MARKET WRAPS

Watch For:

Housing Starts for July; Industrial Production and Capacity

Utilization for July; Canada Housing Starts for July; Canada

Consumer Price Index for July; earnings from Walmart, Home

Depot

Opening Call:

Stock futures dipped on Tuesday ahead of results from major

retailers that could offer clues about consumer behavior during a

period of rampant inflation.

Investors are eyeing a week of key retail earnings, with Walmart

and Home Depot set to post results later Tuesday.

On Wednesday, the FOMC will publish the minutes from its policy

meeting in July, with the minutes closely read for signals on the

Fed's next move.

Tim Pagliara, chief investment officer at CapWealth, said a few

softer inflation readings "doesn't mean the Fed will slow or even

pause the pace of rate hikes, which is what the market is

expecting."

Pagliara said the recent market "melt-up" was "more akin to a

bear market rally and we remind investors that the dot-com bubble

saw four bear market rallies of 20% or more, with each one testing

new lows."

European stocks edged higher for a five-session winning streak,

while Asian shares finished mixed, with a tech selloff htting Hong

Kong's Hang Seng.

Stocks to Watch:

An economic slowdown is encroaching on Apple, which has

reportedly laid off 100 contract workers in charge of

recruiting.

Those made redundant--across several regions--were informed

Apple needed to make adjustments for its current business climate,

according to a Bloomberg report on Tuesday that cited sources close

to the company.

Not all of its contract workers were let go, and full-time

employees involved in recruiting are being retained, the report

said.

A representative for Apple didn't immediately respond to a

request for comment by MarketWatch.

Read more here.

Forex:

The dollar could rise further in the near-term, supported by the

energy shock, uncertainty over whether the PBOC will engineer

another mini-devaluation in the renminbi and improved U.S. economic

data, ING said.

The energy independence of the U.S. leaves the dollar relatively

insulated to rising energy prices, ING added.

Data on industrial production later Tuesday and retail sales on

Wednesday should ease recession fears, ING said. "106.95/107.00

looks like the near-term target for the DXY Dollar Index."

---

Sterling was little moved after the latest U.K. employment data

as investors look ahead to Wednesday's key inflation print.

"The employment reading indicates a robust jobs market and will

provide the Bank of England further reason to continue on its

current trajectory for a higher interest rate environment," Silicon

Valley Bank said.

The U.K. unemployment rate was little changed at 3.8% in the

three months to June while the number of people in employment

increased 160,000 over the quarter and average earnings excluding

bonuses rose 4.7% following 4.4% growth in the previous

quarter.

Bonds:

The prospect of a slowdown of economic activity makes UBS Asset

Management "rather cautious" in its positioning in government

bonds, considering selloffs as an entry opportunity.

"Risk assets have not yet priced in the extent of this economic

slowdown, " UBS AM said, staying underweight stocks and using

selloffs in bonds as an opportunity to increase exposure to

sovereign fixed income.

It sees balanced risks to developed-market sovereign yields

outside the U.S., and sees Treasurys remaining the world's

pre-eminent haven and top source of risk-free yield.

Energy:

Crude futures were more than 1.5% lower in Europe, extending

Monday's hefty losses, on the prospects of a revival of the Iran

nuclear deal and the subsequent resumption of Iranian oil

exports.

DNB Markets said that could see Iran increase production by 1

million barrels a day within 9 months from current levels of 2.5

million barrels.

Metals:

Metals prices edged lower in European trading hurt by a strong

dollar that spiked on Monday after China had cut rates to add some

stimulus to its lockdown-hit economy.

"The macro mood feels heavier this morning," Peak Trading

Research said, noting that the Chinese yuan, the number one

importer currency, had fallen after the PBOC rate cuts.

TODAY'S TOP HEADLINES

Activist Politan Capital Has 9% Stake in Masimo

An activist investor has a big stake in Masimo Corp. and plans

to push the medical-device company to take action to improve its

stock price following a poorly received acquisition, according to

people familiar with the matter.

Politan Capital Management LP, founded by veteran activist

Quentin Koffey, has a 9% stake in Masimo worth roughly $750

million, the people said. Politan's specific ideas couldn't be

learned.

Dan Loeb's Third Point Calls for Disney to Spin Off ESPN,

Refresh Board

Activist investor Dan Loeb's Third Point LLC has bought a new

stake in Walt Disney Co. and is calling on the media company to buy

the rest of Hulu, explore spinning off ESPN and refresh its

board.

Mr. Loeb on Monday said his firm, which liquidated a large

Disney stake earlier this year, has repurchased a "significant

stake" in the company and sent a letter to Disney Chief Executive

Bob Chapek urging the company to engage with Third Point on a

number of issues.

WWE Says Probe of Vince McMahon Is 'Substantially Complete'

An investigation by World Wrestling Entertainment Inc.'s board

of directors into allegations of sexual misconduct against former

chairman and chief executive Vince McMahon is "substantially

complete," the company said in a securities filing on Monday.

The internal investigation, announced in June, found roughly $20

million in expenses that should have been recorded in the company's

financial statements, including $14.6 million that Mr. McMahon

agreed to pay women to settle allegations of sexual misconduct from

2006 to 2022, according to people familiar with the deals. Earlier

this month, the company disclosed additional payments in 2007 and

2009 totaling $5 million that it said were unrelated to the

allegations of misconduct that led to the investigation.

There Is No Preset Path for Australian Rate Rises, RBA Says

SYDNEY-The Reserve Bank of Australia is staying flexible on the

size and pace of future interest-rate rises, underlining in the

minutes of its Aug. 2 board meeting the need to respond to a

shifting inflation outlook and labor data.

The minutes, published Tuesday, repeated the RBA's warning that

the path to reining in inflation while maintaining economic growth

is narrow.

UK Unemployment Rate Increased Modestly in Three Months to

June

The unemployment rate in the U.K. rose slightly in the three

months to June, although the country's labor market remained

tight.

The U.K.'s unemployment rate stood at 3.8% in the three months

through June, up from 3.7% in the preceding three-month period,

according to data from the Office for National Statistics published

Tuesday.

Explosions Hit Russian Ammunition Depot in Crimea

Russian authorities reported explosions at an ammunition depot

in Crimea on Tuesday morning, a week after blasts at a Russian air

base on the peninsula appeared to destroy several warplanes.

The new explosions took place at a temporary ammunition dump at

a former farm near the village of Maiske in northern Crimea, a

local official told Russia state news agency TASS. Local

authorities are evacuating Maiske.

Merrick Garland Weighed Search of Trump's Mar-a-Lago for

Weeks

WASHINGTON-Attorney General Merrick Garland deliberated for

weeks over whether to approve the application for a warrant to

search former President Donald Trump's Florida home, people

familiar with the matter said, a sign of his cautious approach that

will be tested over the coming months.

The decision had been the subject of weeks of meetings between

senior Justice Department and FBI officials, the people said. The

warrant allowed agents last Monday to seize classified information

and other presidential material from Mar-a-Lago.

Former Trump Organization Finance Chief Set to Plead Guilty

The Trump Organization's former finance chief is expected to

plead guilty later this week to criminal charges stemming from his

indictment on tax-fraud charges, according to people familiar with

the matter.

A court hearing is scheduled Thursday morning for longtime chief

financial officer Allen Weisselberg, records show. The guilty plea,

which is expected to carry a sentence of five months in jail, isn't

final, the people said. Mr. Weisselberg isn't expected to cooperate

with Manhattan prosecutors as part of the deal, according to the

people.

Record Numbers of Migrants Arrested at Southern Border, With Two

Million Annual Total in Sight

Record numbers of migrants are being arrested while crossing the

southern U.S. border with Mexico, a sustained surge of single men

and families from across Latin America either seeking asylum or

work, according to new figures Monday from U.S. Customs and Border

Protection.

Border Patrol agents have made about 1.82 million arrests at the

southern border so far in the government's fiscal year, which runs

from October to the end of September. The number beats the record

set last fiscal year, which was 1.66 million apprehensions in the

year ending September 2021.

Camden Diocese Insurers Granted Permission to Challenge

Bankruptcy Plan

A bankruptcy judge sided with insurers for the Diocese of

Camden, allowing them to make their case against the church's

reorganization plan to settle sexual-abuse claims at a trial in

October.

In a court ruling on Friday, Judge Jerrold Poslusny said it was

reasonable for insurers including Century Indemnity Co. and Lloyd's

of London to oppose the plan that they said would harm their rights

in future litigation over sex-abuse claims against the Catholic

diocese in southern New Jersey.

Write to paul.larkins@dowjones.com TODAY IN CANADA

Earnings:

Osisko Mining 2Q

Economic Indicators (ET):

0815 Jul Housing Starts

0830 Jun International transactions in securities

0830 Jul CPI

Stocks to Watch:

Anaergia 2Q Rev C$42.2M Vs. C$26.8M; Restated Annual Audited

Fincl Statements for Yr Ended Dec 2021; Restatements Result of

Previously Announced Discussions With Auditor KPMG Over Technical

Acct Standard; No Change to Previously Disclosed Guidance for

Fiscal 2022, 2023; Expects to Continue Growth Momentum, Improve

Performance in Rest of Yr

---

Automotive Prop REIT 2Q Net C$31.2M

---

Big Rock Brewery 2Q Loss/Shr C$0.09; 2Q Loss C$588,000; 2Q Rev

C$15.8M; 6-Mos Loss/Shr C$0.28 Vs. EPS C$0.05; 6-Mos Rev C$24.6M

Vs. C$24.3M; Sales Affected by Unfavorable Industry Trends,

Specifically in Value Beer Segment; Focusing on Continued Pdt

Innovation, Dev in Premium Category; Engaging in Group Purchasing

to Mitigate Inflationary Pressures; Co-packing Segment Continuing

to Grow as Total Percentage of Rev

---

Inovalis REIT 2Q EPS C$0.14; 2Q Rev C$6.88M

---

Trevali 2Q Loss/Shr C$0.63 Vs. EPS C$0.04; 2Q Rev C$52.0M Vs.

C$101.1M; Initiative to Refinance Debt Maturing in Sept Hasn't

Advanced Sufficiently; No Assurance That Strategic Review to

Solicit Proposals for Investment in Co, Potential Sale of All/Part

of Business Will Progress in Timely Manner; Expects to Miss

Prepayment on Revolving Credit Facility Due Aug 17; Still in Talks

Senior Lenders Over Anticipated Breach of Terms, Potential Default

of Facility

---

Tassal Agrees to A$1.1 Bln Takeover by Canada's Cooke

Tassal Group has agreed to be bought by Canada's Cooke in a

takeover that values the Australian salmon producer at about $772.4

million.

Tassal on Tuesday said that its board unanimously recommended

Cooke's all-cash offer of A$5.23 a share. Tassal previously

rebuffed a A$4.85 indicative proposal from Cooke, which had already

proposed A$4.67 a share and then A$4.80 a share.

The offer price assumes Tassal will not declare a final

dividend. Tassal plans a shareholder vote in November and expects

completion by the end of 2022.

Expected Major Events for Tuesday

04:30/JPN: Jun Tertiary Industry Index

06:00/UK: Jul UK monthly unemployment figures

09:00/GER: Aug ZEW Indicator of Economic Sentiment

12:15/CAN: Jul Housing Starts

12:30/CAN: Jun International transactions in securities

12:30/US: Jul New Residential Construction - Housing Starts and

Building Permits

12:30/CAN: Jul CPI

12:55/US: 08/13 Johnson Redbook Retail Sales Index

13:15/US: Jul Industrial Production & Capacity

Utilization

20:30/US: 08/12 API Weekly Statistical Bulletin

23:01/UK: Jul Scottish Retail Sales Monitor

23:50/JPN: Jun Orders Received for Machinery

23:50/JPN: Jul Provisional Trade Statistics for the Month

All times in GMT. Powered by Onclusive and Dow Jones.

Expected Earnings for Tuesday

Acer Therapeutics Inc (ACER) is expected to report $-0.88 for

2Q.

AgEagle Aerial Systems Inc (UAVS) is expected to report for

2Q.

Agilent Technologies (A) is expected to report $1.04 for 3Q.

Allena Pharmaceuticals Inc (ALNA) is expected to report $-0.48

for 2Q.

Archaea Energy Inc (LFG) is expected to report for 2Q.

Bio-Path Holdings Inc (BPTH) is expected to report for 2Q.

Cue Biopharma Inc (CUE) is expected to report $-0.47 for 2Q.

Empire Petroleum Corp (EP) is expected to report for 2Q.

FTI Consulting (FCN) is expected to report $1.74 for 4Q.

Flanigan's Enterprises Inc (BDL) is expected to report for

3Q.

GEE Group Inc (JOB) is expected to report $0.01 for 3Q.

Global-E Online Ltd (GLBE) is expected to report for 2Q.

Greenlane Holdings Inc (GNLN) is expected to report for 2Q.

Home Depot Inc (HD) is expected to report $4.96 for 2Q.

Interpace Biosciences Inc (IDXG) is expected to report for

2Q.

Jack Henry & Associates Inc (JKHY) is expected to report

$1.00 for 4Q.

Janus International Group Inc (JBI) is expected to report for

2Q.

Lulu's Fashion Lounge Holdings Inc (LVLU) is expected to report

for 2Q.

Lumentum Holdings Inc (LITE) is expected to report for 4Q.

MGT Capital Investments (MGTI) is expected to report for 2Q.

Melco Resorts & Entertainment Ltd (MLCO) is expected to

report $-0.41 for 2Q.

NexImmune Inc (NEXI) is expected to report for 2Q.

Orgenesis Inc (ORGS) is expected to report $-0.02 for 2Q.

P3 Health Partners Inc (PIII) is expected to report for 1Q.

PAVmed Inc (PAVM) is expected to report $-0.23 for 2Q.

Premier Inc (PINC) is expected to report $0.47 for 4Q.

QuickLogic Corp (QUIK) is expected to report for 2Q.

SPAR Group Inc (SGRP) is expected to report for 2Q.

Simply Inc (SIMPQ) is expected to report for 1Q.

StageZero Life Sciences Ltd (SZLS.T) is expected to report for

2Q.

Tofutti Brands (TOFB) is expected to report for 2Q.

Vidler Water Resources Inc (VWTR) is expected to report for

2Q.

Walmart Inc (WMT) is expected to report $1.82 for 2Q.

Yunhong CTI Ltd (CTIB) is expected to report for 2Q.

Powered by Onclusive and Dow Jones.

ANALYST RATINGS ACTIONS

1Life Healthcare Cut to Hold From Buy by Jefferies

Air Products & Chemicals Raised to Outperform From Market

Perform by BMO Capital

American Equity Cut to In-Line From Outperform by Evercore ISI

Group

Avalara Cut to Market Perform From Outperform by Raymond

James

Charter Communications Cut to Neutral From Overweight by

Atlantic Equities

CME Group Cut to Market Perform From Outperform by Raymond

James

Comcast Cut to Neutral From Overweight by Atlantic Equities

Cullen/Frost Bankers Raised to Buy From Neutral by Compass

Point

Dollar General Cut to Market Perform From Outperform by BMO

Capital

Equifax Cut to Neutral From Overweight by Atlantic Equities

Franklin Electric Cut to Neutral From Buy by Northcoast

Research

Green Dot Cut to Equal-Weight From Overweight by Barclays

Home Point Capital Cut to Neutral From Outperform by Wedbush

IDEAYA Biosciences Cut to Hold From Buy by Stifel

Illinois Tool Works Cut to Sell From Hold by Deutsche Bank

Kinsale Capital Group Cut to Neutral From Buy by Compass

Point

Kiora Pharmaceuticals Cut to Hold From Buy by Maxim Group

Lindsay Cut to Neutral From Buy by Northcoast Research

McDonald's Raised to Buy From Neutral by Kalinowski Research

Plains All American Raised to Buy From Hold by Stifel

Plains GP Holdings Raised to Buy From Hold by Stifel

PLx Pharma Cut to Market Perform From Market Outperform by JMP

Securities

PLx Pharma Cut to Perform From Outperform by Oppenheimer

Poshmark Raised to Overweight From Equal-Weight by Barclays

PPL Corp Raised to Buy From Neutral by B of A Securities

Press Release: Nearly 60% of Renters saw Rent Increase in Past

12 Months

Quanterix Cut to Hold From Buy by Canaccord Genuity

RCM Tech Raised to Buy From Neutral by B. Riley Securities

Revolve Group Cut to Underweight From Equal-Weight by

Barclays

Ryerson Holding Coverage Assumed by BMO Capital at

Outperform

Shift Technologies Cut to Underweight From Neutral by JP

Morgan

Southwest Airlines Cut to Hold From Buy by Argus Research

TaskUs Cut to Equal-Weight From Overweight by Morgan Stanley

Truist Financial Cut to Neutral From Buy by Compass Point

Vroom Cut to Underweight From Neutral by JP Morgan

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

August 16, 2022 05:06 ET (09:06 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

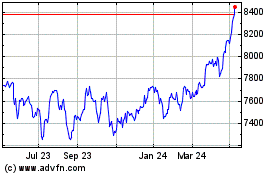

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

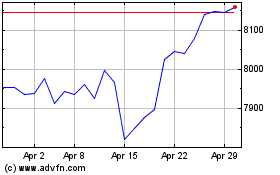

FTSE 100

Index Chart

From Apr 2023 to Apr 2024