Van Lanschot Kempen enters into strategic partnership with Robeco and acquires online investment platform

02 February 2023 - 6:00PM

Van Lanschot Kempen enters into strategic partnership with Robeco

and acquires online investment platform

Van Lanschot Kempen enters into

strategic partnership

with Robeco and

acquires online

investment platform

Evi van Lanschot to

continue to offer Robeco

investment funds

Amsterdam/’s-Hertogenbosch and Rotterdam, the Netherlands, 2

February 2023

- Evi van Lanschot becomes leading online investment services

provider in the Netherlands with c. €6.0 billion in assets under

management (AuM), offering product solutions from both Van Lanschot

Kempen and Robeco

- The acquisition will put Van Lanschot Kempen in an excellent

vantage position to further grow its online investment

proposition

- Following a two-year integration period, the new combine is

expected to break even in 2025 and subsequently make a positive

contribution to Van Lanschot Kempen’s net profit

- The transaction will have a limited negative 0.4 percentage

point impact on Van Lanschot Kempen’s capital ratio

- Robeco’s investment funds will continue to be offered on Evi

van Lanschot’s platform, and the impact on Robeco’s AuM will

therefore be limited

- Robeco Retail Nederland employees will join Van Lanschot Kempen

to jointly work towards further growth of the online investment

proposition

Van Lanschot Kempen and Robeco have reached agreement on Van

Lanschot Kempen’s acquisition of Robeco’s online distribution

platform for investment services. The partnership fits in with

Robeco’s strategic focus on its core business in the Dutch and

global wholesale and institutional markets. Previously Robeco

discontinued its fiduciary management and private equity

activities. The transfer of the direct retail activities is a next

step in this process. For Van Lanschot Kempen, the acquisition

provides a strong vantage point for further growth in line with its

strategic objectives and respond to the growing demand for online

investment solutions among others as the Dutch pensions market

moves towards more individualised pensions.

The online distribution platform for investment services of

Robeco Retail will merge with Evi van Lanschot. The combination had

€6.0 billion in AuM for circa 150,000 clients at the end of 2022.

The combined platform will continue to offer Robeco’s investment

funds and the impact on Robeco’s AuM will therefore be limited.

Robeco’s clients will retain their current investments under the

same conditions.

Bringing together two investment houses’ deep-seated

knowledgeThe transaction sees Robeco and Van Lanschot

Kempen bring together the deep-seated knowledge and expertise of

two investment houses with a long Dutch history. As part of the

transaction, both parties commit to stepping up collaboration on

behalf of Van Lanschot Kempen’s private banking clients.

Together, Robeco and Evi van Lanschot will work on a smooth

transfer of the Robeco Retail activities. Robeco’s investment funds

will remain available to clients post-transfer under the Evi van

Lanschot name. Robeco Retail’s staff will join Van Lanschot Kempen

and, together with the colleagues at Evi van Lanschot, will work

towards the further growth of online investment services.

Karin van

Baardwijk,

Robeco’s

CEO, said:

“Since its inception nearly 95 years ago, Robeco has evolved from a

Netherlands-based investment consortium into an international asset

manager that serves institutional investors and distributes its

investment funds through platforms such as banks, insurers and

other intermediaries. This new partnership fits in with our

strategic focus on further enhancing this position, with the Dutch

market remaining a key priority. We’ve took extreme caution and

care in our search to find a partner that would offer a new home,

sufficient growth and future-oriented perspective to both our

online distribution platform clients and our colleagues. We look

forward to expanding and enhancing this partnership and offering

our combined proposition to clients.”Maarten

Edixhoven, Chair of the

Van Lanschot Kempen Management Board,

added: “This acquisition provides an opportunity for us to

fuel our growth aspirations for Evi van Lanschot. The partnership

will turn Evi van Lanschot into the leading platform for online

investment services in the Netherlands. We’re seeing a strong

demand from clients for an independent Dutch player. I’m delighted

to welcome the Robeco Retail employees into our organisation and

look forward to combining Evi’s and Robeco’s investment proposition

to create the country’s best personal and online investment

services provider for our clients.”About

Robeco and Evi van

LanschotCurrently, around €4.7 billion in AuM is invested

in Robeco One and Robeco Plus, while Evi van Lanschot has some €1.3

billion in AuM and provides online wealth management, pension

solutions and Evi4Kids.

The transactionThe transaction will have a

negative impact on Van Lanschot Kempen’s CET 1 ratio of 0.4

percentage points. A two-year integration path is envisaged and is

expected to involve one-off costs of between c. €8 million and €11

million. The new combination is expected to break even by 2025 and

then to start making a positive contribution to Van Lanschot

Kempen’s net profit. The transaction is expected to be completed in

June 2023 and is subject to any regulatory approvals that may be

required.

Van Lanschot KempenMedia

Relations: +31

20 354 45 85;

mediarelations@vanlanschotkempen.comInvestor

Relations: +31

20 354 45 90;

investorrelations@vanlanschotkempen.com

RobecoCorporate Communicatie:

Claudia Goossen: +31 6

218 431 82;

c.goossen@robeco.nl

About Van Lanschot KempenVan Lanschot Kempen is

a wealth manager active in Private Banking, Investment Management

and Investment Banking, with the aim of preserving and creating

wealth, in a sustainable way, for both its clients and the society

of which it is part. In Belgium, we have been active as Van

Lanschot Belgium since 1991. As a sustainable wealth manager with a

long-term focus, Van Lanschot Kempen proactively seeks to prevent

negative impact for all stakeholders and to create positive

long-term financial and non-financial value. Listed at Euronext

Amsterdam, Van Lanschot Kempen is the Netherlands’ oldest

independent financial services company, with a history dating back

to 1737. To fully leverage the potential of the Van Lanschot Kempen

organisation for its clients, it provides solutions that build on

the knowledge and expertise across its entire group and on its open

architecture platform. Van Lanschot Kempen is convinced that it is

able to meet the needs of its clients by offering them access to

the full range of its products and services across all its

businesses.

For more information, please visit vanlanschotkempen.com

About RobecoRobeco is an

international pure-play wealth manager, which was founded in 1929

and currently has 16 offices across the world. Its head office is

in Rotterdam, the Netherlands. Robeco has been a leading player in

responsible investing since 1995 and provides an extensive offering

of active investment strategies to both institutional and private

investors on the back of its integrated ESG research, coupled with

fundamental and quantitative research. What’s more, its strategies

cover a wide range of asset classes. As at

31 December 2022, Robeco’s assets under management stood

at €171 billion. Robeco is a subsidiary of ORIX Corporation

Europe NV. For more information, please visit Robeco.com

Important legal information and cautionary note on

forward-looking statementsThis press release may contain

forward-looking statements and targets on future events and

developments. These forward-looking statements and targets are

based on the current insights, information and assumptions of Van

Lanschot Kempen’s management about known and unknown risks,

developments and uncertainties. Forward-looking statements and

targets do not relate strictly to historical or current facts and

are subject to such risks, developments and uncertainties which by

their very nature fall outside the control of Van Lanschot Kempen

and its management. Actual results, performances and circumstances

may differ considerably from these forward-looking statements and

targets.

Van Lanschot Kempen cautions that forward-looking statements and

targets in this press release are only valid on the specific dates

on which they are expressed, and accepts no responsibility or

obligation to revise or update any information, whether as a result

of new information or for any other reason. The figures in this

press release have not been audited.

This press release does not constitute an offer or solicitation

for the sale, purchase or acquisition in any other way or

subscription to any financial instrument and is not a

recommendation to perform or refrain from performing any

action.

Elements of this press release contain information about Van

Lanschot Kempen NV within the meaning of Article 7(1) to (4) of EU

Regulation No. 596/2014.

This press release is a translation of the Dutch language

original and is provided as a courtesy only. In the event of any

disparities, the Dutch language version will prevail. No rights can

be derived from any translation thereof.

- Van Lanschot Kempen_Robeco press release

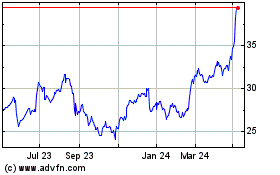

Van Lanschot Kempen NV (EU:VLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

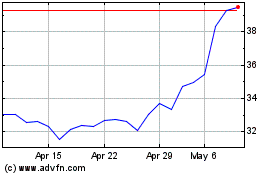

Van Lanschot Kempen NV (EU:VLK)

Historical Stock Chart

From Apr 2023 to Apr 2024