August 4, 2022

Record Order Book, Revised

Guidance

Highlights

- 2022 Directional1 EBITDA guidance

increased from around US$900 million to above US$950 million

- 2022 Directional revenue guidance

increased from above US$3.1 billion to around US$3.2 billion

- Record-level US$31.1 billion pro-forma

order book, providing cash flow visibility until 2050

- Record-level US$8.8 billion pro-forma

net cash flow from Lease and Operate backlog2 corresponding to

US$315 million average annual net cash flow until 2050

- Seventh Fast4Ward® Multi-Purpose

Floater (MPF) hull ordered

- New 2030 intermediate greenhouse gas

(GHG) related targets, creating pathway to net-zero by 2050

The Half Year 2022 Earnings and Interim Financial Statements are

published on the Company’s website here.

Bruno Chabas, CEO of SBM Offshore,

commented:

“Our teams continue to deliver solid results,

despite the challenging environment. On our overall project

portfolio, strategic mitigating measures against inflation have

been proving effective on controlling cost and protecting schedule.

Nevertheless, parts of the portfolio remain sensitive to the

pressure in the global supply chain and impact from COVID-19

pandemic. The overall profitability of the project portfolio

remains robust. We have revised upwards our full year EBITDA and

revenue guidance.

With the award of the FPSO ONE GUYANA project,

our order book has increased to a new record level of US$31.1

billion. We expect to deliver around US$9 billion net cash flow

from our Lease and Operate backlog during the period which gives

unique visibility on cash flow for the next 28 years. Our market

outlook for new FPSOs remains positive as the world requires energy

which is not only sustainable, but also affordable and reliable.

This is what the Company is delivering through its competitive

Fast4Ward® FPSOs which are also characterized by low emissions

intensity. We have therefore ordered our seventh Fast4Ward® MPF

hull.

Our Lease and Operate division continues to

deliver good results. FPSO Liza Unity has been successfully ramped

up in industry-leading time, FPSO Liza Destiny’s compression system

was successfully upgraded and FPSO Cidade de Anchieta is

progressing towards a safe restart.

To achieve our goal of net-zero by 2050 we have

established the following intermediate targets: by 2030, we target

net-zero scope 1 and 2 emissions3, a 50% reduction of scope 3 GHG

intensity4 and zero routine flaring5 in our fleet. We are also

seeing good progress under our emissionZERO® program with the aim

to have a near-zero emissions FPSO available to the market by

2025.

Through our New Energies platform, we are

developing new products and services compatible with our net-zero

roadmap. We have co-developer positions in the USA, the UK and

Northern Ireland and continue to position the Company in selected

developments to accelerate our technology and to monitor and

stimulate this market. Our 25MW floating offshore wind project in

the south of France is progressing towards delivery in 2023.

The orderly transition from fossil to renewable

energy will require companies to design and develop innovative

technical solutions combined with the capability to reliably

execute, finance and operate them. At the same time, it will

require discipline in providing value to all stakeholders with a

particular focus on profitability while balancing risk. As an

energy transition company, SBM Offshore is well positioned to

support, make a difference to and benefit from multiple pathways in

the growing energy transition market.”

Financial Overview

| |

|

Directional6 |

|

IFRS6 |

| |

|

|

|

|

|

|

|

|

|

in US$ million |

|

1H 2022 |

1H 2021 |

% Change |

|

1H 2022 |

1H 2021 |

% Change |

|

Revenue |

|

1,763 |

1,072 |

64% |

|

2,406 |

1,555 |

55% |

|

Lease and Operate |

|

854 |

752 |

14% |

|

694 |

631 |

10% |

|

Turnkey |

|

909 |

321 |

184% |

|

1,712 |

924 |

85% |

|

Underlying7

revenue |

|

1,763 |

1,147 |

54% |

|

2,406 |

1,630 |

48% |

|

Lease and Operate |

|

854 |

827 |

3% |

|

694 |

706 |

-2% |

|

Turnkey |

|

909 |

321 |

184% |

|

1,712 |

924 |

85% |

|

EBITDA |

|

500 |

426 |

17% |

|

581 |

411 |

41% |

|

Lease and Operate |

|

527 |

456 |

16% |

|

342 |

323 |

6% |

|

Turnkey |

|

16 |

9 |

69% |

|

283 |

129 |

120% |

|

Other |

|

(43) |

(40) |

8% |

|

(43) |

(40) |

8% |

|

Underlying EBITDA |

|

500 |

501 |

0% |

|

581 |

486 |

20% |

|

Lease and Operate |

|

527 |

531 |

-1% |

|

342 |

398 |

-14% |

|

Turnkey |

|

16 |

9 |

69% |

|

283 |

129 |

120% |

|

Other |

|

(43) |

(40) |

8% |

|

(43) |

(40) |

8% |

|

Profit attributable to Shareholders |

|

103 |

64 |

63% |

|

296 |

148 |

100% |

|

Underlying Profit attributable to

Shareholders |

|

103 |

61 |

71% |

|

296 |

145 |

105% |

|

Earnings per share (US$ per share) |

|

0.58 |

0.34 |

71% |

|

1.67 |

0.79 |

110% |

|

Underlying earnings per share (US$ per share) |

|

0.58 |

0.32 |

79% |

|

1.67 |

0.78 |

115% |

| |

|

|

|

|

|

|

|

|

|

in US$ million |

|

1H 2022 |

1H 2021 |

% Change |

|

1H 2022 |

1H 2021 |

% Change |

|

Non-recurring items impacting

revenue |

|

- |

(75) |

|

|

- |

(75) |

|

|

Deep Panuke termination fee |

|

- |

(75) |

|

|

- |

(75) |

|

|

Non-recurring items impacting EBITDA |

|

- |

(75) |

|

|

- |

(75) |

|

|

Deep Panuke termination fee |

|

- |

(75) |

|

|

- |

(75) |

|

|

Non-recurring items impacting

Depreciation |

|

- |

78 |

|

|

- |

78 |

|

|

Deep Panuke termination fee |

|

- |

78 |

|

|

- |

78 |

|

|

Total non-recurring items impacting Profit |

|

- |

3 |

|

|

- |

3 |

|

| |

|

|

|

|

|

|

|

|

|

in US$ billion |

|

Jun-30-22 |

Dec-31-21 |

% Change |

|

Jun-30-22 |

Dec-31-21 |

% Change |

|

Pro-forma Backlog |

|

31.1 |

29.5 |

5% |

|

- |

- |

|

|

Net Debt |

|

5.3 |

5.4 |

-1% |

|

7.0 |

6.7 |

4% |

Underlying Directional revenue increased to

US$1,763 million compared with US$1,147 million for the same period

in 2021. The 54% growth is driven by Turnkey revenue which

increased to US$909 million compared with US$321 million in the

year-ago period.

This resulted from a ramp-up of Turnkey

activities with five FPSOs under construction and the completion of

FPSO Liza Unity in the first half-year of 2022. Furthermore, the

earlier announced partial divestment on FPSOs Almirante Tamandaré

and Alexandre de Gusmão at the beginning of 2022 allowed the

Company to recognize revenue for all the EPCI related work

performed to date on these projects to the extent of the partners’

ownership in lessor related SPV’s.

Underlying Directional Lease and Operate revenue

for the first half-year of 2022 stands at US$854 million, an

increase of US$27 million compared with the same period prior year.

This mainly reflects FPSO Liza Unity successfully joining the fleet

partially offset by the end of the Deep Panuke MOPU and FPSO

Capixaba lease contracts and the FPSO Kikeh Lease and Operate

contract extension which lowered the average straight-lined day

rate.

The shutdown of operations of FPSO Cidade de

Anchieta had only a limited impact on revenue over the period due

to the integration of the extension of the contract corresponding

to the period of shutdown beyond the original end date of the

lease. As a consequence, the total contractual lease revenue

remains unchanged, whereas the revenue of the period, recognized on

a straight-line basis over the full updated lease period, has been

minimally impacted.

Underlying Directional EBITDA remained stable at

US$500 million compared with US$501 million for the same period in

2021.

Although the Company recorded a significant

increase in revenue related to projects under construction, there

was not a commensurate impact on Directional Turnkey EBITDA which

increased from US$9 million in the year-ago period to US$16

million. FPSOs Liza Unity, Prosperity and ONE GUYANA are 100% owned

by the Company. In accordance with the Company’s policy for

Directional reporting, the direct payments received during

construction for these units are therefore recognized as revenue

without contribution to gross margin. FPSO Alexandre de Gusmão did

not contribute to margin during the period as it just reached the

requisite gate of completion allowing margin recognition at the end

of half-year 2022. Further, parts of the portfolio remain sensitive

to the pressure in the global supply chain and impact from COVID-19

pandemic and the degree to which this can be mitigated varies from

project to project.

Underlying Directional Lease and Operate EBITDA

came in at US$527 million in the first half-year of 2022, in line

with the prior year period. This trend resulted from the same

drivers as for the Underlying Lease and Operate revenue.

The other non-allocated cost was in line with

the previous year and stood at US$(43) million.

After reduced depreciation and net financing

costs, underlying Directional net profit for first half 2022

increased to a total of US$103 million, or US$0.58 per share.

The first half-year of 2021 Underlying

Directional revenue and EBITDA includes US$75 million related to

final cash received during the period under the final settlement

signed with the client following the redelivery of the Deep Panuke

MOPU in July 2020.

Funding and Directional Net Debt

Despite the continued investment in growth, net

debt slightly decreased from US$5.4 billion to US$5.3 billion as of

June 30, 2022. This primarily resulted from the strong operating

cash flow generation and the derecognition, to the extent of

partners’ ownership, of the net debt related to FPSOs Almirante

Tamandaré and Alexandre de Gusmão over the period following the

partial divestment of the two units.

The majority of the Company's debt at half-year

consisted of non-recourse project financing (US$3.9 billion or 67%

of total debt) in special purpose companies. This non-recourse

balance includes the project loan related to FPSO Liza Unity for

which the pre-completion company guarantee was released in June

2022. The remainder (US$1.9 billion) comprised of borrowings to

support the on-going FPSO construction program which will become

non-recourse following project execution finalization and release

of the related parent company guarantee.

As of June 30, 2022, the net cash balance stood

at US$478 million, lease liabilities totaled c. US$47 million and

the Company’s Revolving Credit Facility was undrawn.

Directional Pro-Forma Backlog

Change in ownership scenarios and lease contract

duration have the potential to significantly impact the Company's

future cash flows, net debt balance as well as the profit and loss

statement. The Company therefore provides a pro-forma Directional

backlog based on the best available information regarding ownership

scenarios and lease contract duration for the various projects.

The pro-forma Directional backlog increased by

almost US$1.6 billion compared with the position at December 31,

2021 to a total of US$31.1 billion. The increase was mainly the

result of the awarded contract for the FPSO ONE GUYANA project

which was offset partially by turnover for the period which

consumed approximately US$1.8 billion of backlog.

|

(in billion US$) |

|

Turnkey |

Lease & Operate |

Total |

| 2H 2022 |

|

0.5 |

0.9 |

1.4 |

| 2023 |

|

0.9 |

1.8 |

2.7 |

| 2024 |

|

1.7 |

1.8 |

3.5 |

| Beyond

2024 |

|

3.3 |

20.2 |

23.5 |

|

Total Backlog |

|

6.4 |

24.7 |

31.1 |

The pro-forma Directional backlog at June 30,

2022 reflects the following key assumptions:

- The FPSO Liza Destiny contract

covers 10 years of lease and operate.

- The FPSO Liza Unity, Prosperity and

ONE GUYANA contracts cover a maximum period of two years of lease

and operate within which period the units will be purchased by the

client. The impact of the sale is reflected in the Turnkey backlog,

assumed at the end of the contractual lease and operate

period.

- The 13.5% equity divestment in FPSO

Sepetiba to CMFL has not yet been reflected in the backlog as the

transaction remains subject to various approvals.

For further details of the overall assumptions applicable to the

backlog, refer to the Half Year 2022 Earnings report.

Project Review

|

Project |

Client/country |

Contract |

SBM Share8 |

Capacity, Size |

Percentage of Completion |

Expected First Oil |

|

Sepetiba |

PetrobrasBrazil |

22.5 year Lease & Operate |

64.5% |

180,000 bpd |

>75% |

2023 |

|

Prosperity |

ExxonMobilGuyana |

2 year Build, Operate, Transfer |

100% |

220,000 bpd |

>50% <75% |

2023 |

|

Almirante

Tamandaré |

PetrobrasBrazil |

26.25 year Lease & Operate |

55% |

225,000 bpd |

>25% <50% |

2024 |

|

Alexandre de Gusmão |

PetrobrasBrazil |

22.5 year Lease & Operate |

55% |

180,000 bpd |

>25% <50% |

2025 |

|

ONE GUYANA |

ExxonMobilGuyana |

2 year Build, Operate, Transfer |

100% |

250,000 bpd |

<25% |

2025 |

The continuing effects from the COVID-19

pandemic and the indirect impacts from the war between Russia and

Ukraine and related pressure in the global supply chain continue to

create challenges in SBM Offshore’s project execution. Project

teams are closely monitoring the situation and are working to

mitigate possible impacts in close cooperation with the Company’s

suppliers and clients. The weighted average portfolio percentage of

completion stands approximately at 40% as of June 30, 2022. An

update on individual projects schedule is provided below

considering latest known circumstances.

FPSO Sepetiba - Work is progressing on

integration and commissioning. The project targets first oil in

2023.

FPSO Prosperity - Both the topsides fabrication

and the module lifting campaign have safely and successfully been

completed allowing for the commencement of the integration and

commissioning phase. First oil is likely to occur before year-end

2023.

FPSO Almirante Tamandaré - The topsides

fabrication and the Fast4Ward® MPF hull construction continue

to progress in line with plan. The project targets first oil in the

second half of 2024.

FPSO Alexandre de Gusmão - Site construction

activities are progressing in fabrication yards, the MPF hull

construction has restarted following yard shutdown. First oil is

expected in 2025.

FPSO ONE GUYANA - Engineering is progressing in

line with plan and the project is progressing according to

schedule. First oil is expected in 2025.

Fast4Ward® MPF hulls - Under the Fast4Ward®

program, the Company has ordered a seventh MPF hull which is

expected to be delivered in 2024.

SBM Nauvata - In order to further enhance and align its project

engineering capabilities, the Company intends to acquire the 49%

equity ownership currently held by its partner in the SBM Nauvata

engineering center located in Bangalore, India. The acquisition is

expected to be completed in 2023.

Fleet Operational Update

FPSO Cidade de Anchieta

The unit has been shutdown since January 22,

2022 following the observation of oil near the vessel. Immediately

anti-pollution measures were deployed which were effective and

production was shutdown. The estimated volume of oil released in

relation to the incident stands at 191 m3 which was reported to

local authorities. While the Company regrets this incident,

management commends client and SBM Offshore staff who ensured that

the FPSO remained safe and under control as well as minimizing the

impact to the environment. The unit remains in shutdown as

inspection, cleaning and repair work is progressing. The Company is

working together with client, authorities and class towards safely

resuming production in the second half of 2022.

FPSO Liza Destiny - The upgraded flash gas

compressor was successfully installed and is performing as

planned.

Fleet Uptime

In addition to the FPSO Cidade de Anchieta

shutdown, the implementation of upgrades to safety systems on

another asset impacted the fleet uptime which stood at 90% during

the first half of 2022. The fleet’s underlying performance was 97%

excluding FPSO Cidade de Anchieta. The Company expects uptime to be

back at historical performance levels in the second half of the

year.

Contract extensions - The Company has agreed two

contract extensions related to the operation of FPSO Serpentina

(extension to August 2022) and lease and operation of FPSO Mondo

(extension to December 2023). The combined impact of these

extensions is limited.

FPSO Capixaba - Following the contractual

planning to shutdown production in May 2022, the Company has

started to prepare for the vessel’s demobilization.

New Energies

Provence Grand Large

SBM Offshore is progressing on the construction

of its first pilot project in floating offshore wind, which remains

scheduled for commissioning in 2023. The construction and

installation of three floaters for the Provence Grand Large

project, jointly owned by EDF Renewables and Maple Power, will

account for approximately 10% of the globally installed floating

wind electricity generation capacity in 2023. This is the first

floating offshore wind project under construction in France and

will be the first project worldwide to be installed using tension

leg mooring technology which has minimal motion and seabed

footprint. This technology enhances electricity generation and

reduces maintenance costs. It is also the first floating wind

project to be financed by commercial banks. Lessons learned have

been integrated into the Company’s Float4WindTM

concept which is optimized for mass production and competitiveness

for large offshore floating wind farms.

Environment, Social and Governance

Safety

The Company’s Total Recordable Injury Frequency

Rate year to date was 0.10, compared with the full year 2022 target

of below 0.15. SBM Offshore’s priority remains the health and

safety of its staff, contractors and their families, along with

ensuring safe operations across all the Company’s activities.

Climate Change (GHG emissions reduction) –

intermediate targets to support net-zero by 2050

As announced in 2021, SBM Offshore has the

ambition to achieve net-zero by no later than 2050, including scope

1, scope 2 and scope 3 downstream leased assets, the latter

covering the emissions from its FPSO fleet. In support of its 2050

net-zero ambition, SBM Offshore has created intermediate targets,

using a science-based approach9 as follows:

- Reduce GHG

intensity of Scope 3 downstream leased assets by 50% by 2030, from

2016 as a base year

- Offer the market

emissionZERO®, leading to a near-zero10 FPSO at latest by 2025

- Achieve more

than 2GW floating offshore wind installed or under development by

2030

- Reach net-zero

emissions on scope 1 and 2 by no later than 20253

- Achieve Zero

routine flare by 2030

ESG Index - As of May 12, 2022, SBM Offshore was

included in the AEX ESG index. The index identifies the 25

companies that demonstrate the best ESG practices from the 50

constituents of the AEX and AMX indices.

Outlook and Guidance

The Company’s 2022 Directional revenue guidance

is revised from above US$3.1 billion to around US$3.2 billion, of

which around US$1.7 billion is expected from the Lease and Operate

segment and above US$1.5 billion from the Turnkey segment. 2022

Directional EBITDA guidance is increased from around US$900 million

to above US$950 million. This revision is mainly a result of the

fact that it has been possible to mitigate some of the potential

risks foreseen at the beginning of the year, for example

confirmation of the extension to the FPSO Cidade de Anchieta

contract commensurate with the period of shutdown with associated

revenue and margin recognized on a straight-line basis over the

full updated lease period.

This guidance considers the currently foreseen

impacts from both the pandemic and the war between Russia and

Ukraine on projects and fleet operations. The Company highlights

that the direct and indirect effects of these events could continue

to have a material impact on the Company’s business and results and

the realization of the guidance for 2022.

Conference Call

SBM Offshore has scheduled a conference call

together with a webcast, which will be followed by a Q&A

session, to discuss the 2022 Half Year Earnings release.

The event is scheduled for Thursday, August 4,

2022 at 10.00 AM (CEST) and will be hosted by Bruno Chabas (CEO),

Philippe Barril (CTO), Øivind Tangen (COO) and Douglas Wood

(CFO).

Interested parties are invited to register prior

to the call using the link: Half Year 2022 Earnings Conference

Call

Please note that the conference call can only be

accessed with a personal identification code, which is sent to you

by email after completion of the registration.

The live webcast will be available at: Half Year

2022 Earnings Webcast

A replay of the webcast, which is available

shortly after the call, can be accessed using the same link.

Corporate Profile

SBM Offshore designs, builds, installs and

operates offshore floating facilities for the offshore energy

industry. As a leading technology provider, we put our marine

expertise at the service of a responsible energy transition by

reducing emissions from fossil fuel production, while developing

cleaner solutions for renewable energy sources.

More than 5,000 SBMers worldwide are committed

to sharing their experience to deliver safe, sustainable and

affordable energy from the oceans for generations to come.

For further information, please visit our

website at www.sbmoffshore.com.

The Management BoardAmsterdam, the Netherlands,

August 4, 2022

|

Financial Calendar |

Date |

Year |

|

Third Quarter 2022 Trading Update |

November 10 |

2022 |

|

Full Year 2022 Earnings |

February 23 |

2023 |

|

Annual General Meeting |

April 13 |

2023 |

|

First Quarter 2023 Trading Update |

May 11 |

2023 |

|

Half Year 2023 Earnings |

August 10 |

2023 |

For further information, please contact:

Investor RelationsLudovic

RobinoInvestor Relations Manager

|

Mobile: |

+31 (0) 6 15 16 50 35 |

|

E-mail: |

ludovic.robino@sbmoffshore.com |

|

Website: |

www.sbmoffshore.com |

Media RelationsVincent

KempkesGroup Communications Director

|

Mobile: |

+377 (0) 6 40 62 87 35 |

|

E-mail: |

vincent.kempkes@sbmoffshore.com |

|

Website: |

www.sbmoffshore.com |

Market Abuse Regulation

This press release may contain inside

information within the meaning of Article 7(1) of the EU Market

Abuse Regulation.

Disclaimer

Some of the statements contained in this release

that are not historical facts are statements of future expectations

and other forward-looking statements based on management’s current

views and assumptions and involve known and unknown risks and

uncertainties that could cause actual results, performance, or

events to differ materially from those in such statements. These

statements may be identified by words such as ‘expect’, ‘should’,

‘could’, ‘shall’ and similar expressions. Such forward-looking

statements are subject to various risks and uncertainties. The

principal risks which could affect the future operations of SBM

Offshore N.V. are described in the ‘Risk Management’ section of the

2021 Annual Report.

Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results and performance of the Company’s business

may vary materially and adversely from the forward-looking

statements described in this release. SBM Offshore does not intend

and does not assume any obligation to update any industry

information or forward-looking statements set forth in this release

to reflect new information, subsequent events or otherwise.

Nothing in this release shall be deemed an offer

to sell, or a solicitation of an offer to buy, any securities. The

companies in which SBM Offshore N.V. directly and indirectly owns

investments are separate legal entities. In this release “SBM

Offshore” and “SBM” are sometimes used for convenience where

references are made to SBM Offshore N.V. and its subsidiaries in

general. These expressions are also used where no useful purpose is

served by identifying the particular company or companies.

"SBM Offshore®", the SBM logomark, “Fast4Ward®”,

“emissionZERO®” and “Float4WindTM” are proprietary marks owned by

SBM Offshore.

1 Directional reporting, presented in the

Financial Statements under Operating Segments and Directional

Reporting, represents a pro-forma accounting policy, which treats

all lease contracts as operating leases and consolidates all

co-owned investees related to lease contracts on a proportional

basis based on percentage of ownership. This explanatory note

relates to all Directional reporting in this document.2 Reflects a

pro-forma view of the Company’s Directional backlog and expected

net cash from Lease and Operate after tax and debt service. Please

refer to Half Year 2022 Earnings for details.3 Aiming for 100%

sourcing of green energy by 2030 and considering investments in

certified projects to balance any residual GHG emissions from Scope

1 & 2, reaching a ‘net-zero’ level on total GHG emissions.4

Reduce GHG intensity of Scope 3 downstream leased assets by 50% by

2030, compared to 2016 as a base year.5 Routine flaring of gas

considered as flaring during normal oil production operations in

the absence of sufficient facilities or amenable geology to

re-inject the produced gas, utilize it on-site, or dispatch it to a

market. Applies to GHG emissions from Scope 3 downstream

leased assets.6 Figures may not add up due to rounding.

7 Underlying Directional revenue and EBITDA are

adjusted for the non-recurring events during a financial period to

enable comparison of normal business activities for the current

period in relation to the comparative period.8 As of June 30, 20229

SBM Offshore looks to apply a science-based approach, using key

frameworks such as or of equivalent performance: Task Force on

Climate-Related Financial Disclosures (TCFD), Science-based

initiative, Greenhouse gas Protocol, EU Taxonomy, CDP benchmark. 10

An emissionZERO® FPSO including closed flare, combined cycle power

generation and carbon capture storage or of equivalent

performance.

- SBM Offshore Half Year 2022 Earnings press release

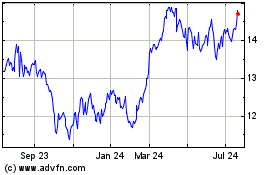

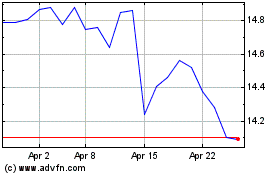

SBM Offshore NV (EU:SBMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

SBM Offshore NV (EU:SBMO)

Historical Stock Chart

From Apr 2023 to Apr 2024