BIOCORP: Full-Year 2022 Financial Results and Outlook for 2023

29 March 2023 - 4:30PM

Business Wire

- Sales up 14% to €11.67 million

- Significant increase in operating expenses to €12.58 million

(+20%) due to the growing internationalization of connected

products activities

- Positive EBITDA at €42.9K

- Negative annual net income of €0.65 million

- Closing cash position of €2.67 million compared to €1.84

million in 2021

- Acceleration of distribution partnerships in all geographical

areas

- Extremely favorable outlook for 2023 with the ramp-up of

revenues from sales of connected products

Regulatory News:

BIOCORP (FR0012788065 – ALCOR / Eligible PEA PME) (Paris:ALCOR),

a French company specialized in the design, development, and

manufacturing of innovative medical devices, today announces its

annual results for the year ended on December 31, 2022, as approved

by the Board of directors on March 27th.

Eric Dessertenne, CEO of BIOCORP, commented: "More

products, more partnerships and more geographical areas to cover.

In a macro-economic environment that remains as complex as ever, we

have managed to make it on three levels this year. First, on the

industrial and commercial level, with the strengthening of

strategic positions for our connected devices, whether with our

historical or recent partners: Sanofi, Merck, Novo Nordisk and

Becton Dickinson. Secondly, on the regulatory front, 2022 has

enabled us to reach a crucial milestone with the FDA’s 510k

clearance, making our Mallya connected device the only one in its

class to be cleared on both sides of the Atlantic Ocean. Finally,

at the strategic level, our vision of the connected health devices

market has been strengthened. This market, dynamic but still in its

infancy, appears today to all our interlocutors as an obvious

necessity due to the constant pressure on healthcare systems

(increase in the cost of treatments, consideration of compliance by

payers). More than ever, BIOCORP is recognized by the major

industry players as a trusted partner to embark on the path to

digital health. In this general context, our revenues, which still

come mainly from the receipt of milestone payments, increased last

year by more than 12%. As for our result, slightly negative at €

-0.6 million, it results mainly from the strong increase in fees

related to regulatory affairs (patent filings in all territories)

and expenses related to the internationalization of our device

deliveries (compatibility tests). However, the EBITDA remains

positive at € 42.9K. In conclusion, 2022 was a year of growth

investments reflecting our internationalization. 2023 will also be

marked by a high level of investment with the extension of our

production site in Issoire and by a gradual transition to a model

of recurring revenues from the sale of our connected devices.”

Key financial data on 12/31/2022

In €

31/12/2022

31/12/2021

Sales

11 670 405

10 225 314

Other operating income

177 783

328 411

Total operating income

11 848 188

10 553 725

Operating expenses

External purchase and expenses

802 110

417 781

Taxes, duties, and other levies

4 700 143

3 944 614

Wages and expenses

6 010 074

5 051 671

Other operating expenses

1 067 961

1 002 252

Total operating expenses

12 580 288

10 416 318

Net operating income

42 904

936 817

Net financial income

-732 100

137 408

Exceptionnal income

-60 932

-89 641

Research Tax Credit and Innovation Tax

Credit

-116 736

48 560

Total operating expenses

258 589

197 908

Net Result

-651 179

294 234

Closing cash position

2 666 352

1 845 602

- Annual revenues reached €11.670K in 2022, up 14%

compared to 2021 (€10.225K).

- In 2022, other operating income amounts to €177.8K

compared to €328.4K in 2021. This variation is mainly due to a

decrease in the amount of work in progress.

- Operating expenses reached €12.580K, up more than 20%

compared to 2021, resulting in particular from a sharp increase in

expenses related to regulatory approvals (FDA registration), fees

as well as Intellectual Property expenses (patent filings) and

expenses related to the internationalization of device sales

(expert and compatibility tests), as well as an increase in

salaries and expenses related to the reinforcement of strategic

functions in order to ensure the expected growth in the years to

come.

- Considering these elements, the operating result for

2022 is negative at (€732K) compared to a positive result of €137K

one year earlier.

- The financial result for 2022 showed a net amount of

(€60.9K) compared to (€89.6K) in 2021, mainly due to interest on

loans.

- The extraordinary result amounts to (€116.7K) against

€48.5K in 2021 mainly due to the malus recorded on BIOCORP shares

within the framework of the liquidity contract.

- BIOCORP benefited from CIR (Crédit d’Impôt Recherche) and CII

(Crédit Impôt Innovation) for a total amount of €258.59K (vs

€197.9K in 2021).

- Considering all these elements, BIOCORP shows a net loss of

€651.2K against a net profit of €294.2K in 2021.

- As of December 31, 2022, BIOCORP showed a cash position of

€2.666,3K compared to €1.845,6 at 12/31/2021.

2022 Highlights

- Obtaining 510(k) clearance from the U.S. Food & Drug

Administration (FDA) for Mallya® and opening of markets on the

other side of the Atlantic with the support of major diabetes

players (Sanofi, Roche, and Novo Nordisk).

- Technology integration of Mallya with digital applications

developed by the Belgian AARDEX Group. Both parties were

selected by Trials@Home, a center of excellence for

decentralized clinical trials, which includes manufacturers Sanofi,

Pfizer, and J&J.

- Expanded industrial collaboration with German Merck KGaA

for the development and worldwide distribution of a specific

version of Mallya. The agreement provides for milestone payments of

up to EUR 5 million for product development during the first three

years of the collaboration. Additional revenues are expected to

reach €8 million based on commercial milestones and adoption of

Mallya devices by Merck KGaA’s patients.

- Global agreement with the American company BD (Becton

Dickinson) for the development of Biocorp's proprietary Injay®

technology (NFC technology for pre-filled syringes) combined with

the BD UltraSafePlusTM passive needle guard to help

biopharmaceutical manufacturers capture and transmit data related

to self-administered injections.

- Strengthening of the partnership with the world leader in

insulin, the Danish group Novo Nordisk: commercial launch of

Mallya® for patients with diabetes in Japan, and extension to other

undisclosed therapeutic areas.

- Obtaining of the CE mark for SoloSmart®, a medical

device from the Mallya range for Sanofi's Solostar® pens.

- BIOCORP obtains the EU quality assurance certificate for

production meeting the new regulation for medical devices

(MDR).

Outlook 2023

- Expansion of the Issoire production site: 30% increase in

production area and areas dedicated to connected devices, notably

Mallya and Injay.

- Continuing the partnership dynamic and gradual transition to a

recurring revenue model from the sale of our range of devices.

- Reinforced investments in software and services to offer

complete digital solutions to the pharmaceutical industry and to

accelerate the deployment of our connected devices.

The 2022 annual financial report is available on the Company's

website.

ABOUT BIOCORP Recognized for its expertise in the development

and manufacture of medical devices and delivery systems, BIOCORP

has today acquired a leading position in the connected medical

device market thanks to Mallya. This smart sensor for insulin

injection pens allows reliable monitoring of injected doses and

thus offers better compliance in the treatment of patients with

diabetes. Available for sale from 2020, Mallya spearheads BIOCORP's

product portfolio of innovative connected solutions. The company

has 80 employees.

BIOCORP is listed on Euronext since July 2015 (FR0012788065 –

ALCOR). For more information, please visit www.biocorp.fr.

Disclaimer

This press release is for information purposes only. This press

release does not constitute, and shall not be deemed to constitute,

an offer to the public, an offer to subscribe, an offer to sell or

a solicitation of interest in a transaction by way of public

offering of financial securities in any jurisdiction.

Financial securities may be offered or sold in the United States

only pursuant to registration under the U.S. Securities Act of

1933, as amended (the "Securities Act"), or pursuant to an

exemption from such registration requirement. The securities of the

Company that are the subject of this press release have not been

and will not be registered under the Securities Act, and the

Company does not intend to conduct a public offering of the

securities that are the subject of this press release in the United

States.

The release, publication, or distribution of this press release

in some countries may violate applicable laws. The information

contained in this press release does not constitute an offer of

securities in France, the United States, Canada, Australia, Japan

or any other country. This press release may not be published,

transmitted, or distributed, directly or indirectly, in the United

States, Canada, Australia or Japan.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230328005658/en/

BIOCORP

Sylvaine Dessard Marketing & Communication Director

rp@biocorp.fr + 33 (0)6 88 69 72 85

Bruno ARABIAN barabian@ulysse-communication.com +33 (0)6 87 88

46 26

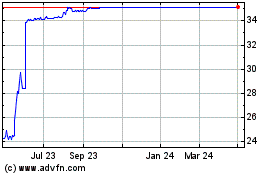

Biocorp (EU:ALCOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Biocorp (EU:ALCOR)

Historical Stock Chart

From Apr 2023 to Apr 2024