Thunderbird Resorts Inc. ("Thunderbird") (FSE: 4TR; and

Euronext: TBIRD) is pleased to announce that its 2021

Annual Report and Audited Consolidated Financial Statements have

been filed with the Euronext ("Euronext Amsterdam") and the

Netherlands Authority for Financial Markets ("AFM"). As a

Designated Foreign Issuer with respect to Canadian securities

regulations, the Annual Report is intended to comply with the rules

and regulations set forth by the AFM and the Euronext

Amsterdam.

Copies of the Annual Report in the English language will be

available at no cost at the Group's website

at www.thunderbirdresorts.com. Copies in the English

language are available at no cost at the Group's operational office

in Panama and at the offices of our local paying agent ING

Commercial Banking, Paying Agency Services, Location Code TRC

01.013, Foppingadreef 7, 1102 BD Amsterdam, the Netherlands (tel:

+31 20 563 6619, fax: +31 20 563 6959, email:

iss.pas@ing.nl). Copies are also available on SEDAR

at www.SEDAR.com.

Below are certain material excerpts from the full 2021 Annual

Report, the entirety of which can be found on our website

at www.thunderbirdresorts.com.

LETTER FROM CEO

Dear Shareholders and Investors:

The below summarizes the Group's performance through December

31, 2021.

1. CHANGES IN PERFORMANCE IN

2021

In summary, Group revenue and adjusted EBITDA from continuing

operations increased by $2.1 million or 18.5% and $1.6 million or

68.8%, respectively. Consolidated Profit for the period is

$289 thousand, an improvement of $2.2 million or 114.8% as compared

with 2020 results.

A. EBITDA1: Peru property EBITDA fell by

$78 thousand while Nicaragua property EBITDA increased by $1.56

million, both through December 31, 2021, as compared to the same

period in 2020. Corporate Expense was reduced by $70 thousand

in 2021 as compared to 2020. Adjusted EBITDA increased by $1.6

million or by 68.8% through December 31, 2021, as compared to

through December 31, 2020.

B. Profit / (Loss):

The Group's Loss improved by approximately $2.2 million to a

profit of $289 thousand for the period as compared to

2020. This improvement was the result of increased revenue of

$2.1 million partially offset by increased expenses of $505

thousand in 2021 as compared to 2020.

C. Net Debt: Net debt as of December 31,

2021, increased to $16.1 million as compared to $15.8 million as of

December 31, 2020. Due to a change in accounting policy as

required by IFRS 16, the Group is required to account for the net

present value of real estate operating lease contracts as

Obligations under leases and hire purchase contracts. Approximately

$4.7 million of our net debt is comprised of Obligations under

leases and hire purchase contracts.

2. MANAGEMENT TO MITIGATE THE RISKS OF

COVID-19

In terms of demand, Covid-19 hit the Group's markets harder

than in much of the world. Hotels, in general, remained

largely empty, office leases were commonly terminated or materially

renegotiated and gaming facilities, like with restaurants in other

parts, were often seen as greater contagion risks as compared to

other businesses. Moreover, unlike in the developed markets,

there were few fiscal tools and policies available to support

businesses and to stimulate demand in the Group's markets.

Having said that, in 2021 and through date of 2022, Management

stabilized its operations and cash management as compared to 2020,

and feel reasonably confident that the Group is able to carry on

with the shareholder mandate set forth in the September 21, 2016,

Special Resolutions. To be prudent, however, the Group has

updated its Management Statement on Going Concern as compared to

the last update in its 2021 Half-year Report. See more

about Group's progress directly below.

3. MATERIAL PROGRESS TOWARD SHAREHOLDER

MANDATE

The Group continues to pursue decisions that will support the

best interest of shareholders according to the shareholder mandate

set forth in the September 21, 2016, Special Resolutions, the

status of which is summarized below in relation to the Group's key

remaining assets:

A. Peru Hotel Real Estate Converted to Apartment

Units: As of the date of publication of this 2021

Annual Report, the Group has converted its 66-suite hotel in Lima,

Peru, into a 66-unit condominium apartment complex. The Group

has: i) Legally sub-divided the former hotel into 66 individually

titled apartment units; ii) Procured all change of use and other

regulatory approvals; iii) Restructured approximately $4.5 million

of senior debt based on the change of use, enabling the Group to

sell units and accelerate debt payment with each sale; and iv)

Executed preliminary sales agreements for approximately 40

apartment units with estimated sales value of approximately $6

million. Final bank approvals were received in April 2022, and

the Group is now actively signing final sales agreements for

contracted units and pursuing the sales of remaining units with a

projection to generate in excess of $10 million from all unit

sales, with possible completion of this transaction during

2022.

B. Peru Office Real Estate Performance

Improving: The Group also has approximately 6,703 m2

of rentable-sellable office space, and 158 underground parking

spaces. Office occupancies have improved materially in Q1

2022, rising from less than 60% occupancy in the depths of the

covid crisis to approximately 80% as of the date of publication of

this 2021 Annual Report. While leases are not generating the

same revenue per square meter than achieved pre-covid,

the Group's typical 2- to 5-year lease renewal schedule should

help to recover lost revenue per meter as leases come up for

renewal.

C. Nicaragua Gaming and Real Estate

Assets: As of the publication date of this 2021

Annual Report, the Group continued to own a 56% interest in a

Nicaraguan holding company that owns the following assets: i)

Gaming: Three full casinos and three slot parlors with a combined

approximately 630 gaming positions; and ii) Real Estate:

Approximately 4,562 m2 of land divided among 5 parcels as more

fully detailed on page 14. While not precisely segmented

herein, Nicaragua EBITDA has experienced material recovery from the

2nd half of 2021 through Q1 2022.

D. Costa Rica Real Estate Asset: As

of the publication of this 2021 Annual Report, the Group continues

to own a 50% interest in a Costa Rican entity that owns the

11.6-hectare real estate property known as "Tres Rios." Tres

Rios, with its own, dedicated off ramp, is located close to the

country's 2nd largest mall on the highway between the capital city

of San Jose and the commuter city of Cartago.

The Group will continue to pursue decisions that will support

the best interest of shareholders according to the shareholder

mandate set forth in the September 21, 2016, Special

Resolutions.

Salomon Guggenheim

Chief Executive Officer and President

April 30, 2022

1. "EBITDA" is not an accounting term under IFRS, and

refers to earnings before net interest expense, income taxes,

depreciation and amortization, equity in earnings of affiliates,

minority interests, development costs, other gains and losses, and

discontinued operations. "Property EBITDA" is equal to EBITDA at

the country level(s). "Adjusted EBITDA" is equal to property EBITDA

less "Corporate expenses," which are the expenses of operating the

parent company and its non-operating subsidiaries and

affiliates.

GROUP OVERVIEW

The Group's consolidated profit / (loss) summary for the twelve

months ended December 31, 2021, as compared with the same period of

2020 is contained in the Group's Annual Report for year ending

December 31, 2021, located at www.thunderbirdresorts.com. In

summary, Group revenue and adjusted EBITDA increased by $2.1

million or 18.5% and $1.6 million or 68.8%,

respectively. Consolidated Profit for the period is $289

thousand, an improvement of $2.2 million or 114.8% as compared with

2020 results.

RISK MANAGEMENT

For more detail on Risk Factors, see Chapter 8 of the Annual

Report.

MANAGEMENT STATEMENT ON "GOING CONCERN"

Management has reviewed their plan with the Directors and has

collectively formed a judgment about the going concern of the

Group. In arriving at this judgment, Management has prepared the

cash flow projections of the Group. The Group has suffered

recurring losses over the past years. In response to the recurring

losses of the previous years, Management has taken actions which

will be described in the following paragraphs.

Directors have reviewed this information provided by Management

and have considered the information in relation to the financing

uncertainties in the current economic climate, the Group's existing

commitments and the financial resources available to the

Group. Specifically, Directors have considered: (i) there are

probably no sources of new financing available to the Group; (ii)

the Group has limited trading exposures to our local suppliers and

retail customers; (iii) other risks to which the Group is exposed,

the most significant of which is considered to be regulatory risk;

(iv) sources of Group income, including management fees charged to

and income distributed from its various operations; (v) cash

generation and debt amortization levels; (vi) fundamental trends of

the Group's businesses; (vii) ability to re-amortize and unsecured

lenders; and (viii) level of interest of third parties in the

acquisition of certain operating assets, and status of genuine

progress and probability of closing within the Going Concern

period. The Directors have also considered certain critical

factors that might affect continuing operations, as

follows:

- Special Resolution: On September 21, 2016, the Group's

shareholders approved a special resolution that, among other items,

authorized the Board of Directors of the Corporate to sell "any or

all remaining assets of the Corporation in such amounts and at such

times as determined by the Board of Directors." This

resolution facilitates the sale of any one or any combination of

assets required to support maintaining of a going concern by the

Group.

- Corporate Expense and Cash Flow: Corporate expense has

decreased materially in recent years, and continues to decrease,

but still must accommodate for compliance as a public company.

- Liquidity and Working Capital: As of the date of publication of

this 2021 Annual Report, the Group forecasts operating with lower

levels of reserves and working capital until such time as liquidity

events might occur. Selling assets will be critical to

creating a healthy level of working capital reserves for periods

beyond the Going Concern period.

While the below events or lack thereof may create uncertainty

and cast doubt on going concern, the Group believes that it is in a

stronger position to sustain going concern as of the publication

date of this 2021 Annual Report as compared to recent years during

the covid crisis.

- Peru Real Estate Sales: As of the date of publication of this

2021 Annual Report, the Group has converted its 66-suite hotel in

Lima, Peru into a 66-unit condominium apartment complex. The

Group has: i) Legally sub-divided the former hotel into 66

individually titled apartment units; ii) Procured all change of use

and other regulatory approvals; iii) Restructured approximately

$4.5 million of senior debt based on the change of use, enabling

the Group to sell units and accelerate debt payment with each sale;

and iv) Executed preliminary sales agreements for approximately 40

apartment units with estimated sales value of over $6

million. Final bank approvals were received in April 2022, and

the Group is now actively signing final sales agreements for

contracted units and pursuing the sales of remaining units with a

projection to generate in excess of $10 million from all unit

sales, with possible completion of this transaction during

2022. If for whatever reason the Group is not able to complete

the sales of sufficient units to pay down its senior secured lender

and related government supported debt in Peru (combined of

approximately $5M) and to partially pay down its remaining

unsecured debt, this could harm the Group's ability to remain as a

going concern in 2024.

- Other liquidity events: If the Group is not able to

create other liquidity events from its remaining Peru, Costa Rica

and Nicaragua assets in 2023-2024, it is reasonable to expect that

unsecured lenders may pursue years of litigation against the Group

at that time, though as to whether or not this would have an impact

on Going Concern at that time is hard to assess.

Considering the above, Management and Directors are satisfied

that the consolidated Group has adequate resources to mitigate the

uncertainty and that the Group is able to continue as a going

concern for at least the 12 months following the filing date of

this report. For these reasons, Management and Directors have

therefore prepared the consolidated financial statements on a going

concern basis.

THUNDERBIRD RESORTS, INC. CONSOLIDATED

STATEMENT OF FINANCIAL POSITION (Expressed in thousands of United

States dollars) For the year ended December 31, 2021, were approved

by the Board of Directors on April 30, 2022, and are contained in

the 2021 Annual Report posted at www.thunderbirdresorts.com.

The consolidated financial statements and the accompanying notes

are an integral part of these consolidated financial

statements.

SUBSEQUENT EVENTS

These are the material events to disclose from December 31,

2021, through the release of this 2021 Annual Report

Peru Hotel Real Estate Converted to Apartment Units: As of the

date of publication of this 2021 Annual Report, the Group has

converted its 66-suite hotel in Lima, Peru, into a 66-unit

condominium apartment complex. The Group has: i) Legally

sub-divided the former hotel into 66 individually titled apartment

units; ii) Procured all change of use and other regulatory

approvals; iii) Restructured approximately $4.5 million of senior

debt based on the change of use, enabling the Group to sell units

and accelerate debt payment with each sale; and iv) Executed

preliminary sales agreements for approximately 40 apartment units

with estimated sales value of over $6 million. Final bank

approvals were received in April 2022, and the Group is now

actively signing final sales agreements for contracted units and

pursuing the sales of remaining units with a projection to generate

in excess of $10 million from all unit sales, with possible

completion of this transaction during 2022.

ABOUT THE COMPANY

Thunderbird Resorts Inc. is an international provider of branded

casino and hospitality services, focused on markets in Latin

America. Its mission is to "create extraordinary experiences

for our guests. "Additional information about the Group is

available at www.thunderbirdresorts.com.

Contact: Peter Lesar, Chief Financial Officer ∙ Phone: (507)

223-1234 ∙ Email: plesar@thunderbirdresorts.com

Cautionary Notice: Cautionary Notice: The

Annual Report referred to in this release contains certain

forward-looking statements within the meaning of the securities

laws and regulations of various international, federal, and state

jurisdictions. All statements, other than statements of historical

fact, included in the Annual Report, including without limitation,

statements regarding potential revenue and future plans and

objectives of Thunderbird are forward-looking statements that

involve risk and uncertainties. There can be no assurances that

such statements will prove to be accurate and actual results could

differ materially from those anticipated in such statements.

Important factors that could cause actual results to differ

materially from Thunderbird's forward-looking statements include

competitive pressures, unfavorable changes in regulatory

structures, and general risks associated with business, all of

which are disclosed under the heading "Risk Factors" and elsewhere

in Thunderbird's documents filed from time-to-time with the

Euronext Amsterdam and other regulatory authorities. Included in

the Annual Report are certain "non-IFRS financial measures," which

are measures of Thunderbird's historical or estimated future

performance that are different from measures calculated and

presented in accordance with IFRS, within the meaning of applicable

Euronext Amsterdam rules, that are useful to investors. These

measures include (i) Property EBITDA consists of income from

operations before depreciation and amortization, write-downs,

reserves and recoveries, project development costs, corporate

expenses, corporate management fees, merger and integration costs,

income/(losses) on interests in non-consolidated affiliates and

amortization of intangible assets. Property EBITDA is a

supplemental financial measure we use to evaluate our country-level

operations. (ii) Adjusted EBITDA represents net earnings before

interest expense, income taxes, depreciation and amortization,

equity in earnings of affiliates, minority interests, development

costs, and gain on refinancing and discontinued operations.

Adjusted EBITDA is a supplemental financial measure we use to

evaluate our overall operations. Property EBITDA and Adjusted

EBITDA are supplemental financial measures used by management, as

well as industry analysts, to evaluate our operations. However,

Property and Adjusted EBITDA should not be construed as an

alternative to income from operations (as an indicator of our

operating performance) or to cash flows from operating activities

(as a measure of liquidity) as determined in accordance with

generally accepted accounting principles.

This content was issued through the press release distribution

service at Newswire.com.

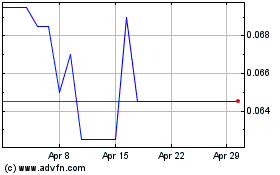

Thunderbird Resorts (EU:TBIRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

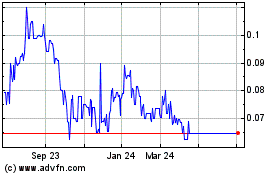

Thunderbird Resorts (EU:TBIRD)

Historical Stock Chart

From Apr 2023 to Apr 2024