Australian, NZ Dollars Climb Amid Fed Decision, Ukraine Peace Talks

17 March 2022 - 3:25PM

RTTF2

The Australian and NZ dollars moved up against their major

counterparts in the Asian session on Thursday, as most Asian shares

rose amid progress in peace talks between Russia and Ukraine,

China's pledge for more stimulus and the Federal Reserve's interest

rate hike that was in-line with expectations.

The Fed raised the federal funds rate by 0.25 percent, to a

target range of 0.25 percent to 0.50 percent.

The central bank signaled six more quarter-point interest rate

hikes for this year.

Signs of a progress in peace negotiations between Russia and

Ukraine cheered investors.

Russian Foreign Minister Sergey Lavrov said on Wednesday that

even though the negotiations are difficult for obvious reasons,

there is room for reaching a compromise.

Data from the Australian Bureau of Statistics showed that the

jobless rate in Australia came in at a seasonally adjusted 4.0

percent in February.

That was below expectations for 4.1 percent and down from 4.2

percent in January.

The Australian economy added 77,400 jobs last month, blowing

away forecasts for an increase of 37,000 jobs following the gain of

12,900 jobs in the previous month.

The aussie climbed to a 6-day high of 0.7321 against the

greenback, after falling to 0.7282 in early deals. Against the yen,

it touched 87.07, its highest level since February 2018. The next

possible resistance for the currency is seen around 0.75 against

the greenback and 90.00 against the yen.

The aussie advanced to 3-day highs of 0.9281 against the loonie,

1.0698 against the kiwi and 1.5073 against the euro, off its early

lows of 0.9235, 1.0650 and 1.5146, respectively. The aussie is seen

finding resistance around 0.94 against the loonie, 1.08 against the

kiwi and 1.49 against the euro.

The NZ currency appreciated to a 6-day high of 0.6849 against

the greenback and a 3-day high of 1.6105 against the euro, from its

early lows of 0.6823 and 1.6166, respectively. The currency is

likely to locate resistance around 0.70 against the greenback and

1.58 against the euro.

The kiwi jumped to 81.44 against the yen, a level unseen since

November 4, 2021. On the upside, 83.00 is possibly seen as its next

resistance level.

Looking ahead, Eurozone final CPI for February is set for

release in the European session.

The Bank of England's monetary policy announcement is due at

8:00 am ET. The BoE is widely expected to raise its key rate by 25

basis points to 0.75 percent from 0.50 percent.

U.S. weekly jobless claims for the week ended March 12,

industrial production, building permits and housing starts for

February will be featured in the New York session.

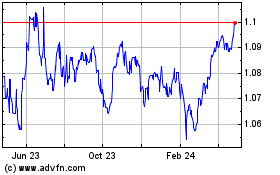

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

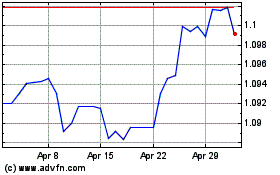

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024