Australian, NZ Dollars Drop On Concerns Over Aggressive Fed Rate Hikes

22 April 2022 - 1:56PM

RTTF2

The Australian and NZ dollars weakened against their most major

counterparts in the Asian session on Friday, as Asian stock markets

are mostly lower, tracking a sell-off on Wall Street overnight,

following hawkish comments from Federal Reserve Chair Jerome Powell

suggesting the possibility of an aggressive tightening of monetary

policy to counter high inflation.

Speaking at an IMF panel discussion, Powell signaled that a

half-point rate hike would be on the table when the Fed meets on

May 3 and 4.

The Fed chief said that the central bank is prepared to raise

rates "a little more quickly" to control inflationary

pressures.

Powell's comments pushed up treasury yields and the dollar,

hurting the appeal of risk-sensitive currencies.

Oil prices fell following hawkish commentary from Powell and on

fears over a falling energy demand due to virus lockdowns in

China.

In economic news, the latest survey from S&P Global showed

that Australia's manufacturing sector continued to expand in April,

and at a faster rate, with a manufacturing PMI score of 57.9.

That's up from 57.7 in March, and it moves further above the

boom-or-bust line of 50 that separates expansion from

contraction.

The services PMI improved to 56.6 in April from 55.6 in March,

while the composite rose to 56.2 from 55.1.

The aussie dropped to a 3-day low of 93.68 against the yen and a

fresh 5-week low of 0.7325 against the greenback, off its previous

highs of 94.73 and 0.7377, respectively. If the aussie falls

further, it is likely to test support around 90.00 against the yen

and 0.72 against the greenback.

The aussie reversed from its eary highs of 1.4678 against the

euro and 0.9279 against the loonie, declining to a 3-week low of

1.4809 and more than a 5-week low of 0.9231, respectively. The next

possible support for the aussie is seen around 1.51 against the

euro and 0.90 against the loonie.

The aussie hovered at a session's low of 1.0936 against the

kiwi, down from a high of 1.0968 seen at 12:20 am ET. On the

downside, 1.07 is possibly seen as its next support level.

The kiwi weakened to near a 2-month low of 0.6687 against the

greenback and more than a 5-week low of 1.6210 against the euro,

down from its prior highs of 0.6737 and 1.6077, respectively. The

kiwi is seen finding support around 0.64 against the greenback and

1.66 against the euro.

Against the yen, the kiwi was down at a 3-day low of 85.53. The

kiwi may locate support around the 83.00 level.

Looking ahead, PMI reports from major European economies are due

in the European session.

Canada retail sales for February, manufacturing sales,

industrial product and raw materials price indexes, all for March,

are set to be released in the New York session.

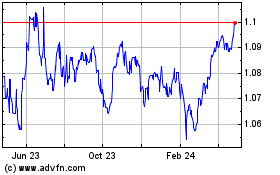

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

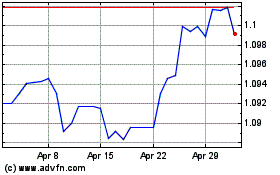

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024