CORRECTING and REPLACING: Antin Infrastructure Partners: Half-year Liquidity Contract Statement

09 July 2022 - 2:07AM

Business Wire

Regulatory News:

This replaces the announcement made at 5:45 PM CET on July 6 due

to multiple changes.

Antin Infrastructure Partners: Half-year

Liquidity Contract Statement

In accordance with the provisions of the French Financial

Markets Authority’s decision N°2021-01 of 22 June 2021 renewing the

implementation of liquidity contracts for shares as an accepted

market practice, Antin (Paris:ANTIN) informs the public of the

following1:

- Available resources on 30 June 2022: 38,734 Antin shares

and €925,584.47

- Number of transactions on buy side in the first half of

2022: 3,911

- Number of transactions on sell side in the first half of

2022: 3,640

- Traded volume on buy side in the first half of 2022:

345,145 shares for €9,129,717

- Traded volume on sell side in the first half of 2022:

297,650 shares for €7,856,291

As a reminder, at the date of signature of the liquidity

contract with BNP Paribas Exane (25 March 2022), the available

resources were 0 Antin shares and €2,000,000.00.

1 This statement cancels and supersedes the half-year liquidity

contract statement released on 6 July 2022.

TRANSACTIONS DETAILS

Date

Buy side

Sell side

Quantity of shares

Number of transactions

Traded volume in EUR

Quantity of shares

Number of transactions

Traded volume in EUR

March 2022

03-25-2022

6,538

68

184,311

3,102

42

87,823

03-28-2022

10,700

132

300,821

7,700

84

217,131

03-29-2022

9,895

150

288,239

9,020

137

263,452

03-30-2022

10,950

132

317,283

2,176

41

63,480

03-31-2022

32

1

922

2,000

26

57,897

April 2022

04-01-2022

1,560

21

44,916

400

9

11,706

04-04-2022

7,104

91

204,567

5,804

82

168,147

04-05-2022

8,500

91

251,129

3,450

54

102,389

04-06-2022

11,000

101

316,913

4,296

74

124,453

04-07-2022

7,350

106

207,513

5,927

80

167,962

04-08-2022

6,026

60

170,338

6,026

90

170,854

04-11-2022

6,024

59

169,944

280

5

7,929

04-12-2022

6,535

105

179,039

7,700

168

211,905

04-13-2022

7,540

80

209,957

3,296

55

92,327

04-14-2022

7,400

123

201,976

5,900

82

161,229

04-19-2022

5,850

56

157,786

3,857

57

104,217

04-20-2022

2,801

24

75,127

2,910

24

78,573

04-21-2022

5,350

214

143,351

5,350

50

143,816

04-22-2022

1,250

17

33,300

1,750

23

47,058

04-25-2022

7,566

86

201,517

2,066

13

56,276

04-26-2022

4,713

51

120,355

1,750

20

45,027

04-27-2022

3,250

43

81,020

2,207

29

55,299

04-28-2022

3,000

28

73,960

530

11

13,171

04-29-2022

1,500

6

37,430

4,976

50

124,528

May 2022

05-02-2022

8,964

66

218,748

9,100

141

223,533

05-03-2022

3,250

40

79,194

1,481

28

36,350

05-04-2022

9,501

102

226,721

274

6

6,609

05-05-2022

2,500

4

58,050

5,000

51

117,521

05-06-2022

4,600

57

102,622

4,501

8

100,463

05-09-2022

3,000

28

65,727

691

9

15,212

05-10-2022

2,000

16

42,946

5,000

69

107,671

05-11-2022

3,440

40

75,027

5,200

45

113,589

05-12-2022

3,166

23

70,271

4,516

41

100,781

05-13-2022

-

-

-

6,230

41

149,132

05-16-2022

7,500

87

189,557

7,500

92

190,122

05-17-2022

5,565

53

141,743

5,565

87

142,312

05-18-2022

7,251

91

188,050

8,250

58

214,649

05-19-2022

8,250

79

211,914

4,743

46

122,209

05-20-2022

1

1

25

6,747

60

177,079

05-23-2022

4,753

57

132,046

7,450

78

208,017

05-24-2022

6,650

90

191,141

7,850

97

226,556

05-25-2022

3,946

53

115,061

6,576

60

192,283

05-26-2022

3,423

34

101,488

4,693

62

140,095

05-27-2022

1,800

25

54,973

6,100

63

186,670

05-30-2022

5,000

54

154,013

4,620

51

142,602

05-31-2022

8,500

82

257,010

8,375

97

253,618

June 2022

06-01-2022

4,535

40

133,322

-

-

-

06-02-2022

2,170

30

61,675

5,300

48

151,336

06-03-2022

3,025

34

87,272

3,000

26

86,666

06-06-2022

2,500

23

71,750

5,000

52

144,625

06-07-2022

5,460

74

154,893

2,766

59

78,712

06-08-2022

4,000

40

110,506

1

1

28

06-09-2022

1,200

30

32,916

5,000

82

138,137

06-10-2022

6,770

85

181,823

4,134

81

111,605

06-13-2022

5,750

56

146,903

2,643

43

67,883

06-14-2022

7,509

73

186,260

4,600

71

114,120

06-15-2022

3,500

51

83,772

3,960

46

95,118

06-16-2022

5,175

46

121,487

2,227

44

52,329

06-17-2022

3,200

19

74,853

4,496

42

105,458

06-20-2022

4,629

44

107,521

3,670

47

85,928

06-21-2022

6,367

49

146,468

7,326

65

169,309

06-22-2022

5,704

51

130,152

6,000

82

136,915

06-23-2022

5,750

36

130,979

5,750

91

131,224

06-24-2022

3,395

24

78,264

4,645

32

107,667

06-27-2022

2,500

23

59,575

7,643

65

182,506

06-28-2022

3,750

27

89,433

2,553

27

61,388

06-29-2022

6,512

67

151,377

1,251

17

29,224

06-30-2022

6,250

62

140,475

2,750

23

62,394

FIRST-HALF 2022

345,145

3,911

9,129,717

297,650

3,640

7,856,291

About Antin Infrastructure Partners

Antin Infrastructure Partners is a leading private equity firm

focused on infrastructure. With over €22bn in Assets Under

Management across its Flagship, Mid Cap and NextGen investment

strategies, Antin targets investments in the energy and

environment, telecom, transport and social infrastructure sectors.

With offices in Paris, London, New York, Singapore and Luxembourg,

Antin employs over 175 professionals dedicated to growing,

improving and transforming infrastructure businesses while

delivering long-term value to portfolio companies and investors.

Majority owned by its partners, Antin is listed on compartment A of

the regulated market of Euronext Paris (Ticker: ANTIN ISIN:

FR0014005AL0).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220708005218/en/

Media Nicolle Graugnard,

Communication Director Email: nicolle.graugnard@antin-ip.com

Shareholder Relations

Ludmilla Binet, Head of Shareholder Relations Email: ludmilla.binet@antin-ip.com

Brunswick Email:

antinip@brunswickgroup.com Tristan Roquet Montegon: +33 (0)6 37 00

52 57 Gabriel Jabès: +33 (0)6 40 87 08 14

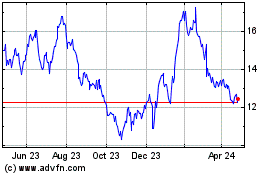

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

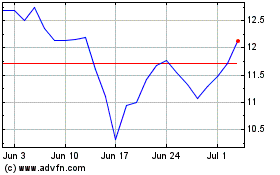

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Apr 2023 to Apr 2024