16% increase in operating revenues 76% growth

in catalogue sales, at €11M Current operating income (before

catalogue write-down): €9.1M Successful strategy to generate free

cash flow: + €6.5M Dynamic growth trajectory and stronger

assets

Regulatory News:

Xilam Animation (Paris:XIL), the independent animation

programme production and distribution company, announces its

financial results for the fiscal year ending 31 December 2022,

reviewed by the Board of Directors meeting on 28 March 2023, under

the chairmanship of Marc du Pontavice.

(in thousands of euros)

31.12.2022 (1)

Consolidated excl. catalogue write-down

31.12.2022 (1)

Consolidated

31.12.2021

Consolidated

Sales of new production and

developments

25,014

25,014

20,365

New-production grants(2)

5,462

5,462

8,670

Total new production and development

income

30,476

30,476

29,035

Total catalogue sales

11,277

11,277

6,422

Other revenue

260

260

136

Total revenues and other income

42,013

42,013

35,593

Other grants and current operating

income(3)

3,348

4,706

4,646

Total operating revenues

45,451

46,719

40,240

Operating expenses

Depreciation and write-down

(16 063)

(20 285)

(16 063)

(28 190)

(6 239)

(25 330)

Current operating income

9,102

2,466

8,671

% of revenue

21.7%

5.9%

24.4%

Operating income

8,857

2,221

8,698

% of revenue

21.1%

5.3%

24.4%

Group consolidated net income

6,319

1,342

6,840

% of revenue

15.0%

3.2%

19.2%

(1) Unaudited data (2) Excluding the Audiovisual Tax Credit

(ATC) (3) Including the Audiovisual Tax Credit (ATC)

Marc du Pontavice, Chairman and CEO of Xilam: "In 2022,

Xilam successfully pursued its strategic developments with the

launch of several non-proprietary productions and young adult

programmes that open up new avenues for growth. There was a

significant increase in revenue (excluding grants), which rose 35%,

with catalogue sales reaching a new high of more than €11M, driven

by our three main franchises. However, while this performance led

to an increase in the overall value of the catalogue, we also,

paradoxically, recorded a write-down for some titles, which

technically impacted our operating profitability, albeit

temporarily. This did not affect our liquid assets, which improved

by €3M thanks to our ability to generate free cash flow, again

demonstrating the strength of our business model. Xilam continues

to grow and strengthen its position from year to year, reaching key

milestones and gaining increasing recognition from the entire

distribution market. Xilam has high-calibre talent and continues to

lead the way in animation production while maintaining profitable

growth and very buoyant momentum."

Strong growth in sales of new productions and catalogue

titles (+35%), at €36.3M

Total revenues, details of which were published on 16 February,

stood at €46.7M, an increase of 16%, which is a new record for the

group and reflects its ability to adapt its offering to a changing

market while seizing growth opportunities.

This improvement was a direct result of the sharp increase in

sales of new production and catalogue titles, which reached €36.3M,

an increase of 35%:

- Sales of new production and developments grew by 23% to €25.0M,

with outstanding performance in Work for Hire, at €13.0M, and

proprietary productions, at €12.0M.

- There was very significant growth in catalogue sales, which

surged 76% to €11.3M, a new record.

Xilam cemented its leading position with 13 series in

production, nine of which were launched in 2022 alone.

In 2022, annual production expenditure grew by 16%, at €36.3M.

This was largely due to growth in value, reflecting Xilam's ability

to attract the market's largest budgets from major clients. Among

the 13 series in production, nine were launched in 2022, cementing

Xilam's position as a leader in the European market. This

performance embodies the group's exceptional artistic and technical

versatility, which empowers it to tackle all genres and address an

extremely wide range of target audiences. It also leads to the

coming increase in revenues to be recorded in the accounts upon

delivery of the programmes associated with these expenses.

The ramp-up of Cube Creative, acquired in 2020, has been slower

than expected, and a new management team is now in place to bring

Cube in line with the group's growth trajectory and

profitability.

Current operating margin (before catalogue write-down):

21.7%

Current operating income, before the catalogue write-down, stood

at €9.1M, an operating margin of 21.7%. Excluding Cube Creative,

the margin was even higher, at 26.1%.

This confirms the solidity of Xilam's business model, which is

underpinned by three pillars: proprietary production, catalogue

sales and Work for Hire.

Impact of the catalogue write-down: €6.6M

The growth in catalogue sales mainly stemmed from the group's

three flagship franchises (Oggy and the Cockroaches, Zig &

Sharko and Chicky), which represented 72% of sales. In contrast,

some other catalogue titles did not perform as well, particularly

those series not commissioned for a second season.

In accordance with accounting standards, titles that are gaining

in strength cannot be revalued, while those with less visibility

must be written down. As announced during the publication of the

2022 full-year revenues on 16 February, Xilam recorded a gross

write-down in the value of its catalogue of an exceptional amount

of €7.9M, partially offset by the recognition of the corresponding

audiovisual tax credit for €1.3 million.

This adjustment for accounting purposes has no impact on the

group's cash position; nor does it call into question the economic

value of the catalogue, as witnessed by the record level of sales

in 2022.

The group estimates that potential future revenues from

catalogue titles remains largely superior to their book value, such

that the catalogue will continue to make a very significant

contribution to group earnings.

Operating income and net income

After allowing for the catalogue write-down, operating income

stood at €2.2M, compared with €8.7M in 2021. Excluding write-down,

this would amount to 8,9M€.

Net income totalled €1.3M, after deduction of interest expenses

and taxes. Excluding the catalogue write-down, net income totalled

€6.3M.

Financial position: positive free cash flow and net

structural debt reduced by 58%

As of 31 December 2022, net financial debt (excluding rental

debts) stood at €15.9M (compared with €18.6M as of 31 December

2021), a reduction of €2.7M.

This improvement stems from:

- Positive free cash flow of €6.5M, thanks to the ramp-up in

Work for Hire and record catalogue sales. - The stability of

self-liquidating financial debt (such as factoring), at €13.4M. -

The stability of non-self-liquidating financial debt, at

€15.7M.

As a result, the net cash position improved by €3.3M to €13.3M,

while net structural (non-self-liquidating) debt was reduced by 58%

to €2.5M.

As of 31 December 2022, shareholders' equity amounted to €69.5M

(compared to €67.6M at the end of 2021).

Corporate Social Responsibility

In November 2022, Xilam took an important step forward by

appointing a Chief Impact Officer to give a strong impetus to the

group's responsible transformation.

Since the creation of this new position, the time for action has

come and Xilam is multiplying initiatives to meet the many

challenges of the ecological transition with results that are

already tangible and sustainable. A carbon assessment to measure

the environmental impact of the Group's activities and to define a

trajectory for reducing its greenhouse gases is currently being

finalised. An overhaul of infrastructures and IT tools for an

in-depth GREEN evolution has already been approved with the first

concrete effects expected for the second half of 2023. A

transformation of digital production practices and processes to

reduce and then limit the volume of data storage is also planned

for this year.

In this search for ecological and societal transition, Xilam is

resolutely moving towards a responsible transformation of its

activities. With a view to communicating, supporting, and

intensifying this approach among all the Group's employees, Xilam

has created a contributory blog on the challenges of sustainable

development which it will launch next month.

In addition, Xilam has also stepped up its ongoing commitment to

youth employment and training, and took on 14 apprentices in 2022

to help them gain a foothold in the job market and bring fresh

impetus to the sector.

In 2022, Xilam was given a rating of 4 stars (out of 5) by

Humpact, an improvement of 0.5 points compared with 2021. The group

also achieved a score of 63/100 from Gaïa in 2022.

Strong objectives and perspectives

Building on its solid order book, Xilam expects its annual

production expenditures (proprietary and non-proprietary) to reach

between €42M and €45M in 2023, a level designed to strenghen the

company's growth trajectory. Xilam will also ramp up the sale of

merchandising based on the Oggy Oggy pre-school series in 2023,

following a promising launch for the 2022 festive season.

In an environment buoyed by significant investments in digital

platforms, Xilam plans to continue its cycle of profitable growth

and double revenues to around €80M by 2026, in line with the

Ambition 2026 plan.1

Agenda

Combined Annual General Shareholders’ Meeting: 8 June 2023

Publication of H1-2023 revenues: 20 July 2023 (after market

closing) Publication of H1-2023 results: 28 September 2023 (after

market closing)

About Xilam As a major player in the animation industry,

Xilam is an integrated studio founded in 1999 that creates,

produces and distributes original programmes in more than 190

countries for children and adults, broadcast on television and on

SVoD (Netflix, Disney+, Amazon, etc.) and AVoD (YouTube, Facebook,

etc.) platforms. With a global reputation for creativity and its

capacity for innovation, an editorial and commercial expertise at

the forefront of its industry, Xilam is positioned as a key player

in a fast-growing market. Each year, Xilam, builds on its real

successes and capitalises on powerful historical brands (Oggy and

the Cockroaches, Zig & Sharko, Chicky, etc.) and new brands

(Oggy Oggy in the pre-school sector, Mr. Magoo, Karate Sheep, etc.)

which are consolidating and expanding a significant catalogue of

more the 2,700 episodes and 3 feature films including the

Oscar-nominated I Lost My Body. Xilam has unique GCI skills. Xilam

employs more than 600 people, including 400 artists, across its

studios in Paris, Lyon, Angoulême and Hô-Chi-Minh in Vietnam. Xilam

is listed on Euronext Paris Compartment B - PEA - SRD long

Eligibility. Code ISIN: FR0004034072, Mnemo: XIL

1 Total operating revenues

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230330005626/en/

Marc du Pontavice - Chairman and CEO Cécile Haimet - CFO Phone

+33 (0)1 40 18 72 00

Image Sept Agency xilam@image7.fr Karine Allouis (Media

Relations) - Phone +33 (0)1 53 70 74 81 Laurent Poinsot (Investor

Relations) – Phone +33 (0)1 53 70 74 77

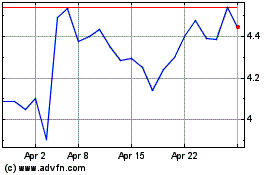

Xilam Animation (EU:XIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Xilam Animation (EU:XIL)

Historical Stock Chart

From Apr 2023 to Apr 2024