Hitachi-Thales Deal Could Push Up Fares for Passengers, UK Watchdog Says

09 December 2022 - 7:06PM

Dow Jones News

By Joshua Kirby

Hitachi Ltd.'s planned acquisition of Thales SA's

rail-infrastructure business could lessen competition and drive up

fares in the U.K., the country's financial regulator said Friday,

warning of an in-depth probe of the deal if its concerns aren't

addressed.

The Japanese conglomerate last summer entered talks to buy

Thales's rail-signaling business for an enterprise vale of 1.66

billion euros ($1.75 billion.) The deal between Hitachi and the

French firm could eliminate a credible competitor from the

tendering process for mainline signaling to be held by U.K.

railway-infrastructure operator Network Rail, the country's main

customer for signaling, the Competition & Markets Authority

said.

"The resulting loss of competition across both mainline and

urban signaling markets could increase costs for Network Rail and

Transport for London and have an adverse knock-on effect on

taxpayers and passengers," the regulator said, referring to the

operator of the capital's metro network.

The country's signaling already suffers from a lack of

competition, with the market essentially limited to just two

suppliers, namely Germany's Siemens AG and France's Alstom SA, the

CMA said.

Hitachi now has the opportunity to submit proposals to resolve

the CMA's competition concerns. If it fails to address the

concerns, the deal will face a more thorough phase two

investigation, the CMA said.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

December 09, 2022 02:51 ET (07:51 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

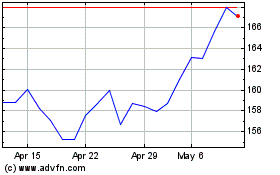

Thales (EU:HO)

Historical Stock Chart

From Mar 2024 to Apr 2024

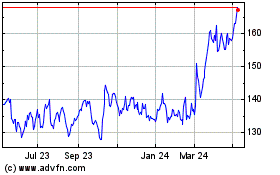

Thales (EU:HO)

Historical Stock Chart

From Apr 2023 to Apr 2024