TotalEnergies's Strategy After Russia, Shareholder Returns to Come Into Focus at Investor Day -- Preview

28 September 2022 - 12:42AM

Dow Jones News

By Giulia Petroni

TotalEnergies SE is hosting an investor day on Wednesday. Here's

what to watch:

STRATEGY AND RUSSIA: Management is expected to provide an

updated strategy plan for a possible future without Russia in the

picture, but uncertainties linger as the French major stopped short

of announcing a full exit. "We don't expect TTE to change its

stance... and remain wary around the potential for asset

expropriation, and the impact it could have on TTE's LNG

portfolio," RBC Capital Markets' Biraj Borkhataria says. Meanwhile,

analysts at Credit Suisse say that by not committing to new capital

to the country, the company may have lost some flexibility on the

delivery of long-term objectives.

SHAREHOLDERS REMUNERATION: TotalEnergies may look at rebasing

its dividend to U.S. dollars rather than euros to better align its

payout with its functional currency, according to analysts. "Given

the company's financial framework is USD-based, we think this makes

sense and could imply a 10%-15% increase to get the overall

dividend back to around $8 billion per annum," says RBC's

Borkhataria.

CAPITAL EXPENDITURE: CS analysts foresee the oil-and-gas company

keeping this year's capex guide at the top of the $13 billion-$16

billion range in order to address the energy crisis with

short-cycle projects and accelerate the transition away from fossil

fuels. Guidance on capex could be pressured by inflation across the

hydrocarbon and low carbon value chains, according to RBC.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

September 27, 2022 10:27 ET (14:27 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

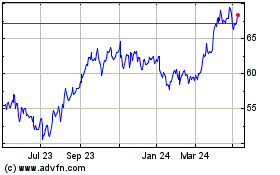

TotalEnergies (EU:TTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

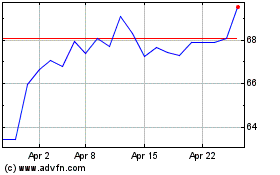

TotalEnergies (EU:TTE)

Historical Stock Chart

From Apr 2023 to Apr 2024