Amundi: H1 2022 results

H1 2022 results

Resilient earnings in an

unfavourable market environment

A high level of

net

income1:

€593m in H1

Resilient business activity:

+€5bn inflows

in H1

|

Results |

H1 2022: high level of net

income and continued

operational efficiency

- Significant increase in net

management fees (+12% vs. H1 2021 and +4.6% on a like-for-like

basis2)

- Operational efficiency maintained

(53% cost/income ratio1)

- High level of adjusted net income1:

€593m

A resilient Q2

- Resilient net management fees in an

unfavourable environment

- Lower performance fees, in line

with market conditions

- Stable operating expenses1

- Adjusted net income1 of €269m

|

|

Business activity |

A good 1st half:

inflows3 of +€5.0bn,

and +€11.0bn in MLT ex

JVs4

- Strong momentum in Retail (+€13.4bn

in MLT assets4, 5)

- Limited outflows with Institutional

clients: -€2.4bn in MLT assets4,5

- Outflows in treasury products4

(-€27.6bn)

- Buoyant net inflows in the Asian

JVs (+€21.5bn)

Q2: positive

inflows3 of +€1.8bn

- Retail: resilient activity (-€0.9bn

in MLT assets4,5),

- Institutionals: outflows of -€9.1bn

(MLT assets4,5), against a backdrop of derisking

- Almost stable activity in treasury

products4 (-€1.3bn)

- Strong business momentum in JVs

(+€13.1bn)

Assets under management of €1,925bn

at 30/06/2022 |

Paris, 29 July 2022

Amundi’s Board of Directors, chaired by Yves

Perrier, convened on 28 July 2022 to review the financial

statements for the first half of 2022.

Commenting on the figures, Valérie Baudson, CEO,

said:

“In an unfavourable environment, Amundi

maintained a good level of profitability and operational

efficiency, demonstrating the robustness of its diversified

model.

Total inflows were positive in Q2, thanks to the

resilience of the Retail business, the strength of our Asian joint

ventures and the good performance of our growth drivers. Amundi

Technology continued to develop and saw its revenues increase

sharply.”

I. Business activity held

up well, in unfavourable market

conditions

Amundi’s assets under management

totalled €1,925bn at 30 June 2022, up +7.3% year-on-year and down

-4.8% vs. the end of March 2022, with a negative

market effect of -€98bn in Q2.

Business activity in Q2

2022

The second quarter was characterised by

unfavourable market conditions:

- equity markets

dropped sharply: in Q2, the EuroStoxx decreased by -12%6 ; in

average, markets fell by -7.3% vs. Q2 2021 and -7.6% vs. Q1

20227;

- bond markets also

declined (-7% between 31/03/2022 and 30/06/20228), with rates up

around 100bp between 31/03/2022 and 30/06/2022;

- a general

environment of increased risk aversion.

This unfavourable environment was illustrated by

the significant outflows observed across the entire European asset

management market.

Against this backdrop, Amundi’s business

activity held up particularly well, with positive inflows of

+€1.8bn.

- In

Retail, activity held up well in

medium/long-term assets9

(-€0.9bn). Inflows from third-party

distributors (+€1.6bn) were positive in the main European

markets (France, Italy, Germany). In the French

networks, activity was positive in MLT assets (+€0.6bn), but was

offset by outflows (before maturity) from structured products

(-€0.9bn). In the international networks

(excluding the Amundi BOC WM subsidiary in China), flows were

stable (-€0.1bn); business activity remained robust in Italy, in

unit-linked and thematic funds (as illustrated by the success of

CPR Hydrogen). For the Chinese subsidiary Amundi BOC

WM, the slowdown in activity can be explained by the

maturities of the funds launched in 2021, and by the market

environment and sanitary situation in China.

-

For institutional clients, MLT assets

posted outflows of -€9.1bn, due to the

derisking strategy of some clients, particularly in the

Institutional and Sovereign segment. In the Employee Savings

segment, inflows were positive (+€2.9bn) due to the seasonal

effect. The Insurers segment recorded moderate outflows (-€1.5bn),

in connection with the sale of a subsidiary by CA Assurances.

- Activity in

treasury products was virtually stable (-€1.3bn

excluding JVs) with seasonal outflows from corporate clients

(dividend payments), partially offset by inflows related to

derisking by institutional clients.

- Activity in

the JVs saw solid levels of inflows (+€13.1bn). The Indian

JV SBI MF maintained its leading position in the Indian market10

with +€8.9bn in inflows, particularly from pension funds. In China

(ABC-CA), business activity was good, with flows remaining solid at

+€3.7bn, particularly in Institutionals, and with -€1.3bn of

outflows from low-margin products (Channel Business). In Korea,

flows remained positive (+€1.9bn, mainly in treasury

products).

Continued development of Amundi

Technology

Amundi Technology continues its development with

the acquisition of Savity, an Austrian fintech offering a robo

advisor white label solution for the retail market, available in

Austria and Germany.

AG2R, an insurance client with AuM of €120bn,

successfully migrated to ALTO Investments.

Sabadell Bank chose Amundi Technology and its

ALTO W&D product to develop a new solution for its private

banking business, with a robo advisor solution for its new online

banking offer.

Business activity in H1

2022

Overall,

the first half of the year, Amundi posted positive flows of

+€5.0bn.

Flows in MLT assets ex JVs

were brisk (+€11.0bn), with notably a good momentum in

Retail (+€13.4bn in MLT, mainly with third-party distributors); for

Institutional clients, outflows were limited (-€2.4 in MLT) in a

“derisking” context.

- Active

management: in sharply declining markets, Amundi's inflows

were still even; investment performance remained at a good level,

with more than 68% of open-ended fund AuM in the top two quartiles,

according to Morningstar11, and more than 78% based over

five-years. With 298 funds rated 4 and 5 stars, Amundi is the third

largest player in Europe by the number of funds. The success of the

Multi Asset strategies, ESG mandates and OCIO12 solutions was also

noteworthy.

- Activity in

Real Assets was strong, with +€2.8bn in inflows,

particularly in Private Equity, Real Estate and Private Debt,

bringing assets under management to €66bn at 30/06/2022.

- Passive

management, ETFs and smart beta had a good first half of the year

with +€11.4bn in net inflows, bringing AuM to €284bn at end-June

2022. This performance is remarkable in the context of the

merger with Lyxor, whose advantages are confirmed. While Amundi

ETFs had a particularly solid first quarter, inflows were affected

in the second quarter by the wait-and-see attitude of some clients

looking to reduce risk in their portfolios.

In ETFs, by recording the second highest inflows

in the market in the first half of the year, Amundi consolidated

its position as the number two player in Europe and leading

European ETF manager with a market share of around 14%13.

In Asian JVs, business activity was

high, at +€21.5bn, notably in India and China.

II. Continued high level

of profitability

First half of 2022

Note: figures reported for the first half of

2021 did not include Lyxor. The reported and combined H1 2021

income statements (on a like-for-like basis, with Lyxor) are

presented in the notes.

Adjusted

data14

Stable revenues excluding financial

income (€1,615m vs. €1,623m in H1 2021):

- Net

management fees15 rose significantly by +12.0%, thanks to

the acquisition of Lyxor and the strong inlfows over 12 months. On

a like-for-like basis16 the increase was +4.6%. The average margin

was stable (17.5bp) compared to H1 202117 thanks to a favourable

mix effect.

- As expected,

performance fees (€95m) were lower than the

exceptional level seen in H1 2021 (€266m).

- Amundi

Technology's revenues continued to grow to €22m

(+15.5%).

Operating expenses increased to

€844m due to the acquisition of Lyxor, but were stable on a

like-for-like basis. Amundi demonstrated its ability to

maintain its operational efficiency, even in a difficult market

environment. Its cost/income ratio stood at 53.1%, one of the best

in the industry.

The contribution to net income from

equity-accounted entities (mainly

joint ventures in Asia) increased by +6.5% vs. H1 2021, to €41m,

with a notable increase in the Indian JV (SBI FM), whose

contribution increased from €21m to €25m, thanks to business

momentum.

Adjusted net income remained high at

€593m. On a normalised basis18, this result was up +8.1%

compared to H1 2021, and +5.6% on a like-for-like basis19.

Accounting data

Accounting net income (Group share) amounted to

€527m. It includes the usual amortisation of intangible assets, as

well as integration costs related to Lyxor.

Note: as a reminder, H1 2021 also included an

exceptional tax gain (with no impact on cash flow) of +€114m,

linked to the application of the “Affrancamento” scheme in

Italy.

Second quarter 2022

Adjusted data

Amundi’s quarterly adjusted net income

remained high at €269m. Its change compared to the first quarter of

2022 can be explained by the sharp drop

of the markets and

of performance fees.

Net revenues excluding financial

income were €769m:

- Net

management fees (excluding Amundi Technology’s revenues)

held up well at €733m; their evolution

(-4.3% vs. Q1 2022) is more moderate than the markets overall

(-7,6%20).

- The

normalisation of performance fees was

accentuated by the market environment; they amounted to €24m

compared to a quarterly average of €42m between 2017 and 2020.

- Amundi

Technology’s revenues rose 24.5% vs. Q1 2022 to €12m.

Operating expenses were stable

(€422m), despite continued IT investments, and included in

particular an exceptional (non-cash) accounting expense of -€4m

(IFRS 2), related to the capital increase reserved for employees

(see Section IV). Excluding this one-off expense, operating

expenses would have been down slightly vs. Q1 2022.

As a result, the cost/income

ratio was 55.9% vs.

50.6% in Q1 2022 (51.8% on a normalised basis21), in line with the

decline in revenues linked to the market effect.

The contribution to income from

equity-accounted entities (mainly Asian joint

ventures) increased by +6.3% vs. Q1 2022, to €21m.

Accounting data

Accounting net income (Group share) amounted to

€224m. It includes the usual amortisation of intangible assets, as

well as integration costs related to Lyxor (€40m before tax and

€30m after tax), including the charges provisioned for employee

departures plans.

Note: as a reminder, Q2 2021 also included an

exceptional tax gain (with no impact on cash flow) of +€114m,

linked to the application of the “Affrancamento” scheme in

Italy.

III. Continued

commitment to Responsible

Investment

Amundi continued to

implement its 2025 action

plan.

Responsible Investment

assets under management were

€793bn at 30 June 2022, stable compared with 30

June 2021. The change from 31 December

2021 (€847bn in assets under management) is linked to a negative

market effect, partially offset by the continued integration of ESG

criteria into investment management, and sustained inflows (+€8.8bn

in MLT22 in H1), mostly in active management.

H1 2022 highlights:

- Good momentum for

Climate and Environment solutions, ESG fixed-income funds, and the

Equity thematic funds;

- Continued product

innovation, in particular with the launch of the Amundi Euro

Corporate Short Term Green Bond fund, as well as the CPR Blue

Economy thematic fund (a global equity fund to support marine

economic ecosystems and protect sustainably the oceans).

In addition, Amundi continues to align

its internal policy with its commitments: Amundi was the

first asset manager in the world to present a “Say on Climate”

resolution to a shareholder vote (AGM held on 18th of May 2022).

Almost 98% of shareholders approved this resolution.

IV. A

solid financial structure

Tangible equity23 amounted to €3.3bn at 30 June

2022, down slightly compared to end-2021 due to the payment of

dividends (€0.8bn) for the 2021 financial year.

The CET1 ratio was 17.9% at the end of June

2022, well above regulatory requirements, to be compared with 16.1%

at end 2021.

Note: in May 2022, rating agency Fitch confirmed

Amundi’s A+ rating with a stable outlook, one of the best in the

sector.

V. Other

information

Successful capital increase

reserved to

employees

The “We Share

Amundi” capital increase reserved

to employees (announced on 20 June) was

successfully completed on 26 July 2022: over one in three

employees worldwide, and over half of employees in France,

participated to the capital increase, which, for the fifth

consecutive year, offered a share subscription with a discount.

Nearly 2,000 employees present in 15 countries subscribed to this

capital increase for a total amount of nearly €29m.

The deal, which was executed under existing

legal authorisations approved by the General Shareholders’ Meeting

on 18 May 2022, reflects Amundi's ambition to involve its employees

not only in the company's growth but also in economic value

creation. It also allows to increase employees’ feelings of

belonging.

The impact of this capital increase on net

earnings per share is negligible: 785,480 shares were created

(representing 0.4% of capital before the shares issuance).

This issuance brings the

number of shares making up Amundi's share capital to 203,860,131 on

27 July 2022.

Employees now hold more

than 1% of Amundi’s share capital, compared with

0.8% before the capital increase.

Launch of a share buyback programme as

part of performance shares

plans

After obtaining the necessary regulatory

approval, Amundi announces the launch of a share buyback programme

limited to a maximum of €60m, or a maximum of 1 million shares,

representing around 0.5% of the share capital. This programme is

intended to cover the performance shares plans already awarded.

In order to avoid dilution for existing shares

shareholders, Amundi has decided not to issue any new shares, but

to buy back the shares that will be delivered to beneficiaries

starting in 2023 (following a vesting period and subject to

performance and presence conditions24).

See appendix for further details.

Financial disclosure schedule

- Publication of Q3

and 9M 2022 results:

28

October 2022

- Publication of Q4

and FY 2022 results:

8

February 2023

- Publication of Q1

2023

results:

28 April 2023

- Publication of H1 2023 results:

28

July 2023

- Publication of 9M 2023 results:

27

October 2023

***

Reminder of

sensitivities to markets variations

- Changes in

the equity markets :

+/- 10%

→ +/-

€125m in net revenues

- Changes

in interest rates :

+/-

100 bps

→ -/+

€50m in net

revenues

Sensitivity on run-rate net management fees

(excluding performance fees).

Market sensitivities do not take into account

potential impact of market movements on flows.

Income Statements

| |

|

H1 2022 |

|

H1 2021 new presentation |

|

Chg. H1 2022 / H1 2021

new presentation |

|

|

Chg. H1 2022 / H1 2021

like-for-like |

| |

|

|

|

|

|

|

|

|

|

|

Adjusted net revenue |

|

1,589 |

|

1,619 |

|

-1.9% |

|

|

-7.4% |

|

Net asset management revenue |

|

1,594 |

|

1,604 |

|

-0.6% |

|

|

-6.4% |

|

o/w net management fees |

|

1,499 |

|

1,338 |

|

12.0% |

|

|

4.6% |

|

o/w performance fees |

|

95 |

|

266 |

|

- |

|

|

- |

|

Technology |

|

22 |

|

19 |

|

15.5% |

|

|

15.5% |

|

Net financial income and other net income |

|

(27) |

|

(4) |

|

- |

|

|

- |

|

Operating expenses |

|

(844) |

|

(764) |

|

10.5% |

|

|

0.8% |

| |

|

|

|

|

|

|

|

|

|

|

Adjusted gross operating income |

|

744 |

|

855 |

|

-13.0% |

|

|

-15.2% |

|

Adjusted cost/income ratio |

|

53.1% |

|

47.2% |

|

6 pts |

|

|

4.3 pts |

|

Cost of risk & Other |

|

(4) |

|

(20) |

|

- |

|

|

- |

|

Equity-accounted entities |

|

41 |

|

38 |

|

6.5% |

|

|

6.5% |

|

Adjusted income before taxes |

|

781 |

|

874 |

|

-10.5% |

|

|

-12.7% |

|

Adjusted corporate tax |

|

(187) |

|

(223) |

|

-16.3% |

|

|

-18.9% |

|

Minority interests |

|

(1) |

|

4 |

|

- |

|

|

- |

|

Adjusted net income, Group share |

|

593 |

|

654 |

|

-9.3% |

|

|

-11.2% |

|

Amortisation of intangible assets after tax |

|

(29) |

|

(24) |

|

20.5% |

|

|

27.4% |

|

Integration costs net of tax |

|

(37) |

|

0 |

|

- |

|

|

- |

|

Net income, Group share |

|

527 |

|

630 |

|

-16.4% |

|

|

-18.4% |

|

Impact of Affrancamento |

|

0 |

|

114 |

|

- |

|

|

- |

|

Net income, Group share including Affrancamento |

|

527 |

|

744 |

|

-28,7% |

|

|

-30,2% |

| |

|

Q2 2022 |

|

Q2 2021 new presentation |

|

Chg. Q2 2022 / Q2

2021 |

|

|

Chg.Q2 2022 / Q2

2021 like-for-like |

|

Q1 2022 |

|

Chg. Q2 2022 / Q1

2022 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net revenue |

|

754 |

|

849 |

|

-11.2% |

|

|

-16.4% |

|

835 |

|

-9.7% |

|

Net asset management revenue |

|

757 |

|

835 |

|

-9.3% |

|

|

-14.7% |

|

837 |

|

-9.5% |

|

o/w net management fees |

|

733 |

|

679 |

|

7.9% |

|

|

0.2% |

|

766 |

|

-4.3% |

|

o/w performance fees |

|

24 |

|

155 |

|

- |

|

|

- |

|

71 |

|

-65.9% |

|

Technology |

|

12 |

|

12 |

|

2.2% |

|

|

2.2% |

|

10 |

|

24.5% |

|

Net financial income and other adjusted net income |

|

(15) |

|

3 |

|

- |

|

|

- |

|

(12) |

|

30.3% |

|

Adjusted operating expenses |

|

(422) |

|

(388) |

|

8.6% |

|

|

-1.7% |

|

(423) |

|

-0.2% |

|

Adjusted gross operating income |

|

332 |

|

461 |

|

-27.9% |

|

|

-29.8% |

|

412 |

|

-19.4% |

|

Adjusted cost/income ratio |

|

55.9% |

|

45.7% |

|

10.2 pts |

|

|

8.4 pts |

|

50.6% |

|

5.3 pts |

|

Cost of risk & Other |

|

(0) |

|

(18) |

|

- |

|

|

- |

|

(4) |

|

|

|

Equity-accounted entities |

|

21 |

|

21 |

|

2.1% |

|

|

2.1% |

|

20 |

|

6.3% |

|

Adjusted income before taxes |

|

353 |

|

464 |

|

-23.9% |

|

|

-25.7% |

|

428 |

|

-17.6% |

|

Corporate tax 1 2 |

|

(84) |

|

(120) |

|

-29.8% |

|

|

-32.1% |

|

(103) |

|

-18.3% |

|

Minority interests |

|

0 |

|

1 |

|

- |

|

|

- |

|

(1) |

|

- |

|

Adjusted net income, Group share |

|

269 |

|

345 |

|

-22.1% |

|

|

-23.7% |

|

324 |

|

-17.0% |

|

Amortisation of intangible assets after tax |

|

(15) |

|

(12) |

|

20.5% |

|

|

29.9% |

|

(15) |

|

0.0% |

|

Integration costs net of tax |

|

(30) |

|

0 |

|

- |

|

|

- |

|

(8) |

|

- |

|

Net income, Group share |

|

224 |

|

333 |

|

-32.6% |

|

|

-34.2% |

|

302 |

|

-25.7% |

|

Impact of Affrancamento |

|

0 |

|

114 |

|

- |

|

|

- |

|

0 |

|

- |

|

Net income, Group share including Affrancamento |

|

224 |

|

446 |

|

-49.7% |

|

|

-50.6% |

|

303 |

|

-26.0% |

Adjusted data: excluding

amortisation of intangible assets, Lyxor integration costs, and, in

Q2 and H1 2021, excluding the impact of Affrancamento.

New presentation of revenues

with Amundi Technology revenues presented on a separated line

Constant scope: with Lyxor

The accounting net income for Q2 2021

includes a net one-time tax gain (net of a substitution

tax) of +€114m (no cash flow impact): “Affrancamento” mechanism of

the Italian Budget Law for 2021 (Law no. 178/2020), resulting in

the recognition of Deferred Tax Assets on intangible assets

(goodwill); this was excluded from Adjusted Net Income.

Change in assets under

management1 from end-December

2020 to end-June 2022

| |

(€bn) |

Assets under management |

Netinflows |

Market and foreign

exchangeeffect |

Scope effect |

|

Change in AuM vs. previous quarter |

|

As of 31/12/2020 |

1,729 |

|

|

|

|

+4.0% |

|

|

Q1 2021 |

|

-12.7 |

+39.3 |

|

/ |

|

|

|

As of 31/03/2021 |

1,755 |

|

|

|

|

+1.5% |

|

|

Q2 2021 |

|

+7.2 |

+31.4 |

|

/ |

|

|

|

As of 30/06/2021 |

1,794 |

|

|

|

/ |

+2.2% |

|

|

Q3 2021 |

|

+0.2 |

+17.0 |

|

/ |

|

|

|

As of 30/09/2021 |

1,811 |

|

|

|

/ |

+1.0% |

|

|

Q4 2021 |

|

+65.6 |

+39.1 |

|

+14825 |

|

|

|

As of 31/12/2021 |

2,064 |

|

|

|

/ |

|

|

|

Q1 2022 |

|

+3.2 |

-46.4 |

|

/ |

-2.1% |

|

|

As of 31/03/2022 |

2,021 |

|

|

|

/ |

|

|

|

Q2 2022 |

|

+1.8 |

- 97.8 |

|

/ |

|

|

As of 30/06/2022 |

1,925 |

|

|

|

|

-4.8% |

1. AuM (including Lyxor from 31/12/2021) and net

inflows (including Lyxor from 2022) include assets under advisory

and assets marketed and take into account 100% of the Asian JVs’

assets under management and net inflows. For Wafa in Morocco,

assets are reported on a proportional consolidation basis

Assets under management and net inflows

by client segment1

|

|

AuM |

AuM |

% chg. |

Inflows |

Inflows |

Inflows |

Inflows |

|

(€bn) |

30/06/2022 |

30/06/2021 |

vs. 30/06/2021 |

H1 2022 |

Q2 2022 |

Q1 2022 |

Q2 2021 |

|

French networks |

115 |

122 |

-5.7% |

-2.6 |

-1.3 |

-1.3 |

-1.7 |

|

International networks |

160 |

160 |

0.1% |

1.6 |

-1.9 |

3.5 |

5.7 |

|

o/w Amundi BOC WM |

12 |

4 |

x3 |

0.3 |

-2.1 |

2.3 |

2,5 |

|

Third-party distributors |

298 |

206 |

44.5% |

12.9 |

1.0 |

11.9 |

3.6 |

|

Retail (excl. JVs) |

573 |

488 |

17.4% |

11.9 |

-2.3 |

14.1 |

7.6 |

|

Institutionals2 & sovereigns |

448 |

423 |

5.8% |

-10.7 |

-7.8 |

-3.0 |

0.4 |

|

Corporates |

86 |

86 |

0.5% |

-18.9 |

-5.5 |

-13.4 |

-3.8 |

|

Employee Savings |

74 |

75 |

-1.0% |

2.0 |

3.4 |

-1.3 |

2.8 |

|

CA & SG insurers |

435 |

468 |

-7.0% |

-0.8 |

0.9 |

-1.7 |

-2.2 |

|

Institutionals |

1,043 |

1,052 |

-0.8% |

-28.5 |

-9.1 |

-19.4 |

-2.9 |

|

JVs |

308 |

254 |

21.4% |

21.5 |

13.1 |

8.4 |

2.6 |

|

|

|

|

|

|

|

|

|

|

TOTAL |

1,925 |

1,794 |

7.3% |

5.0 |

1.8 |

3.2 |

7.2 |

|

Average first-half AuM (excl. JVs) |

1,715 |

1,515 |

13.2% |

/ |

/ |

/ |

/ |

1. AuM (including Lyxor from 31/12/2021) and net

inflows (including Lyxor from 2022) include assets under advisory

and assets marketed and take into account 100% of the Asian JVs’

assets under management and net inflows. For Wafa in Morocco,

assets are reported on a proportional consolidation

basis. 2. Including funds of

funds

Assets under management and net inflows

by asset class1

|

|

AuM |

AuM |

% chg. |

Inflows |

Inflows |

Inflows |

Inflows |

|

(€bn) |

30/06/2022 |

30/06/2021 |

vs. 30/06/2021 |

H1 2022 |

Q2 2022 |

Q1 2022 |

Q2 2021 |

|

Active management |

1,034 |

1,074 |

-3.7% |

-0.4 |

-9.5 |

9.1 |

18.9 |

|

Equities |

170 |

175 |

-2.7% |

2.9 |

3.6 |

-0.7 |

2.4 |

|

Multi-asset |

293 |

286 |

2.3% |

4.9 |

-6.1 |

11.0 |

12.5 |

|

Bonds |

572 |

613 |

-6.7% |

-8.2 |

-7.0 |

-1.2 |

4.0 |

|

Structured products |

28 |

36 |

-20.1% |

-2.9 |

-1.6 |

-1.2 |

-2.1 |

|

Passive management |

284 |

184 |

54.5% |

11.4 |

0.8 |

10.6 |

4.0 |

|

ETFs & ETCs |

176 |

77 |

128.9% |

9.4 |

0.1 |

9.3 |

2.3 |

|

Index & Smart Beta |

108 |

107 |

1.2% |

1.9 |

0.7 |

1.2 |

1.7 |

|

Real and alternative assets |

97 |

59 |

63.7% |

2.9 |

0.3 |

2.6 |

0.9 |

|

MLT assets |

1,444 |

1,352 |

6.7% |

11.0 |

-10.0 |

21.0 |

21.7 |

|

Treasury products excl. JVs |

173 |

188 |

-7.9% |

-27.6 |

-1.3 |

-26.3 |

-17.0 |

|

JVs |

308 |

254 |

21.4% |

21.5 |

13.1 |

8.4 |

2.6 |

|

TOTAL |

1925 |

1794 |

7.3% |

5.0 |

1.8 |

3.2 |

7.2 |

1. AuM (including Lyxor from 31/12/2021) and net

inflows (including Lyxor from 2022) include assets under advisory

and assets marketed and take into account 100% of the Asian JVs’

assets under management and net inflows. For Wafa in Morocco,

assets are reported on a proportional consolidation basis.

Assets under management and net inflows

by geographic segment1

|

|

AuM |

AuM |

% chg. |

Inflows |

Inflows |

Inflows |

Inflows |

|

(€bn) |

30/06/2022 |

30/06/2021 |

vs. 30/06/2021 |

H1 2022 |

Q2 2022 |

Q1 2022 |

Q2 2021 |

|

France |

887 |

928 |

-4.4% |

-22.8 |

0.0 |

-22.8 |

-12.5 |

|

Italy |

194 |

191 |

1.6% |

4.8 |

0.9 |

3.8 |

2.8 |

|

Europe excl. France and Italy |

326 |

248 |

31.4% |

1.4 |

-7.3 |

8.7 |

9.4 |

|

Asia |

393 |

323 |

21.6% |

25.9 |

11.8 |

14.2 |

7.2 |

|

Rest of world |

124 |

103 |

20.3% |

-4.3 |

-3.6 |

-0.7 |

0.4 |

|

TOTAL |

1,925 |

1,794 |

7.3% |

5.0 |

1.8 |

3.2 |

7.2 |

|

TOTAL excl. France |

1,037 |

865 |

19.9% |

27.8 |

1.8 |

26.0 |

19.7 |

1. AuM (including Lyxor from 31/12/2021) and net

inflows (including Lyxor from 2022) include assets under advisory

and assets marketed and take into account 100% of the Asian JVs’

assets under management and net inflows. For Wafa in Morocco,

assets are reported on a proportional consolidation basis.

Appendix Launch of a share buyback

programmeas part of performance

shares incentive

plans

Having obtained the necessary regulatory

authorisation, Amundi announces

the launch of a share buyback programme, via a mandate

agreed with an Investment Services Provider

(KeplerCheuvreux)

In accordance with the authorisation granted by

the Ordinary General Meeting of shareholders held on 18 May 2022

and the delegation by the Board of Directors to the Chief Executive

Officer, the share buyback programme will have the following

features:

1. Objective

The shares will be acquired in the market in

order to cover the performance share incentives plans that have

already been awarded.

In order to avoid dilution for existing

shareholders, Amundi has decided to not issue any new shares, but

to buy back the shares that will be delivered to beneficiaries

starting in 2024 (following a vesting period and subject to

performance and presence conditions26).

2. Maximum number of

shares and amount

The number of shares acquired will not exceed 1

million, representing around 0.5% of the share capital. The total

amount allocated to this programme may not exceed €60m.

3. Features of the

purchased shares

The Amundi shares in question are those admitted

for trading on the Euronext regulated market in Paris under ISIN

code FR0004125920.

4. Duration of the

share buyback programme

The authorisation of the Ordinary General

Shareholders’ Meeting of 18 May 2022 was granted for a period of

eighteen months from the date of this Meeting.

This programme is part of the share buyback

programme described in Chapter 1 (pages 42-43) of Amundi's 2021

Universal Registration Document filed with the Autorité des Marchés

Financiers on 12 April 2022 under number D.22-0281 and available on

Amundi's website:

https://legroupe.amundi.com/regulated-information. Any amendment to

one of the features of this share buyback programme while it is

underway will be disclosed in accordance with the terms and

conditions set out in II of Article 241-2 of the General Regulation

of the Autorité des Marchés Financiers.

As a reminder, Amundi already holds 359,468

shares at 30 June 2022 under the liquidity contract entered into

with Kepler Cheuvreux and as part of the previous share buyback

programmes.

Methodology

appendix

I. Accounting and adjusted

data1. Accounting

data: For the first six months of 2021 and 2022, data

after amortisation of intangible assets (distribution agreements

with Bawag, UniCredit and Banco Sabadell; Lyxor client contracts);

and after the integration costs related to Lyxor.

2. Adjusted

data: To present an income statement that is closer to the

economic reality, the following adjustments have been made:

restatement of amortisation of intangible assets (deducted from net

revenues); the integration costs related to Lyxor.

In the accounting data, amortisation of intangible

assets:

- Q2

2021: €17m before tax and €12m after tax

- Q1

2022: €20m before tax and €15m after tax

- Q2

2022: €20m before tax and €15m after tax

- H1

2021: €34m before tax and €24m after tax

- H1

2022: €41m before tax and €29m after tax

In the accounting data, integration costs related

to Lyxor:

- Q2

2021: 0

- Q1

2022: €10m before tax and €8m after tax

- Q2

2022: €40m before tax and €30m after tax

- H1

2021: 0

- H1

2022: €51m before tax and €37m after tax

II. Acquisition of LyxorIn

accordance with IFRS 3, recognition on Amundi’s balance sheet as of

31/12/2021 of:

- goodwill ;

- an intangible asset, representing

client contracts, of €40m before tax (€30m after tax), which will

be amortised on a straight-line basis over 3 years;

In the Group income statement, the above-mentioned

intangible asset is amortised on a straight-line basis over 3 years

starting in 2022; the full-year impact of this amortisation is €10m

net of tax (i.e. €13m before tax). This amortisation is recognised

as a deduction from net income and added to the existing

amortisation of distribution agreements.

III. Alternative Performance

Indicators27To present an income statement that is closer

to the economic reality, Amundi publishes adjusted data which

excludes amortisation of intangible assets, Lyxor integration costs

and the impact of Affrancamento (see above).These combined and

adjusted data are reconciled with accounting data as

follows:accounting dataadjusted data

|

€m |

|

6M 2022 |

|

6M 2021 |

|

Q2 2022 |

|

Q1 2022 |

|

Q2 2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues (a) |

|

1,548 |

|

1,585 |

|

734 |

|

814 |

|

832 |

|

|

+ Amortisation of intangible assets before tax |

|

41 |

|

34 |

|

20 |

|

20 |

|

17 |

|

|

Adjusted net revenues (b) |

|

1,589 |

|

1,619 |

|

754 |

|

835 |

|

849 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses (c) |

|

-895 |

|

-764 |

|

-462 |

|

-433 |

|

-388 |

|

|

+ Integration costs before tax |

|

51 |

|

0 |

|

40 |

|

10 |

|

0 |

|

|

Adjusted operating expenses

(d) |

|

-844 |

|

-764 |

|

-422 |

|

-423 |

|

-388 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Gross operating income (e) = (a)+(c) |

|

653 |

|

821 |

|

271 |

|

382 |

|

444 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted gross operating income (f) =

(b)+(d) |

|

744 |

|

855 |

|

332 |

|

412 |

|

461 |

|

|

Cost/income ratio (c)/(a) |

|

57.8% |

|

48.2% |

|

63.0% |

|

53.1% |

|

46.7% |

|

|

Adjusted cost/income ratio (d)/(b) |

|

53.1% |

|

47.2% |

|

55.9% |

|

50.6% |

|

45.7% |

|

|

Cost of risk & Other (g) |

|

-4 |

|

-20 |

|

0 |

|

-4 |

|

-18 |

|

|

Equity-accounted entities (h) |

|

41 |

|

38 |

|

21 |

|

20 |

|

21 |

|

|

Income before tax (i) = (e)+(g)+(h) |

|

690 |

|

839 |

|

292 |

|

398 |

|

447 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted income before tax (j) = (f)+(g)+(h) |

|

781 |

|

874 |

|

353 |

|

428 |

|

464 |

|

|

Taxes (k) |

|

-162 |

|

-213 |

|

-68 |

|

-94 |

|

-115 |

|

Adjusted taxes (l) |

|

-187 |

|

-223 |

|

-84 |

|

-103 |

|

-120 |

|

Minority interests (m) |

|

-1 |

|

4 |

|

0 |

|

-1 |

|

1 |

|

Net income, Group share (n)= (i)+(k)+(m)-(p) |

|

527 |

|

630 |

|

224 |

|

302 |

|

333 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income, Group share

(o) = (j)+(l)+(m) |

|

593 |

|

654 |

|

269 |

|

324 |

|

345 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Affrancamento impact (p) |

|

0 |

|

114 |

|

0 |

|

0 |

|

114 |

|

|

Net income, Group share (n)+(p) including

Affrancamento |

|

527 |

|

744 |

|

224 |

|

302 |

|

448 |

|

About AmundiAmundi, the leading

European asset manager, ranking among the top 10 global players28,

offers its 100 million clients - retail, institutional and

corporate - a complete range of savings and investment solutions in

active and passive management, in traditional or real assets.

With its six international investment hubs29,

financial and extra-financial research capabilities and

long-standing commitment to responsible investment, Amundi is a key

player in the asset management landscape.

Amundi clients benefit from the expertise and

advice of 5,400 employees in 35 countries. A subsidiary of the

Crédit Agricole group and listed on the stock exchange, Amundi

currently manages more than €1.9 trillion of assets30.

Amundi, a trusted partner, working every

day in the interest of its clients and society.

www.amundi.com

|

Press

contacts: |

|

Investor contacts: |

|

Natacha Andermahr |

Nathalie Boschat |

Anthony

Mellor Thomas

Lapeyre |

|

Tel. +33 1 76 37 86 05 |

Tel. +33 1 76 37 54 96 |

Tel. +33 1 76 32 17

16 Tel. +33 1 76 33

70 54 |

|

natacha.andermahr@amundi.com |

nathalie.boschat@amundi.com |

anthony.mellor@amundi.com

thomas.lapeyre@amundi.com |

DISCLAIMER:

This document may contain projections concerning

Amundi's financial situation and results. The figures given do not

constitute a “forecast” as defined in Delegated Regulation (EU) No.

2019/980 of 14 March 2019.

This information is based on scenarios that

employ a number of economic assumptions in a given competitive and

regulatory context. As such, the projections and results indicated

may not necessarily come to pass due to unforeseeable

circumstances. The reader should take all of these uncertainties

and risks into consideration before forming their own opinion.

The figures presented were prepared in

accordance with IFRS guidelines. Audit procedures are currently

underway.

The information contained in this document, to

the extent that it relates to parties other than Amundi or comes

from external sources, has not been independently verified, and no

representation or warranty has been expressed as to, nor should any

reliance be placed on, the fairness, accuracy, correctness or

completeness of the information or opinions contained herein.

Neither Amundi nor its representatives can be held liable for any

negligence or loss that may result from the use of this document or

its contents, or anything related to them, or any document or

information to which the document may refer.

1Adjusted data: excluding amortisation of

intangible assets and excluding integration costs and, in Q2 2021,

excluding the impact of Affrancamento. See page 11 for definitions

and methodology. 2 vs. H1 combined with Lyxor3 Assets under

management and net inflows including Lyxor AM as of Q1 2022 include

assets under advisory and assets marketed and take into account

100% of the Asian JVs’ assets under management and net inflows. For

Wafa in Morocco, assets are reported on a proportional

consolidation basis. 4 Excl. JVs5 Medium/Long-Term Assets:

excluding treasury products 6 Between 31/03/2022 to 30/06/2022.7

Eurostoxx index8 Bloomberg Euro Aggregate Index9 Medium/Long-Term

Assets: excluding treasury products10 Source: AMFI.11 Source:

Morningstar Direct, Broadridge FundFile - Open-ended funds and ETFs

worldwide, June 2022 12 Outsourced Chief Investment Officer

solutions13 Source: ETF GI, end of June 2022 14Adjusted data:

excluding amortisation of intangible assets and excluding

integration costs and, in Q2 2021, excluding the impact of

Affrancamento. See page 11 for definitions and methodology. 15

Excluding Amundi Technology’s revenues, which are now reported on a

separate line of the income statement16 Compared to a combined H1

2021 (with Lyxor)17 Margin at constant scope (including Lyxor) and

excluding Amundi Technology’s revenues. 18 Normalised data: data

excluding exceptional performance fees (= higher-than-average

performance fees per quarter in 2017-2020). 19 vs. H1 2021 with

Lyxor20 Decrease of average levels of the EuroStoxx index Q2

2022/Q1 202221 Normalised data: data excluding exceptional

performance fees (= higher-than-average performance fees per

quarter in 2017-2020). 22 Excl. CA and SG insurers23 Equity

excluding goodwill and intangible

assets.24 The number

of shares allocated will therefore only be definitive when they are

delivered. 25

Lyxor26 The number

of shares allocated will only be definitive when they are

delivered. 27 Please refer to section 4.3 of the 2020 Universal

Registration Document filed with the French AMF on 12/04/2021

28 Source: IPE “Top 500 Asset Managers”

published in June 2022, based on assets under management as at

31/12/202129 Boston, Dublin, London, Milan, Paris and Tokyo30

Amundi data including Lyxor as at 30/06/2022

- Amundi PR Results H1 2022

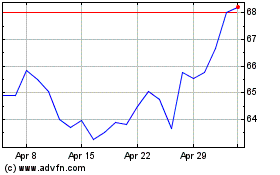

Amundi (EU:AMUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amundi (EU:AMUN)

Historical Stock Chart

From Apr 2023 to Apr 2024