AXA Shares Rise on EUR1 Billion Buyback, 1st Half Beating Expectations

03 August 2022 - 7:37PM

Dow Jones News

By Ed Frankl

Shares in AXA SA rose on Wednesday as it launched a share

buyback after beating expectations at its first-half results.

At 0850 GMT, shares were up 4.8% to EUR23.25

The buyback, worth up to 1 billion euros ($1.02 billion), would

launch as soon as is "reasonably practicable", based on market

conditions, the French insurer said.

It comes after EUR2.2 billion worth of shares were bought in the

year to date.

The Paris-based company reported first-half profit of EUR4.11

billion with revenue at EUR55.14 billion, beating expectations of

EUR3.37 billion and EUR54.61 billion, respectively, according to

analysts' consensus provided by the company.

The company shrugged off a pretax hit of around EUR300 million

net of reinsurance from the war in Ukraine, within previous

expectations of it being similar to a midsized catastrophe

event.

The share-buyback announcement came earlier than anticipated,

UBS analysts said in a note, with the bank having expected the

current macroeconomic environment to make this more likely a

year-end possibility.

The buyback program, which is due to complete by February 2023,

should likely lead to investors placing a lower cost of equity on

the stock, UBS said.

Write to Ed Frankl at edward.frankl@dowjones.com

(END) Dow Jones Newswires

August 03, 2022 05:22 ET (09:22 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

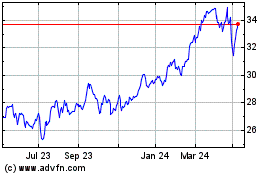

Axa (EU:CS)

Historical Stock Chart

From Mar 2024 to Apr 2024

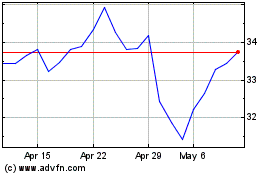

Axa (EU:CS)

Historical Stock Chart

From Apr 2023 to Apr 2024