Execution of ANTIN INFRASTRUCTURE PARTNERS’ growth strategy

continued; Hard cap for Flagship Fund V set at €12bn

Regulatory News:

Antin Infrastructure Partners (Paris:ANTIN):

HIGHLIGHTS OF THE QUARTER

- Fundraising for Flagship Fund V ongoing. Target commitments at

€10bn, hard cap set at €12bn

- Fundraising for NextGen Fund I progressed with €0.8bn of

commitments secured

- Capital continued to be deployed at a steady pace with two

inaugural investments signed for NextGen Fund I during the quarter,

SNRG and Power Dot. Investment in RAW Charging announced after the

end of the reporting period

- Exit of lyntia Networks from Flagship Fund III and Fund III-B

announced in May

- All funds are performing either ahead of plan or on plan. Gross

Multiples were largely stable compared with 1Q 2022

FUNDRAISING

- AUM at €22.4bn as of 30 June 2022, up +12.8% over the last

twelve months and up +1.7% versus 1Q 2022

- Fee-paying AUM at €13.6bn, up +1.3% over the last twelve months

and down (0.9)% compared to 1Q 2022 due to the realisation of

investments

- Fundraising environment remained constructive, supported by

fund investors’ increased focus on inflation protection and

appetite for real assets

- Fundraising for Flagship Fund V started with good momentum

following its launch at the end of March 2022. First close of Fund

V is expected during 3Q 2022, pending announcement of a final

investment in Flagship Fund IV. Fund V target commitments at €10bn

and hard cap set at €12bn

- Following first close of NextGen Fund I in December 2021,

fundraising progressed with €0.8bn in commitments secured at the

end of the second quarter. Fundraising expected to be largely

completed by the end of 2022

INVESTMENT ACTIVITY

- Investments totalled €1.7bn over the last twelve months across

Flagship, Mid Cap and NextGen (€2.9bn including

co-investments)

- Capital deployment began strongly for NextGen Fund I with two

inaugural investments signed during the second quarter, SNRG and

Power Dot. A third investment (RAW Charging) was announced after

the end of the reporting period. All three investments demonstrate

a strong commitment to the decarbonisation of transport and

energy

- SNRG is a UK developer and operator of fully integrated smart

grids for residential and industrial & commercial customers,

announced and closed in 2Q 2022

- Power Dot is a leading European electric vehicle charging

platform. Transaction expected to close in 3Q 2022

- Flagship Fund IV was ~61% invested as of 30 June 2022. Mid Cap

Fund I is already ~36% invested as of 30 June 2022, 12 months after

final close. NextGen Fund I was ~15% invested as of 30 June 2022 on

the basis of the fund’s target commitments of €1.2bn, and ~22%

invested including the acquisition of RAW Charging announced after

the end of the reporting period

EXIT ACTIVITY

- Gross Exits announced over the last twelve months amounted to

€2.0bn (€2.3bn including co-investments)

- In the second quarter, Antin announced its exit from lyntia

Networks, a leading wholesale operator in the Spanish

telecommunications market. Closing is expected by the end of the

year. Antin continues to own lyntia Access, a wholesale

Fibre-to-the-Home platform. Inclusion in activity report upon full

exit of lyntia

FUND PERFORMANCE

- All funds are performing either ahead of plan or on plan

- Flagship Funds II and III are ahead of plan with Gross

Multiples of 2.6x and 1.8x respectively. Gross Multiple for

Flagship Fund III improved by +0.1x over the quarter

- Flagship Fund IV, Fund III-B and Mid Cap Fund I are performing

on plan with Gross Multiples of 1.3x, 1.6x and 1.1x respectively.

Improvement of +0.1x for Fund III-B over the quarter

FINANCING

- Majority of portfolio company debt financing is either fixed

rate or hedged, mitigating the effects of increasing interest rates

on Antin’s portfolio companies

- Infrastructure debt financing remained available to Antin

during the quarter, despite the challenging capital market and

macroeconomic environment

- £4.9bn in debt capital raised for CityFibre in June 2022. This

represents the largest debt financing ever completed by Antin and

ranks among the largest fibre debt financing transactions completed

in Europe to date

PEOPLE

- Total number of employees amounted to 191 on 30 June 2022 and

165 excluding the fund administration team based in Luxembourg

- Number of employees increased by +12 during the quarter and by

+23 since the beginning of the year excluding the fund

administration team

- Several key hires made during the quarter, including the

appointment of Rakesh Shankar as Partner based in New York

dedicated to the NextGen strategy

- Execution of the hiring plan is on track to support Antin’s

near-term growth in FPAUM. Slower pace of hiring expected for the

remainder of 2022

ESG

- Antin rated as “low risk” by Sustainalytics, a leading

independent Environmental, Social and Governance (ESG) research,

ratings and analytics firm, in first‑ever rating of the Group

- Result places Antin in the top ~1% of all companies rated in

the “Asset Management and Custody Services” sector by

Sustainalytics

POST CLOSING EVENTS

- Acquisition of a majority stake in RAW Charging announced on 8

July 2022 from NextGen Fund I. RAW Charging is a fast‑growing

owner-operator of public electrical vehicle charging stations in

the UK. Closing expected in 3Q 2022

APPENDIX

DEVELOPMENT OF AUM AND FEE-PAYING AUM OVER THE LAST TWELVE

MONTHS

€bn

AUM

Fee-Paying AUM

Beginning of period, 30 June

2021

19.9

13.4

Gross inflows

2.1

1.0

Step-downs

-

-

Exits (1)

(2.3)

(0.8)

Revaluations

2.7

-

FX and other

-

-

End of period, 30 June 2022

22.4

13.6

Change in %

+12.8%

+1.3%

QUARTERLY DEVELOPMENT OF AUM AND FEE-PAYING AUM

€bn

AUM

Fee-Paying AUM

Beginning of period, 31 March

2022

22.0

13.7

Gross inflows

0.6

0.3

Step-downs

-

-

Exits (1)

(0.7)

(0.4)

Revaluations

0.5

-

FX and other

-

-

End of period, 30 June 2022

22.4

13.6

Change in %

1.7%

(0.9)%

ACTIVITY REPORT

€bn

Jun-2021 LTM

Jun-2022 LTM

AUM

19.9

22.4

Fee-Paying AUM

13.4

13.6

Fundraising

3.9

0.8

Fundraising incl. co-Investments

5.7

1.8

Investments

4.0

1.7

Investments incl. co-Investments

5.7

2.9

Gross exits (2)

1.7

2.0

Gross exits incl. co-Investments (2)

2.9

2.3

KEY STATS BY FUND

Fund

Vintage

AUM €bn

Fee- Paying AUM €bn

Committed Capital €bn

% Invested

% Realised

Gross Multiple

Expectation

Flagship

Fund II

2013

0.6

0.3

1.8

87%

92%

2.6x

Above plan

Fund III (2) (3)

2016

6.6

2.7

3.6

89%

23%

1.8x

Above plan

Fund IV

2019

10.4

6.5

6.5

61%

0%

1.3x

On plan

Fund III-B (2)

2020

1.9

1.1

1.2

88%

0%

1.6x

On plan

Mid Cap

Fund I

2021

2.2

2.2

2.2

36%

0%

1.1x

On plan

NextGen

Fund I (4)

2021

0.8

0.8

0.8

15% (5)

0%

-

-

DEFINITIONS

Antin: Umbrella term for Antin Infrastructure Partners

S.A.

Antin Funds: Investment vehicles managed by Antin

Assets Under Management (AUM): Operational performance

measure representing both the assets managed by Antin from which it

is entitled to receive management fees or a carried interest, the

assets from co-investment vehicles which do not generate management

fees or carried interest, and the net value appreciation on current

investments

Carried Interest: A form of revenue that Antin and other

carried interest participants are contractually entitled to receive

via its direct or indirect entities in the Carry Vehicles of the

Antin Funds. Carried Interest corresponds to a form of variable

consideration that is fully dependent on the performance of the

relevant Antin Fund and its underlying investments

Committed Capital: The total amounts that fund investors

agree to make available to a fund during a specified time

period

Exits: Cost amount of realisation of investments through

a sale or write-off of an investment made by an Antin Fund. Refers

to signed realisations in a given period

Fee-Paying Assets Under Management (FPAUM): The portion

of AUM from which Antin is entitled to receive management fees or

carried interest across all of the Antin Funds at a given time

Gross Exits: Value amount of realisation of investments

through a sale or write-off of an investment made by an Antin Fund.

Refers to signed realisations in a given period

Gross Inflow: New commitments through fundraising

activities or increased investment in funds charging fees after the

investment period

Gross Multiple: Calculated by dividing (i) the sum of (a)

the total cash distributed to the Antin Fund from the portfolio

company and (b) the total residual value (excluding provision for

carried interest) of the Fund’s investments by (ii) the capital

invested by the Fund (including fees and expenses but excluding

carried interest). Total residual value of an investment is defined

as the fair market value together with any proceeds from the

investment that have not yet been realised. Gross Multiple is used

to evaluate the return on an Antin Fund in relation to the initial

amount invested.

Investments: Signed investments by an Antin fund

% Invested: Measures the share of a fund’s total

commitments that has been deployed. Calculated as the sum of (i)

closed and/or signed investments (ii) any earn-outs and/or purchase

price adjustments, (iii) funds approved by the Investment Committee

for add-on transactions, (iv) less any expected syndication, as a %

of a fund’s committed capital at a given time

% Realised: Measures the share of a fund’s total value

creation that has been realised. Calculated as realised value over

the sum of realised value and remaining value at a given time

Realised Value / (Realised Cost): Value (cost) of an

investment, or parts of an investment, that at the time has been

realised

Remaining Value / (Remaining Costs): Value (cost) of an

investment, or parts of an investment, currently owned by Antin

funds (including investments for which an exit has been announced

but not yet completed)

Step-Downs: Normally resulting from the end of the

investment period in an existing fund, or when a subsequent fund

begins to invest

ABOUT ANTIN INFRASTRUCTURE PARTNERS

Antin Infrastructure Partners is a leading private equity firm

focused on infrastructure. With over €22bn in Assets under

Management across its Flagship, Mid Cap and NextGen investment

strategies, Antin targets investments in the energy and

environment, telecom, transport and social infrastructure sectors.

With offices in Paris, London, New York, Singapore and Luxembourg,

Antin employs over 190 professionals dedicated to growing,

improving and transforming infrastructure businesses while

delivering long-term value to portfolio companies and investors.

Majority owned by its partners, Antin is listed on compartment A of

the regulated market of Euronext Paris (Ticker: ANTIN – ISIN:

FR0014005AL0)

Financial Calendar

1H 2022 Results

14 September 2022

3Q 2022 AUM

Announcement

4 November 2022

_____________________________ (1) Gross exits for AUM and exits

at cost for FPAUM (2) Excludes the partial sale of lyntia.

Inclusion in activity report upon full exit (3) % realised includes

the partial sale of assets from Flagship Fund III to Fund III-B (4)

Fundraising ongoing. Target commitments at €1.2bn. Hard cap at

€1.5bn (5) % invested calculated based on target commitments of

€1.2bn

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220720005800/en/

SHAREHOLDER RELATIONS

Ludmilla Binet Head of Shareholder Relations

Email: ludmilla.binet@antin-ip.com

MEDIA

Nicolle Graugnard Communication Director

Email: nicolle.graugnard@antin-ip.com

BRUNSWICK

Email: antinip@brunswickgroup.com

Tristan Roquet Montegon +33 (0) 6 37 00 52 57

Gabriel Jabès +33 (0) 6 40 87 08 14

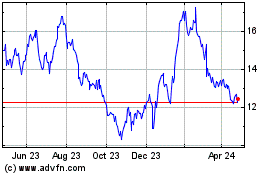

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

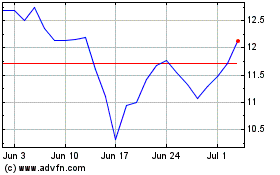

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Apr 2023 to Apr 2024