UK PMI Data Point to Further Weakness Ahead

1147 GMT - Data from a purchasing managers index suggested the

U.K. economic contraction didn't worsen in November, but some

forward-looking data such as new orders signal the rate of

contraction could accelerate in the coming months, Berenberg

economists Holger Schmieding and Kallum Pickering say in a note.

The rebound in business expectations is likely linked to the

improving political situation, but current activity remains under

severe strain from weak confidence, costs pressures and tight

financial conditions, they say. The data suggest U.K. companies are

still adding jobs despite the worsening outlook, but the slowing

pace of job creation is probably an ominous sign employment will

start to fall as the recession deepens in winter, Berenberg says.

(xavier.fontdegloria@wsj.com)

Companies News:

United Utilities 1H Pretax Profit Rose, But Swung to Underlying

Loss

United Utilities Group PLC said Wednesday that pretax profit

rose for the first half on lower net finance expenses, but it swung

to a loss on an underlying basis as macroeconomic conditions hit

earnings.

---

Johnson Matthey Swung to 1H Pretax Profit, Keeps Dividend

Johnson Matthey PLC on Wednesday reported a swing to pretax

profit for the first half of fiscal 2023, despite lower revenue,

and maintained its dividend payout.

---

Bakkavor Sees FY 2022 Profit at Lower End of Views Despite 3Q

Top-Line Growth

Bakkavor Group PLC said Wednesday that revenue grew well in the

third quarter despite macro pressures, and that it sees full-year

profit in line with market forecasts, though at the lower end of

expectations.

---

Pets at Home Group 1H Pretax Profit Hit by Higher Costs; Backs

FY Guidance

Pets at Home Group PLC on Wednesday reported a 19% fall in

pretax profit for the first half of the fiscal year after booking

higher costs, but raised the dividend payout and backed its

full-year underlying guidance.

---

Britvic FY 2022 Pretax Profit, Revenue Rose on Increased Volume;

Lifts Dividend

Britvic PLC said Wednesday that fiscal 2022 pretax profit and

revenue rose on increased in volume and despite macroeconomic

headwinds, and lifted its dividend.

---

Halfords Group 1H Pretax Profit Fell on Higher Costs; Keeps

Dividend

Halfords Group PLC said Wednesday that pretax profit for the

first half fell amid higher sales costs and operating expenses but

service demand continues to increase.

---

Best of the Best Hopes to Finalize Negotiations With Globe

Invest Before Year End

Best of the Best PLC said Wednesday that it is hoping to have

finalized agreements with Globe Invest Limited, which signaled its

intent to take a stake in the company, before the end of the

year.

---

Coats Group Revenue Rose in 2H to October; Sees 2022 Meeting

Views

Coats Group PLC said Wednesday that it is on track to meet its

full-year expectations, and with strong organic growth in the

latter half of the year.

---

De La Rue Swings to 1H Pretax Loss; Expects to Miss FY

Forecast

De La Rue PLC on Wednesday reported a swing to pretax loss for

the first half of fiscal 2023 after booking exceptional charges

mainly related to the termination of a contract and said that it

will miss adjusted operating profit market forecasts for the

year.

---

Hostelworld Sees 2022 Revenue, Earnings Improving on Persistent

Momentum

Hostelworld Group PLC said Wednesday that strong bookings and

revenue momentum have persisted since its performance update in

October, and it expects full-year revenue and earnings to

significantly improve.

---

DP Eurasia 10-Month System Sales Grew 12%, Backs 2022

Guidance

DP Eurasia NV said Wednesday that 10-month system sales rose by

12%, supported by pricing.

---

Rotork Four-Month Revenue Rose 19%; To Meet FY 2023 Guidance

Rotork PLC said Wednesday that revenue for the four months ended

Oct. 30 rose 19%, boosted by higher selling prices as well as

measures taken to improve supply-chain issues.

Market Talk:

Pets at Home's New Customers Help to Boost Sales

1136 GMT - Pets at Home Group is picking up more new customers,

HSBC says after the U.K. pet-goods retailer stuck to its full-year

guidance, though first-half underlying pretax profit fell amid

higher transport and energy costs. The 1H results matched

expectations, supported by increased second-quarter sales and

customers, HSBC says. "This is another good update from Pets and

builds on a strong 1Q update in August," HSBC analyst Paul

Rossington says in a note. "Key for us is that this is supported by

an increase in new customer growth." Still, Pets shares drop 3.6%.

(philip.waller@wsj.com)

UK PMI Data Add to Signs of Immediate Recession

1121 GMT - The U.K. economy is likely to have already fallen

into recession, Capital Economics U.K. economist Ashley Webb says

in a note after November's purchasing managers index data. The

composite PMI, which ticked up to 48.3 from 48.2 in October, is

consistent with a 0.2% quarterly contraction in the three months to

November, a figure that is slightly better than what current

forecasts for overall 4Q imply, he says. The data also showed price

pressures continued to moderate, but growth in firms' input costs

remained high, Webb says. "With domestic inflationary pressures

still very intense, we don't think that the weakening activity will

convince the Bank of England to stop raising interest rates just

yet," he says. (xavier.fontdegloria@wsj.com)

Halfords's Lack of Consistency Could Be Behind Share Fall

1112 GMT - Given that a couple of months ago Halfords said it

would hit its FY 2023 target, its current guidance for earnings to

be at the bottom end of expectations has halted its shares'

momentum and prompted a profit taking, AJ Bell Investment Director

Russ Mould says as shares drop 5.4%. Despite this, the company's

strategy to bolster its motoring services division offers a more

predictable and repeating revenue, making the business more

resilient to weather the consumer backdrop, he says. "The big thing

which may be worrying investors...is the lack of consistency,"

Mould says. (michael.susin@wsj.com)

Halfords's Lack of Consistency Could Be Behind Share Fall

1112 GMT - Given that a couple of months ago Halfords said it

would hit its FY 2023 target, its current guidance for earnings to

be at the bottom end of expectations has halted its shares'

momentum and prompted a profit taking, AJ Bell Investment Director

Russ Mould says as shares drop 5.4%. Despite this, the company's

strategy to bolster its motoring services division offers a more

predictable and repeating revenue, making the business more

resilient to weather the consumer backdrop, he says. "The big thing

which may be worrying investors...is the lack of consistency,"

Mould says. (michael.susin@wsj.com)

Sage Makes Progress, But Margin Uncertainty Lingers

1109 GMT - Sage is making progress but risks remain, Deutsche

Bank says, upgrading the accountancy-software firm to hold from

sell and increasing its price target to 800 pence from 590p.

Management is making the right decisions in a competitive

environment to increase growth, while investment is boosting

revenue momentum despite a tougher economy, Deutsche says. "Having

said that, uncertainties remain around margin progress going

forward, with management choosing to invest the growth upside into

[operating expenditure] in FY22," Deutsche analyst Johannes

Schaller writes, adding that economic risks remain, particularly in

the U.K. "There appears to be scope for better operating leverage

into FY23, but with shares trading above software peer-group

multiples, we see a lot of this already priced in." Shares rise

0.3% to 811p. (philip.waller@wsj.com)

BT Group Looks Confident

1047 GMT - BT Group struck a confident tone in its business

update Tuesday when the company confirmed it would implement the

contracted CPI +3.9% price rises across its consumer brands in

April and said that EE will become the flagship brand, Jefferies

analysts Jerry Dellis and Yi Hsin Yeoh say in a research note. The

U.K. telecom company will direct its efforts toward EE as the BT

brand will be phased out, with the former having wider customer

appeal, balanced representation across ages and strong customer

appeal in cities, the analysts say. BT also noted that customer

churn is under control even as the earliest adopters of the CPI

+3.9% price rise contracts start to exit their tie-ins, they add.

Jefferies has a buy rating on the stock with a 250.00 pence price

target. (kyle.morris@dowjones.com)

Hostelworld's Shares Could Travel Far to the Upside

1042 GMT - Hostelworld's shares trade at an undemanding price

given the near- to medium-term growth opportunities and marked

discount to its historic average range, Shore Capital says in a

note. The online hotel-booking platform is a unique way to invest

in the travel industry and it's pleasing to see its recovery

accelerate now it's clear of pandemic disruption, Shore analysts

Katie Cousins and Greg Johnson say. "Across the medium term, we

believe the group has scope to benefit from its increased

investment into technology and social features," say the analysts.

Shore Capital retains its buy recommendation for the Hostelworld

stock as it sees significant upside to its fair value target of 140

pence and a positive business outlook. Shares are down 0.5% at 92.0

pence. (joseph.hoppe@wsj.com)

Contact: London NewsPlus; paul.larkins@wsj.com

(END) Dow Jones Newswires

November 23, 2022 07:37 ET (12:37 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

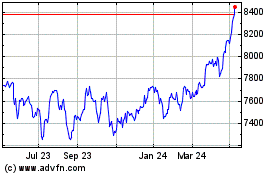

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

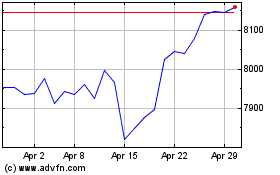

FTSE 100

Index Chart

From Apr 2023 to Apr 2024