Believe: strong FY'22 operational and financial performance, on

trajectory to reach mid-term objectives 2 years ahead of IPO plan

Strong FY’22 operational and financial

performance on trajectory to reach mid-term objectives 2 years

ahead of IPO plan Paris, France – March 15,

2023

2022 Key Figures1

- Revenues of €760.8 million, up +31.8% at current rate with an

organic growth of +32.2%.

- Digital revenue growth of +33.8% out of which +34.7%

organically.

- Adjusted EBITDA at €34.7 million or a margin of 4.6% (versus

4.0% in FY’21).

- Positive Free cash flow generation of €52 million (versus

negative free cash flow in FY’21).

- Net cash at the end of December’22 just above €300

million.

2022 Highlights

- Strong performance of the portfolio of artists and labels

reflecting successful positioning on digital music genres.

Additional market share gains across key markets, notably in Europe

and Asia.

- Significant level of new artist and label signings and strong

renewals with top artists and labels reflecting appeal and clear

perception of differentiated digital capabilities. Continued

investment in Automated and Premium Solutions fueling profitable

growth and further building market share.

- Group profitability improvement, reflecting better amortization

of Central Platform costs.

- Achieving positive free cash flow generation ahead of IPO Plan

uplifting firepower for M&A.

- Progress in key CSR indicators and Group’s commitment to Shape

Music for Good well recognized by non-financial rating

agencies.

2023 Outlook

- Since the IPO, Believe has demonstrated its capacity to control

its investment cycle according to its organic growth and deliver on

its profitability trajectory.

- In FY’23, the Group will continue to drive a profitable growth

strategy towards its long-term target of 15% Adjusted EBITDA

margin.

- For FY’23, the Group is organized to deliver profitable growth

in a base scenario of degraded economic environment. Believe is

also ready to accelerate investments in case of better

macro-economic conditions.

- The assumptions underlying Believe’s growth scenario for FY’23

are continued increase in paid streaming, continued market share

gains and challenging ad-funded streaming monetization, which led

the Group to anticipate:

- Organic growth of +18%

- Further progressive improvement in Adjusted EBITDA margin: c.

5.0%

- Positive free cash flow

- Believe expects to leverage its cash to resume its acquisition

strategy in FY’23 driven by opportunities created by current market

conditions.

Denis Ladegaillerie, Founder and

CEO said: “We ended 2022 strongly delivering above our IPO

commitments both operationally and financially for the second year

in a row. In 2022, as we have done each year since 2005, we did

what we said we would do ... or better. We grew our market share;

we improved profitability; we generated significant cash flow from

our operations. Every day the music market becomes more digital and

our differentiated positioning and our competitive advantages in

the digital world become clearer to our artists

and our partners. The quality of services that our teams provide by

leveraging their passion for music, digital expertise and

technology solutions contributes to the success of a wide variety

of local labels and artists all around the world at all stages of

their career. In 2023, we will continue our profitable growth

strategy: invest in our teams to grow market share, innovate in

audience development products for our artists and labels, and

further drive operational efficiencies through technology and scale

to increase profitability. We aim to be the best music company at

developing artists and labels in the digital ecosystem. Everyday my

belief that Believe is best positioned to succeed becomes

stronger.”

2022 KEY FIGURES

| in

€million |

FY 2021 |

FY 2022 |

Change YoY |

Organic change |

| Group Revenues |

577.2 |

760.8 |

+31.8% |

+32.2% |

|

Premium Solutions |

541.3 |

712.6 |

+31.6% |

+32.5% |

|

Automated Solutions |

35.8 |

48.2 |

+34.5% |

+27.1% |

| Adjusted EBITDA pre-central

platform |

83.3 |

107.9 |

+29.4% |

|

| in % of revenues |

14.4% |

14.2% |

(20)bps |

|

|

Premium Solutions |

78.0 |

101.3 |

+29.8% |

|

|

Automated Solutions |

5.3 |

6.6 |

+23.9% |

|

| Central Platform |

(60.0) |

(73.2) |

+21.9% |

|

| Group's Adjusted

EBITDA |

23.3 |

34.7 |

+48.9% |

|

|

in % of revenues |

4.0% |

4.6% |

+60bps |

|

| Operating income / loss (EBIT) |

(19.6) |

(22.3) |

|

|

| Net cash from operating activities |

(7.7) |

73.7 |

|

|

| Free cash flow |

(30.7) |

52.0 |

|

|

| Cash on the balance sheet |

262.7 |

303.3 |

|

|

2022 HIGHLIGHTS

Strong performance of the portfolio of artists and

labels across key markets

Believe once again delivered an outstanding

performance in FY’22. Based on strong growth momentum, all

businesses recorded increases in revenue from their existing

portfolio and further expanded their roster by signing new artists

and labels. The Group demonstrated its winning strategy of

progressively building local teams to address the ever-growing

number of music genres as they are becoming more and more

digital.

The success of the Group’s model and strategy to

best serve artists and labels at all stages of their career allowed

Believe to surpass €1.1 billion of digital music sales (DMS) for

2022 and grow its digital revenues by 34.7% organically. The

model’s appeal to artists and labels was proven in all markets, as

illustrated by the geographical diversity of the large number of

artists and labels joining Believe: the number of artists served

directly or via labels by the Group indeed increased by around 200K

artists to reach the milestone of c. 1.3 million in FY’22.

Leadership positions in most key

markets, particularly in Europe and Asia Believe confirmed

its position in France in FY’22 as the second largest player in the

Top 200 streaming album chart for new releases for local

repertoire, as well as for the Top 200 catalogue streaming album

chart and the Top 200 single chart. Believe further demonstrated

its upstream capacity as highlighted by the successful development

of new artist Nej who reached Gold status with her project “SOS”.

Her track “Paro” also became one of the biggest successes on Tik

Tok worldwide with 22 billion views and 15 million content

creations.

In Germany, Believe became the third largest

recorded music company on local repertoire in the streaming market

in FY’22, as the local artists and labels in its roster reached new

heights in digital successes across all music genres. The Group was

also the second largest player for hip-hop in Germany and

demonstrated its unique capacity to cater to each artist’s needs as

they move from one stage of their career to the next. The success

of Theo Junior, who started out as a TuneCore artist to the top

charted positions, or the new milestones achieved by Milky Chance

who generated 1.2 billion streams in FY’22 and reached a new peak

with their all-time hit “Stolen Dance” are tribute to the strength

of the Group’s solutions.

Believe continued to significantly grow and gain

market share across the markets it operates in Asia, leveraging

continued investment in local teams, reinforced management

capabilities, and strategic partnerships in India and in the

Philippines. The Group is now positioned as leader in India and

Southeast Asia, while further accelerating its deployment in the

Greater China region. Believe has significantly built up its

capabilities in its Label and Artist Solutions since 2018 and

Artist Service since 2021 and now has c. 80 people in 5 offices in

Greater China. The level of activity remained sustained throughout

the year as the digital monetization increased in Greater China,

which led to the signings in Premium Solutions of more than 300

labels and above 250 artists directly.

Reinforced appeal to highly successful

talent producers thanks to market leadership in digital

The significant growth and achievements of the Group has deeply

increased its appeal to well-known and highly successful producers

who want to develop artists in the digital ecosystem. Believe has

set up two strategic investments in Europe and one in India to

create labels with talented partners who provide additional

sourcing capabilities on top of their expertise. These new labels

will focus on music genres that are already digital or start

transitioning, which will contribute to accelerated revenue

growth.

In France, the Group invested in Structure, a

new French pop label partnering with two successful producers,

behind the recent success of several multi-platinum French pop

artists. This partnership further expands the Group’s sourcing

capacities and penetration of the French pop market, which has been

initiated in Q4’21 with the strategic partnerships with PlayTwo and

Jo&Co, as the genre is becoming more digital. Believe

also invested in Madizin Music, a German well-known brand managed

by two renowned producers, composers, and entrepreneurs. With this

partnership, Believe joins hands with Madizin Music label’s

passionate music team to continue their path and to focus on German

language music – Pop and traditional Schlager music which have just

started their digitalization. In India, Believe signed an exclusive

agreement with Panorama Music, that has just been founded by a

prominent Indian film producer, distributor and studio executive in

India’s music and entertainment industry who is behind several

Bollywood blockbusters. This agreement will accelerate the Group’s

expansion in the new Bollywood Original Soundtrack market, which

constitutes the country’s largest music segment and is also

progressively switching to digital.

Continuous investment in tech-enabled

products and solutions to foster the highest level of service for

all labels and artists at all stages of their career

In FY’22 Believe upgraded its marketing suite

with new audience development products which are consistently

leveraged by local teams to service artists directly or through

their labels. Those products leverage AI and data mining capacities

to help increase the reach and efficiency of the promotion and

marketing activities. The Group also launched Encore, a mobile

version of the Datamusic suite used by artists and labels to track

their global performance, connect with fans, celebrate their

success, and identify when they are in the spotlight.

In Automated Solutions, TuneCore established

itself as the global DIY leader, offering music creators and

self-releasing artists one of the highest level of services

available in the industry. The Unlimited Pricing offer, which was

introduced in June, provided them with a large choice of options to

distribute their content on a regular basis in line with their

expectations. This new offer will ensure TuneCore retains its

status as the world’s highest paying distribution service for

self-releasing artists and music creators, proven by the milestone

of $3 billion earned by TuneCore users since its launch in 2006.

There is a strong pipeline of new features planned for 2023

including new Split functionalities as well as several improvements

in the user experience to further reinforce the appeal of its

automated platform. Self-releasing artists now have the option to

create a split on a release once it has been fully uploaded for

distribution, which allows to directly share streaming and download

royalties with the people who help them to create their music.

TuneCore’s efforts to offer the highest quality of service and

innovation have been recognized in March 2023, as TuneCore ranked

#3 in the Fast Company’s 10 Most Innovative Music Companies

list.

Further progressing in its CSR project

to Shape Music for GoodBelieve was active in building

trusting relationships with respect, fairness and transparency,

notably through sharing value creation with artists, labels and

internal teams. Believe pursued the association of employees to

value creation with a second LTI plan for key executives, the first

employee shareholding plan and the implementation of a capital gain

sharing agreement between the CEO and the Company to the benefits

of employees (one of the first in France for listed companies).

The Group continued its active policy towards

promoting gender diversity in the music industry and across all

levels of its organization. Along a gender balanced board of

directors and executive committee, gender diversity progressed

across the Group. Women represented 43.1% of the total headcount in

FY’22 (versus 40.0% in FY’21) and 37.6% of the managers (versus

34.0% in FY’21). Believe also maintained an excellent result of

99/100 for the French remuneration metric “Gender Equality index”

for France. Believe also extended the measurement of gender equal

remuneration to the Group key countries by drawing inspiration from

the French index calculation.

Strong organic revenue growth throughout

the full year FY’22 revenues grew by +31.8% to reach

€760.8 million, largely driven by strong organic growth

(+32.2%). Digital revenues, which represented 92.3% of

Group’s revenues (compared with 90.9% in FY’21) were up +34.7%

organically, reflecting streaming market growth and additional

market share gains. The Group further benefited from the expansion

of services’ offer in key markets and continuing investment in

local teams and capabilities over the past three years. Non-digital

sales increased by +7.6% organically during the year, mainly driven

by revenue growth in merchandising, live and branding activities

which offset the decline of the demand for physical sales.

As anticipated, organic growth was well above

+30% in the full year notwithstanding a lower increase rate in

Q4’22 than in Q3’22 (+22.6% versus +37.6% in Q3’22). The decrease

in the growth rate was notably driven by ad-funded streaming

revenues, which only grew by low double digits in the last quarter

of FY’22, affecting both Premium and Automated segments.

Growth in all geographies, with a

particularly strong increase in Asia Pacific and

Africa

| in €

million |

FY 2021 |

FY 2022 |

Change YoY |

| APAC / Africa |

130.5 |

199.3 |

+52.7% |

| France |

96.0 |

128.6 |

+34.0% |

| Americas |

83.5 |

109.2 |

+30.7% |

| Europe (excl. France &

Germany) |

164.7 |

210.2 |

+27.6% |

| Germany |

102.4 |

113.6 |

+11.0% |

|

Total |

577.2 |

760.8 |

+31.8% |

In FY’22, revenue growth reached +52.7%

in Asia Pacific and Africa which represented 26.2%

of Group revenues (versus 22.6% in FY’21). Market dynamics remained

strong throughout the year despite a slowdown in the growth of

ad-funded streaming revenues since June’22 which impacted the

activity of the region. The expansion of premium services’ offer

and the strategic partnerships with Think Music and VMAG enabled

strong growth in India and Southeast Asia, while the Group

accelerated its development in Greater China during the

year.

In France, revenues increased

by +34.0% in FY’22 and represented 16.9% of Group revenues. The

Group confirmed its position as a key player in France and its

capacity to develop better and further established artists,

newcomers, and catalogue within a digital world. Besides, Believe

increased its appeal to a wider variety of music genres, notably

thanks to the strategic partnerships signed with Play Two and

Jo&Co which contributed to accelerating the revenue growth in

FY’22.

Americas grew by +30.7% and

represented 14.3% of Group revenues, reflecting the success of

TuneCore’s “new artist” plan which allows music creators an

unlimited release of their songs to the music libraries of social

platforms for no upfront fee (revenue share model) and was launched

in November 2021. The full deployment of TuneCore Unlimited Pricing

in June was also successful but impacted revenue by subscriber as

anticipated. It is expected that this impact will be offset with a

ramp up in the subscription b ase in the future. Believe also

benefitted from the strength of its business in Brazil which

remained very dynamic throughout the year.

Europe (excluding France and

Germany) recorded revenue growth of +27.6% and represented

27.6% of total revenues in FY’22 (versus 28.5% in FY’21 reflecting

decreasing weight of the Russian business). The Group remained on a

strong growth trajectory in the UK, Southern Europe and Eastern

Europe, while the level of activity remained sustained in Italy.

Revenues in the region were nevertheless affected by lower revenue

growth in Turkey (currency effect on the market) and Russia (that

represented c. 7.5% of the Group revenue in FY’22).

In Germany, revenues increased

by +11.0% in FY’22 and represented 14.9% of Group revenues. This

performance was mostly driven by digital activities which

outperformed the local market and the success of Believe on local

repertoire. Non-digital sales continued to drag on the overall

performance as the Group is still exiting from contracts which are

too heavy in physical sales.

Premium and Automated Solutions both driving the revenue

growth and greater artist monetization as illustrated by Digital

Music Sales which surpassed €1.1bn

Digital Music Sales2 amounted to €1.1billion in

FY’22, confirming the success of the Group’s model and commercial

strategy to best serve artists and labels at all stages of their

career.

Premium Solutions DMS, which are the basis of

digital revenues in the segment recorded significant growth of

+33.8% to reach 658.6 million in FY’22. Revenues amounted to €712.6

million, up +31.6% year-over-year reflecting strong organic growth

(+32.5%). The positive perimeter effect related to the integration

of FY’21 acquisitions was offset by a negative exchange rate impact

driven by the devaluation of the Turkish lira. With more music

genres becoming digital, Believe accelerated its investment in key

markets expanding its services’ offer and local capabilities in the

last years. This resulted in a strong performance throughout the

year and strengthened market positions in several geographies.

Automated Solutions reported DMS of €475.6

million, up +10.1% year-over-year. Revenues, which are not directly

correlated to DMS due to the subscription model of TuneCore,

amounted to €48.2 million or an increase of +34.5%. This strong

performance reflected organic growth of +27.1% and a positive forex

impact mainly related to the appreciation of the dollar versus the

euro. The launch of the new pricing offer drove subscriptions up,

while revenue per subscriber reflected positive trends with an

increased number of creators switching from the discovery offer to

the highest pricing plan throughout the second half of 2022. The

level of activity was also supported by the international

deployment of TuneCore and its localization

strategy.

Improvement of the Adjusted EBITDA

margin thanks to better amortization of Central Platform

costs

Aligned with the strong organic growth,

Adjusted EBITDA pre-Central Platform costs3 grew

by 29.4% in FY’22 to reach €107.9 million (versus €83.3 million in

FY’21). Believe continued investing throughout 2022 to support its

profitable growth strategy. In Premium Solutions, the Group

deployed additional sourcing and servicing capabilities across its

key markets with a strong focus on Europe and Asia, given growth

prospects in the regions. In Automated Solutions, the Group pursued

its investment to deploy the new Unlimited Pricing offering and

further upgrade the user experience on TuneCore interface,

including the development of new features. Overall, the Adjusted

EBITDA margin pre-Central Platform costs were stable compared with

FY’21 and amounted to 14.2% of revenue. This margin includes growth

investment in both segments, which represented approximately 5% of

total revenues for FY’22.

The Central Platform costs

(€73.2 million in FY’22 versus €60.0 million in FY’21) have

continued to decrease over revenue representing 9.6% of Group

revenues compared with 10.4% in FY’21. As announced at the IPO, the

scale up of the Central Platform has been completed by the end of

2020. Since then, the Group has pursued its investment in the

Central Platform but at a much lower pace to remain at the

forefront of innovation, to further strengthen its relationships

with digital partners and deploy its solutions to more market

segments and music genres. Consequently, Believe continued its

investment on its proprietary tech-enabled products and solutions

to optimize their efficiencies and impact, notably by deploying

more spending in data analysis and digital marketing, both key in

the audience and monetization development solutions that local

teams leverage to service artists and labels.

As for previous years, some Central Platform

investments are capitalized under IFRS accounting principles. In

FY’22, total investment (P&L and capitalized costs) in the

Central Platform amounted to c. €89 million. Total investment went

up +11.2% year-over-year compared with organic revenue growth of

+32.2%.

The Group’s Adjusted EBITDA

amounted to €34.7 million in FY’22 compared with €23.3 million in

FY’21, up +48.9% year-over-year, as the better amortization of

Central Platform costs is providing solid operating leverage.

Consequently, Adjusted EBITDA margin stood at 4.6% in FY’22

compared with 4.0% in FY’21 and is well on track with the mid-term

objective (Group adjusted EBITDA margin of 5% to 7% by 2025).

Operating loss (EBIT) reflecting an

increase in D&A related to FY’21

acquisitionsDepreciation & Amortization amounted to

€44.9 million in FY’22 compared with €33.7 million in FY’21. This

increase was mostly related to the acquisitions completed in Q4’21.

As a result EBIT amounted to €(22.3) million in FY’22,

compared with a loss of €(19.6) million in FY’21.

Positive free cash flow and solid level

of firepower for the M&A strategy Free cash flow was

positive by €52.0 million in FY’22, a significant improvement

compared with last year (€30.7 million negative in FY’21). Believe

returned to positive free cash flow generation thanks to a working

capital variation of €53.4 million, the increase in Adjusted EBITDA

and lower capital expenditures as a percentage of revenues (3.3%

versus 4.6% in FY’21).

Working capital variation was back to positive

territory as customer advances progressed but were not marked by

longer term contracts with large labels. In FY’21, the renewal of

several tier one labels based on longer term generated a peak in

advances. In addition, the positive working capital variation was

enhanced by an annual installment of approximately €20 million from

one digital partner, which was renewed in Q3’22 and switched from

quarterly to annual payment in advance.

Cash on the balance sheet amounted to €303.3

million at the end of December’22 compared with €262.7 million at

the end of December’21, mostly reflecting the positive free cash

flow generation. Believe has therefore surpassed its post-IPO cash

level and is well positioned to further execute its bolt-on M&A

strategy in FY’23.

FY’23 OUTLOOK AND MID-TERM OBJECTIVES

Since the IPO, Believe has demonstrated its

capacity to control its investment cycle according to its organic

growth and deliver on its profitability trajectory. In FY’23, the

Group will therefore continue to drive a profitable growth

trajectory towards its long-term profitability objective.

For FY’23, the Group is organized to deliver

profitable growth in a scenario of a degraded economic environment

impacting ad-funded streaming activities. Believe is also ready to

accelerate its investments if macro-economic conditions enable the

Group to generate stronger growth.

Believe’s growth scenario for FY’23 implies

further increase and deployment of paid streaming, additional

market share gains and challenging ad-funded streaming

monetization. The switch from ad-supported to paid streaming

is also expected to further progress in all markets. Based on these

assumptions, Believe expects FY’23 organic growth to be around +18%

for the Group. This would represent an organic CAGR of c. +25% for

the period 2021-2023.

Believe is committed to continue investing in

its Central Platform to be at the forefront of innovation. The

Group will also pursue its strong investments in local sales and

capabilities to fuel its profitable growth and seize opportunities

offered by the accelerated digitalization of a wider variety of

music genres. The Group is also committed to raising progressively

its Adjusted EBITDA margin and will therefore monitor its

investment pace and focus on improving efficiency to reach an

Adjusted EBITDA margin of c. 5% in FY’23.

The Group is expected to generate positive free

cash flow for the full year. It will benefit from a second annual

installment of approximately €20 million in Q3’23 from one of its

digital partners, which was renewed in Q3’22.

Overall, the Group is on track with its

strategic roadmap to build the best digital music company to

develop digital artists at all stages of their career. Believe

confirms its medium-term trajectory communicated at the IPO,

including a 2021-2025 CAGR of between +22% and +25% and a Group

Adjusted EBITDA of 5%-7% by 2025, implying a segment Adjusted

EBITDA margin of 15%-16% (which is a "high growth period" margin,

as the revenue growth is partially reinvested). Believe reiterates

its confidence in its ability to achieve its long-term target of at

least 15% Group Adjusted EBITDA margin.

Webcast: We will host a webcast

https://edge.media-server.com/mmc/p/hdkgs2ca and

conference call starting at 6:30 p.m. CET (5:30 p.m. GMT) today.

Denis Ladegaillerie, our Founder and CEO, and Xavier Dumont, our

Chief Financial and Strategy Officer, will present FY 2022 revenues

and earnings and answer questions addressed in the call or

submitted through the webcast. All information related to the

annual results are available on our investor website: Believe -

Investors Website - Financials

Conference call details:France, Paris: +33

(0) 1 70 91 87 04United Kingdom, London: +44 1 212 818

004United States, New York: +1 718 705 87 96Conference

ID: 88365

2023 financial agenda Believe (Ticker: BLV, ISIN:

FR0014003FE9):27 April 2023: Q1 2023 revenues - Press

release to be issued after market close

16 June 2023: Shareholders’ Annual General Meeting

2 August 2023: H1 2023 revenues and earnings - Press release to

be issued after market close

24 October 2023: Q3 2023 revenues - Press release to be issued

after market close

| Investor

Relations & Financial media Emilie

MEGEL investors@believe.comTel: +33 1

53093391 Cell: + 33 6 07 09 98

60 |

Press

Relations Manon

JESSUAmanon.jessua@believe.comAgathe

Joubert agathe.joubert@agenceproches.comCell: +33

7 63 13 60 99 |

Appendix

1. Use of Alternative Performance

Indicators

To supplement our financial information

presented in accordance with IFRS, we use the following non-IFRS

financial measures:

- DMS is the revenue generated from digital store partners and

social media platforms before royalty payment to artists and

labels.

- Organic growth accounts for revenue growth at a like-for-like

perimeter and at constant exchange rate.

- Adjusted EBITDA is calculated based on operating income (loss)

before (i) depreciation, amortization and impairment, (ii)

share-based payments (IFRS 2) including social security

contributions and employer contributions (iii) other operating

income and expense; and (iv) depreciation of assets identified at

the acquisition date net of deferred taxes from the share of net

income (loss) of equity-accounted companies.

- Free cash flow corresponds to net cash flows from operating

activities, after taking into account acquisitions and disposals of

intangible assets and property, plant and equipment, and restated

for (i) costs related to acquisitions, (ii) acquisition costs of a

group of assets, that does not meet the definition of a business

combination and (iii) advances related to distribution contracts

intended specifically for the acquisition of assets (acquisition of

companies, catalogs, etc).

2. Quarterly revenues by division

|

in € million |

Q1’21 |

Q1’22 |

Change |

Organic at constant rate |

| Premium solutions |

115.6 |

151.1 |

+30.7% |

+31.6% |

| Automated solutions |

8.5 |

11.4 |

+33.6% |

+28.6% |

|

Total revenues |

124.1 |

162.5 |

+30.9% |

+31.4% |

|

in € million |

Q2’21 |

Q2’22 |

Change |

Organic at constant rate |

| Premium solutions |

127.5 |

178.1 |

+39.7% |

+40.2% |

| Automated solutions |

8.5 |

11.6 |

+36.3% |

+27.6% |

|

Total revenues |

136.0 |

189.7 |

+39.5% |

+39.4% |

|

in € million |

Q3’21 |

Q3’22 |

Change |

Organic at constant rate |

| Premium solutions |

135.3 |

184.4 |

+36.2% |

+37.7% |

| Automated solutions |

8.6 |

12.6 |

+46.8% |

+36.1% |

|

Total revenues |

143.9 |

197.0 |

+36.9% |

+37.6% |

|

in € million |

Q4’21 |

Q4’22 |

Change |

Organic at constant rate |

| Premium solutions |

162.9 |

199.0 |

+22.2% |

+22.9% |

| Automated solutions |

10.2 |

12.5 |

+23.3% |

+17.5% |

|

Total revenues |

173.1 |

211.6 |

+22.3% |

+22.6% |

3. Q4 revenues by geography

|

in € million |

Q4’21 |

Q4’22 |

Change YoY |

| Asia-Pacific / Africa |

41.7 |

56.2 |

+34.8% |

| France |

28.4 |

35.1 |

+23.5% |

| Americas |

25.1 |

30.8 |

+22.7% |

| Europe (excl. France &

Germany) |

48.4 |

58.7 |

+21.2% |

| Germany |

29.5 |

30.9 |

+4.7% |

|

Total |

173.1 |

211.6 |

+22.3% |

4. Revenue breakdown between digital and non-digital

sales

|

|

Q1’21 |

Q2’21 |

Q3’21 |

Q4’21 |

FY’21 |

Q1’22 |

Q2’22 |

Q3’22 |

Q4’22 |

FY’22 |

| Digital sales |

90% |

92% |

92% |

90% |

91% |

93% |

92% |

94% |

91% |

92% |

| Non-digital

sales |

10% |

8% |

8% |

10% |

9% |

7% |

8% |

6% |

9% |

8% |

5. Digital and non-digital sales growth (as

reported)

|

|

Q1’22 |

Q2’22 |

H1’22 |

Q3’22 |

Q4’22 |

H2’22 |

FY’22 |

| Digital sales |

+35.3% |

+40.1% |

+37.8% |

+39.6% |

+22.8% |

+30.5% |

+33.8% |

|

Non-digital sales |

-6.5% |

+32.1% |

+11.4% |

+6.1% |

+17.6% |

+12.9% |

+12.2% |

About BelieveBelieve is one of

the world’s leading digital music companies. Believe’s mission is

to develop independent artists and labels in the digital world by

providing them the solutions they need to grow their audience at

each stage of their career and development. Believe’s passionate

team of digital music experts around the world leverages the

Group’s global technology platform to advise artists and labels,

distribute and promote their music. Its 1,650 employees in more

than 50 countries aim to support independent artists and labels

with a unique digital expertise, respect, fairness and

transparency. Believe offers its various solutions through a

portfolio of brands including Believe, TuneCore, Nuclear Blast,

Naïve, Groove Attack, AllPoints, Ishtar and Byond. Believe is

listed on compartment A of the regulated market of Euronext Paris

(Ticker: BLV, ISIN: FR0014003FE9). www.believe.com

Forward Looking statement This

press release contains forward-looking statements regarding the

prospects and growth strategies of Believe and its subsidiaries

(the “Group”). These statements include statements relating to the

Group’s intentions, strategies, growth prospects, and trends in its

results of operations, financial situation and liquidity. Although

such statements are based on data, assumptions and estimates that

the Group considers reasonable, they are subject to numerous risks

and uncertainties and actual results could differ from those

anticipated in such statements due to a variety of factors,

including those discussed in the Group’s filings with the French

Autorité des Marchés Financiers (AMF) which are available on the

website of Believe (www.believe.com). Prospective information

contained in this press release is given only as of the date

hereof. Other than as required by law, the Group expressly

disclaims any obligation to update its forward-looking statements

in light of new information or future developments. Some of the

financial information contained in this press release is not IFRS

(International Financial Reporting Standards) accounting

measures.

1 Alternative performance indicators are presented, defined and

reconciled with IFRS in appendices 1 of this press release (page

8).

2. Digital Music Sales or DMS is a non IFRS measure defined in

appendix 1

3. The Adjusted EBITDA pre-central platform costs consists in

the Adjusted EBIITDA of the Automated and Premium Solutions

segments before taking into account central platform costs. Central

platform costs account for the costs that cannot be allocated by

segment

- 2023-03-15-Believe-FY 2022 earnings-ENG

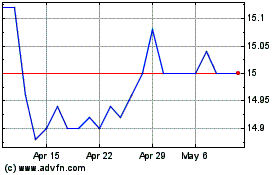

Believe (EU:BLV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Believe (EU:BLV)

Historical Stock Chart

From Apr 2023 to Apr 2024