AMG Advanced Metallurgical Group N.V. Reports Record Earnings for

Second Quarter 2022

Strategic Highlights

- Construction and commissioning of

the new vanadium spent catalyst recycling facility in Zanesville,

Ohio is proceeding as planned. The roaster is fully operational,

and the entire plant is expected to be at run-rate capacity by the

end of the fourth quarter of 2022.

- The project to expand the spodumene

production in AMG Brazil is on time and on budget. The objective is

to be in full production in the second half of 2023 or

earlier.

- AMG Lithium has started

construction of the first European lithium refinery, and

commissioning for the first module of the battery-grade lithium

hydroxide upgrader will commence in the second half of 2023.

- AMG’s first lithium vanadium

battery (“LIVA”) for industrial power management applications is

proceeding as planned and the objective is to be fully operational

in the fourth quarter of 2022.

- Shell & AMG Recycling B.V.

(“SARBV”) and its partner, the United Company for Industry (“UCI”),

have signed an agreement with Saudi Arabian Oil Company (“Aramco”).

Basic engineering has begun on the first of four projects to build,

own and operate a conversion plant of vanadium-containing

gasification ash supplied by Aramco into vanadium oxide and

vanadium electrolyte.

Financial Highlights

- Revenue increased by 42% to $424.1

million in the second quarter of 2022 from $298.4 million in the

second quarter of 2021.

- EBITDA was $81.1 million in the

second quarter of 2022, up 158% versus the second quarter 2021

EBITDA of $31.4 million, marking the highest six-month and

quarterly EBITDA in AMG’s history and its eighth straight quarter

of sequential improvement.

- Annualized return on capital

employed was 25.5% for the first six months of 2022, more than

double the 10.0% for the same period in 2021.

- Net income to shareholders for the

second quarter of 2022 was $29.6 million, yielding 91 cents diluted

earnings per share, compared to $3.6 million of net income to

shareholders in the same period in the prior year and 11 cents

diluted earnings per share.

- AMG’s liquidity as of June 30,

2022, was $476 million, with $301 million of unrestricted cash and

$175 million of revolving credit availability.

- AMG declares an interim dividend of

€0.30 per ordinary share, to be paid in the third quarter of

2022.

Amsterdam, 28 July 2022

(Regulated Information) --- AMG Advanced

Metallurgical Group N.V. (“AMG”, EURONEXT AMSTERDAM: “AMG”)

reported second quarter 2022 revenue of $424.1 million, a 42%

increase versus the second quarter of 2021. EBITDA for the second

quarter of 2022 was $81.1 million, a 158% increase versus the

second quarter of 2021. This also marks the eighth straight quarter

of sequential growth after the pandemic low point in the second

quarter of 2020.

Dr. Heinz Schimmelbusch, Chairman of the

Management Board and CEO, said, “AMG generated the highest

quarterly EBITDA in our history in the second quarter of 2022.

EBITDA for the second quarter of 2022 was $81 million, up 158% from

the same period in 2021, and 48% higher than the first quarter of

2022. This outstanding result is mainly driven by our AMG Clean

Energy Materials segment, where strong lithium prices lead to

improved profitability in AMG Brazil, as well as by increased

aerospace activity within our AMG Critical Materials Technologies

segment.

“All of AMG’s strategic projects cluster in our

AMG Clean Energy Materials segment and all of these projects are

proceeding as planned. Each of these projects is oriented toward

growing our production of electricity storage materials or

increasing our footprint in the circular economy.

- Commissioning has started at the

Zanesville, Ohio, spent catalyst recycling facility. The roasting

plant has reached its design capacity and is presently undergoing

the final performance test. The “melt shop” is starting its

commissioning process. With this new recycling plant, AMG

solidifies its position as the world leader in the recycling of

refinery waste. We are pleased to announce that large scale

shipments of refinery waste from overseas have started.

- The expansion project of AMG

Brazil’s lithium concentrate production is proceeding as planned

and the production is fully sold at market price via long-term

contracts.

- AMG Lithium has begun construction

of the first European lithium refinery. The first module of the

battery-grade lithium hydroxide upgrader will commence

commissioning in the second half of 2023.

- AMG’s first lithium vanadium

battery (“LIVA”) for industrial power management applications has

begun commissioning.

- SARBV and UCI recently signed

agreements in the Kingdom of Saudi Arabia. The joint venture plans

to execute four distinct projects under an entity currently being

formed, Advanced Circular Materials Company (“ACMC”):

- Build, own and operate a conversion

plant of vanadium-containing gasification ash into vanadium oxide

and vanadium electrolyte for redox flow batteries;

- A spent catalyst recycling

facility;

- A fresh catalyst R&D

laboratory;

- Mass energy storage facilities (vanadium redox flow battery

manufacturing).

Basic engineering for

the first project has begun and it will lay the foundation for all

other projects with the Supercenter. It will produce and sell

high-purity vanadium oxide and vanadium electrolyte. This is the

largest such project in the world and is under long-term

market-based contracts with Aramco. The materials this project will

produce are destined to feed the emerging vanadium redox flow

battery market.

“We are extremely pleased to announce the

accomplishments of these strategic projects along with the best

quarterly results in the history of the Company.”

Key Figures

| In 000’s US

dollars |

|

| |

Q2 ‘22 |

Q2 ‘21 |

Change |

|

Revenue |

$424,094 |

$298,374 |

42% |

|

Gross profit |

102,240 |

48,499 |

111% |

| Gross margin |

24.1% |

16.3% |

|

|

|

|

|

|

|

Operating profit |

65,246 |

3,691 |

1,668% |

| Operating

margin |

15.4% |

1.2% |

|

| |

|

|

|

|

Net income attributable to shareholders |

29,631 |

3,566 |

731% |

|

|

|

|

|

| EPS - Fully

diluted |

0.91 |

0.11 |

727% |

| |

|

|

|

|

EBIT (1) |

69,763 |

20,462 |

241% |

|

EBITDA (2) |

81,126 |

31,401 |

158% |

| EBITDA

margin |

19.1% |

10.5% |

|

| |

|

|

|

|

Cash from operating activities |

39,505 |

23,018 |

72% |

Notes:

(1) EBIT is defined as earnings

before interest and income taxes. EBIT excludes restructuring,

asset impairment, inventory cost adjustments, environmental

provisions, exceptional legal expenses, equity-settled share-based

payments, and strategic expenses.(2) EBITDA is

defined as EBIT adjusted for depreciation and amortization.

Operational Review

AMG Clean Energy Materials

|

|

Q2 ‘22 |

Q2 ‘21 |

Change |

|

Revenue |

$159,762 |

$90,135 |

77% |

| Gross profit |

60,821 |

13,822 |

340% |

| Gross profit

before non-recurring items |

61,654 |

16,122 |

282% |

| Operating profit

(loss) |

49,704 |

(7,415) |

N/A |

| EBITDA |

58,232 |

12,554 |

364% |

AMG Clean Energy Materials’ revenue increased

77% compared to the second quarter of 2021, to $159.8 million,

driven mainly by higher prices in vanadium, tantalum and lithium

concentrates. Sales volumes were down due to shipping schedule

variances from AMG Brazil and maintenance downtime at our Cambridge

facility.

Gross profit before non-recurring items for the

quarter increased 282% compared to the same period in the prior

year, primarily due to the increased price environment.

SG&A expenses in the second quarter of 2022

were $11.1 million, $1.6 million higher than the second quarter of

2021, largely due to higher share-based and variable compensation

expense.

The second quarter 2022 EBITDA increased 364%,

to $58.2 million, from $12.6 million in the second quarter of 2021,

due to the improved gross profit as noted above.

AMG Critical Minerals

|

|

Q2 ‘22 |

Q2 ‘21 |

Change |

|

Revenue |

$103,416 |

$76,793 |

35% |

| Gross profit |

14,028 |

13,732 |

2% |

| Gross profit

before non-recurring items |

14,029 |

13,397 |

5% |

| Operating

profit |

7,086 |

7,009 |

1% |

| EBITDA |

9,069 |

9,220 |

(2%) |

AMG Critical Minerals’ revenue increased by

$26.6 million, or 35%, to $103.4 million, driven by strong sales

volumes of antimony and graphite as well as higher sales prices in

silicon and antimony.

Gross profit before non-recurring items of $14.0

million in the second quarter was $0.6 million higher compared to

the second quarter of 2021. The higher revenue was due to the

improved pricing and higher sales volumes noted above and was

offset by increased raw material prices as well as the ongoing rise

in energy and shipping costs.

SG&A expenses in the second quarter of 2022

slightly increased by 2%, to $7.0 million, compared to the same

period in 2021.

The second quarter 2022 EBITDA was consistent

with the same period in the prior year despite ongoing inflationary

pressures including energy and shipping cost increases.

AMG Critical Materials Technologies

|

|

Q2 ‘22 |

Q2 ‘21 |

Change |

|

Revenue |

$160,916 |

$131,446 |

22% |

| Gross profit |

27,391 |

20,945 |

31% |

| Gross profit

before non-recurring items |

27,431 |

21,059 |

30% |

| Operating

profit |

8,456 |

4,097 |

106% |

| EBITDA |

13,825 |

9,627 |

44% |

AMG Critical Materials Technologies' second

quarter 2022 revenue increased by $29.5 million, or 22%, compared

to the same period in 2021. This improvement was due to increased

titanium alloys sales, as well as higher chrome metal pricing

associated with improving conditions in the aerospace sector.

Second quarter 2022 gross profit before non-recurring items

increased by $6.4 million, or 30%, to $27.4 million due to the

higher volumes and prices.

SG&A expenses increased by $2.1 million in

the second quarter of 2022 compared to the same period in 2021,

mainly driven by higher share-based and variable compensation

expense and higher professional fees in the current quarter.

AMG Critical Materials Technologies’ EBITDA

increased to $13.8 million during the quarter, compared to $9.6

million in the second quarter of 2021. This was primarily due to

higher profitability in chrome metal and titanium alloys.

AMG Engineering signed $59.8 million in new

orders during the second quarter of 2022, driven by strong orders

of induction furnaces, representing a 1.10x book to bill ratio.

Order backlog was $181.0 million as of June 30, 2022, slightly

lower than the $183.5 million as of March 31, 2022.

Financial Review

Tax

AMG recorded an income tax expense of $23.2

million in the second quarter of 2022, compared to an income tax

benefit of $5.6 million in the same period in 2021. This variance

was mainly driven by higher pre-tax income compared to the prior

period and movements in the Brazilian real versus the US dollar.

The effects of the Brazilian real caused a $3.8 million non-cash

tax expense in the second quarter of 2022 compared to a $12.4

million non-cash tax benefit in the second quarter of 2021.

Movements in the Brazilian real exchange rate impact the valuation

of the Company’s net deferred tax positions related to our

operations in Brazil.

AMG paid taxes of $9.1 million in the second

quarter of 2022, compared to tax payments of $2.5 million in the

second quarter of 2021.

Exceptional Items

AMG’s second quarter 2022 gross profit includes

exceptional items, which are not included in the calculation of

EBITDA.

A summary of exceptional items included in gross

profit in the second quarters of 2022 and 2021 are below:

Exceptional items included in gross profit

|

|

Q2 ‘22 |

Q2 ‘21 |

Change |

|

Gross profit |

$102,240 |

$48,499 |

111% |

| Inventory cost

adjustment |

— |

1,497 |

N/A |

| Restructuring

expense |

41 |

334 |

(88%) |

| Asset impairment

reversal |

— |

(640) |

N/A |

| Strategic project

expense |

833 |

888 |

(6%) |

|

Gross profit excluding exceptional items |

103,114 |

50,578 |

104% |

Energy Costs

Total energy costs were $9.9 million higher in

the second quarter of 2022 versus the same period in 2021 due to

significant increases in gas and electricity costs during the

quarter. The majority of this increase was at our silicon business

in Germany, but that business benefited from fully hedged power

costs. Other business units benefited from long-term electricity

contracts that have no price escalation clauses, and the business

units that did experience energy cost increases were able to pass

through most of these increased costs to their customers.

SG&A

AMG’s second quarter 2022 SG&A expenses were

$37.0 million compared to $33.2 million in the second quarter of

2021, with the variance largely driven by higher compensation

expense due to higher profitability forecasted for the year and

increased professional fees associated with strategic projects.

Liquidity

|

|

June 30, 2022 |

December 31, 2021 |

Change |

|

Senior secured debt |

$365,751 |

$371,897 |

(2%) |

|

Cash & cash equivalents |

300,758 |

337,877 |

(11%) |

|

Senior secured net debt |

64,993 |

34,020 |

91% |

|

Other debt |

22,644 |

24,398 |

(7%) |

|

Net debt excluding municipal bond |

87,637 |

58,418 |

50% |

|

Municipal bond debt |

319,363 |

319,476 |

—% |

|

Restricted cash |

42,182 |

93,434 |

(55%) |

|

Net debt |

364,818 |

284,460 |

28% |

AMG had a net debt position of $364.8 million as

of June 30, 2022. This increase was mainly due to the

significant investment in growth initiatives during the

quarter.

AMG continued to maintain a strong balance sheet

and adequate sources of liquidity during the second quarter.

Employee benefit liabilities decreased $55 million during the

quarter to $108 million mainly due to rising discount rates. This

decrease in employee benefit liabilities combined with AMG’s higher

earnings have increased our equity attributable to shareholders to

$357 million, a 33% increase over the year-end value.

As of June 30, 2022, the Company had $301

million in unrestricted cash and cash equivalents and $175 million

available on its revolving credit facility. As such, AMG had $476

million of total liquidity as of June 30, 2022.

Net Finance Costs

AMG’s second quarter 2022 net finance costs were

$12.2 million compared to $4.8 million in the second quarter of

2021. This increase was mainly driven by non-cash intergroup

related foreign exchange losses of $7.5 million during the

quarter.

AMG capitalized $2.1 million of interest costs

in the second quarter of 2022 versus $3.8 million in the same

period in 2021, driven by interest associated with the Company’s

tax-exempt municipal bond supporting the vanadium expansion in

Ohio. This decrease is due to a portion of the municipal bond

interest costs which are no longer being capitalized due to the

ramp up of production at our Zanesville facility.

Outlook

AMG continues to provide strong and consistent

results despite the global economic fallout from the geopolitical

turbulence in recent months. We are continuing to focus on the

things we can control and are extremely pleased with the noted

achievements in our strategic initiatives which will drive

long-term value creation. EBITDA was $81.1 million in the second

quarter of 2022, the highest quarterly EBITDA in AMG’s history. As

mentioned, it was the eighth straight quarter of sequential

improvement.

As the year has progressed and more information

is available, AMG is increasing its EBITDA guidance for the full

year 2022 to a range of between $280 million and $300 million. This

range is supported by AMG’s geographic diversification and the

strength of the global lithium market.

Net income to EBITDA

reconciliation

|

|

Q2 ‘22 |

Q2 ‘21 |

|

Net income |

$29,879 |

$4,272 |

| Income tax

expense (benefit) |

23,156 |

(5,580) |

| Net finance

cost |

12,211 |

4,761 |

| Equity-settled

share-based payment transactions |

1,372 |

1,194 |

| Restructuring

expense |

41 |

334 |

| Inventory cost

adjustment |

— |

1,497 |

| Asset impairment

reversal |

— |

(640) |

| Environmental

provision |

— |

11,651 |

| Strategic project

expense (1) |

3,107 |

2,525 |

|

Others |

(3) |

448 |

|

EBIT |

69,763 |

20,462 |

|

Depreciation and amortization |

11,363 |

10,939 |

|

EBITDA |

81,126 |

31,401 |

(1) The Company is in the initial development

and ramp-up phases for several strategic expansion projects,

including AMG Vanadium’s expansion project, the joint venture with

Shell, Hybrid Lithium Vanadium Redox Flow Battery System, and the

lithium expansion in Germany, which incurred project expenses

during the quarter but are not yet operational. AMG is adjusting

EBITDA for these exceptional charges.

| AMG Advanced

Metallurgical Group N.V. |

|

|

| Condensed Interim

Consolidated Income Statement |

|

|

| For the

quarter ended June 30 |

|

|

| In thousands of

US dollars |

2022 |

2021 |

| |

Unaudited |

Unaudited |

|

Continuing operations |

|

|

| Revenue |

424,094 |

298,374 |

| Cost of

sales |

(321,854) |

(249,875) |

| Gross

profit |

102,240 |

48,499 |

| |

|

|

| Selling,

general and administrative expenses |

(37,034) |

(33,232) |

| |

|

|

| Environmental

expense |

— |

(11,651) |

| Other income,

net |

40 |

75 |

| Net other

operating income (expense) |

40 |

(11,576) |

| |

|

|

| Operating

profit |

65,246 |

3,691 |

| |

|

|

| Finance

income |

2,081 |

264 |

| Finance cost |

(14,292) |

(5,025) |

| Net

finance cost |

(12,211) |

(4,761) |

| |

|

|

| Share of

loss of associates and joint ventures |

— |

(238) |

| |

|

|

| Profit

(loss) before income tax |

53,035 |

(1,308) |

| |

|

|

| Income

tax (expense) benefit |

(23,156) |

5,580 |

| |

|

|

| Profit

for the period |

29,879 |

4,272 |

| |

|

|

| Profit

attributable to: |

|

|

| Shareholders of

the Company |

29,631 |

3,566 |

| Non-controlling

interests |

248 |

706 |

| Profit

for the period |

29,879 |

4,272 |

| |

|

|

| Earnings

per share |

|

|

| Basic earnings

per share |

0.93 |

0.11 |

| Diluted earnings

per share |

0.91 |

0.11 |

| AMG Advanced

Metallurgical Group N.V. |

|

|

| Condensed Interim

Consolidated Income Statement |

|

|

| For the

six months ended June 30 |

|

|

| In thousands of

US dollars |

2022 |

2021 |

| |

Unaudited |

Unaudited |

|

Continuing operations |

|

|

| Revenue |

827,957 |

562,360 |

| Cost of

sales |

(650,523) |

(466,997) |

| Gross

profit |

177,434 |

95,363 |

| |

|

|

| Selling,

general and administrative expenses |

(74,496) |

(66,325) |

| |

|

|

| Environmental

expense |

— |

(11,711) |

| Other income,

net |

122 |

173 |

| Net other

operating income (expense) |

122 |

(11,538) |

| |

|

|

| Operating

profit |

103,060 |

17,500 |

| |

|

|

| Finance

income |

2,380 |

474 |

| Finance cost |

(23,510) |

(13,889) |

| Net

finance cost |

(21,130) |

(13,415) |

| |

|

|

| Share of

loss of associates and joint ventures |

(500) |

(625) |

| |

|

|

| Profit

before income tax |

81,430 |

3,460 |

| |

|

|

| Income

tax (expense) benefit |

(21,667) |

6,490 |

| |

|

|

| Profit

for the period |

59,763 |

9,950 |

| |

|

|

| Profit

attributable to: |

|

|

| Shareholders of

the Company |

58,746 |

8,665 |

| Non-controlling

interests |

1,017 |

1,285 |

| Profit

for the period |

59,763 |

9,950 |

| |

|

|

| Earnings

per share |

|

|

| Basic earnings

per share |

1.84 |

0.29 |

| Diluted earnings

per share |

1.81 |

0.28 |

| AMG Advanced

Metallurgical Group N.V. |

|

|

|

Condensed Interim Consolidated Statement of Financial Position |

|

| |

|

|

| In thousands of

US dollars |

June 30,2022 Unaudited |

December 31, 2021 |

|

Assets |

|

|

|

Property, plant and equipment |

739,610 |

693,624 |

|

Goodwill and other intangible assets |

41,761 |

44,684 |

|

Derivative financial instruments |

22,508 |

95 |

|

Other investments |

26,707 |

29,830 |

|

Deferred tax assets |

39,953 |

52,937 |

|

Restricted cash |

33,682 |

85,023 |

|

Other assets |

8,394 |

8,471 |

| Total

non-current assets |

912,615 |

914,664 |

|

Inventories |

263,273 |

218,320 |

|

Derivative financial instruments |

5,854 |

4,056 |

|

Trade and other receivables |

194,563 |

145,435 |

|

Other assets |

80,641 |

65,066 |

|

Current tax assets |

9,093 |

5,888 |

|

Restricted cash |

8,500 |

8,411 |

|

Cash and cash equivalents |

300,758 |

337,877 |

| Total

current assets |

862,682 |

785,053 |

| Total

assets |

1,775,297 |

1,699,717 |

| AMG Advanced

Metallurgical Group N.V. |

|

|

|

Condensed Interim Consolidated Statement of Financial Position |

|

| (continued) |

|

|

| |

|

|

| In thousands of

US dollars |

June 30,2022 Unaudited |

December 31, 2021 |

|

Equity |

|

|

|

Issued capital |

853 |

853 |

|

Share premium |

553,715 |

553,715 |

|

Treasury shares |

(14,906) |

(16,596) |

|

Other reserves |

(56,868) |

(96,421) |

|

Retained earnings (deficit) |

(126,088) |

(173,117) |

| Equity

attributable to shareholders of the Company |

356,706 |

268,434 |

| |

|

|

| Non-controlling

interests |

25,052 |

25,718 |

| Total

equity |

381,758 |

294,152 |

| |

|

|

|

Liabilities |

|

|

|

Loans and borrowings |

663,781 |

675,384 |

|

Lease liabilities |

41,277 |

45,692 |

|

Employee benefits |

107,827 |

162,628 |

|

Provisions |

14,467 |

14,298 |

|

Deferred revenue |

21,105 |

22,341 |

|

Other liabilities |

7,116 |

11,098 |

|

Derivative financial instruments |

818 |

2,064 |

|

Deferred tax liabilities |

5,076 |

5,617 |

| Total

non-current liabilities |

861,467 |

939,122 |

|

Loans and borrowings |

31,528 |

27,341 |

|

Lease liabilities |

4,237 |

4,857 |

|

Short-term bank debt |

12,449 |

13,046 |

|

Deferred revenue |

20,957 |

18,478 |

|

Other liabilities |

83,078 |

80,672 |

|

Trade and other payables |

283,443 |

252,765 |

|

Derivative financial instruments |

12,518 |

6,010 |

|

Advance payments from customers |

49,601 |

35,091 |

|

Current tax liability |

18,318 |

10,586 |

|

Provisions |

15,943 |

17,597 |

| Total

current liabilities |

532,072 |

466,443 |

| Total

liabilities |

1,393,539 |

1,405,565 |

| Total

equity and liabilities |

1,775,297 |

1,699,717 |

| AMG Advanced

Metallurgical Group N.V. |

|

|

| Condensed Interim

Consolidated Statement of Cash Flows |

|

|

| For the

six months ended June 30 |

|

|

| In thousands of

US dollars |

2022 |

2021 |

| |

Unaudited |

Unaudited |

| Cash from

operating activities |

|

|

| Profit for the

period |

59,763 |

9,950 |

| Adjustments to

reconcile net profit to net cash flows: |

|

|

|

Non-cash: |

|

|

|

Income tax expense (benefit) |

21,667 |

(6,490) |

|

Depreciation and amortization |

21,890 |

21,902 |

|

Asset impairment reversal |

— |

(776) |

|

Net finance cost |

21,130 |

13,415 |

|

Share of loss of associates and joint ventures |

500 |

625 |

|

Loss (gain) on sale or disposal of property, plant and

equipment |

33 |

(91) |

|

Equity-settled share-based payment transactions |

2,752 |

2,127 |

|

Movement in provisions, pensions, and government grants |

(2,917) |

2,647 |

|

Working capital and deferred revenue adjustments |

(63,774) |

14,171 |

| Cash

generated from operating activities |

61,044 |

57,480 |

| Finance costs

paid, net |

(12,153) |

(10,053) |

| Income tax

paid |

(13,040) |

(4,499) |

| Net cash

from operating activities |

35,851 |

42,928 |

|

|

|

|

| Cash used

in investing activities |

|

|

| Proceeds from

sale of property, plant and equipment |

93 |

1,055 |

| Acquisition of

property, plant and equipment and intangibles |

(82,608) |

(78,606) |

| Investments in

associates and joint ventures |

(500) |

(1,000) |

| Change in

restricted cash |

51,252 |

65,562 |

| Interest received

on restricted cash |

76 |

25 |

| Capitalized

borrowing cost |

(8,321) |

(7,795) |

| Other |

8 |

19 |

| Net cash

used in investing activities |

(40,000) |

(20,740) |

| AMG Advanced

Metallurgical Group N.V. |

|

|

| Condensed Interim

Consolidated Statement of Cash Flows |

|

|

| (continued) |

|

|

| For the

six months ended June 30 |

|

|

| In thousands of

US dollars |

2022 |

2021 |

| |

Unaudited |

Unaudited |

| Cash

(used in) from financing activities |

|

|

| Proceeds from

issuance of debt |

152 |

2,411 |

| Payment of

transaction costs related to debt |

— |

(390) |

| Repayment of

borrowings |

(8,437) |

(3,127) |

| Net (repurchase

of) proceeds from issuance common shares |

(1,523) |

121,569 |

| Dividends

paid |

(10,098) |

(3,858) |

| Payment of lease

liabilities |

(2,588) |

(2,608) |

| Contributions by

non-controlling interests |

— |

648 |

| Net cash

(used in) from financing activities |

(22,494) |

114,645 |

|

|

|

|

| Net

(decrease) increase in cash and cash equivalents |

(26,643) |

136,833 |

| |

|

|

| Cash and cash

equivalents at January 1 |

337,877 |

207,366 |

| Effect of

exchange rate fluctuations on cash held |

(10,476) |

(3,097) |

| Cash and

cash equivalents at June

30 |

300,758 |

341,102 |

This press release contains inside information within the

meaning of Article 7(1) of the EU Market Abuse Regulation.

This press release contains regulated

information as defined in the Dutch Financial Markets Supervision

Act (Wet op het financieel toezicht).

About AMG

AMG is a global critical materials company at

the forefront of CO2 reduction trends. AMG produces highly

engineered specialty metals and mineral products and provides

related vacuum furnace systems and services to the transportation,

infrastructure, energy, and specialty metals & chemicals end

markets.

AMG Clean Energy Materials segment combines

AMG’s recycling and mining operations, producing materials for

infrastructure and energy storage solutions while reducing the CO2

footprint of both suppliers and customers. AMG Clean Energy

Materials segment spans the vanadium, lithium, and tantalum value

chains. AMG Critical Materials Technologies segment combines AMG’s

leading vacuum furnace technology line with high-purity materials

serving global leaders in the aerospace sector. AMG Critical

Minerals segment consists of AMG’s mineral processing operations in

antimony, graphite, and silicon metal.

With approximately 3,300 employees, AMG operates

globally with production facilities in Germany, the United Kingdom,

France, the United States, China, Mexico, Brazil, India, Sri Lanka,

and Mozambique, and has sales and customer service offices in Japan

(www.amg-nv.com).

For further information, please

contact:AMG Advanced Metallurgical Group

N.V. +1

610 975 4979Michele

Fischermfischer@amg-nv.com

Disclaimer

Certain statements in this press release are not

historical facts and are “forward looking.” Forward looking

statements include statements concerning AMG’s plans, expectations,

projections, objectives, targets, goals, strategies, future events,

future revenues or performance, capital expenditures, financing

needs, plans and intentions relating to acquisitions, AMG’s

competitive strengths and weaknesses, plans or goals relating to

forecasted production, reserves, financial position and future

operations and development, AMG’s business strategy and the trends

AMG anticipates in the industries and the political and legal

environment in which it operates and other information that is not

historical information. When used in this press release, the words

“expects,” “believes,” “anticipates,” “plans,” “may,” “will,”

“should,” and similar expressions, and the negatives thereof, are

intended to identify forward looking statements. By their very

nature, forward-looking statements involve inherent risks and

uncertainties, both general and specific, and risks exist that the

predictions, forecasts, projections and other forward-looking

statements will not be achieved. These forward-looking statements

speak only as of the date of this press release. AMG expressly

disclaims any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statement contained

herein to reflect any change in AMG's expectations with regard

thereto or any change in events, conditions, or circumstances on

which any forward-looking statement is based.

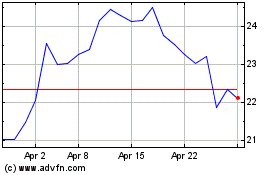

AMG Critical Materials NV (EU:AMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

AMG Critical Materials NV (EU:AMG)

Historical Stock Chart

From Apr 2023 to Apr 2024