Amundi: Q3 and 9M 2022 results

Amundi: Q3 and 9M 2022

results

Net income1

of €282m in the third quarter, up 5% on the second

quarter

|

Results |

9M 2022: high level of

net income1 (€875m) and

operational efficiency maintained A solid

Q3 in difficult market conditions

- High level of net management fees,

up 2% vs. Q2 2022

- Expenses1 down by 2% vs. Q2 2022

(cost-income ratio1 of 54.7%)

- Adjusted net income1 of €282m, up

5% vs. Q2 2022

|

|

Business activity |

9M 2022:

flows2 of

-€8.0bn of which +€7.5bn in Medium/Long-Term

Assets3 excluding JVs

Q3 2022:

flows of -€12.9bn of which -€3.5bn in MLT

excluding JVs

- Positive activity in the networks

and in active expertise

- Outflows in passive management

(third-party distributors and Institutionals) related to the

“derisking” context

Assets under management of €1,895bn at 30 September

2022: +5% year-on-year and -2% over 3 months |

|

Integration of Lyxor |

Operational integration complete (IT migration

accomplished)Initial effects of revenue and cost

synergies recorded |

Paris, 28 October 2022

Amundi’s Board of Directors, chaired by Yves

Perrier, convened on 27 October 2022 to review the financial

statements for the third quarter and first nine months of 2022.

Commenting on the figures, Valérie Baudson, CEO,

said:

“Over the first nine months of the year, Amundi

showed solid performance in a persistently tough market

environment, maintaining a high level of profitability and

operational efficiency. In the third quarter, Amundi’s activity

held up well, particularly in medium/long-term assets, in a market

characterised by strong outflows4. Lyxor's operational integration

was successfully completed, allowing to record the initial effects

of revenue and cost synergies. These results confirm the robustness

of Amundi's profile.”

I. Business activity held

up well in unfavourable market conditions

The third quarter was characterised by

unfavourable market conditions:

- equity markets

declined sharply: the EuroStoxx lost 5% over 3 months5, and is down

24% since the end of 2021; on average it dropped 15% vs. Q3 2021,

5% vs. Q2 2022 and 5% between 9M 2021 and 9M 2022;

- bond markets

declined (-5% between 30/06/2022 and 30/09/20226), with rates7 up

around 75bps in the third quarter and 250bps over the first nine

months of the year;

- the US dollar

appreciated 6% against the Euro between 30/06/2022 and

30/09/2022;

- an overall increase

in risk aversion

The European asset management market 8 displayed

substantial outflows in Q3 (-€111bn of which -€101 €bn in MLT

assets).

Amundi's assets under management

totalled €1,895bn at 30 September 2022, up 4.7% over one year and

down 1.5% from the end of June 2022.

Q3 2022 business activity

Against this backdrop, Amundi showed

resilient business activity in MLT assets ex JVs (-€3.5bn compared

to -€10.0bn in Q2).

- In Retail,

business activity was solid in the French

(+€0.5bn in MLT,

specifically in active management and real assets) and

international networks (+€1.4bn9

in MLT).

- Active

management flows were positive (+€1.1bn in MLT), driven by

equity (thematic management) and bond products.

- Outflows in passive

management (-€3.8bn) were attributable to the

derisking prevailing among Institutionals and

third-party distributors

In treasury products, outflows of -€8.1bn (ex

JVs) were concentrated in Corporate and Institutional clients.

Business activity in the JVs

was negative this quarter (-€1.3bn) owing to outflows in treasury

products and in Channel Business10 in China. In MLT

assets11, flows were positive

(+€3.8bn), thanks to the momentum of the Indian JV SBI MF,

which consolidates its leadership in the Indian market12.

Total flows in Q3 were

-€12.9bn.

Continued development of Amundi

Technology

Amundi Technology continued to grow with 45

clients at end September 2022 (compared to 42 at end June). Three

new clients subscribed to the ALTO Wealth & Distribution

offer.

9M 2022 business activity

Over the first 9 months of 2022, Amundi had

-€8.0bn in outflows, driven by outflows in treasury products

(-€35.6bn).

Excluding JVs, MLT flows

were significant (+€7.5bn) thanks to

Retail (+€10.6bn in MLT, essentially

in third-party distributors); in

the Institutional

segment, outflows were

limited (-€3.1bn in MLT).

- Active

management: in generally falling markets, Amundi's flows

were positive (+€1.6bn), with flows in particular in Equities

(especially thematic management). Fund performance

was solid, with over 69% of

assets in open-ended funds in the top two quartiles according to

Morningstar13 over 1 and 3 years, and over 76% over 5 years. With

306 funds rated 4 and 5 stars, Amundi is the second largest player

in Europe in terms of number of funds.

- Activity in

Real Assets (excluding alternative assets) was strong,

with net inflows of +€3.0bn, particularly in Real Estate and

Private Equity, bringing assets under management to €66bn at

30/09/2022.

- Passive

management, ETFs and Smart beta posted net inflows

of +€7.5bn, bringing AuM to €275bn at the end of

September 2022. This performance was significant amid the

merger with Lyxor. In ETFs, while the start of the year was

particularly promising, the market experienced a slowdown in a

general climate of derisking. Nonetheless, with inflows of

+€4.6bn14 over 9 months, Amundi consolidated its position as the

second ETF player in Europe and the European leader with a market

share of around 13.5%15 (AUM of €167bn at 30/09/2022).

In the Asian JVs, business activity

was strong with inflows of

+€20.2bn, mainly in India and China.

II. Continued high level

of profitability and operational efficiency

Note: figures published in 2021 did not include

Lyxor. The published 9M 2021 income statements as well as the

change vs Q3 and 9 months 2022 combined (on a like-for-like basis,

with Lyxor) are presented in the appendix. Also, Amundi Technology

revenues are presented on a separate line of the P&L in 2021

and 2022.

Q3 2022

results (adjusted data)

Amundi’s quarterly adjusted net income

of €282m remained high, a considerable increase (+4.7%)

compared to Q2 2022, thanks to the

positive jaws effect between net management fees and

well-controlled expenses.

Net revenues

at €758m:

- Net

management fees16 were

€747m, a slight increase over Q2 2022 (+1.9%)

thanks to the improved client/product mix, a positive currency

effect (US dollar / euro), and some non-recurring items.

- The normalisation

of performance fees (€13m) was more pronounced in

light of the market environment.

- Amundi

Technology’s revenues (€12m) were stable Q3/Q2 and up vs.

Q3 2021 (+43%), confirming its development over 12 months.

- Financial and other

revenues were -€13m, given the market backdrop.

Operating expenses (€415m)

were down by 1.7% from Q2 2022, and down 2% vs. Q3

2021 on a like-for-like basis. These evolutions are related to the

initial effects of costs synergies related to the Lyxor integration

and to cost control efforts, which offset a negative currency

effect (US dollar/euro).

Cost/income

ratio was 54.7%, an

improvement compared to Q2 2022.

The contribution to income from

equity-accounted entities (mainly Asian joint

ventures) increased by +11.8% vs. Q2 2022, to €24m.

9M 2022

results (adjusted data)

Adjusted net income stood at

€875m, an increase of +3.4%

vs 2021 excluding

the exceptional level

of performance fees recorded in

202117, and virtually stable (+0.5%)

on a like-for-like basis (including Lyxor in

2021).This continued high level of profitability can be attributed,

as for Q3, to two factors:

- net

management fees18 (€2,245m) up by

+2.6% on a like-for-like basis, in spite of the steep

decline of equity and bond markets; this can be attributed to the

momentum of inflows over 12 months and the improved client/product

mix.

-

stable expenses on a like-for-like

basis (-0.1% vs. 9M 2021) thanks to cost control and the

initial effects of synergies, which offset investments in our

growth engines and the negative currency effect.

As such, Amundi demonstrated its ability

to maintain its operational efficiency, even in a

difficult market environment. Cost/income ratio was 53.7%, one of

the best in the industry.

To be noted: the continued development of

Amundi Technology whose revenues grew by 24% to

€34m.

III. Continued commitment

to Responsible Investing

Amundi stayed on track to implement its

2025 action plan with transformation of

fund ranges and product innovation:

- A wide range of

sectoral ESG ETFs on global equities was launched, as did the first

ESG ETF on Italian large caps;

- The Emerging

Markets Equity ESG Improvers fund was also launched.

Responsible Investing assets under

management were €769bn at 30

September 2022. The change vs 31 December 2021 (€847bn)

was due to a negative market effect. MLT19 inflows totalled +€7.9bn

over the first nine months.

IV. Lyxor

The operational integration of Lyxor,

acquired at the end

of 2021, is complete: team were

integrated in Q1 2022, entities were merged in Q2 2022, and the IT

migration was completed in 6 months, in September 2022. These steps

were successful, on schedule, and did not disrupt business

activity. In ETFs, Amundi has become a solid European leader with

€167bn in AuM at 30/09/2022.

The resulting synergies will be in line

with previous guidance:

- pre-tax cost

synergies are expected to reach €60m in 2024 on a full year

basis;

- projected

full-year revenue synergies of €30m in 2025.

The initial effects of cost synergies were

already recorded, and the rate of completion should ramp up in the

fourth quarter of 2022 and in 2023.

These elements confirm the valuecreation potential

of this acquisition, with a return on investment expected to be

greater than 14% in 2024 including all synergies.

Financial disclosure schedule

- Publication of Q4

and FY 2022 results:

8

February 2023

- Publication of Q1

2023

results:

28 April 2023

- AGM for the 2022

financial year:

12

May 2023

- Publication of H1 2023 results:

28

July 2023

- Publication of 9M 2023 results:

27

October 2023

***

Income Statements

Adjusted data: excluding

amortisation of intangible assets and excluding integration costs

and, for 9M 2021, excluding the impact of Affrancamento.

New presentation of revenues

since 2021 with Amundi Technology’s revenues shown on a separate

line

Constant scope: data combined

with Lyxor

The accounting net

income for Q2 2021 included a net one-time tax

gain (net of a substitution tax) of +€114m (no cash flow

impact): “Affrancamento” mechanism of the Italian Budget Law for

2021 (Law no. 178/2020), resulting in the recognition of Deferred

Tax Assets on intangible assets (goodwill); this was excluded from

Adjusted Net Income.

|

€m |

|

9M 2022 |

|

9M 2021 (exc. Lyxor) |

|

Chg. 9M 22 / 9M 21 (exc. Lyxor) |

|

|

Chg. 9M 22 / 9M 21 combined |

| |

|

|

|

|

|

|

|

|

|

|

Adjusted net revenue |

|

2,347 |

|

2,410 |

|

-2.6% |

|

|

-8.5% |

|

Net asset management revenue |

|

2,353 |

|

2,394 |

|

-1.7% |

|

|

-7.8% |

|

o/w net management fees |

|

2,245 |

|

2,038 |

|

10.2% |

|

|

2.6% |

|

o/w performance fees |

|

108 |

|

356 |

|

- |

|

|

- |

|

Technology |

|

34 |

|

27 |

|

24.2% |

|

|

24.2% |

|

Net financial income and other net income |

|

(40) |

|

(11) |

|

- |

|

|

- |

|

Operating expenses |

|

(1,259) |

|

(1,147) |

|

9.8% |

|

|

-0.1% |

|

Adjusted cost/income ratio |

|

53.7% |

|

47.6% |

|

6.1 pts |

|

|

4.5 pts |

| |

|

|

|

|

|

|

|

|

|

|

Adjusted gross operating income |

|

1,088 |

|

1,264 |

|

-13.9% |

|

|

-16.6% |

|

Cost of risk & Other |

|

(4) |

|

(13) |

|

- |

|

|

- |

|

Equity-accounted entities |

|

64 |

|

63 |

|

1.9% |

|

|

1.9% |

|

Adjusted income before taxes |

|

1,148 |

|

1,313 |

|

-12.6% |

|

|

-15.1% |

|

Taxes |

|

(272) |

|

(331) |

|

-17.9% |

|

|

-20.8% |

|

Minority interests |

|

(1) |

|

5 |

|

- |

|

|

- |

|

Adjusted net income, Group share |

|

875 |

|

987 |

|

-11.3% |

|

|

-13.7% |

|

Amortisation of intangible assets after tax |

|

(44) |

|

(37) |

|

20.5% |

|

|

25.0% |

|

Integration costs net of tax |

|

(44) |

|

0 |

|

- |

|

|

- |

|

Net income, Group share |

|

787 |

|

951 |

|

-17.2% |

|

|

-19.6% |

|

Impact of Affrancamento |

|

0 |

|

114 |

|

- |

|

|

- |

|

Net income, Group share including Affrancamento |

|

787 |

|

1,065 |

|

-26% |

|

|

-28% |

|

€m |

|

Q3 2022 |

|

Q2 2022 |

|

|

Chg. Q3 22/Q2 22 |

|

Q3 2021 (exc. Lyxor) |

|

Chg. Q3 22/Q3 21 (exc. Lyxor) |

|

|

|

Chg.Q3 22/Q3 21 combined |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net revenue |

|

758 |

|

754 |

|

|

0.6% |

|

791 |

|

-4.2% |

|

|

|

-10.8% |

|

Net asset management revenue |

|

759 |

|

757 |

|

|

0.3% |

|

790 |

|

-3.9% |

|

|

|

-10.6% |

|

o/w net management fees |

|

747 |

|

733 |

|

|

1.9% |

|

700 |

|

6.7% |

|

|

|

-1.3% |

|

o/w performance fees |

|

13 |

|

24 |

|

|

-47.5% |

|

90 |

|

- |

|

|

|

- |

|

Technology |

|

12 |

|

12 |

|

|

2.0% |

|

8 |

|

43.4% |

|

|

|

43.4% |

|

Net financial income and other net income |

|

(13) |

|

(15) |

|

|

- |

|

(8) |

|

78.0% |

|

|

|

70.6% |

|

Operating expenses |

|

(415) |

|

(422) |

|

|

-1.7% |

|

(383) |

|

8.4% |

|

|

|

-2.0% |

|

Adjusted cost/income ratio |

|

54.7% |

|

55.9% |

|

|

-1.2 pts |

|

48.4% |

|

6.4 pts |

|

|

|

4.9 pts |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted gross operating income |

|

343 |

|

332 |

|

|

3.4% |

|

409 |

|

-16.0% |

|

|

|

-19.6% |

|

Cost of risk & Other |

|

(0) |

|

(0) |

|

|

- |

|

7 |

|

- |

|

|

|

- |

|

Equity-accounted entities |

|

23 |

|

21 |

|

|

11.9% |

|

25 |

|

-5.2% |

|

|

|

-5.2% |

|

Adjusted income before taxes |

|

366 |

|

353 |

|

|

3.8% |

|

440 |

|

-16.7% |

|

|

|

-19.9% |

|

Taxes |

|

(85) |

|

(84) |

|

|

1.4% |

|

(108) |

|

-21.3% |

|

|

|

-24.7% |

|

Minority interests |

|

0 |

|

0 |

|

|

- |

|

1 |

|

- |

|

|

|

- |

|

Adjusted net income, Group share |

|

282 |

|

269 |

|

|

4.7% |

|

333 |

|

-15.3% |

|

|

|

-18.5% |

|

Amortisation of intangible assets after tax |

|

(15) |

|

(15) |

|

|

0.0% |

|

(12) |

|

20.5% |

|

|

|

20.5% |

|

Integration costs net of tax |

|

(6) |

|

(30) |

|

|

- |

|

0 |

|

- |

|

|

|

- |

|

Net income, Group share |

|

261 |

|

224 |

|

|

16.1% |

|

321 |

|

-18.7% |

|

|

|

-21.9% |

Change in assets under

management1 from end-December

2020 to end-September 2022

| |

(€bn) |

Assets under management |

Netinflows |

Market andforeign exchange

effect |

Scope effect |

|

Change in AuM vs. previous quarter |

|

As of 31/12/2020 |

1,729 |

|

|

|

|

+4.0% |

|

|

Q1 2021 |

|

-12.7 |

+39.3 |

|

/ |

|

|

|

As of 31/03/2021 |

1,755 |

|

|

|

|

+1.5% |

|

|

Q2 2021 |

|

+7.2 |

+31.4 |

|

/ |

|

|

|

As of 30/06/2021 |

1,794 |

|

|

|

/ |

+2.2% |

|

|

Q3 2021 |

|

+0.2 |

+17.0 |

|

/ |

|

|

|

As of 30/09/2021 |

1,811 |

|

|

|

/ |

+1.0% |

|

|

Q4 2021 |

|

+65.6 |

+39.1 |

|

+14820 |

|

|

|

As of 31/12/2021 |

2,064 |

|

|

|

/ |

|

|

|

Q1 2022 |

|

+3.2 |

-46.4 |

|

/ |

-2.1% |

|

|

As of 31/03/2022 |

2,021 |

|

|

|

/ |

|

|

|

Q2 2022 |

|

+1.8 |

- 97.8 |

|

/ |

|

|

As of 30/06/2022 |

1,925 |

|

|

|

|

-4.8% |

|

Q3 2022 |

|

-12.9 |

-16.3 |

|

/ |

|

|

As of 30/09/2022 |

1,895 |

|

|

|

|

|

1. AuM (including Lyxor from 31/12/2021) and net

inflows (including Lyxor from Q1 2022) include assets under

advisory and assets marketed and take into account 100% of the

Asian JVs’ assets under management and net inflows. For Wafa in

Morocco, assets are reported on a proportional consolidation

basis

Assets under management and net flows by

client segment1

|

|

AuM |

AuM |

% chg. |

Inflows |

Inflows |

Inflows |

Inflows |

|

(€bn) |

30.09.2022 |

30.09.2021 |

/30.09.2021 |

9M 2022 |

Q3 2022 |

Q2 2022 |

Q3 2021 |

|

French networks |

114 |

121 |

-6.0% |

-1.8 |

+0.9 |

-1.3 |

-1.3 |

|

International networks |

156 |

165 |

-5.5% |

+1.3 |

-0.3 |

-1.9 |

+5.4 |

|

o/w Amundi BOC WM |

10 |

7 |

+40.4% |

-1.5 |

-1.8 |

-2.1 |

+3.3 |

|

Third-party distributors |

292 |

212 |

+37.7% |

+9.6 |

-3.3 |

+1.0 |

+4.4 |

|

Retail (excl. JVs) |

562 |

499 |

+12.8% |

+9.1 |

-2.8 |

-2.3 |

+8.5 |

|

Institutionals2 & sovereigns |

438 |

428 |

+2.3% |

-15.5 |

-4.7 |

-7.8 |

+5.2 |

|

Corporates |

84 |

85 |

-0.5% |

-20.6 |

-1.7 |

-5.5 |

-1.0 |

|

Employee Savings |

71 |

76 |

-6.3% |

+1.8 |

-0.2 |

+3.4 |

-0.5 |

|

CA & SG insurers |

420 |

471 |

-11.0% |

-3.0 |

-2.2 |

+0.9 |

+0.6 |

|

Institutionals |

1,013 |

1,060 |

-4.4% |

-37.2 |

-8.8 |

-9.1 |

+4.3 |

|

JVs |

319 |

252 |

+26.7% |

+20.2 |

-1.3 |

+13.1 |

-12.7 |

|

|

|

|

|

|

|

|

|

|

TOTAL |

1,895 |

1,811 |

+4.7% |

-8.0 |

-12.9 |

+1.8 |

+0.2 |

|

Average AuM excl. JVs |

1,689 |

1,715 |

+1.5% |

/ |

/ |

/ |

/ |

1. AuM (including Lyxor from 31/12/2021) and net

inflows (including Lyxor from Q1 2022) include assets under

advisory and assets sold and take into account 100% of the Asian

JVs’ inflows and assets under management. For Wafa in Morocco,

assets are reported on a proportional consolidation basis. 2.

Including funds of funds

Assets under management and net flows by

asset class1

|

|

AuM |

AuM |

% chg. |

Inflows |

Inflows |

Inflows |

Inflows |

|

(€bn) |

30.09.2022 |

30.09.2021 |

/30.09.2021 |

9M 2022 |

Q3 2022 |

Q2 2022 |

Q3 2021 |

|

Active management |

1,011 |

1,091 |

-7.4% |

+0.7 |

+1.1 |

-9.5 |

+11.1 |

|

Equities |

167 |

177 |

-5.3% |

+4.9 |

+2.0 |

3.6 |

-0.5 |

|

Multi-asset |

280 |

294 |

-4.7% |

+0.5 |

-4.3 |

-6.1 |

+8.3 |

|

Bonds |

563 |

620 |

-9.2% |

-4.8 |

+3.4 |

-7.0 |

+3.4 |

|

Structured products |

28 |

35 |

-19.7% |

-2.8 |

0.0 |

-1.6 |

-1.2 |

|

Passive management |

275 |

187 |

+47.0% |

+7.5 |

-3.8 |

0.8 |

+3.9 |

|

ETFs & ETCs |

167 |

78 |

+113.3% |

+4.6 |

-4.8 |

0.1 |

+1.8 |

|

Index & Smart Beta |

107 |

108 |

-0.9% |

+2.9 |

+1.0 |

0.7 |

+2.1 |

|

Real and alternative assets |

98 |

61 |

+61.9% |

+2.1 |

-0.8 |

0.3 |

+1.2 |

|

MLT assets |

1,411 |

1,373 |

+2.8% |

+7.5 |

-3.5 |

-10.0 |

+15.0 |

|

Treasury products excl. JVs |

165 |

186 |

-11.4% |

-35.6 |

-8.1 |

-1.3 |

-2.2 |

|

JVs |

319 |

252 |

+26.7% |

+20.2 |

-1.3 |

13.1 |

-12.7 |

|

TOTAL |

1,895 |

1,811 |

+4.7% |

-8.0 |

-12.9 |

1.8 |

+0.2 |

1. AuM (including Lyxor from 31/12/2021) and net

inflows (including Lyxor from Q1 2022) include assets under

advisory and assets sold and take into account 100% of the Asian

JVs’ inflows and assets under management. For Wafa in Morocco,

assets are reported on a proportional consolidation basis

Assets under management and net

flows by geographic segment1

|

|

AuM |

AuM |

% chg. |

Inflows |

Inflows |

Inflows |

Inflows |

|

(€bn) |

30.09.2022 |

30.09.2021 |

/30.09.2021 |

9M 2022 |

Q3 2022 |

Q2 2022 |

Q3 2021 |

|

France |

858 |

935 |

-8.2% |

-30.0 |

-7.2 |

0.0 |

+2.2 |

|

Italy |

190 |

192 |

-0.8% |

+6.3 |

+1.6 |

0.9 |

+0.8 |

|

Europe excl. France and Italy |

320 |

254 |

+25.6% |

-1.3 |

-2.6 |

-7.3 |

+4.7 |

|

Asia |

402 |

324 |

+24.0% |

+23.3 |

-2.6 |

11.8 |

-9.0 |

|

Rest of world |

125 |

106 |

+18.5% |

-6.4 |

-2.1 |

-3.6 |

+1.4 |

|

TOTAL |

1,895 |

1,811 |

+4.7% |

-8.0 |

-12.9 |

1.8 |

+0.2 |

|

TOTAL excl. France |

1,037 |

876 |

+18.4% |

+22.0 |

-5.7 |

1.8 |

-2.0 |

1. AuM (including Lyxor from 31/12/2021) and net

inflows (including Lyxor from Q1 2022) include assets under

advisory and assets sold and take into account 100% of the Asian

JVs’ inflows and assets under management. For Wafa in Morocco,

assets are reported on a proportional consolidation basis

Methodology

appendix

I. Accounting and adjusted

data1. Accounting

data: For the first nine months of 2021 and 2022, data

after amortisation of intangible assets (distribution agreements

with Bawag, UniCredit and Banco Sabadell; Lyxor client contracts)

and after the integration costs related to Lyxor.

2. Adjusted

data The following adjustments were made to present the

most economically accurate income statement: restatement of the

amortisation of intangible assets (deducted from net revenues);

integration costs related to Lyxor.

In the accounting data, amortisation of intangible

assets:

- Q3

2021: €17m before tax and €12m after tax

- Q2

2022: €20m before tax and €15m after tax

- Q3

2022: €20m before tax and €15m after tax

- 9M

2021: €51m before tax and €37m after tax

- 9M

2022: €61m before tax and €44m after tax

In the accounting data, integration costs related

to Lyxor:

- Q1

2022: €10m before tax and €8m after tax

- Q2

2022: €40m before tax and €30m after tax

- Q3

2022: €9m before tax and €6m after tax

- 9M

2022: €59m before tax and €44m after tax

II. Normalized DataIn

2021, a record amount of performance fees had been registered

(427M€). This amount is significantly higher than the average from

2017 to 2020 (~€42m per quarter, i.e. ~€170m per year). To compare

the 2022 data with 2021, Amundi computes a normalized amount of

performance fees with those amount historically recorded, though

excluding the impact of this exceptional level of performance fees.

Details in the API table on the next page

III. Acquisition of

LyxorIn accordance with IFRS 3, recognition on Amundi’s

balance sheet as of 31/12/2021 of:

- goodwill;

- an intangible asset, representing

client contracts, of €40m before tax (€30m after tax), amortised on

a straight-line basis over 3 years;

In the Group income statement, the above-mentioned

intangible asset will be amortised on a straight-line basis over 3

years starting in 2022; the full-year impact of this amortisation

is €10m net of tax (i.e. €13m before tax). This amortisation is

recognised as a deduction from net revenues and is added to the

existing amortisation of distribution agreements.

IV. Alternative Performance

Indicators21To present the most economically accurate

income statement, Amundi publishes adjusted data which excludes

amortisation of intangible assets and the impact of Affrancamento

(see above).These combined and adjusted data are reconciled with

accounting data as follows:

= = adjusted and normaised data

|

€m |

|

9M 2022 |

|

9M 2021 |

|

Q3 2022 |

|

Q2 2022 |

|

Q3 2021 |

| |

|

|

|

|

|

|

|

|

|

|

|

Net revenues (a) |

|

2,286 |

|

2,359 |

|

738 |

|

734 |

|

774 |

|

+ Amortisation of intangible assets before tax |

|

61 |

|

51 |

|

20 |

|

20 |

|

17 |

|

Adjusted net revenues (b) |

|

2,347 |

|

2,410 |

|

758 |

|

754 |

|

791 |

|

- Exceptional performance fees |

|

0 |

|

-232 |

|

0 |

|

0 |

|

-49 |

|

Adjusted net revenues

(c) |

|

2,347 |

|

2,178 |

|

758 |

|

754 |

|

742 |

| |

|

|

|

|

|

|

|

|

|

|

|

Operating expenses (d) |

|

-1,318 |

|

-1,147 |

|

-423 |

|

-462 |

|

-383 |

|

+ Integration costs before tax |

|

59 |

|

0 |

|

9 |

|

40 |

|

0 |

|

Adjusted operating expenses

(e) |

|

-1,259 |

|

-1,147 |

|

-415 |

|

-422 |

|

-383 |

|

- Additional operating expenses in connection with the exceptional

level of performance fees |

|

0 |

|

39 |

|

0 |

|

0 |

|

8 |

|

Normalised adjusted operating expenses

(f) |

|

-1,259 |

|

-1,107 |

|

-415 |

|

-422 |

|

-374 |

| |

|

|

|

|

|

|

|

|

|

|

|

Gross operating income (g) = (a)+(d) |

|

967 |

|

1,213 |

|

314 |

|

271 |

|

392 |

| |

|

|

|

|

|

|

|

|

|

|

|

Adjusted gross operating income (h) =

(b)+(e) |

|

1,088 |

|

1,264 |

|

343 |

|

332 |

|

409 |

| |

|

|

|

|

|

|

|

|

|

|

|

Normalised adjusted gross operating income

(i) = (c)+(f) |

|

1,088 |

|

1,071 |

|

343 |

|

332 |

|

368 |

|

Cost/Income ratio (d)/(a) |

|

57.7% |

|

146.0% |

|

57.4% |

|

63.0% |

|

49.4% |

|

Adjusted cost/income ratio (e)/(b) |

|

53.7% |

|

142.9% |

|

54.7% |

|

55.9% |

|

48.4% |

|

Normalised adjusted cost/income ratio (f)/(c) |

|

-46.3% |

|

-49.2% |

|

-45.3% |

|

-44.1% |

|

-49.6% |

|

Cost of risk & Other (j) |

|

-4 |

|

-13 |

|

0 |

|

0 |

|

7 |

|

Equity-accounted entities (k) |

|

64 |

|

63 |

|

23 |

|

21 |

|

25 |

|

Income before tax (l) = (g)+(j)+(k) |

|

1,027 |

|

1,262 |

|

337 |

|

292 |

|

423 |

| |

|

|

|

|

|

|

|

|

|

|

|

Adjusted income before tax (m) = (h)+(j)+(k) |

|

1,148 |

|

1,313 |

|

366 |

|

353 |

|

440 |

| |

|

|

|

|

|

|

|

|

|

|

|

Normalised adjusted income before tax (n) =

(i)+(j)+(k) |

|

1,148 |

|

1,121 |

|

366 |

|

353 |

|

400 |

|

Income tax (o) |

|

-239 |

|

-202 |

|

-77 |

|

-68 |

|

-103 |

|

Adjusted income tax (p) |

|

-272 |

|

-331 |

|

-85 |

|

-84 |

|

-108 |

|

Normalised adjusted income tax (q) |

|

-272 |

|

-279 |

|

-85 |

|

-84 |

|

-97 |

|

Minority interests (r) |

|

-1 |

|

5 |

|

0 |

|

0 |

|

1 |

|

Net income, Group share (s) = (l)+(o)+(r)-(v) |

|

787 |

|

951 |

|

261 |

|

224 |

|

321 |

| |

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income, Group share

(t) = (m)+(p)+(r)-(v) |

|

875 |

|

987 |

|

281.8 |

|

269 |

|

333 |

| |

|

|

|

|

|

|

|

|

|

|

|

Normalised adjusted net income, Group share

(u) = (n)+(q)+(r)-(v) |

|

875 |

|

847 |

|

282 |

|

269 |

|

303 |

|

Impact of Affrancamento (v) |

|

0 |

|

114 |

|

0 |

|

0 |

|

0 |

|

Net income, Group share (s)+(v) including

Affrancamento |

|

787 |

|

1,065 |

|

261 |

|

224 |

|

321 |

About AmundiAmundi, the leading

European asset manager, ranking among the top 10 global players22,

offers its 100 million clients – retail, institutional and

corporate – a complete range of savings and investment solutions in

active and passive management, in traditional or real assets.

With its six international investment hubs23,

financial and extra-financial research capabilities and

long-standing commitment to responsible investment, Amundi is a key

player in the asset management landscape.

Amundi's clients benefit from the expertise and

advice of 5,400 employees in 35 countries. A subsidiary of the

Crédit Agricole group, Amundi is a listed company and currently

manages almost €1.9 trillion in assets24.

Amundi, a trusted partner, working every

day in the interest of its clients and society.

www.amundi.com

Press contact:

Natacha AndermahrTél. +33 1 76 37 86

05natacha.andermahr-sharp@amundi.com

Nathalie BoschatTel. +33 1 76

37 54 96nathalie.boschat@amundi.com

Investor contacts:

Anthony MellorTel. +33 1 76 32

17 16anthony.mellor@amundi.com

Thomas LapeyreTel. +33 1 76 33

70 54thomas.lapeyre@amundi.com

DISCLAIMER:

This document may contain projections concerning

Amundi's financial situation and results. The figures provided do

not constitute a “forecast” as defined in Commission Delegated

Regulation (EU) 2019/980.

This information is based on scenarios that

employ a number of economic assumptions in a given competitive and

regulatory context. As such, the projections and results indicated

may not necessarily come to pass due to unforeseeable

circumstances. The reader should take all of these uncertainties

and risks into consideration before forming their own opinion.

The figures presented were prepared in

accordance with IFRS guidelines as adopted by the European Union.

Data including Lyxor are estimated (with assumptions about the

restatement of certain activities retained by SG).

The information contained in this presentation,

to the extent that it relates to parties other than Amundi or comes

from external sources, has not been verified by a supervisory

authority, and no representation or warranty has been expressed as

to, nor should any reliance be placed on, the fairness, accuracy,

correctness or completeness of the information or opinions

contained herein. Neither Amundi nor its representatives can be

held liable for any decision made, negligence or loss that may

result from the use of this presentation or its contents, or

anything related to them, or any document or information to which

the presentation may refer.

1Adjusted data: excluding amortisation of

intangible assets and excluding integration costs and, for 9M 2021,

excluding the impact of Affrancamento. See page 8 for definitions

and methodology. 2 Assets under management and net inflows

including Lyxor AM as of Q1 2022 include assets under advisory and

assets marketed and take into account 100% of the Asian JVs’ assets

under management and net inflows. For Wafa in Morocco, assets are

reported on a proportional consolidation basis. 3 Medium/Long-Term

(MLT) Assets: excluding Treasury products.4 Morningstar open-ended

fund data at end September 2022. See page 25 Between 30/06/2022 and

30/09/20226 Bloomberg Euro Aggregate Index7 10-year OAT8

Morningstar open-ended fund data at end September 20229 Excluding

the Amundi BOC WM subsidiary in China10 Low-margin products11

Excluding Channel Business12 17.5% market share in open-ended

funds, vs. 17.2% at end June. Source: AMFI13 Source: Morningstar

Direct, Broadridge FundFile - Open-ended funds and ETFs worldwide,

end of September 2022 14 ETFs & ETCs15 Source: ETF GI, end of

September 2022 16 Excluding Amundi Technology’s revenues, which are

now reported on a separate line of the income statement17

Normalised data: data excluding exceptional performance fees (=

higher-than-average performance fees per quarter in 2017-2020).18

Excluding Amundi Technology’s revenues, which are now reported on a

separate line of the income statement19 Excluding treasury products

and CA and SG insurers20 Lyxor21 Please refer to section 4.3 of the

2021 Universal Registration Document filed with the French AMF on

12/04/2022

22 Source: IPE “Top 500 Asset Managers”,

published in June 2022, based on AuM at 31/12/2021.23 Boston,

Dublin, London, Milan, Paris and Tokyo24 Amundi data as at

30/09/2022

- 10.28.2022 - PR - 2022 Amundi's 9M and Q3 results

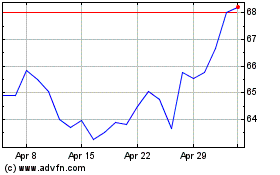

Amundi (EU:AMUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amundi (EU:AMUN)

Historical Stock Chart

From Apr 2023 to Apr 2024