Regulatory News:

A further new important step in the financial restructuring of

ORPEA S.A. (Paris:ORP) (the “Company”) has been achieved

with the signing of an agreement that crystallizes the commitment

of the parties to the agreement in principle announced on 1st

February (the “Agreement in Principle”) to support and

proceed with the actions required for the implementation of the

financial restructuring of the Company.

Therefore, the Company announces that it has concluded such

agreement, entitled lock-up agreement (the “Lock-Up

Agreement ”) with, on one hand, a group of French long-term

investors led by the Caisse des Dépôts et Consignations,

accompanied by CNP Assurances, and also including MAIF, accompanied

by MACSF (together the “Groupement”), and on the other hand,

the five main institutions (the “SteerCo”) coordinating a

larger group of unsecured financial creditors of ORPEA S.A.

On this occasion, the parties have reiterated their support to

the management and the Refoundation Plan of the Group, as presented

by the Company in its press release dated 15 November 2022.

The terms and conditions of the Lock-Up Agreement are common and

include, in particular, the undertaking of the signatory creditors

to support the financial restructuring of the Company in accordance

with the principles agreed in the Agreement in Principle and

accordingly, sign the required contractual documentation. These

provisions authorize the signatories, until the completion date of

the restructuring of the Company, to transfer the debt of the

Company they hold provided that the assignee is bound in the same

terms by the Lock-Up Agreement. Unsecured creditors who are not

signatories to this agreement will be able to access it under the

conditions set out in paragraph 2.

1. Details on the contemplated transactions – possibility of

transferring unsecured debt unconverted to an ad hoc

vehicle

Details on the contemplated transactions

In accordance with the provisions of the Lock-Up Agreement, the

members of the Groupement and of the SteerCo have notably

undertaken to subscribe, each as far as they are concerned, to

three successive capital increases, as the case may be in the form

of a backstop commitment, which will allow a significant reduction

in the Group’s net financial debt1.

By way of reminder, these transactions include (for more

details, see the press release published on 1 February 2023):

- The conversion in equity of the unsecured financial

indebtedness of ORPEA S.A., corresponding to a decrease of the

gross indebtedness of the Group of approximately 3.8 billion euros,

through a first capital increase with maintenance of the

preferential subscription rights of existing shareholders, of

approximately EUR 3.8 billion, guaranteed by all the unsecured

financial creditors of ORPEA S.A. who subscribe, as the case may

be, by way of set-off with their existing claims; and

- The equity injection in cash (new money equity) of EUR 1.55

billion, via two capital increases that would be subscribed by the

Groupement for around EUR 1,355 million in total, and a backstop

for the balance up to 195 million euros, provided by the

SteerCo.

As mentioned by the Company in its previous communications, the

implementation of the contemplated capital increases, which should

be completed in the course of the second semester of 2023, will

result in a massive dilution for existing shareholders, which, on

the basis of the financial parameters disclosed by the Company on

1st February 2023 and the valuation of the Company’s equity

retained by the parties for the purposes of these transactions,

would reflect issue prices significantly lower than the current

market price of ORPEA’s shares and a theoretical value of the

shares post-transactions below €0.20 per share.

In particular:

- the first capital increase of the Company2, which would lead

the existing shareholders to hold approximately 1% maximum3 of the

Company’s share capital (in the case where no existing shareholders

would subscribe thereto), would result in the issuance of

approximately 6.4 billion new shares for an issue amount of

approximately 3.8 billion euros, reflecting a theoretical issue

price for the new shares of approximately 0.59 euro per share,

- the second capital increase of the Company4, by allowing the

Groupement to hold approximately 50.2% of the Company’s share

capital, would result in the issuance of approximately 6.5 billion

new shares for an issue amount of approximately 1.16 billion euros,

reflecting a theoretical issue price of approximately 0.18 euro per

share,

- the third capital increase of the Company5, to which the

members of the Groupement undertake to subscribe on an irreducible

basis for 0.2 billion euros by exercising their preferential

subscription rights, and backstopped for the balance by members of

the SteerCo for the portion not subscribed by shareholders, as the

case may be6, as a result of which the existing shareholders would

hold approximately 0.4% maximum4 of the Company’s share capital (in

the case where no existing shareholders would subscribe to the

capital increases), with the issuance of approximately 2.9 billion

new shares for an issue amount of approximately 0.4 billion euros,

reflecting a theoretical issue price of approximately 0.13 euro per

share.

Thus, following the contemplated transactions, the existing

shareholders, if they decide not to participate in the capital

increases opened to them, would hold only about 0.4% maximum4 of

the capital of Company, while the Groupement would hold about 50.2%

of the capital of Company and the unsecured financial creditors

would hold about 49.4% of the capital of the Company.

In addition, after completion of the transactions, and on the

basis of the valuation of Company’s equity retained by the parties

for the purposes of these transactions, the unsecured financial

creditors which are parties to, or would accede to, the Lock-Up

Agreement, could recover about 30% of the nominal amount of their

claims (including the Support Fee referred to in paragraph 2

below), converted into capital as part of the first capital

increase described above.

Possibility of transferring unsecured debt unconverted to an

ad hoc vehicle

To the extent that certain unsecured financial creditors

approving the restructuring plan could not, or would decide not to

hold new shares under this first capital increase, these unsecured

financial creditors would be offered the possibility of

transferring their unsecured debt at its nominal value to an ad hoc

vehicle (special purpose vehicle - the "SPV"), in exchange

for debt instruments issued by the SPV. The SPV would subscribe to

the first capital increase, by way of conversion of the unsecured

debt transferred to the SPV, and would then hold itself shares of

the Company.

This possibility of transferring debt to the SPV will be limited

to a maximum subscription corresponding to 25 % of all unsecured

financial creditors (i.e. a principal amount of unsecured debt of

approximately EUR 942 million), it being specified that this

percentage could be increased if the members of the Groupement, the

members of the SteerCo and the Company agree on a different

percentage.

The main terms of the mandate of the SPV, which would be

specifically responsible for selling its equity stake in the

Company, would notably include provisions relating to the orderly

sale of the securities on the market or the non-transferability of

the shares for a certain period of time.

2. Accession to the Lock-Up Agreement

Creditors holding the unsecured debt of ORPEA S.A., described in

Annex 1 to this press release, will have the opportunity to accede

to the Lock-Up Agreement as of 14 February 2023 by contacting

Kroll, acting as agent for the Lock-Up (the “Agent”) (Attn:

Victor Parzyjagla and/or Thomas Choquet, orpea@is.kroll.com),

subject to compliance with the terms and conditions of the Lock-Up

Agreement.

In consideration for the undertakings made under the Lock Up

Agreement, SteerCo members and unsecured financial creditors who

have acceded to the Lock Up Agreement and accepted the terms and

conditions thereof (the “Participating Unsecured Creditors”)

will receive, under the conditions set out in the Lock-Up

Agreement, a support fee of 75 basis points calculated on the

nominal value of the relevant amounts of the unsecured debt they

hold (the “Support Fee”). This fee will be paid in cash by

the Company on or around the completion date of the financial

restructuring of ORPEA S.A.

The last accession date to accede to the

Lock-up Agreement is set at the earliest of: (i) the end of the

second Business Day (closing of the Paris Stock Exchange) before

the hearing to initiate the accelerated safeguard procedure before

the Nanterre Commercial Court and (ii) 31 March 2023 (with a

possible extension of this period subject to the prior approval of

the SteerCo Members and the Company) (the "Last Accession

Date").

It is however reminded that it is envisaged that the opening of

the accelerated safeguard procedure could happen in the coming

weeks, in which case the Last Accession Date would occur before 31

March 2023.

The procedures for accessing information relating to the

transaction for unsecured financial creditors wishing to accede to

the Lock-Up Agreement are described in Annex 2 to this press

release.

3. Next steps

The Company intends to continue its discussions with the

unsecured financial creditors who are not yet parties to the

Lock-Up Agreement in order to obtain their adherence to it, and to

present, within the deadline of the current conciliation procedure,

a request for the initiation of an accelerated safeguard procedure

in the course of March to enable the implementation of the

Agreement in Principle. The Company will keep the market informed

of the next steps of its financial restructuring7.

In parallel, the Company is continuing its discussions with its

secured bank creditors under tranches A, B and C of the June 2022

Financing Agreement in order to, in particular, finance its

Refoundation Plan and make the existing contractual documentation

compatible with its financial structure.

In addition, the Group intends to initiate discussions with the

other lenders of the Group which are parties to financing

agreements not affected by the conversion of unsecured debt into

equity, in particular in order to obtain the necessary approvals

regarding the potential change of control and to make, when

necessary, the provisions of the documentation of these existing

financings (“R1” and “R2” financial ratios in particular),

compatible with the new financial and shareholding structure of the

Group as it will be established after the implementation of the

financial restructuring plan.

* *

*

The Company confirms that information that could be qualified as

inside information within the meaning of Regulation No. 596/2014 of

16 April 2014 on market abuse and that may have been given on a

confidential basis to the various stakeholders in the context of

the negotiations has indeed been published to the market, either in

the past or in the context of this press release, with the aim of

re-establishing equal access to information relating to the Group

between the investors.

* *

*

About ORPEA

ORPEA is a leading global player, expert in the care of all

types of frailty. The Group operates in 22 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living, home care), post-acute and rehabilitation care and

mental health care (specialized clinics). It has more than 72,000

employees and welcomes more than 255,000 patients and residents

each year.

https://www.orpea-group.com/

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120, STOXX 600 Europe, MSCI Small Cap Europe and

CAC Mid 60 indices.

ANNEX 1

Unsecured debt of ORPEA S.A.

The unsecured debt of ORPEA S.A. whose holders are concerned by

the procedures for acceding to the Lock-Up Agreement described in

paragraph 2 of this press release includes the following debt:

Bonds

EUR 20 million 2.568% Bonds due 22 December 2022 (ISIN

FR0013080173) EUR 150 million 2.1300% Bonds due 3 July 2024 (ISIN

FR0013262987) EUR 63 million 2.200% Bonds due 15 December 2024

(ISIN FR0013301942) EUR 50 million 2.300% Bonds due 6 March 2025

(ISIN FR0013240827) EUR 400 million 2.6250% Bonds due 10 March 2025

(ISIN FR0013322187) EUR 32 million 3.1440% Bonds due 22 December

2025 (ISIN FR0013080207) EUR 77 million 2.5640% Bonds due 30

November 2027 (ISIN FR0014000T41) EUR 500 million 2.0000% Bonds due

1 April 2028 (ISIN FR0014002O10) EUR 60 million 2.71000% Bonds due

18 December 2028 (ISIN FR00140011S0) EUR 48 million 2.0000% Bonds

due 9 August 2029 (ISIN FR0014004Y16) EUR 15 million 3.0100% Bonds

due 18 December 2030 (ISIN FR00140011R2) EUR 40 million 3.0000%

Bonds due 11 August 2032 (ISIN FR0013481660) EUR 60 million 2.7500%

Bonds due 3 June 2033 (ISIN FR0014003P42) EUR 32.5 million at

3.0000% Bonds due 25 November 2041 (ISIN FR0014006MC2)

Convertible bonds

EUR 500 million Bonds convertible into new shares and/or

exchangeable for existing shares of the Company due 17 May 2027

(ISIN FR0013418795) (OCEANEs)

Unsecured bank loans

Bilateral unsecured bank loans, unionized unsecured bank loans

and unsecured credit lines underwritten by ORPEA S.A.

Partial Secured Euro PP Bonds

EUR 90 million 5.250% Bonds due 4 December 2026 (ISIN

FR0011365634), secured debt at 35% of its principal amount and

unsecured debt for the balance

Schuldschein

Schuldschein loans under German law

NSV

Namensschuldverschreibung loans under German law

ANNEX 2

Procedures for unsecured financial creditors

wishing to join the Lock-Up Agreement

Transaction website access

In order to access the documents made available on the

transaction website: https://deals.is.kroll.com/orpea, creditors

holding Bonds, Convertible Bonds and Partial Secured Euro PP Bonds

(as these terms are defined in annex 1 of this press release)

(together, the “Debt Instruments”, identified as such in

annex 1 of this press release) will need to provide a satisfactory

evidence of their holding of the Debt Instruments on the basis of a

certificate or other statement delivered by their custodian or a

prime broker acting as Direct Participant (as defined below), which

is not older than 2 days at the time they request access to the

transaction website to the Agent by email to orpea@is.kroll.com.

The Agent shall have absolute discretion as to whether creditors

holding Debt Instruments are permitted access to the transaction

website.

For creditors who are lenders, and not creditors holding Debt

Instruments, only lender of records, who appear as lender on the

register maintained by the Company or the relevant agents on its

behalf, will be given access to the transaction website.

Creditors holding Debt Instruments through Euroclear or

Clearstream

For Debt Instruments held through Euroclear or Clearstream, in

accordance with their usual procedures, Euroclear and Clearstream

will initially distribute the information related to the Lock-Up

Agreement to the direct participants of Euroclear or Clearstream

(“EC/CS Direct Participants” and, together with indirect

participants of Euroclear or Clearstream “EC/CS

Participants”). Each relevant EC/CS Direct Participant, after

receiving the information related to the Lock-Up Agreement, will

contact each creditor holding Debt Instruments, directly or through

other EC/CS Participants, with regards to such information. All

creditors holding Debt Instruments should comply with the

requirements of Euroclear or Clearstream, as applicable, and

deliver electronic instructions by the Last Accession Date to

receive the Support Fee due to them.

By submitting, or arranging for the submission of electronic

instructions in respect of the Debt Instruments, the holder of

these Debt Instruments hereby authorizes Euroclear or Clearstream

to block such Debt Instruments and maintain such Debt Instruments

blocked from the date of the relevant electronic instruction

(inclusive) until the Last Accession Date (as defined in paragraph

2 of the press release) (inclusive).

Creditors holding Debt Instruments through Euroclear France

outside Euroclear or Clearstream

For Debt Instruments held through Euroclear France, Euroclear

France will distribute the information related to the Lock-Up

Agreement to direct participants of Euroclear France (the

“Euroclear France Direct Participants” and, together with

indirect participants of Euroclear France, the “Euroclear France

Participants”), who will then send, directly or through other

Euroclear France Participants, such information to the relevant

holders of Debt Instruments. Each holder of Debt Instruments held

through Euroclear France outside Euroclear or Clearstream must

provide (if the holder is a Euroclear France Direct Participant) or

request a Euroclear France Direct Participant to provide, the

Euroclear France Direct Participant’s evidence of the aggregate

amount, in principal or units (as applicable), of the applicable

Debt Instruments blocked by a Euroclear France Direct Participant

on or before the Last Accession Date, in the form of a book entry

certificate (book entry certificate available from the Agent) from

the Euroclear France Direct Participant. Each Euroclear France

Direct Participant acting on behalf of several holders of Debt

Instruments must also provide, in the form of a spreadsheet

attached to the submitted form (spreadsheet available from the

Agent), a list of the amounts in principal amount or units of Debt

Instruments, the names, addresses, email addresses and telephone

numbers of the holders of Debt Instruments.

Lender creditors

Accessions of lenders creditors (including in particular bank

lenders or Schuldschein lenders, or more generally creditors which

are not holders of Debt Instruments) to the Lock-Up Agreement will

be validated based on the registers of lenders of record produced

by the Company or the relevant agents on its behalf as at the Last

Accession Date. Only lenders of record will be authorised to accede

to the Lock-Up Agreement.

1It is specified, with regard to unsecured financial creditors,

that only the members of the SteerCo, which are the initial

signatories of the Lock-Up Agreement, undertake to backstop the

capital increases concerned. Unsecured financial creditors who

adhere to the Lock-Up Agreement after its signature will not be

concerned by this backstop commitment. 2Capital increase with

preferential subscriptions rights of existing shareholders, for an

amount of approximately 3.8 billion euros, backstopped by all

unsecured financial creditors of ORPEA S.A., who subscribe, as the

case may be, by way of set-off with their existing claims. 3

Assuming that the shareholders, meeting as a class of affected

parties, vote in favor of the financial restructuring plan at a

two-third majority. 4Capital increase in cash without preferential

subscription rights to allow the Groupement to subscribe to it for

approximately €1.16 billion. Depending on the definitive terms of

the Plan, a priority right for initial shareholders and/or the new

shareholders could be envisaged; the parameters described could be

adjusted, as the case may be. 5 Capital increase in cash with

preferential subscription rights of existing shareholders for an

amount of approximately €0.4 billion. 6 In return for their

commitment to backstop or subscribe to the third capital increase,

a remuneration would be perceived by the SteerCo members and the

Groupement members, via the issuance of share warrants to the sole

benefit of the the SteerCo and the Groupement members (the

“Warrants”). The Warrants will give the right, to the Groupement

and the SteerCo members only, to subscribe in the aggregate to

1.45% of the capital of the Company (on a fully diluted basis) at

the exercise price of 0.01 euro per share of the Company. In the

absence of the attribution of Warrants pursuant to the conditions

set out in the Agreement in Principle, such remuneration would be

paid through an equivalent amount in cash of approximately €39

million. 7 In particular regarding the conditions (in terms of

dilution of shareholders in particular) of a potential cross-class

cram down against the shareholders, in the case where they would

not approve the plan at a 2/3 majority.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230214005432/en/

Investor Relations ORPEA Jean-Baptiste Roussille

Head of Investor Relations j-b.roussille@orpea.net

Benoit Lesieur Investor Relations Director b.lesieur@orpea.net

Toll free nb. shareholders: +33 (0) 805 480 480

Investor Relations NewCap Dusan Oresansky Tel.:

+33 (0)1 44 71 94 94 ORPEA@newcap.eu

Media Relations ORPEA Isabelle Herrier-Naufle

Media Relations Director Tel.: +33 (0)7 70 29 53 74

i.herrier-naufle@orpea.net

Image 7 Charlotte Le Barbier Tel.: +33 (0)6 78 37 27 60

clebarbier@image7.fr

Laurence Heilbronn Tel.: +33 (0)6 89 87 61 37

lheilbronn@image7.fr

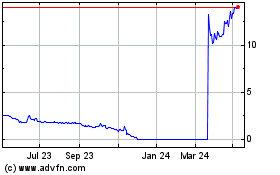

Orpea (EU:ORP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Orpea (EU:ORP)

Historical Stock Chart

From Apr 2023 to Apr 2024