Worldline successfully completes the sale of TSS activities to Apollo Funds

03 October 2022 - 4:00PM

Worldline successfully completes the sale of TSS activities to

Apollo Funds

Worldline

successfully completes the

sale ofTSS

activities to Apollo Funds

Paris La Défense,

October

3rd,

2022 – Worldline [Euronext: WLN], a leader in the payments

industry, announces the completion of the sale of

its Terminals, Solutions & Services (“TSS”)

business

line to Apollo

Funds, as

announced on February 21, 2022.

The standalone company

will now operate

exclusively as

Ingenico.

Worldline successfully completed the sale and

contribution of c. 85% of Ingenico to private equity funds managed

by Apollo (the “Apollo Funds”) with the sale of the remaining c.

15% to take place on January 1st 2023, in line with the

contemplated timeline. The transaction was completed after all the

responsible authorities approved the acquisition by Apollo

Funds.

While this transaction is expected to support

Ingenico in its transformation plan, it also marks a new important

milestone in Worldline’s strategy. It will simplify the Group’s

structure and further increase the focus on core payment services.

The proceeds from this disposal will allow Worldline to further

accelerate its next development phase and to anchor the Group’s

leadership in payments services.

Under the terms of the transaction, Worldline

can benefit from future value creation opportunities made possible

by the robustness and quality of Ingenico, the Apollo Funds’

expertise and know-how and the transformation plan shared between

the parties via the ownership of preferred shares. This structure

allows to align interests between Worldline and the Apollo Funds

and will be directly linked to the total value creation achieved by

Ingenico post completion of the sale. Last, this transaction also

encompasses the entry into force of a partnership agreement

cementing the strategic and long-term relationship between

Worldline and Ingenico over the next 5 years.

As previously announced on February 21st, 2022,

the total consideration for Worldline is based on a current fair

enterprise value of c. € 2.3 billion under the terms of

the transaction, including c. € 1.7 billion upfront value

and up to € 0.9 billion in preferred shares. Net of the

closing price adjustments and net of taxes, Worldline will receive

in aggregate c. € 1.4 billion as net proceeds and will

remain exposed to the future value creation of Ingenico through the

preferred shares for an amount of up to € 0.9 billion (c.

€ 0.6 billion fair value at signing date).

Latham & Watkins is serving as legal counsel

to Worldline. UBS Investment Bank and BNP Paribas are acting as

financial advisors to Worldline.

Paul, Weiss, Rifkind, Wharton & Garrison LLP

and the French offices of Cleary, Gottlieb, Steen & Hamilton

LLP are serving as legal counsel to the Apollo Funds. HSBC is

acting as lead financial advisor, and Barclays and Societe Generale

as financial advisors to the Apollo Funds.

Forthcoming

events

- October 25,

2022 Q3 2022

revenue

Contacts

Investor

Relations

Laurent Marie+33 7 84 50 18

90laurent.marie@worldline.com

Benoit d’Amécourt+33 6 75 51 41

47benoit.damecourt@worldline.com

Press

Sandrine van der Ghinst+32 499 58 53

80sandrine.vanderghinst@worldline.com

Hélène Carlander+33 7 72 25 96

04helene.carlander@worldline.com

About

Worldline

Worldline [Euronext: WLN] is a global leader in

the payments industry and the technology partner of choice for

merchants, banks and acquirers. Powered by 18,000 employees in 40

countries, Worldline provides its clients with sustainable, trusted

and innovative solutions fostering their growth. Services offered

by Worldline include instore and online commercial acquiring,

highly secure payment transaction processing and numerous digital

services. In 2021 Worldline generated a proforma revenue close to 4

billion euros. worldline.com

Worldline’s corporate purpose (“raison d’être”)

is to design and operate leading digital payment and transactional

solutions that enable sustainable economic growth and reinforce

trust and security in our societies. Worldline makes them

environmentally friendly, widely accessible, and supports social

transformation.

Disclaimer

This document contains forward-looking

statements that involve risks and uncertainties, including

references, concerning the Group's expected growth and

profitability in the future which may significantly impact the

expected performance indicated in the forward-looking statements.

These risks and uncertainties are linked to factors out of the

control of the Company and not precisely estimated, such as market

conditions or competitors’ behaviours. Any forward-looking

statements made in this document are statements about Worldline’s

beliefs and expectations and should be evaluated as such.

Forward-looking statements include statements that may relate to

Worldline’s plans, objectives, strategies, goals, future events,

future revenues or synergies, or performance, and other information

that is not historical information. Actual events or results may

differ from those described in this document due to a number of

risks and uncertainties that are described within the 2021

Universal Registration Document filed with the French Autorité des

marchés financiers (AMF) on April 25, 2022 under the filling

number: D.22-0342 and its Amendment filed on July 29, 2022 under

the filling number: D. 21-0342-A01.

Worldline does not undertake, and specifically

disclaims, any obligation or responsibility to update or amend any

of the information above except as otherwise required by law.

This document is disseminated for information

purposes only and does not constitute an offer to purchase, or a

solicitation of an offer to sell, any securities in the United

States or any other jurisdiction. Securities may not be offered or

sold in the United States unless they have been registered under

the U.S. Securities Act of 1933, as amended (the “U.S. Securities

Act”) or the securities laws of any U.S. state, or are exempt from

registration. The securities that may be offered in any transaction

have not been and will not be registered under the U.S. Securities

Act or the securities laws of any U.S. state and Worldline does not

intend to make a public offering of any such securities in the

United States.

- Worldline successfully completes the sale of TSS activities to

Apollo Funds

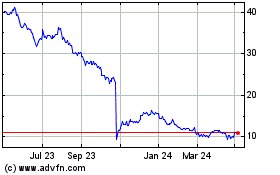

Worldline (EU:WLN)

Historical Stock Chart

From Mar 2024 to Apr 2024

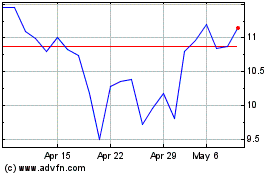

Worldline (EU:WLN)

Historical Stock Chart

From Apr 2023 to Apr 2024