ING 3Q Net Profit Rose, Supported by Increased Income -- Update

04 November 2021 - 6:17PM

Dow Jones News

By Sabela Ojea

ING Groep NV on Thursday reported a higher net profit for the

third quarter from the prior year, and said that it aims to reduce

its funding for the oil-and-gas sector by 2025 as part of its

target of reaching net-zero emissions by 2050.

The Dutch bank posted a net profit for the period of 1.37

billion euros ($1.59 billion) compared with EUR788 million for the

same period a year earlier.

Net interest income was EUR3.39 billion, up from EUR3.33 billion

for the year-earlier period. Total income climbed 8.4% to EUR4.65

billion, helped by higher fee income.

ING's common equity Tier 1 ratio--a key measure of balance-sheet

strength--was 15.8% at the end of the period, up from 15.3% as at

the third quarter of 2020 and 15.7% in the second quarter of

2021.

The lender also said it has reserved EUR684 million of quarterly

net profit for distribution in the third quarter, which is part of

the EUR1.74 billion share buyback program it launched on Oct.

5.

When the bank posted its second-quarter results, it said it

would distribute EUR3.62 billion to shareholders after Sept.

30.

Regarding its net-zero emissions target, ING said it has

sharpened its target for upstream oil and gas and now aims to

reduce its funding for the sector by 12% by 2025 when compared with

2019 levels. It will also set targets for the other eight sectors

of its "Terra approach", it added.

ING is measuring its lending in the sectors of its loan book

that are responsible for most greenhouse gas emissions: power

generation, fossil fuels, automotive, shipping, aviation, steel,

cement, residential mortgages and commercial real estate, it

said.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

November 04, 2021 03:02 ET (07:02 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

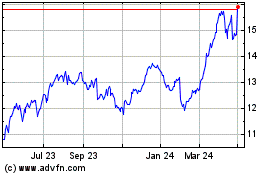

ING Groep NV (EU:INGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

ING Groep NV (EU:INGA)

Historical Stock Chart

From Apr 2023 to Apr 2024