

December 2021

End of

December 2020

Non-current debt

2,680

2,663

+ Current debt

82

134

- Cash and cash equivalents

2,285

1,587

NET DEBT

477

1,210

+ Hybrid bonds

700

700

NET DEBT AND HYBRID BONDS

1,177

1,910

WORKING CAPITAL

(In millions of euros)

End of

December 2021

End of

December 2020

Inventories

1,283

881

+ Accounts receivable

1,432

1,131

+ Other receivables including income taxes

272

233

+ Other current financial assets

109

40

- Accounts payable

1,274

987

- Other liabilities including income taxes

585

408

- Other current financial liabilities

52

15

WORKING CAPITAL

1,185

875

CAPITAL EMPLOYED

(In millions of euros)

End of

December 2021

End of

December 2020

Goodwill, net

1,925

1,933

+ Intangible assets (excluding goodwill), and property, plant and

equipment, net

4,548

4,261

+ Investments in equity affiliates

29

29

+ Other investments and other non-current assets

270

266

+ Working capital

1,185

875

CAPITAL EMPLOYED

7,957

7,364

Elements of capital employed classified as assets held for sale

4

178

CAPITAUX EMPLOYES AJUSTES

7,961

7,542

RETURN ON CAPITAL

EMPLOYED (ROCE) (In millions of euros)

End of

December 2021

End of

December 2020

Recurring operating income (REBIT)

1,184

619

Adjusted capital employed

7,961

7,542

ROCE

14.9 %

8.2 %

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220223006225/en/

Investor relations Béatrice Zilm +33 (0)1 49 00 75 58

beatrice.zilm@arkema.com Peter Farren +33 (0)1 49 00 73 12

peter.farren@arkema.com Mathieu Briatta +33 (0)1 49 00 72 07

mathieu.briatta@arkema.com Caroline Chung +33 (0)1 49 00 74 37

caroline.chung@arkema.com

Media Gilles Galinier +33 (0)1 49 00 70 07

gilles.galinier@arkema.com Véronique Obrecht +33 (0)1 49 00 88 41

veronique.obrecht@arkema.com

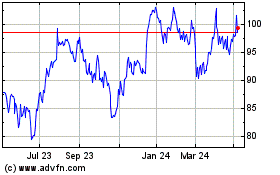

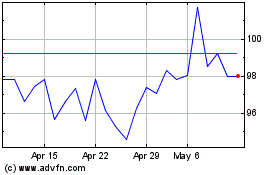

Arkema (EU:AKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arkema (EU:AKE)

Historical Stock Chart

From Apr 2023 to Apr 2024