AMA: 2022 first-half earnings Third-quarter revenues

2022 first-half earnings

Third-quarter revenues

-

Consolidated revenues of €2.1m for the first half of 2022

and a €6.9m operating loss, in a challenging macroeconomic context,

leading the Group to adapt its development strategy.

-

Revenues of €1m for the third quarter, down -18% versus Q3

2021. Orders up +10% in September 2022.

-

The major savings plan rolled out by the Group and its

financial capabilities enable it to look ahead to 2023 with

confidence, in a context in which the digital transition is

essential for the green transition and aligned with the growing

expectations of businesses.

AMA CORPORATION PLC (“AMA”) (ISIN GB00BNKGC5 –

ticker ALAMA), a pioneer for assisted reality solutions and a

publisher and integrator of B2B software solutions for smart

workplaces, is releasing its consolidated half-year earnings at

June 30, 2022, approved by the Board of Directors during its

meeting on October 26, 2022.

|

Unaudited consolidated earnings - IFRS

(€’000) |

First half of 2022 |

First half of 2021 |

Change |

|

Revenues |

2,125 |

3,935 |

-46% |

|

Adjusted gross margin1 % of revenues |

1,47369.3% |

2,35059.7% |

-37%+9.6 pts |

|

Staff costs |

(6,045) |

(4,622) |

+31% |

|

Adjusted EBITDA2 |

(4,351) |

(2,276) |

-91% |

|

EBIT |

(6,883) |

(3,700) |

-86% |

|

Non-current operating losses |

(1,013) |

0 |

|

|

Financial income (expense) |

(18) |

(230) |

|

|

Income from ordinary operations before tax |

(7,914) |

(3,930) |

-101% |

|

Consolidated net income |

(8,558) |

(3,202) |

-161% |

2022 first-half earnings: slowdown in business

has led the Group to adapt its development strategy

For the first half of 2022, the AMA Group

recorded €2.1m of revenues, compared with €3.9m for the first half

of 2021. In a challenging macroeconomic environment, with market

disruption, supply chain issues, inflation and geopolitical risks,

clients and prospects are taking more time with their investment

decisions. This situation is reflected in a number of players on

the assisted reality market. AMA is continuing to move forward with

its international commercial efforts, while further strengthening

its strategic partnerships, to ensure that it is in a good position

when its market accelerates again.

The Group’s gross margin came to €1.5m for the

first half of 2022, with a margin rate of 69.3%, a 9.6-point

improvement thanks to strong growth in software sales (+19%), which

represent 65% of the Group’s revenues for the period. This

improvement in the product mix has been achieved at the expense of

equipment sales, which characterize the first phases when contracts

are put in place.

Adjusted EBITDA contracted -€2m to -€4.4m due to

the significant increase in payroll (+31%) over the first half of

2022 in line with the recruitments launched at the end of 2021.

At the start of June, the Group decided to

launch a global savings plan that will include reducing its

workforce by 53%. The cost of this plan was recognized with €1,013k

of provisions under non-current items in the 2022 first-half

accounts.

The Group will start 2023 with 87 staff (41 in

Sales & Marketing, 21 in R&D, 18 in Operations and 7 in

Administration/CSR), compared with 184 staff at the start of this

year. This will enable the Group to reduce its payroll by around

€4.7m for 2023 versus the level of expenditure that would have been

reached based on a constant level of headcount compared with

end-June 2022.

After €(18)k of financial income and expenses

and a €(644)k tax expense, corresponding to the reversal of

deferred tax assets, the AMA Group’s consolidated income came to

€(8.6)m.

2022 third-quarter business: orders up 10% in

September and XpertEye version 6.8 released

Although third-quarter revenues contracted -18%

to €1m (at constant exchange rates) compared with the third quarter

of 2021, AMA recorded a 10% increase in orders in September.

AMA continues to benefit from a strong client

portfolio, with 473 clients at end-September, including major

global groups.

AMA is continuing to innovate and, in September,

released its fourth update in 2022 with version 6.8 of XpertEye. It

includes the first On & Live remote assistance solution on the

market. Users can simply press a button on their moziware or

RealWear connected glasses to immediately launch collaboration with

XpertEye. It also optimizes the management of multi-user

conferences and compatibility with third-party systems.

Group financial capabilities

At June 30, 2022, the Group’s cash position

totaled €13.7m, compared with €20.6m at December 31, 2021. The

Group has launched a restructuring plan that will enable it to

reduce its cash consumption by around €400k per month from January

1, 2023 compared with the trend for the first half of 2022.

Outlook

Following a contraction phase, the market has

shown positive signs in the past few weeks, with a good rate of

renewals for client contracts.

Based on the renewed interest at trade fairs,

which provide a large number of qualified prospects, the market is

expected to perform well in 2023, further strengthened by growing

awareness of the productivity and environmental stakes addressed

with the digital transformation.

Publication of the Half-Year Financial Report

AMA Corporation PLC’s financial report for the

first half of 2022 will be published on October 31, 2022 in the

morning. It will notably be available online at

www.amaxperteye.com, under “Investors” and “Documents”.

Next date: 2022 fourth-quarter and full-year

revenues: January 31, 2022 (before start of trading)

Disclaimer

This press release contains certain non-factual

elements, including but not restricted to certain statements

concerning its future results and other future events. These

statements are based on the current vision and assumptions of AMA

Corporation PLC’s leadership team. They include various known and

unknown uncertainties and risks that could result in material

differences in relation to the expected results, profitability and

events. In addition, AMA Corporation PLC, its shareholders and its

respective affiliates, directors, executives, advisors and

employees have not checked the accuracy of and make no

representations or warranties concerning the statistical or

forward-looking information contained in this press release that is

taken from or derived from third-party sources or industry

publications. These statistical data and forward-looking

information are used in this press release exclusively for

information.

About

AMA

Whereas most collaborative working tools quickly

reach their limits once outside the office space, AMA enables

experts to work remotely with frontline workers using a secure

software platform combined with video tools that are perfectly

tailored to each business.

With nearly seven years’ experience in remote

assistance solutions, AMA helps industry and service providers of

all sizes, as well as medical establishments, to accelerate their

digital transformation. Deployed in more than 100 countries, AMA’s

assisted reality platform, XpertEye, addresses a wide range of use

cases, from remote diagnostics to inspection, planning and workflow

management. Its unique solutions for remote interactive

collaboration enable businesses and institutions to increase

productivity, speed up resolution times and maximise uptime.

AMA is a sustainable digital company committed

to improving the lives of professionals while preserving the

planet. As we connect experts and frontline workers via a secure

remote collaboration solution, we make business travel less

necessary, reducing the company's carbon footprint by 1 teCO2 per

month for each solution used.

With offices in France, Germany, Spain, the

United States, China (including Hong Kong) and Japan, AMA has a

global presence and works across all time zones to forge close

relationships with its clients wherever they are. AMA is listed on

Euronext Growth Paris (GB00BNKGZC51 – ALAMA). Learn more at

www.amaxperteye.com.

Contacts

| AMA Corporation

PLCPerrine FromontCFO+33 2 23 44 13 39investors@ama.bzh |

Financial Media

RelationsCalyptus - Marie Calleux +33 (0)6 09 68 55 38

ama@calyptus.net |

APPENDICES

Unaudited first-half earnings, approved by the Board of

Directors on October 26, 2022.

Condensed half-year income statement

|

IFRS (€’000) |

H1 2022 |

H1 2021 |

|

Revenues |

2,125 |

3,935 |

|

Purchases consumed |

(452) |

(1,418) |

| Other

Income |

2,433 |

1,997 |

| Other purchases

and external expenses |

(2,403) |

(1,950) |

| Staff costs |

(6,045) |

(4,622) |

| Depreciation of

property, plant and equipment and intangible assets |

(2,251) |

(1,423) |

|

Other expenses |

(290) |

(219) |

|

EBIT |

(6,883) |

(3,700) |

|

Non-current operating income |

(1013) |

0 |

|

Financial income |

58 |

33 |

|

Financial expenses |

(76) |

(263) |

|

Net financial income (expense) |

(18) |

(230) |

|

Pre-tax income |

(7,914) |

(3,930) |

|

Corporate income tax income |

(644) |

728 |

|

Net income for the period |

(8,558) |

(3,202) |

|

Earnings for the period attributable to owners of the

parent |

(8,463) |

(2,847) |

|

Non-controlling interests |

(95) |

(355) |

Quarterly revenues

|

Quarterly revenues - IFRS (€m) (at constant

exchange rates) |

2022 |

2021 |

Change |

|

First quarter |

1.1 |

2.2 |

-52% |

|

Second quarter |

1.0 |

1.8 |

-44% |

|

First half |

2.1 |

4.0 |

-48% |

|

Third quarter |

1.0 |

1.3 |

-18% |

Condensed half-year balance sheet

|

IFRS (€’000) |

2022.06 |

2021.12 |

| Property,

plant and equipment |

1,264 |

2,221 |

| Intangible

assets |

7,649 |

6867 |

| Rights of

use |

1,775 |

2,050 |

| Financial

assets |

166 |

168 |

|

Deferred tax assets |

0 |

598 |

|

Non-current assets |

10,853 |

11,903 |

|

Inventories |

1,771 |

1,683 |

| Current tax

receivables |

449 |

266 |

| Trade and

other receivables |

1,082 |

1,996 |

| Other current

assets |

3,433 |

1733 |

|

Cash and cash equivalents |

13,682 |

20,641 |

|

Current assets |

20,416 |

26,320 |

|

Total assets |

31,270 |

38,223 |

|

|

|

|

| Share

capital |

3,207 |

3,207 |

| Issue

premiums |

34,161 |

34,161 |

| Translation

reserves |

85 |

67 |

|

Retained earnings |

(18,956) |

(10,143) |

|

Equity attributable to owners of the parent |

18,498 |

27,293 |

|

Non-controlling interests |

40 |

(392) |

|

Total shareholders’ equity |

18,538 |

26,901 |

| Borrowings and

financial debt |

2,485 |

852 |

| Lease

liabilities |

951 |

1,119 |

| Defined

benefit plan liabilities |

116 |

185 |

|

Provisions |

|

|

| Other

liabilities |

|

|

|

Deferred tax liabilities |

3 |

3 |

|

Non-current liabilities |

3,557 |

2,160 |

| Bank

overdrafts |

1 |

0 |

| Current tax

liabilities |

54 |

49 |

| Borrowings and

financial debt |

1,429 |

1,772 |

| Lease

liabilities |

845 |

958 |

| Trade and

other payables |

1,375 |

1,943 |

| Client

contract liabilities (deferred income) |

1,732 |

2,130 |

|

Provisions |

1,112 |

381 |

|

Other liabilities |

2,628 |

1,929 |

|

Current liabilities |

9,176 |

9162 |

|

Total liabilities |

12,732 |

11,322 |

|

Total shareholders’ equity and liabilities |

31,270 |

28,223 |

Half-year cash-flow statement

|

IFRS (€’000) |

H1 2022 |

H1 2021 |

|

Net income for the period |

(8,558) |

(3,202) |

|

Adjustments for: |

|

|

| Depreciation

of property, plant and equipment |

1,103 |

665 |

| Depreciation

of intangible assets |

1,152 |

758 |

| Net financial

income (expense) |

18 |

230 |

| Income from

disposal of property, plant and equipment |

91 |

41 |

| Cost of

share-based payments |

130 |

1 |

| Corporate

income tax income |

644 |

(728) |

| Other

items |

728 |

6 |

|

Total adjustments |

3,866 |

972 |

|

Total operating cash flow |

(4,692) |

(2,330) |

|

Change in: |

|

|

|

Inventories |

(231) |

(115) |

|

Trade and other

receivables |

967 |

902 |

|

Contract

liabilities |

(442) |

(300) |

|

Advances and

deposits |

83 |

54 |

|

Trade and other

payables |

(564) |

1,725 |

|

Employee benefits

and provisions |

4 |

26 |

|

Other current

receivables / payables |

(274) |

(1,666) |

|

Other working

capital requirement items |

|

740 |

|

Total changes |

(456) |

625 |

|

Cash flow from operating activities |

(5,148) |

(1,604) |

|

Tax paid |

(241) |

(89) |

|

Net cash from operating activities |

(5,390) |

(1,693) |

| Acquisition of

property, plant and equipment and intangible assets |

(21) |

(691) |

| Income from

disposal of property, plant and equipment and intangible

assets |

(1) |

7 |

| Capitalized

development costs |

(2,195) |

(1,861) |

| Investment

subsidies (incl. research tax credit offsetting capitalized

costs) |

|

121 |

| Increase in

financial assets |

(18) |

(35) |

| Decrease in

financial assets |

21 |

14 |

|

Interest received |

0 |

- |

|

Net cash from investment activities |

(2,215) |

(2,566) |

| Capital

increase |

|

- |

| Receipts from

new borrowings and financial debt |

2,607 |

982 |

| Repayment of

borrowings and financial debt |

(1,316) |

(1,421) |

| Payment of

lease liabilities |

(626) |

(369) |

| Interest paid

on borrowings and current accounts |

(27) |

(70) |

|

Interest paid on lease liabilities |

(11) |

(7) |

|

Net cash from financing activities |

615 |

(885) |

|

Net change in cash and cash equivalents |

(6,989) |

(5,144) |

|

Cash and cash equivalents at January 1 |

20,641 |

1,240 |

|

Impact of the change in exchange rates on cash held |

30 |

28 |

|

Cash and cash equivalents at June 30 |

13,681 |

(3,876) |

1 The adjusted gross margin corresponds to the

margin on purchases consumed excluding the depreciation of

inventory.2 Adjusted EBITDA corresponds to EBIT + depreciation of

property, plant and equipment and intangible assets + share-based

payments in accordance with IFRS 2.

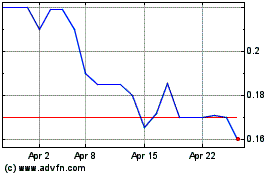

AMA (EU:ALAMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

AMA (EU:ALAMA)

Historical Stock Chart

From Apr 2023 to Apr 2024